How Do You Calculate Net Profit Before Interest And Tax Profit before tax PBT is a measure of a company s profitability that looks at the profits made before any tax is paid How to Calculate Profit Before Tax To calculate the PBT of a company one must follow several steps They are 1 200 000 in cost of goods sold and 300 000 in operating expenses The earnings before interest and

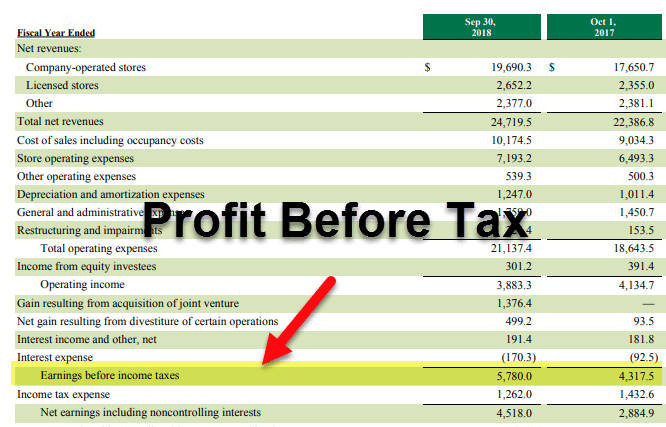

Profit before tax PBT is a line item in a company s income statement that measures profits earned after accounting for operating expenses like COGS SG A Depreciation Amortization etc non operating expenses like interest expense but before paying off the income taxes This is a significant measure because it gives the company s overall profitability and performance before making Earnings Before Interest and Taxes EBIT is a metric used to measure a company s profitability It is calculated by adding interest and tax expenses back to net income The direct method begins with deducting the cost of goods sold and operating expenses from the revenue

How Do You Calculate Net Profit Before Interest And Tax

How Do You Calculate Net Profit Before Interest And Tax

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

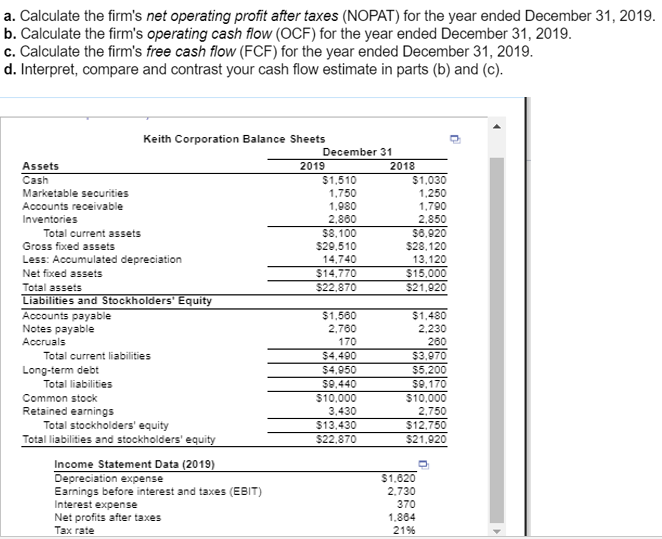

Return On Assets Net Sales Gross Profit Margin Cost Of Goods Operating

https://img.homeworklib.com/questions/5a213060-7285-11ea-9dd0-e5e9a2b40a04.png?x-oss-process=image/resize,w_560

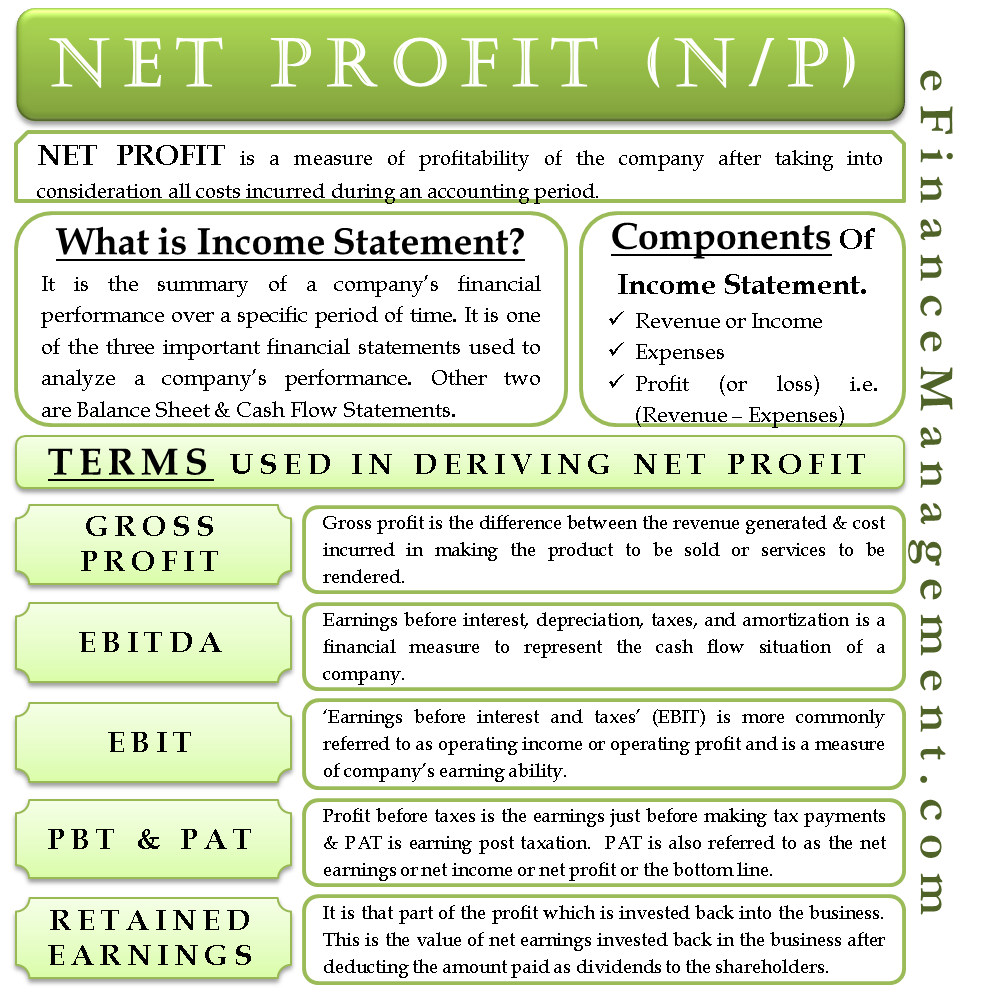

These are usually focused on gross profit operating profit and net profit However as with interest the isolation of a company s tax payments can be an interesting and important metric for EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted

To calculate net profit before tax subtract all expenses except for income taxes from a company s revenue including Cost of goods sold 50 000 in COGS 20 000 in operating expenses and 5 000 in interest expenses its net profit before tax would be 100 000 Total Revenue 50 000 COGS 20 000 Operating Expenses 5 000 Interest This helps to compare the value of companies operating under different tax laws EBIT Earnings before interest and taxes This can be another useful tool for comparing whether companies are equally profitable without looking at how they re financing EBITDA Earnings before interest taxes depreciation and amortization This excludes most

More picture related to How Do You Calculate Net Profit Before Interest And Tax

Net Profit Income Statement Terms EBIT PBT Retained Earnings Etc

https://efinancemanagement.com/wp-content/uploads/2015/10/Net-Profit.png

How To Find Net Profit Before Interest And Tax

https://media.cheggcdn.com/media/2cd/2cd4a4e5-a895-46ae-bc6f-f0fd1e0450b6/php7iqCMp.png

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)

Earnings Before Interest And Taxes EBIT Formula And Example

https://www.investopedia.com/thmb/TKO9xGWig7qtuMSBOW0v3l90mmI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png

How to calculate EBIT To calculate EBIT you should deduct direct and indirect expenses from the net revenue excluding interest and tax From the first formula EBIT Net Income Interest Taxes Net income this is also the net profit or the company s bottom line Interest the company s profit deducted before calculating net income Calculate the earnings before tax EBT The last step is to put everything together and calculate the EBT using the earnings before taxes formula EBT gross profit operating expense interest expense other income Thus the Company Alpha s EBT is 700 000 300 000 200 000 100 000 300 000

[desc-10] [desc-11]

Qu Es El EBITDA F rmula Ejemplo Contabilizar Renting Ejemplos

https://www.contabilizarrenting.com/wp-content/uploads/2021/12/¿Que-es-el-EBITDA-Formula-Ejemplo.jpg

Net Profit Before Interest And Tax 400000 Q 144 Ch 4 Accounting Ratios

https://touch4career.com/wp-content/uploads/2021/10/q144-1024x656.jpg

How Do You Calculate Net Profit Before Interest And Tax - [desc-12]