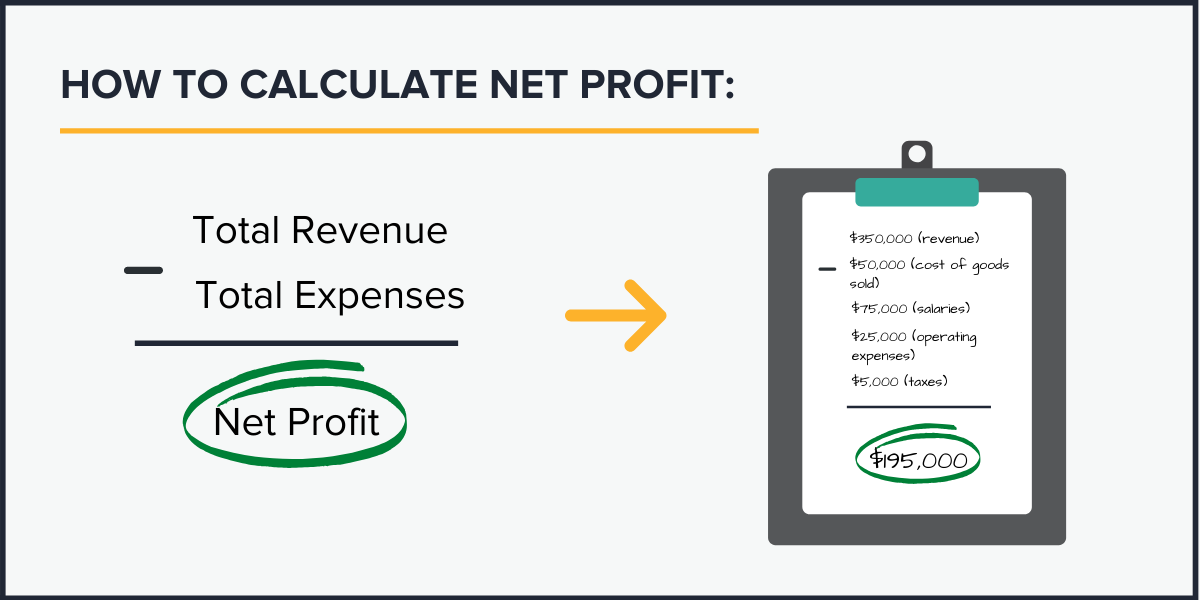

How To Calculate Net Profit After Interest And Tax Net income after taxes represents the profit or earnings after all expense have been deducted from revenue Net income after taxes calculation can be shown as both a total dollar amount and a per

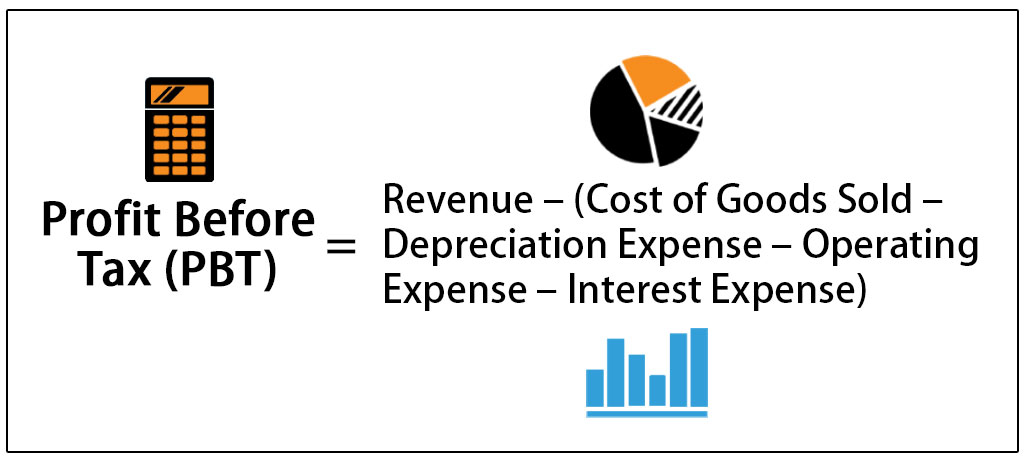

Profit after tax also known as net income or net profit represents the amount of money a company earns after accounting for all expenses taxes and interest payments Profit after tax takes into account the taxes paid by the company on its pre tax earnings Taxes are calculated based on applicable tax rates and deductions and they can How to calculate net profit after tax To calculate NPAT subtract all expenses from revenue including tax The formula for calculating NPAT is NPAT Total Revenue COGS Operating Expenses Interest Expenses Taxes Sample calculation

How To Calculate Net Profit After Interest And Tax

How To Calculate Net Profit After Interest And Tax

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Solved LOGIC COMPANY Comparative Income Statement For Years Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/a5c/a5cb3f28-b099-4112-ae55-b5736ec01ba8/phpXX3iat.png

How To Calculate Profit Percentage Of RETAIL SHOP How To Calculate Net

https://i.ytimg.com/vi/Cv0BgAjQDAY/maxresdefault.jpg

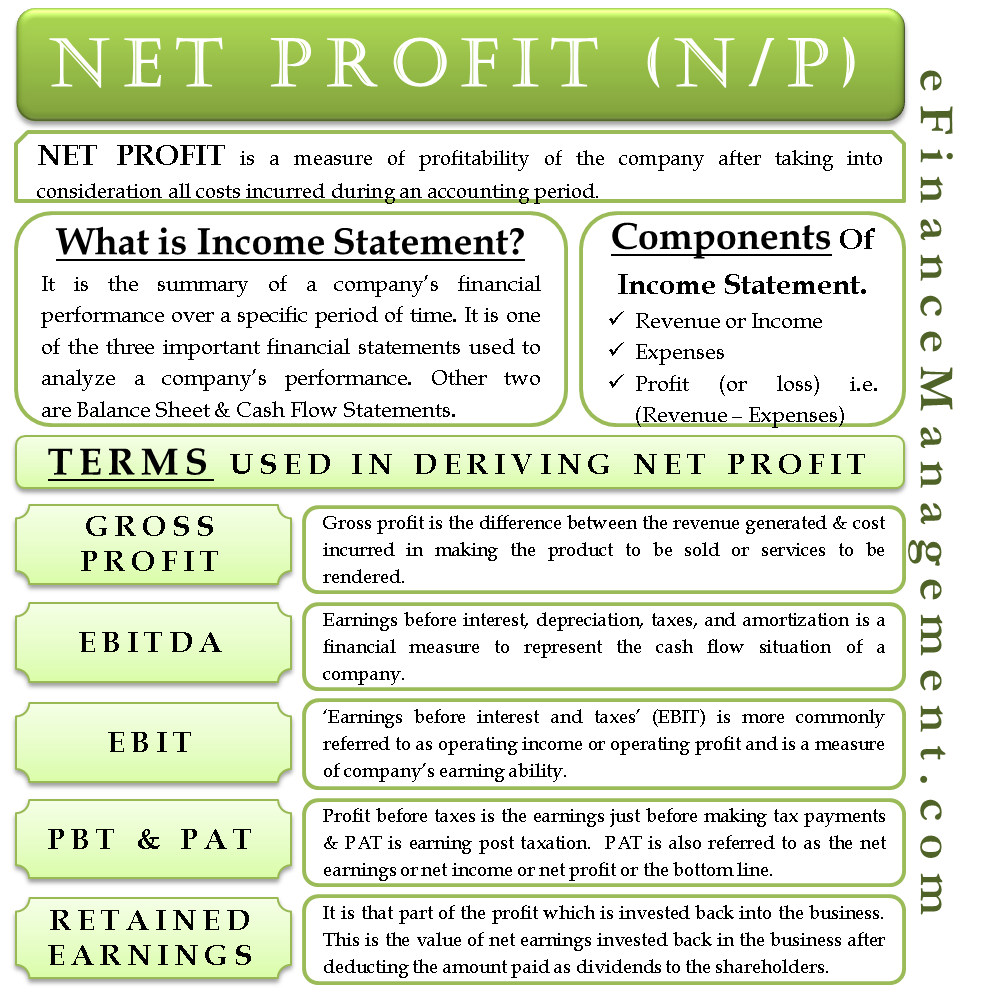

Profit after tax PAT also called net income or net profit refers to a company s total earnings after accounting for all expenses interest taxes and dividends paid PAT is a key metric used to evaluate a company s financial performance and profitability over a specific period of time usually a quarter or fiscal year Net Income is a measure of accounting profitability or the residual after tax profit of a company once all operating and non operating costs are deducted The net income or net profit is recorded at the bottom of the income statement and represents the after tax profit remaining upon deducting all costs and expenses

The key difference between net profit and operating profit is that net profit deducts all expenses including interest and taxes from a company s revenue while operating profit only deducts interest and taxes This means that net profit provides a more comprehensive picture of a company s profitability than operating profit as it takes For example if EBIT is 10 000 and the tax rate is 30 the net operating profit after tax is 0 7 which equals 7 000 calculation 10 000 x 1 0 3 This is an approximation of after tax

More picture related to How To Calculate Net Profit After Interest And Tax

What Is Net Profit Net Profit Formula updated 2022

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

From The Following Information Calculate Interest Coverage Ratio Net

https://s3mn.mnimgs.com/img/shared/content_ck_images/ck_5f59c8482bca7.jpeg

Profit After Tax Definition Calculation Method And Advantages

https://navi.com/blog/wp-content/uploads/2022/11/Profit-After-Tax.jpg

4 Calculate net profit after tax Operating income and the answer to your tax rate equation are used to calculate net profit after tax The net profit after taxes is determined by multiplying the two items together As an illustration if operating income is 10 000 and the solution to the tax rate equation is 0 50 the net profit after tax If the company has raised funds by way of debt then its cost that is interest expense is not included in the calculation of net operating profit after tax Basically net operating profit after tax is the net income of a company considering it as an unleveraged one Similarly we ignore all non operating income and expenses from its

[desc-10] [desc-11]

How To Calculate Net Profit Rate

https://media.cheggcdn.com/study/4e8/4e821d15-2bfb-4354-a341-34ca52733186/image.jpg

Net Profit Income Statement Terms EBIT PBT Retained Earnings Etc

https://efinancemanagement.com/wp-content/uploads/2015/10/Net-Profit.png

How To Calculate Net Profit After Interest And Tax - Net Income is a measure of accounting profitability or the residual after tax profit of a company once all operating and non operating costs are deducted The net income or net profit is recorded at the bottom of the income statement and represents the after tax profit remaining upon deducting all costs and expenses