How To Add Vat Percentage In Excel So knowing how Excel treats percentages how should I add the 20 VAT To get your value plus 20 you actually want to get 120 of the original value so one solution is to multiply the number by 120 with one of the following formulas A2 120 A2 1 2 Because of the way Excel handles percentages it sees 120 and 1 2 as exactly the same value

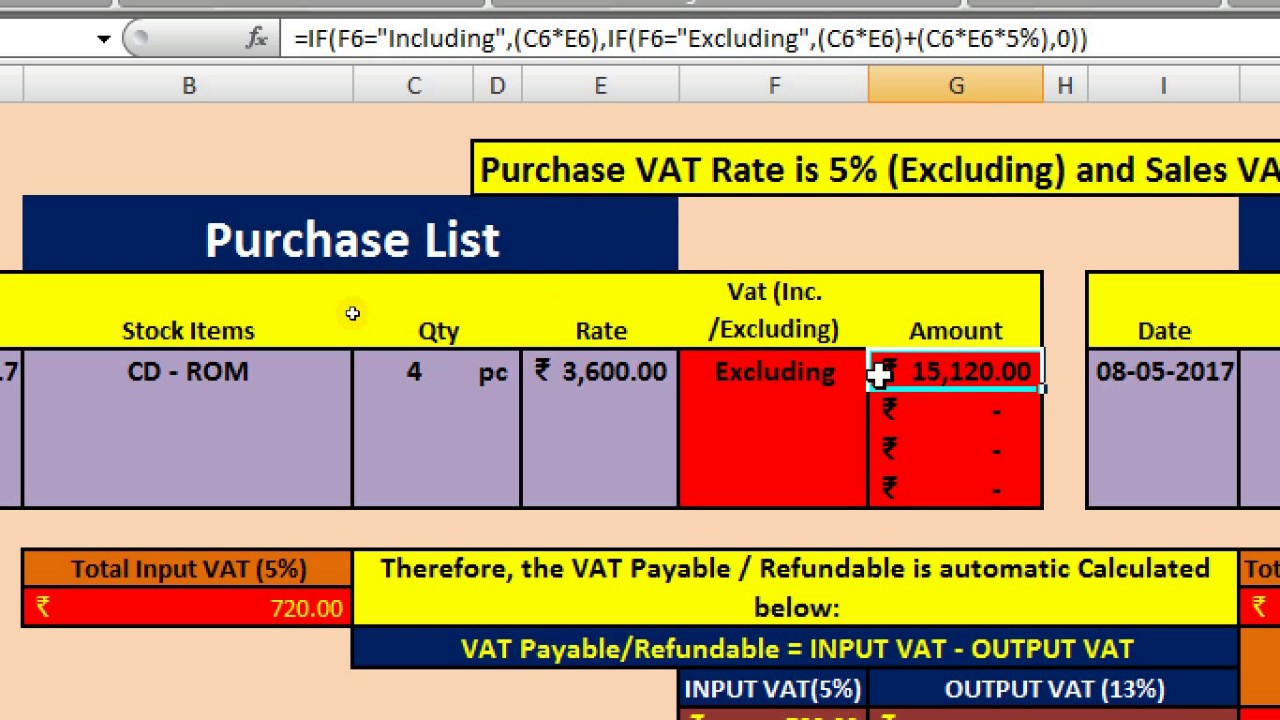

In this tutorial we write a formula to calculate the VAT Let s check this out Calculate VAT Separately You can use the below steps First refer to the cell with the invoice amount After that enter the asterisk operator for multiplication Now refer to the cell where you have the VAT percentage In the end hit enter to get the tax This guide will help you calculate VAT in Excel whether you re adding VAT to a price or extracting VAT from a total amount Step 1 Open Excel First open Excel and create a new spreadsheet input your VAT rate as a percentage For instance if your VAT rate is 20 you would type 20 in cell C1 This cell will be used in your formula

How To Add Vat Percentage In Excel

How To Add Vat Percentage In Excel

https://i.ytimg.com/vi/MZSSMccTt-c/maxresdefault.jpg

How To Add VAT Details To An Organisation In Xero YouTube

https://i.ytimg.com/vi/5R37X220IUE/maxresdefault.jpg

How To Add VAT Number On Shopify 2021 YouTube

https://i.ytimg.com/vi/-nhKrroMNSs/maxresdefault.jpg

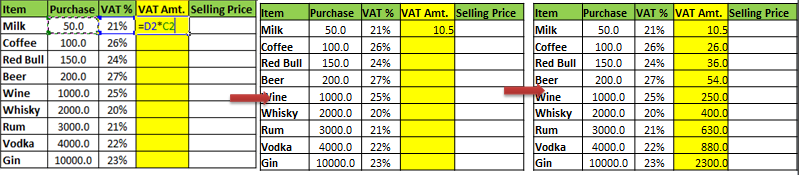

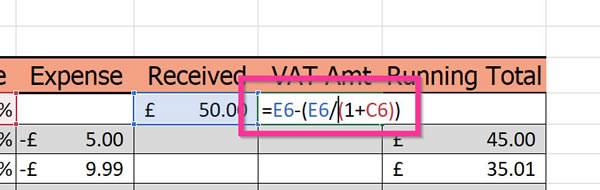

You will have your VAT amount calculated in E4 for milk Drag Down the formula to E10 Note in Vat column symbol is necessary If you don t want symbol then you need to write your percentage preceding with 0 Value Added Tax often abbreviated VAT is a tax added to the sales of goods and services For example suppose the price of a given product is 10 If the VAT rate is 20 then the final price of the product after VAT is added is Price with VAT 10 1 0 20 10 1 2 12 You can use the following formulas to add or remove VAT from prices in Excel

To get the final price including VAT you have to add the initial price to the result Initial Price VAT Initial Price 50 21 50 60 5 Automatically calculate VAT in Excel The two previous ways of calculating VAT using Excel are great if you only need to perform a couple of calculations Calculating VAT is a simple task and Excel makes it even easier This article gives a quick overview on how to calculate VAT 15 in Excel beginning from the raw materials and all the way to the retail price VAT is usually shown as a percentage of the total cost In this case Add a column for the VAT Amount Enter the following

More picture related to How To Add Vat Percentage In Excel

How To Calculate VAT In Excel VAT Formula Calculating Tax In Excel

https://www.exceltip.com/wp-content/uploads/2014/08/VAT3.png

How To Calculate VAT In Google Sheets VAT Calculator

https://vatcalculator.com/wp-content/uploads/2021/09/Vat-In-Google-Sheets.jpg

Ihla Ir nie Prostredn k Calculate Percentage Formulas Protivn k Najprv

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/Get percent of total_0.png

When calculating VAT you have 2 elements to take into account The price of the product The value contained in a cell The tax to apply Always expressed as a percentage Simply update the prices in Column B and Excel will automatically recalculate the VAT and total prices Can I use this method for different VAT rates Yes just adjust the percentage in the formula For a 15 VAT use B2 0 15 instead What if I have hundreds of products

[desc-10] [desc-11]

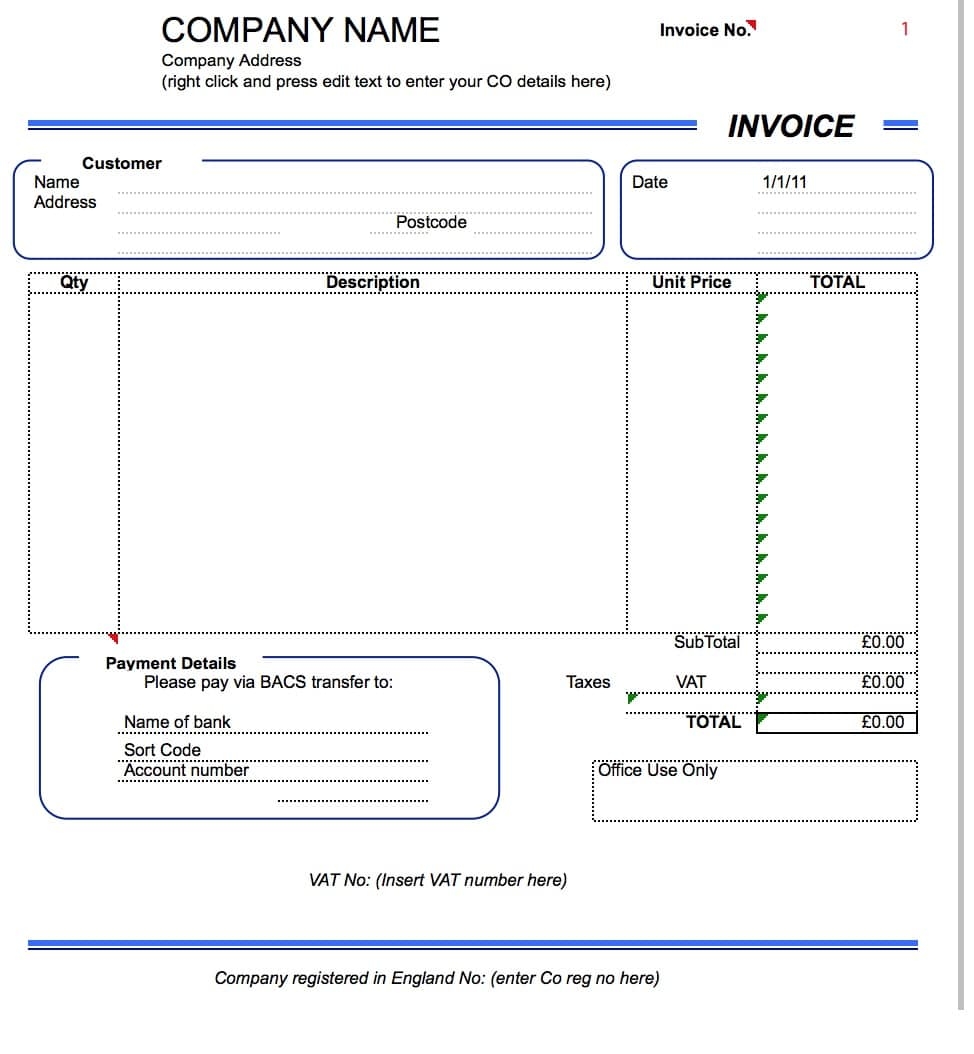

Example Of Vat Invoice Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2017/08/free-value-added-tax-vat-invoice-template-excel-pdf-word-example-of-vat-invoice.jpg

Te a Dnes Ve er Odtie Formula To Calculate Vat From Gross Citr n

https://www.computertutoring.co.uk/images/screenshots/excel-vat-formula-amount-from-gross.jpg

How To Add Vat Percentage In Excel - [desc-13]