How To Find Net Profit After Interest And Tax Net income after taxes represents the profit or earnings after all expense have been deducted from revenue Net income after taxes calculation can be shown as both a total dollar amount and a per

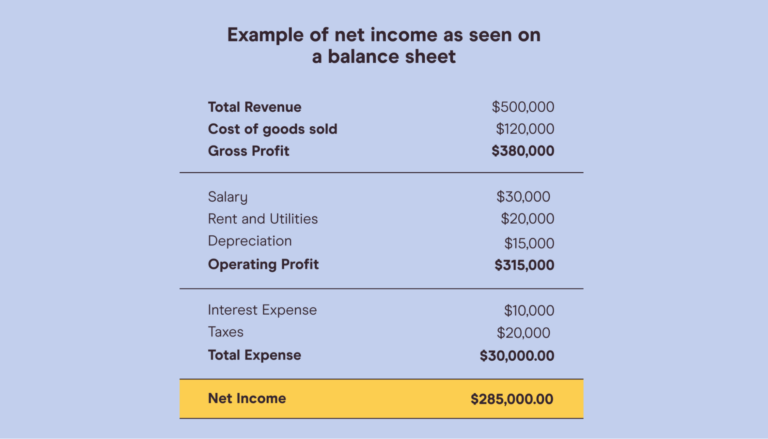

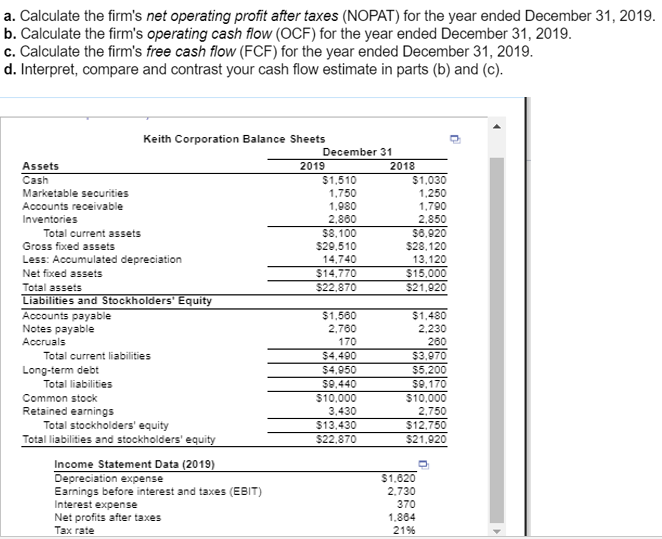

Profit after tax also known as net income or net profit represents the amount of money a company earns after accounting for all expenses taxes and interest payments Profit after tax takes into account the taxes paid by the company on its pre tax earnings Taxes are calculated based on applicable tax rates and deductions and they can Some simple explanation of the main terms in the above table Revenue The total value of business generated from the regular activities of a company Operating expense The cost incurred by the company to generate Revenue Operating profit The money remaining with the company after paying for its operating activities Interest Interest repayment for any borrowings similar to the

How To Find Net Profit After Interest And Tax

How To Find Net Profit After Interest And Tax

https://i.pinimg.com/originals/b1/33/20/b13320a42b2670c67eb925e6a3fef4e4.jpg

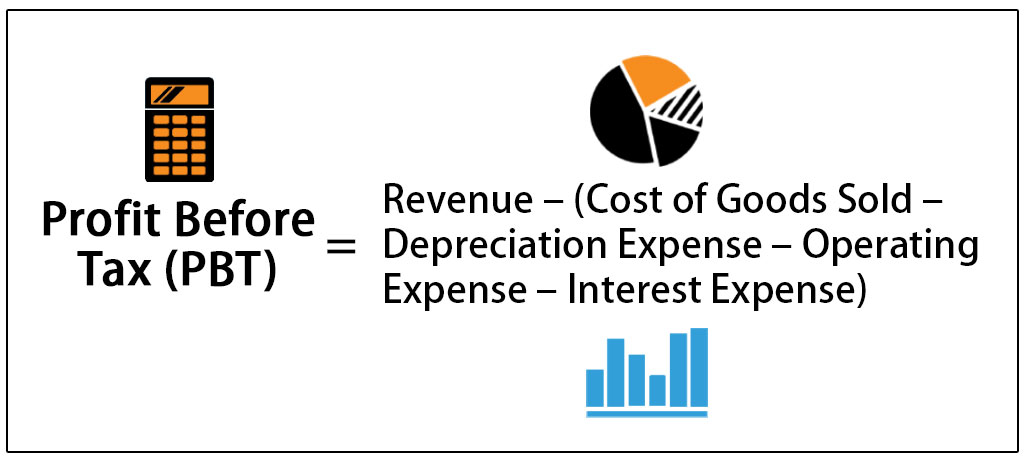

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Hodv b Choroba Stato nos How To Calculate Net Profit Pay ialenstvo

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

Profit after tax PAT also called net income or net profit refers to a company s total earnings after accounting for all expenses interest taxes and dividends paid PAT is a key metric used to evaluate a company s financial performance and profitability over a specific period of time usually a quarter or fiscal year Operating income is sometimes referred to as EBIT or earnings before interest and taxes The formula for operating net income is Net Income Interest Expense Taxes Operating Net Income Or put another way you can calculate operating net income as Gross Profit Operating Expenses Depreciation Amortization Operating

Interest expense refers to the cost of borrowing for the debtor It is accrued and expensed over time Each debt payment is made up of principal repayment and interest expense Net Income After Tax in Ratio Analysis Net income after tax is often used in relation to other account balances to interpret the company s ability to generate profit It summarizes the company s net profit after all expenses and taxes Join the Waitlist High Finance Offer Guaranteed Be the first to know when applications open for WSO Academy s next cohort Pre Tax Income Net Income EBIT Interest Expense 3200 150 3050 After Tax Income NIAT Pre Tax Income Tax 3050 500 2550

More picture related to How To Find Net Profit After Interest And Tax

From The Following Information Calculate Interest Coverage Ratio Net

https://s3mn.mnimgs.com/img/shared/content_ck_images/ck_5f59c8482bca7.jpeg

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

What Is Net Profit Net Profit Formula updated 2022

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

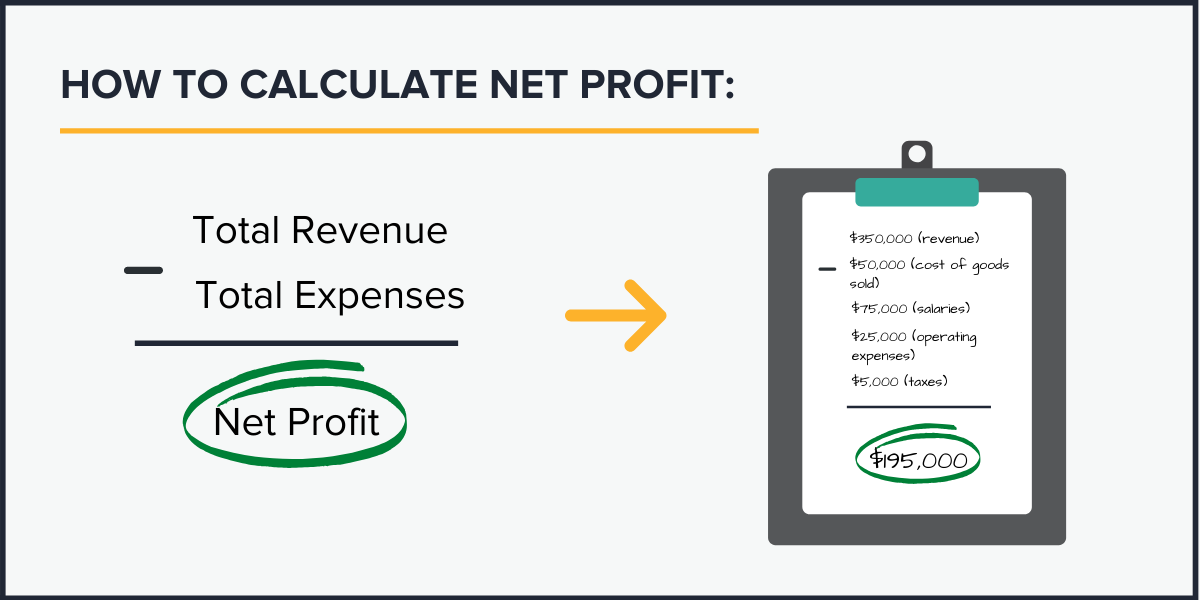

Here s what to know about the differences between net profit before and after tax 20 000 in operating expenses and 5 000 in interest expenses its net profit before tax would be 100 000 Total Revenue 50 000 COGS 20 000 Operating Expenses 5 000 Interest Expenses 25 000 PBT To calculate net income after taxes NIAT take gross sales revenue and subtract the cost of goods sold Then subtract business expenses depreciation interest amortization and taxes Whatever

[desc-10] [desc-11]

Heartwarming Net Income Using Kein Formulae Balance Sheet Template Canada

https://www.myaccountingcourse.com/financial-ratios/images/net-income-formula.jpg

How To Find Net Profit Before Interest And Tax

https://media.cheggcdn.com/media/2cd/2cd4a4e5-a895-46ae-bc6f-f0fd1e0450b6/php7iqCMp.png

How To Find Net Profit After Interest And Tax - [desc-14]