Net Profit After Interest And Tax Formula Thus if we deduct Non operating expenses and operating expenses from revenue we would profit before tax PBT 500 150 68 282 Now calculate the Taxable amount by using PBT and the given tax rate Taxable Amount Tax 30 on PBT 30 of 282 84 6 Therefore as per formula

Net Income After Taxes NIAT Net income after taxes NIAT is an accounting term most often found in a company s annual report that is meant to show the company s definitive bottom line for After tax profit margin is a financial performance ratio calculated by dividing net profit after taxes by revenue A company s after tax profit margin is important because it tells investors the

Net Profit After Interest And Tax Formula

Net Profit After Interest And Tax Formula

https://www.myaccountingcourse.com/financial-ratios/images/earnings-before-interest-and-taxes-equation-calculation.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Y Ltd Profit After Interest And Tax Q 145 Ch 4 Accounting Ratios

https://touch4career.com/wp-content/uploads/2021/10/q145-1024x671.jpg

There are primarily two ways net income after tax is used in an analysis to interpret a company s profitability Firstly through the calculation of return ratios analysts can quantify a company s ability to generate profit given asset investments and equity financing Secondly profitability can be assessed relative to revenues generated Another way to calculate EBITDA is to add back the non cash expenses of depreciation and amortization to a company s earnings before interest and taxes EBIT Here s how this alternate EBITDA formula looks To find EBITDA using this formula and the income statement above find the line items for Net Income 250 000 Interest 50 000

Net Profit Formula To calculate net profit start by reviewing two figures on the income statement total revenue and total expenses Interest Expense 10 000 Taxes 10 000 Net Profit 30 000 By using the formula we can calculate net profit thusly 100 000 20 000 30 000 10 000 10 000 30 000 The formula for after tax income is quite simple as given below To calculate the after tax income simply subtract total taxes from the gross income For example let s assume an individual makes an annual salary of 50 000 and is taxed at a rate of 12 It would result in taxes of 6 000 per year Therefore this individual s after tax

More picture related to Net Profit After Interest And Tax Formula

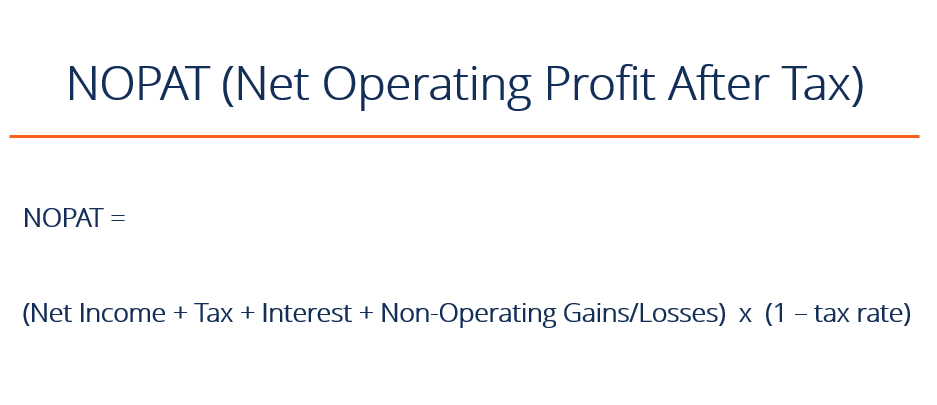

NOPAT

https://cdn.corporatefinanceinstitute.com/assets/nopat.png

From The Following Information Calculate Interest Coverage Ratio Net

https://s3mn.mnimgs.com/img/shared/content_ck_images/ck_5f59c8482bca7.jpeg

Profit After Tax Definition Calculation Method And Advantages

https://navi.com/blog/wp-content/uploads/2022/11/Profit-After-Tax.jpg

Earnings Before Interest Tax EBIT Earnings Before Interest Taxes EBIT is an indicator of a company s profitability calculated as revenue minus expenses excluding tax and interest EBIT Net profit margin is a financial ratio that compares a company s net profit after taxes to revenue You can calculate it using the income statement Net income minority interest tax adjusted interest revenue net Plugging these numbers into the net profit margin formula gives you 97 500 net profit 500 000 revenue 0 195

Another formula begins with net income and has a couple of additional steps to calculate the metric NOPAT Net Income Non Operating Losses Non Operating Gains Interest Expense Taxes 1 Tax Rate From net income bottom line we add back non operating losses and deduct any non operating gains and then add back the Net Operating Profit After Tax NOPAT Net operating profit after tax NOPAT is a company s potential cash earnings if its capitalization were unleveraged that is if it had no debt NOPAT

Calculating Net Profit After Tax And Why It Is THE 1 Metric For Business

https://mytaxhack.com/wp-content/uploads/2017/12/Table-3.png

Online Essay Help Amazonia fiocruz br

https://biz.libretexts.org/@api/deki/files/13449/4ec2c862a6503e971a2144f9fcbcf8f2b5bb6628?revision=1

Net Profit After Interest And Tax Formula - Another way to calculate EBITDA is to add back the non cash expenses of depreciation and amortization to a company s earnings before interest and taxes EBIT Here s how this alternate EBITDA formula looks To find EBITDA using this formula and the income statement above find the line items for Net Income 250 000 Interest 50 000