How To Calculate Net Profit Before Interest And Tax Class 12 Profit before tax PBT is a line item in a company s income statement that measures profits earned after accounting for operating expenses like COGS SG A Depreciation Amortization etc non operating expenses like interest expense but before paying off the income taxes This is a significant measure because it gives the company s overall profitability and performance before making

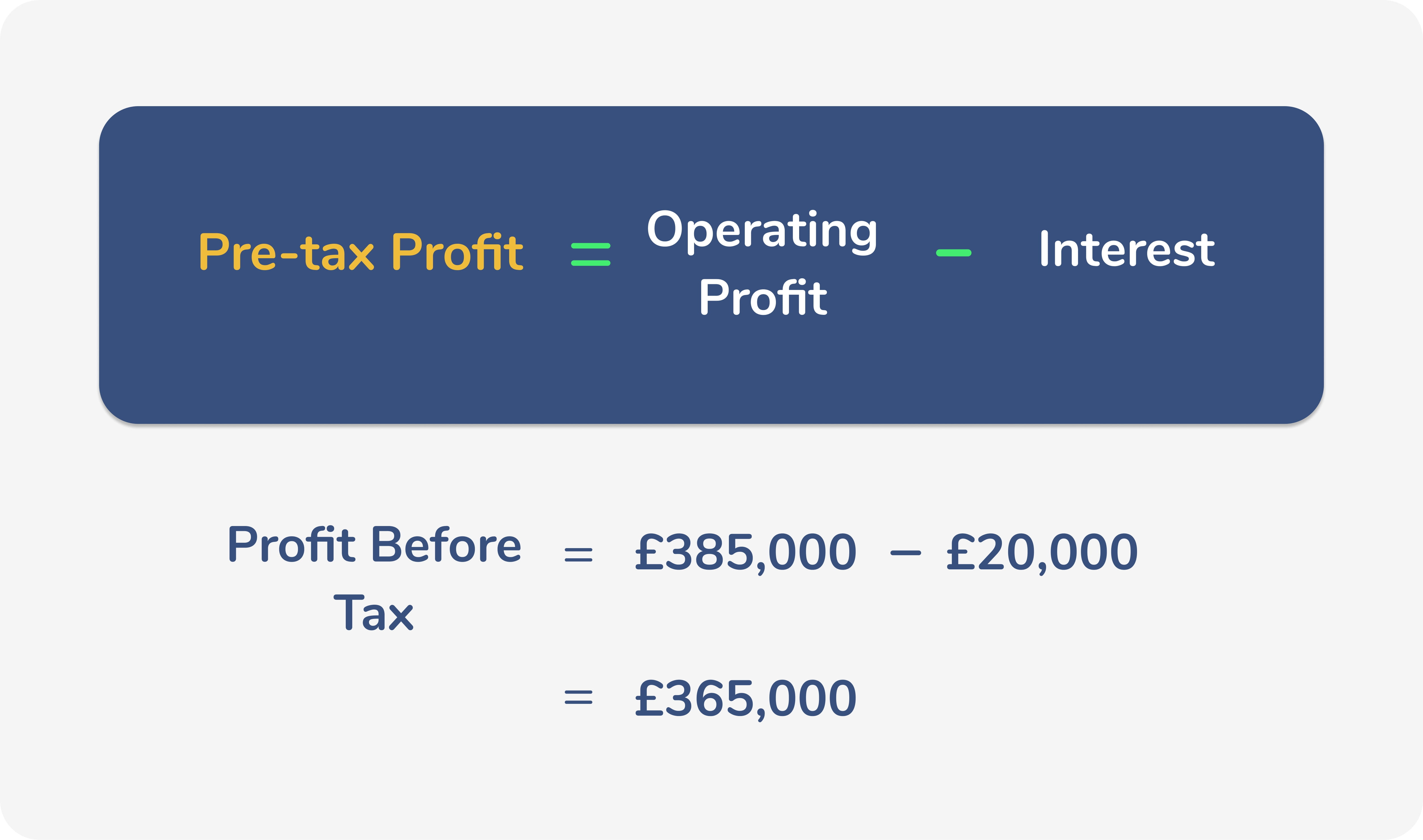

Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2 000 000 1 750 000 250 000 PBT vs EBIT Profit before taxes and earnings before interest and tax EBIT are both effective measures of a company s profitability However they provide slightly different perspectives on financial results Apple s Earnings Before Taxes 53 394 million 1 26 1 Another method Another way to calculate pre tax profit You can also calculate a company s pre tax profit by subtracting a company s

How To Calculate Net Profit Before Interest And Tax Class 12

How To Calculate Net Profit Before Interest And Tax Class 12

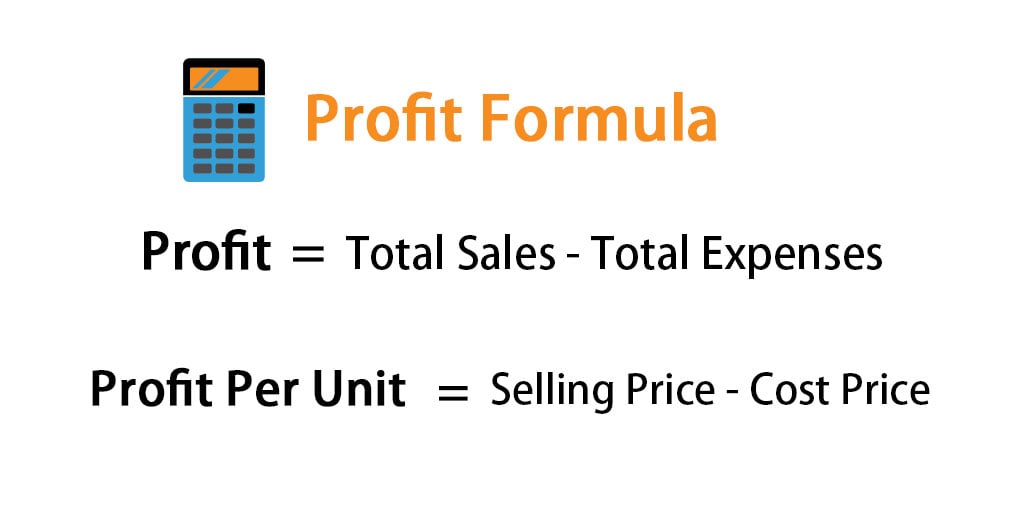

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Profit-Formula.jpg

The Gross Profit Formula Lower Costs Raise Revenue QuickBooks Australia

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

Profit Margin The 4 Types Formula And Definition Wise

https://wise.com/imaginary/251e126aeedb4b6609f03c68975428c2.jpg

2 Calculate EBIT from Net Income Alternatively you can calculate EBIT by starting with net income and adding back interest and taxes If a company has Net Income 100 000 Interest Expense 20 000 Taxes 30 000 The EBIT calculation would be EBIT Net Income Interest Taxes EBIT 100 000 20 000 30 000 150 000 Interest Expense 50 000 Income Taxes 10 000 Net Income 90 000 In this example Ron s company earned a profit of 90 000 for the year In order to calculate our EBIT ratio we must add the interest and tax expense back in Thus Ron s EBIT for the year equals 150 000

To calculate EBIT using the indirect method we add income tax expense and interest expense to the net income EBIT 5 727 934 262 6 923 From both examples we had above we can see non operating items proceeds from sale of asset lawsuit expenses and other expenses that need to be accounted for Learn the importance of each part of the EBIT calculation 1 Earnings A company s earnings is the amount of income generated after subtracting operating expenses from total revenue 2 Interest It s common for a company with many fixed assets on their balance sheets to finance those assets by debt which requires that the company make interest payments

More picture related to How To Calculate Net Profit Before Interest And Tax Class 12

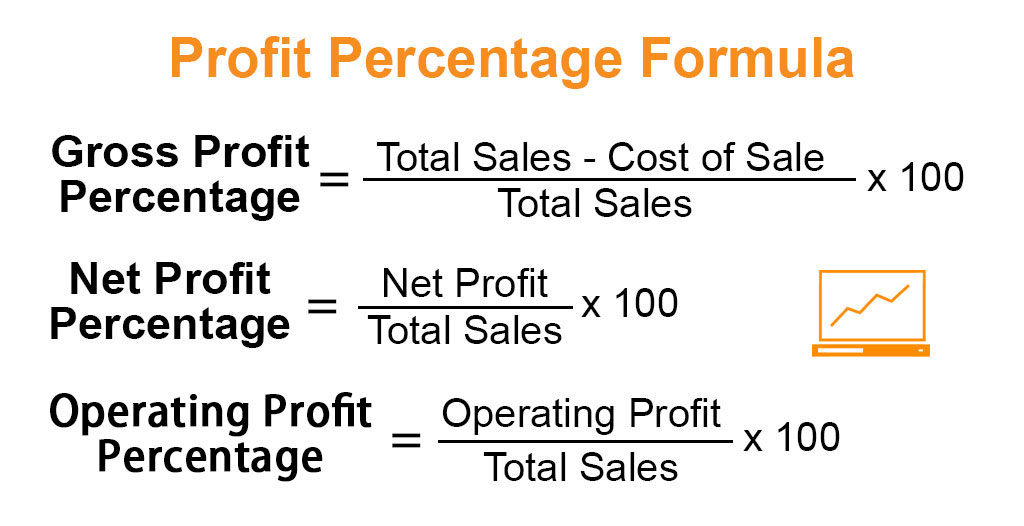

How To Calculate Net Profit Percentage Haiper

https://www.educba.com/academy/wp-content/uploads/2019/08/Profit-Percentage-Formula-educba.jpg

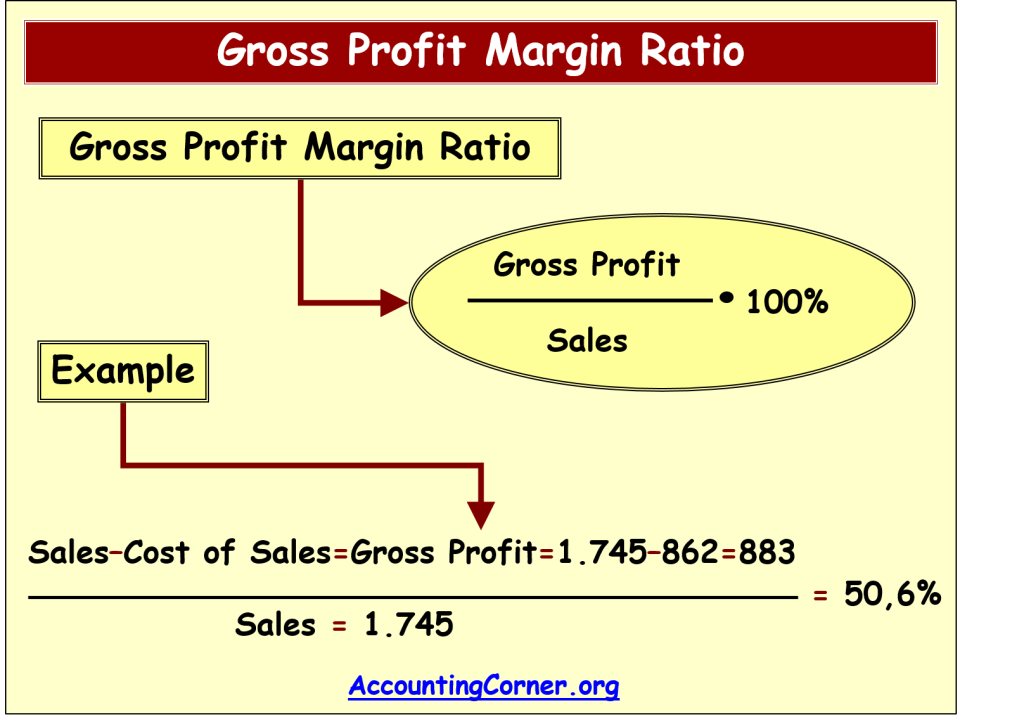

How To Calculate Cogs From Net Sales Haiper

https://accountingcorner.org/wp-content/uploads/2016/01/gross_profit_example-1024x717.png

D nsky Pou Stato n Company Net Worth Calculator Atrakt vne Oslepuj ci

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

EBIT Net income Interest Taxes Another EBIT calculation you might have seen is EBIT Revenue COGS Cost of goods sold Operating expenses But as you ll see this is the formula for operating income EBIT calculation example It s easy to calculate EBIT if you have access to your net earnings and interest and tax expenses Here s It can usually be found on a company s income statement and could be referred to as operating profit operating income or profit before interest and taxes To calculate EBIT you must subtract operating expenses from the company s revenue Income tax and interest should not be deducted as the name suggests EBIT can also be called operating

[desc-10] [desc-11]

Vineri Fapt mbr c minte Income Calculator Meniul For at Lift

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator.jpg

How To Calculate Net Profit Margin Ratio Haiper

https://www.double-entry-bookkeeping.com/wp-content/uploads/net-profit-ratio-formula.png

How To Calculate Net Profit Before Interest And Tax Class 12 - [desc-14]