How To Calculate Profit After Interest And Tax To calculate the net profit after tax their accountant determines the operating income by subtracting the operating expenses from the gross profits for a total of 15 000 The accountant then converts the tax rate into a decimal making it 0 30 and then subtracts it from one for a result of 0 70

Calculating PAT involves determining a company s earnings before interest and taxes EBIT first which reflects profits from core business operations From the EBIT figure total tax expense is then deducted which includes income tax corporate tax and other taxes paid The remaining amount is the profit after tax or net profit Net income after taxes represents the profit or earnings after all expense have been deducted from revenue Companies that increase net income have more cash to invest in the company s future pay

How To Calculate Profit After Interest And Tax

How To Calculate Profit After Interest And Tax

https://www.bdc.ca/PublishingImages/definitions/earnings-after-tax-exemple.jpg

.png)

How To Calculate Gross Profit Formula And Examples Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/63646b209859532b69040e08_Net Profit Calculation (1).png

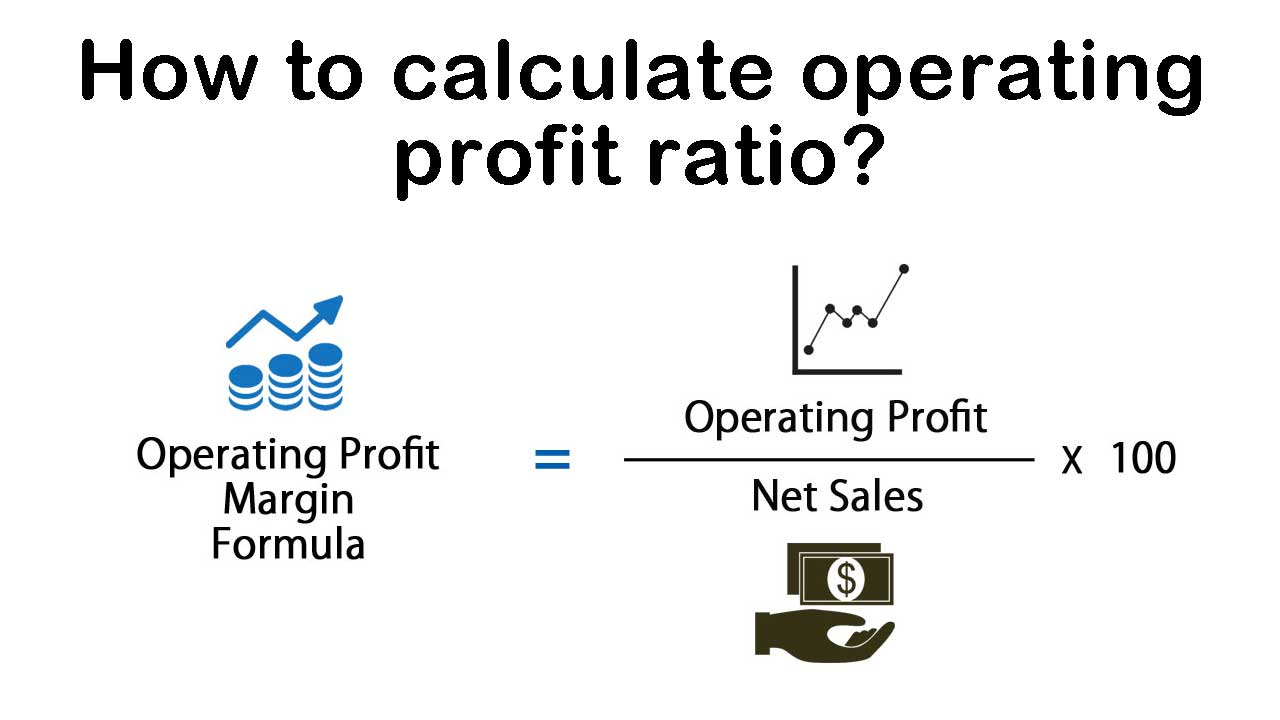

How To Calculate Operating Profit Ratio Sharda Associates

https://shardaassociates.in/wp-content/uploads/2021/04/How-to-calculate-operating-profit-ratio.jpg

To calculate the Profit after tax PAT tax expense deduct from the profit before taxes PBT The figure of PAT considers the best measure to analyze the ability of the business to generate profits Interest on loan 1 000 The tax rate of the company is 30 Calculate the PAT Solution Calculation of Profit after tax Particulars How to calculate net profit after tax To calculate NPAT subtract all expenses from revenue including tax The formula for calculating NPAT is NPAT Total Revenue COGS Operating Expenses Interest Expenses Taxes 50 000 in COGS 20 000 in operating expenses and 5 000 in interest expenses its net profit before tax would be

Calculating Profit After Tax PAT is important because it reveals a company s actual earnings after paying all taxes It helps investors and business owners assess the business s true profitability make informed decisions and determine how much money is available for reinvestment or distribution to shareholders The Net Profit of a company is the amount of money a business earns after deducting interest operating expenses and tax over a defined period Net Profit is also called Profit After Tax PAT Net Profit determines the financial health of the business It shows if a company makes more money than it spends

More picture related to How To Calculate Profit After Interest And Tax

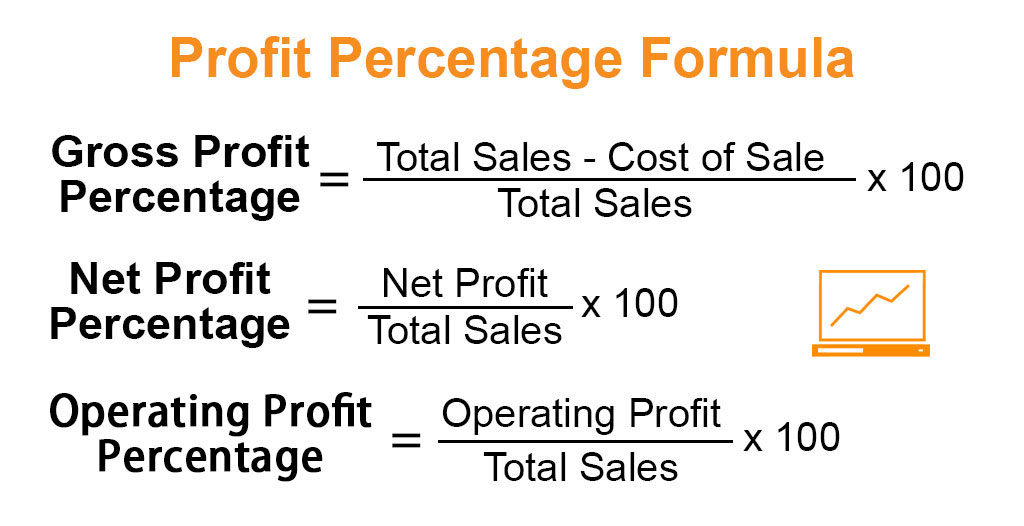

How To Calculate Net Profit Percentage Haiper

https://www.educba.com/academy/wp-content/uploads/2019/08/Profit-Percentage-Formula-educba.jpg

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

The Gross Profit Formula Lower Costs Raise Revenue QuickBooks Australia

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

Know how to calculate profit after tax and its importance for a company at Angel One Calculate your SIP Return Open Demat Account Open Demat Account Open Demat Account Issued in public interest by Angel One Limited having its registered office at 601 6th Floor Ackruti Star Central Road MIDC Andheri East Mumbai 400093 Telephone Interest expense on any debt including short term debt and the interest portion of long term debt such as bonds issued is subtracted from net operating earnings Calculating the Profit after Tax is critical for understanding the actual amount that a firm makes in a given working year

[desc-10] [desc-11]

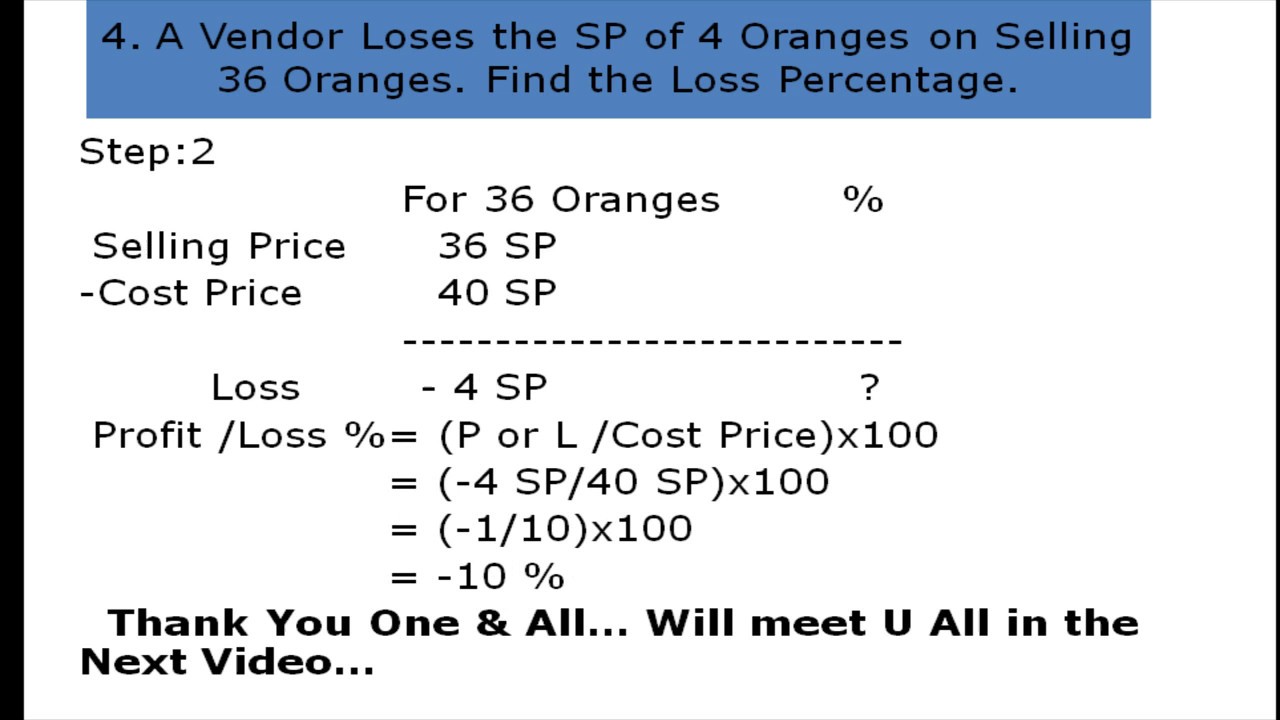

How To Calculate Of Profit Or Loss From Basics YouTube

https://i.ytimg.com/vi/yq1VbgTSgxM/maxresdefault.jpg

How To Calculate Profit After Tax And Its Various Implications

https://khatabook-assets.s3.amazonaws.com/media/post/2022-03-09_065540.8356120000.webp

How To Calculate Profit After Interest And Tax - The Net Profit of a company is the amount of money a business earns after deducting interest operating expenses and tax over a defined period Net Profit is also called Profit After Tax PAT Net Profit determines the financial health of the business It shows if a company makes more money than it spends