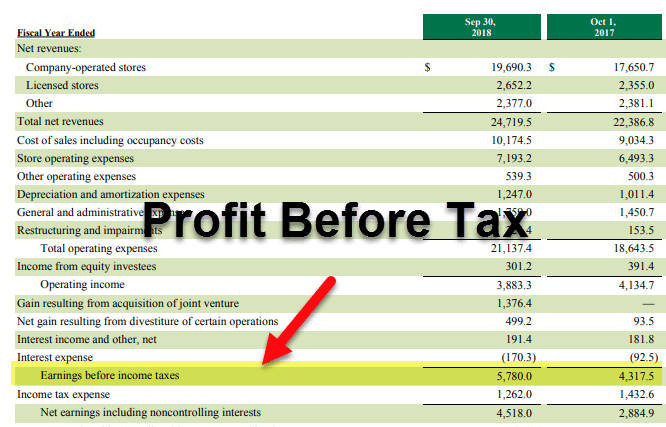

How To Calculate Net Profit Before Interest And Tax Profit before tax PBT is a line item in a company s income statement that measures profits earned after accounting for operating expenses like COGS SG A Depreciation Amortization etc non operating expenses like interest expense but before paying off the income taxes This is a significant measure because it gives the company s overall profitability and performance before making

Profit Before Interest and Tax PBIT Operating Profit Interest Expense Income Tax Provision To better understand this calculation let s break down each component Operating Profit It represents the profit generated from a company s core business operations before considering interest and taxes It is also known as earnings Profit before tax PBT is a measure of a company s profitability that looks at the profits made before any tax is paid How to Calculate Profit Before Tax To calculate the PBT of a company one must follow several steps They are 1 200 000 in cost of goods sold and 300 000 in operating expenses The earnings before interest and

How To Calculate Net Profit Before Interest And Tax

How To Calculate Net Profit Before Interest And Tax

https://www.investsmall.co/wp-content/uploads/2020/06/investments-in-1024x683.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

Apple s Earnings Before Taxes 53 394 million 1 26 1 Another method Another way to calculate pre tax profit You can also calculate a company s pre tax profit by subtracting a company s How to Calculate EBIT EBIT stands for Earnings Before Interest and Taxes and measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated by a company across a given period

Income Tax 25 000 Net Income 151 000 Using the direct method we calculate EBIT as follows EBIT Revenue COGS Operating Expenses Proceeds from Sale of Asset Lawsuit Expenses 500 000 250 000 50 000 3 000 2 000 201 000 Using the indirect method calculating EBIT will be EBIT Net Income Income Tax Interest Going further earnings before interest and tax EBIT which is also known as operating profit operating earnings and profit before interest and taxes factors into both

More picture related to How To Calculate Net Profit Before Interest And Tax

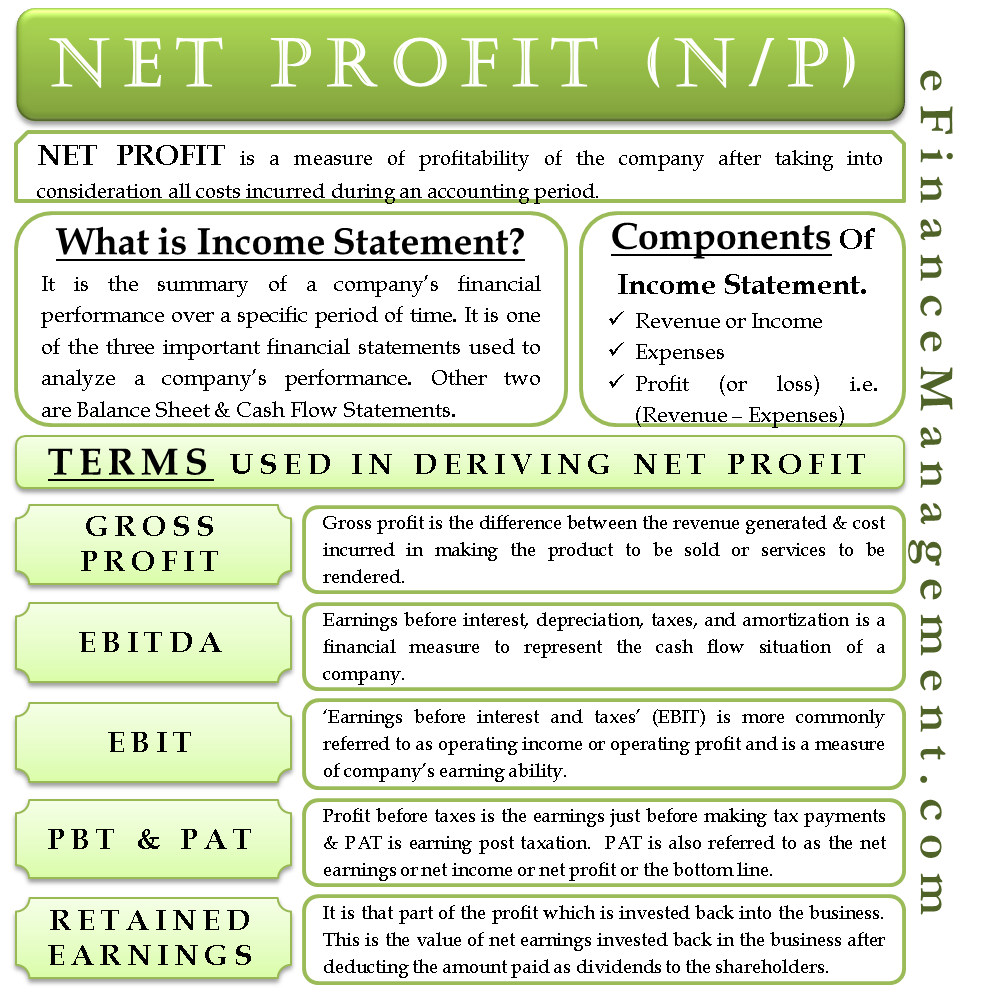

Net Profit Formula How To Calculate Net Profit Tax Shastra

https://taxshastra.com/wp-content/uploads/2020/05/NP-F.jpg

Net Profit Income Statement Terms EBIT PBT Retained Earnings Etc

https://efinancemanagement.com/wp-content/uploads/2015/10/Net-Profit.png

Preliminary Net Income Formula JunaidTasnim

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

The difference between EBIT vs net income comes down to earnings vs EBIT As you know EBIT is earnings before interest and taxes Net income is analogous to earnings So the difference between EBIT vs net income is that EBIT is net income with interest and taxes added back in EBIT vs EBIT margin EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted

[desc-10] [desc-11]

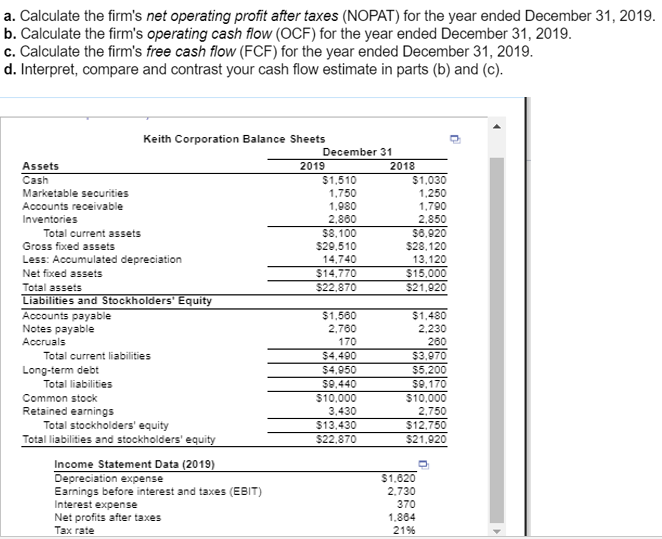

How To Find Net Profit Before Interest And Tax

https://media.cheggcdn.com/media/2cd/2cd4a4e5-a895-46ae-bc6f-f0fd1e0450b6/php7iqCMp.png

Return On Assets Net Sales Gross Profit Margin Cost Of Goods Operating

https://img.homeworklib.com/questions/5a213060-7285-11ea-9dd0-e5e9a2b40a04.png?x-oss-process=image/resize,w_560

How To Calculate Net Profit Before Interest And Tax - Income Tax 25 000 Net Income 151 000 Using the direct method we calculate EBIT as follows EBIT Revenue COGS Operating Expenses Proceeds from Sale of Asset Lawsuit Expenses 500 000 250 000 50 000 3 000 2 000 201 000 Using the indirect method calculating EBIT will be EBIT Net Income Income Tax Interest