How To Get Net Profit Before Interest And Tax To calculate EBIT using the indirect method we add income tax expense and interest expense to the net income EBIT 5 727 934 262 6 923 From both examples we had above we can see non operating items proceeds from sale of asset lawsuit expenses and other expenses that need to be accounted for

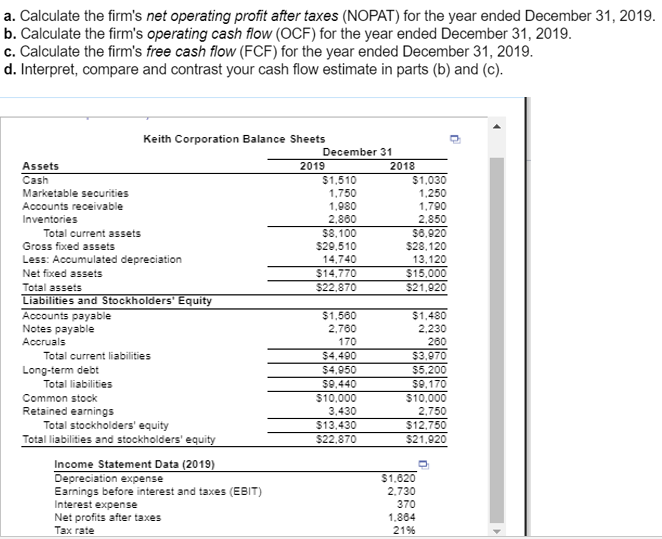

2 Calculate EBIT from Net Income Alternatively you can calculate EBIT by starting with net income and adding back interest and taxes If a company has Net Income 100 000 Interest Expense 20 000 Taxes 30 000 The EBIT calculation would be EBIT Net Income Interest Taxes EBIT 100 000 20 000 30 000 150 000 It is also known as earnings before interest and tax EBIT Interest Expense These are the costs incurred by the company due to interest payments on debt or loans Income Tax Provision It is the amount of income tax a company is obliged to pay to the government based on the profits earned By subtracting the interest expense and

How To Get Net Profit Before Interest And Tax

How To Get Net Profit Before Interest And Tax

https://www.investsmall.co/wp-content/uploads/2020/06/investments-in-2048x1365.jpg

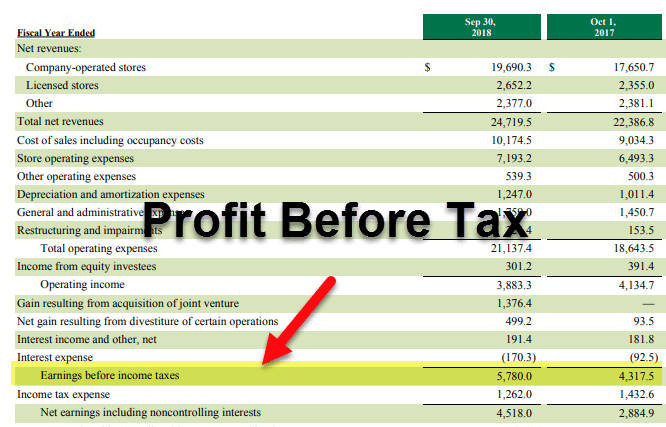

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

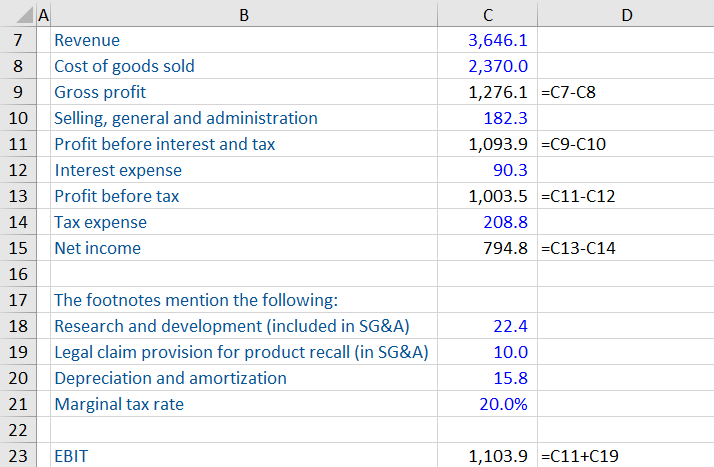

EBIT Net Income Interest Taxes EBIT EBITDA Depreciation and Amortization Expense Starting with net income and adding back interest and taxes is the most straightforward as these items will always be displayed on the income statement Depreciation and amortization may only be shown on the cash flow statement for some businesses Gross profit is shown on a company s income statement It is the profit a company earns after eliminating the costs related to creating the products or enabling the services At the same time EBIT determines a company s profitability by displaying earnings before interest taxes depreciation and amortization

Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2 000 000 1 750 000 250 000 PBT vs EBIT Profit before taxes and earnings before interest and tax EBIT are both effective measures of a company s profitability However they provide slightly different perspectives on financial results In this example EBIT is 200 000 while net income is 100 000 Why Does Earnings Before Interest and Taxes EBIT Matter EBIT provides investment analysts with useful information for evaluating a company s operating performance without regard to interest expenses or tax rates EBIT helps minimize these two variables that may be unique from company to company and enables one to analyze

More picture related to How To Get Net Profit Before Interest And Tax

Earnings Before Interest And Taxes EBIT Financial Edge

https://financial-edge-staging-media.s3-eu-west-2.amazonaws.com/2020/11/EBIT-1.png

Online Essay Help Amazonia fiocruz br

https://biz.libretexts.org/@api/deki/files/13449/4ec2c862a6503e971a2144f9fcbcf8f2b5bb6628?revision=1

Net Profit Before Interest And Tax 400000 Q 144 Ch 4 Accounting Ratios

https://touch4career.com/wp-content/uploads/2021/10/q144-1024x656.jpg

Interest Expense 50 000 Income Taxes 10 000 Net Income 90 000 In this example Ron s company earned a profit of 90 000 for the year In order to calculate our EBIT ratio we must add the interest and tax expense back in Thus Ron s EBIT for the year equals 150 000 EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted

[desc-10] [desc-11]

How To Find Net Profit Before Interest And Tax

https://media.cheggcdn.com/media/2cd/2cd4a4e5-a895-46ae-bc6f-f0fd1e0450b6/php7iqCMp.png

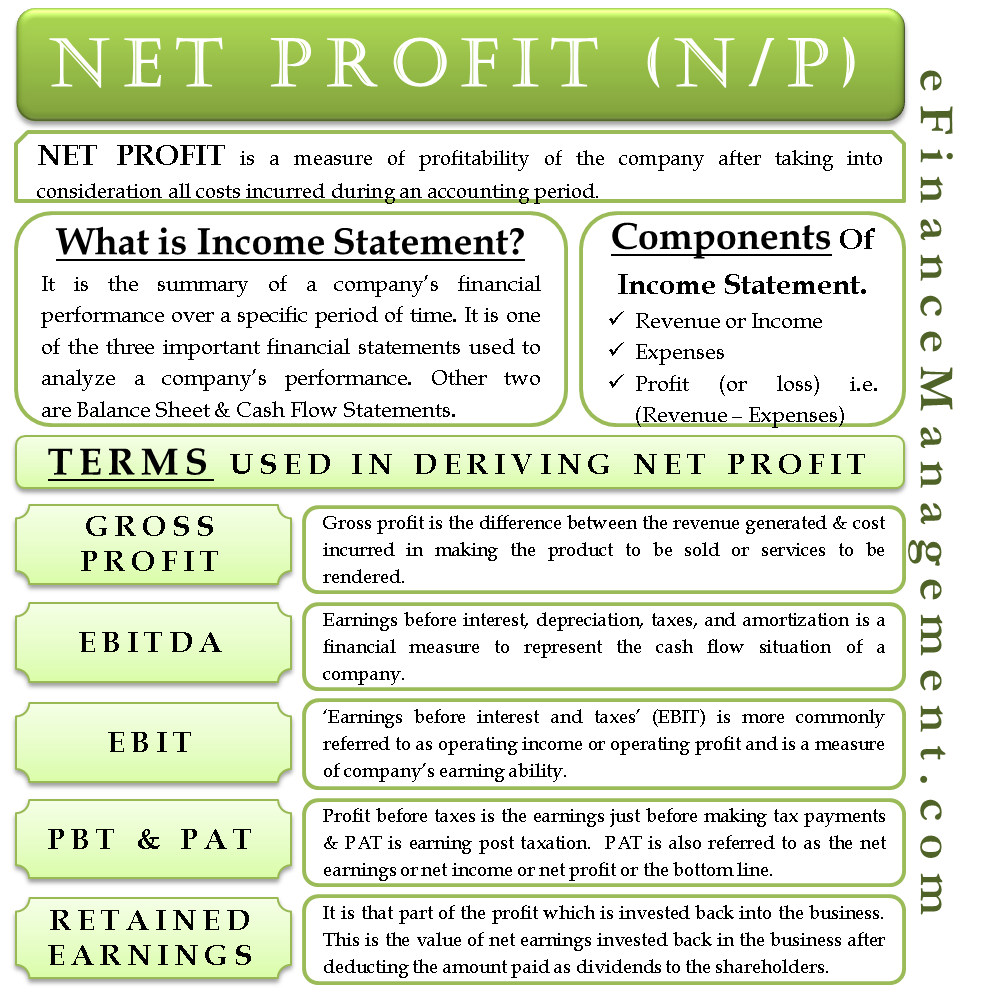

Net Profit Income Statement Terms EBIT PBT Retained Earnings Etc

https://efinancemanagement.com/wp-content/uploads/2015/10/Net-Profit.png

How To Get Net Profit Before Interest And Tax - EBIT Net Income Interest Taxes EBIT EBITDA Depreciation and Amortization Expense Starting with net income and adding back interest and taxes is the most straightforward as these items will always be displayed on the income statement Depreciation and amortization may only be shown on the cash flow statement for some businesses