How To Calculate Net Earnings Before Interest And Tax 2 Calculate EBIT from Net Income Alternatively you can calculate EBIT by starting with net income and adding back interest and taxes If a company has Net Income 100 000 Interest Expense 20 000 Taxes 30 000 The EBIT calculation would be EBIT Net Income Interest Taxes EBIT 100 000 20 000 30 000 150 000

To calculate EBIT using the indirect method we add income tax expense and interest expense to the net income EBIT 5 727 934 262 6 923 From both examples we had above we can see non operating items proceeds from sale of asset lawsuit expenses and other expenses that need to be accounted for Calculate the earnings before tax EBT The last step is to put everything together and calculate the EBT using the earnings before taxes formula EBT gross profit operating expense interest expense other income Thus the Company Alpha s EBT is 700 000 300 000 200 000 100 000 300 000

How To Calculate Net Earnings Before Interest And Tax

How To Calculate Net Earnings Before Interest And Tax

https://www.myaccountingcourse.com/financial-ratios/images/earnings-before-interest-and-taxes-equation-calculation.jpg

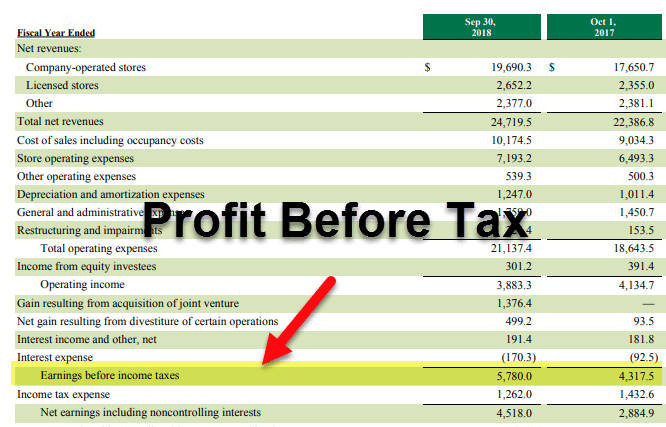

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

How to Calculate EBIT EBIT stands for Earnings Before Interest and Taxes and measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated by a company across a given period Investors use Earnings Before Interest and Taxes for two reasons 1 it s easy to calculate and 2 it makes companies easily comparable 1 It s very easy to calculate using the income statement as net income interest and taxes are always broken out

What is Earnings Before Tax EBT Earnings before tax or pre tax income is the last subtotal found in the income statement before the net income line item The EBT metric is found after all deductions except taxes that have been made against sales revenue These deductions include COGS SG A depreciation and amortization and interest expense Interest Expense 50 000 Income Taxes 10 000 Net Income 90 000 In this example Ron s company earned a profit of 90 000 for the year In order to calculate our EBIT ratio we must add the interest and tax expense back in Thus Ron s EBIT for the year equals 150 000

More picture related to How To Calculate Net Earnings Before Interest And Tax

How To Calculate Net Earnings Formula And Examples Bench Accounting Albam

https://albam.org/wp-content/uploads/2022/11/How-To-Calculate-Net-Earnings-Formula-And-Examples-Bench-Accounting_640.jpg

Hodv b Choroba Stato nos How To Calculate Net Profit Pay ialenstvo

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator.jpg

Pin On Values

https://i.pinimg.com/originals/3d/cc/bd/3dccbdcca9d7c0bf49249ae3607ff862.jpg

EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted Using this data we can calculate the Earnings Before Interest and Taxes EBIT using the direct method EBIT 1 000 000 650 000 200 000 EBIT 150 000 In this example Ron s Lawn Care Equipment and Supply Company has an EBIT of 150 000 for the year

[desc-10] [desc-11]

Preliminary Net Income Formula JunaidTasnim

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

Retained Earnings What Are They And How Do You Calculate Them

https://www.patriotsoftware.com/wp-content/uploads/2020/01/statement-of-retained-earnings-visual-scaled.jpg

How To Calculate Net Earnings Before Interest And Tax - [desc-14]