What Is Net Profit Before Interest And Tax In accounting and finance earnings before interest and taxes EBIT is a measure of a firm s profit that includes all incomes and expenses operating and non operating except interest expenses and income tax expenses 1 2 Operating income and operating profit are sometimes used as a synonym for EBIT when a firm does not have non operating income and non operating expenses

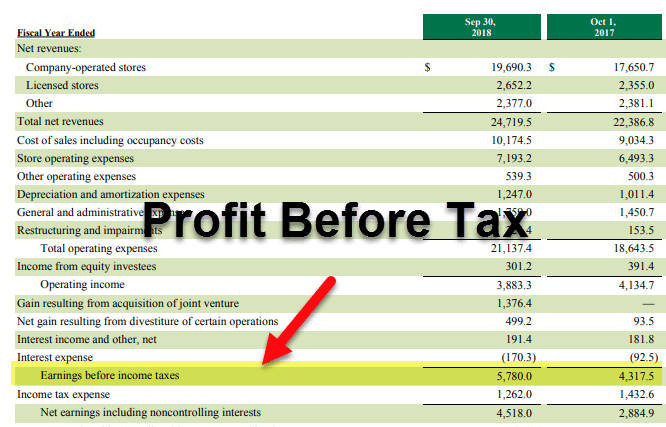

What Is Earnings Before Interest and Taxes EBIT Earnings Before Interest and Taxes EBIT is one of the various profitability metrics for businesses EBIT Net Income Income Tax Interest Expense 151 000 25 000 25 000 201 000 Using either equation or method the EBIT for ABC Company is 201 000 Profit before tax PBT is a measure that looks at a company s profits before the company has to pay income tax and net profit However as with interest the isolation of a company s tax

What Is Net Profit Before Interest And Tax

What Is Net Profit Before Interest And Tax

https://www.investopedia.com/thmb/jxbQ-6tTWq3ObvsamRtcjhGl1xg=/808x808/smart/filters:no_upscale()/macys_income_statement_may18_ebit-5c096172c9e77c0001bfe8a1

Profit Before Interest And Tax Explained InvestSmall

https://www.investsmall.co/wp-content/uploads/2020/06/investments-in-2048x1365.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Net income and earnings before interest and taxes EBIT are two variables that help businesses make decisions on operations and spending By understanding the uses of these financial metrics and how to calculate them you can provide deep insight into a company s finances EBITDA Net Income Taxes Interest Depreciation Amortization EBIT Net Income Interest Taxes EBIT EBITDA Depreciation and Amortization Expense Starting with net income and adding back interest and taxes is the most straightforward as these items will always be displayed on the income statement Depreciation and amortization may only be shown on the cash flow statement for some businesses

EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted Earnings before interest and taxes EBIT is a company s net income plus income tax and interest expenses EBIT is used to analyze the profitability of a company s core operations

More picture related to What Is Net Profit Before Interest And Tax

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

What Is Net Profit Margin Valuation Master Class

https://valuationmasterclass.com/wp-content/uploads/2020/08/44-1024x683.jpg

GRAPHIC

http://www.sec.gov/Archives/edgar/data/1364479/000110465907024979/g91851kai032.jpg

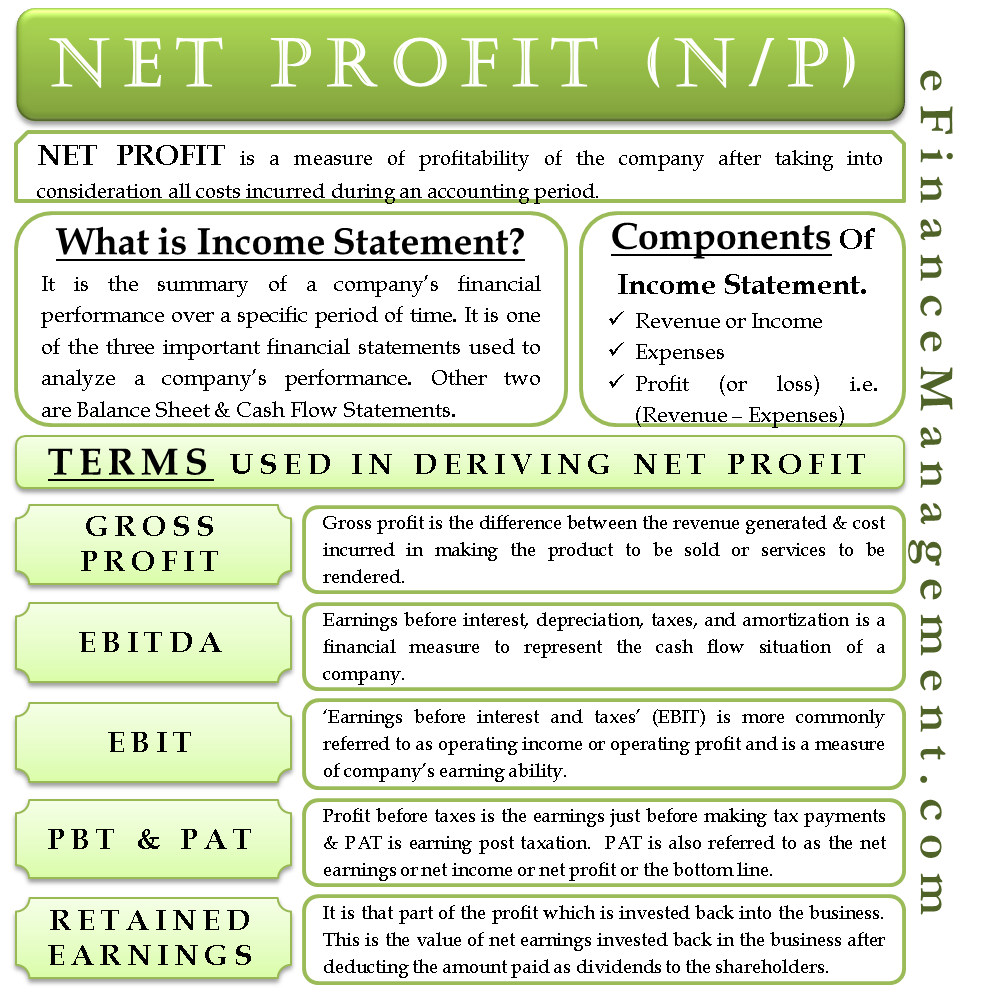

Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2 000 000 1 750 000 250 000 PBT vs EBIT Profit before taxes and earnings before interest and tax EBIT are both effective measures of a company s profitability However they provide slightly different perspectives on financial results Profit Before Interest and Tax PBIT is a measure of a company s operating profit before deducting interest and tax expenses Two widely used metrics in this context are Gross Profit and Net Profit Gross Profit represents the revenue generated from a company s core operations after accounting for the direct costs associated with

[desc-10] [desc-11]

Net Profit Income Statement Terms EBIT PBT Retained Earnings Etc

https://efinancemanagement.com/wp-content/uploads/2015/10/Net-Profit.png

Net Profit Before Interest And Tax 400000 Q 144 Ch 4 Accounting Ratios

https://touch4career.com/wp-content/uploads/2021/10/q144-1024x656.jpg

What Is Net Profit Before Interest And Tax - Earnings before interest and taxes EBIT is a company s net income plus income tax and interest expenses EBIT is used to analyze the profitability of a company s core operations