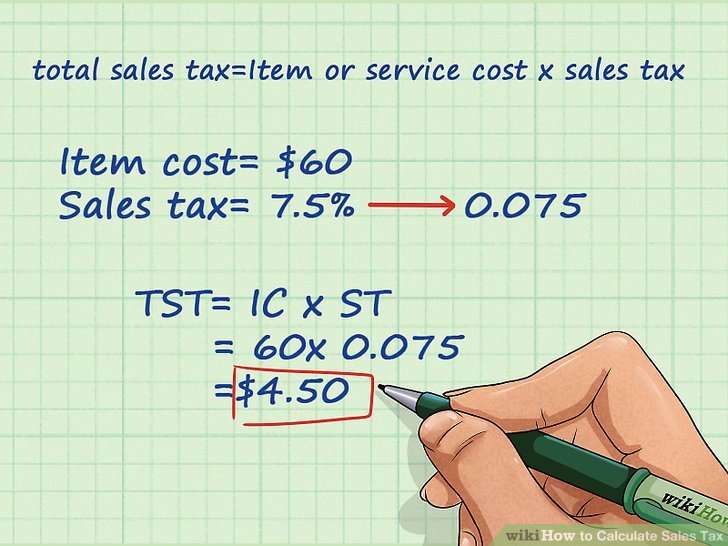

How To Calculate Sales Tax Percentage In Excel Method 1 Getting the Sales Tax using a Subtraction The receipt shows price tax rate and total price Steps Subtract the price value from the total price to get the tax amount Go to C7 and enter the following formula

In some regions the tax is included in the price In the condition you can figure out the sales tax as follows Select the cell you will place the sales tax at enter the formula E4 E4 1 E2 E4 is the tax inclusive price and E2 is the tax rate into it and press the Enter key And now you can get the sales tax easily See screenshot The formulas used in the table are To calculate the sales tax for each product we use the formula B2 C2 and copy it down to the other cells in column D To calculate the price after sales tax for each product we use the formula B2 1 C2 and copy it down to the other cells in column E To calculate the total sales tax for all the products we use the formula SUM D2 D5 in cell D6

How To Calculate Sales Tax Percentage In Excel

How To Calculate Sales Tax Percentage In Excel

https://i.ytimg.com/vi/e3fBMuZFFcs/maxresdefault.jpg

Who Gets The Child Tax Credit 2021 TaxesTalk

https://www.taxestalk.net/wp-content/uploads/the-2021-child-tax-credit-payments-are-expected-to-be-monthly-get-the.jpeg

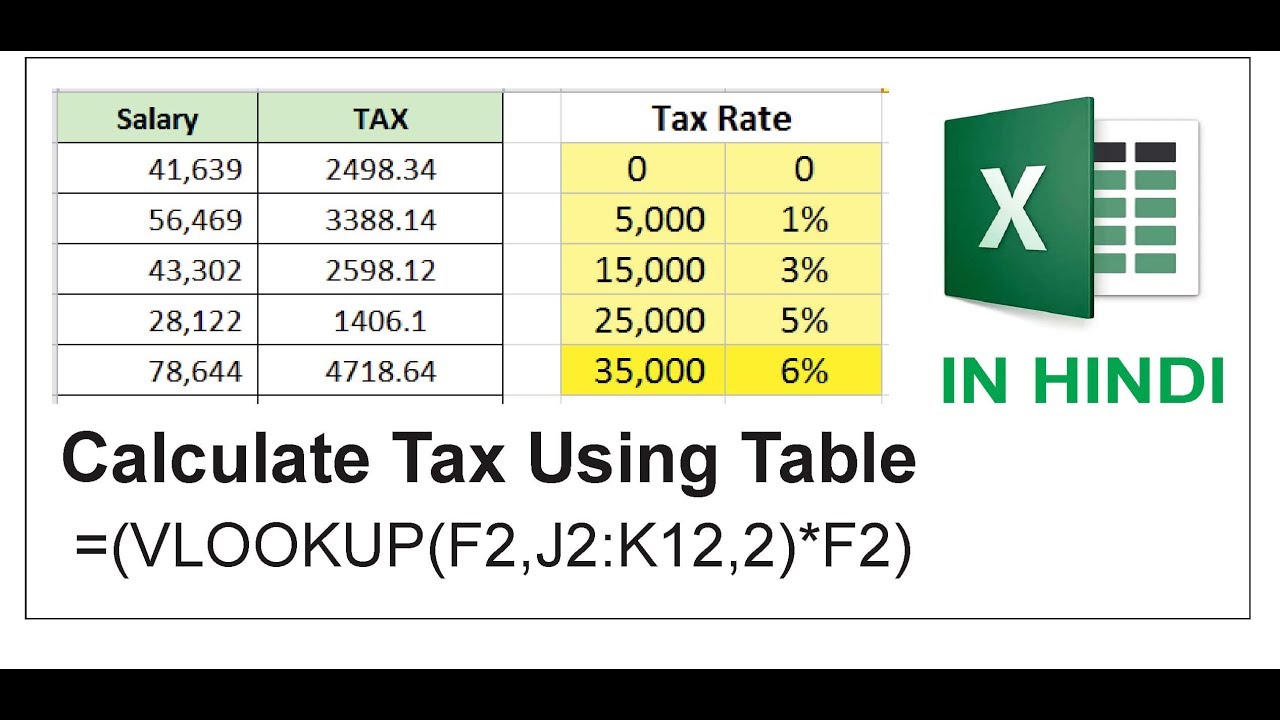

Calculate Sales Tax In Excel Using Vlookup Formula YouTube

https://i.ytimg.com/vi/m6HtEY-UDac/maxresdefault.jpg

Before calculating the sales tax ensure that you have accurately entered the price of the item and the correct tax rate to avoid discrepancies in your final calculations Step 4 Create a Formula to Calculate the Sales Tax Having entered the sales amount and the sales tax rate follow these steps in order to create a Sales tax formula in Excel In the first column under Price enter the amount you want to calculate the tax for You can input multiple prices if you have a list of items Ensure each price is in a separate row to keep the data organized Step 4 Enter the Tax Rate In the second column under Tax Rate enter the tax rate as a decimal For example for 5

Step by Step Guide to Calculate Sales Tax in Excel In this section you ll learn how to calculate sales tax in Excel by creating a formula to compute the tax amount and the total price Step 1 Open Excel and Enter Data Open Excel and create a new worksheet In column A enter your sales amounts In column B enter your sales tax rate 1 Understand the sales tax rate Before creating the formula it s essential to know the sales tax rate applicable to your business or location This rate will be used in the formula to accurately calculate the sales tax 2 Select a cell for the calculation Choose a cell where you want the sales tax amount to be displayed

More picture related to How To Calculate Sales Tax Percentage In Excel

Sales Tax Converter AnurudhNello

https://addons-media.operacdn.com/media/CACHE/images/extensions/35/101835/1.1.0.1-rev1/images/1478e4c4-67aa-4d08-97c8-d7c7ad1577f1/65193076d07a5ec69bc9cb71d7399d0e.jpg

How To Calculate Sales Tax Without A Calculator Calculating Sales Tax

https://i.ytimg.com/vi/zmX7agR-gHA/maxresdefault.jpg

How To Calculate Sales Tax Backwards From Total Imamat Rajani

https://www.bookstime.com/wp-content/uploads/2021/10/7f821497-731b-4c91-bf07-9df6a2b789af-scaled.jpg

2 Create headers in row 1 for Product Name Net Price Sales Tax Rate Sales Tax Amount and Total Amount 3 Fill columns A and B with the product names and corresponding net prices Step 2 Enter the Sales Tax Rate Next you need to enter the percentage of sales tax charged for each item 1 To begin calculating sales tax in Excel open a new worksheet or an existing one where you want to perform the calculations Ensure that the necessary columns and headings are set up to capture the relevant data such as sales amount tax rate and total amount Calculating the Sales Tax 4 Methods to Do It Method 1 Simple Subtraction for

[desc-10] [desc-11]

How To Calculate Sales Tax Percentage From Total TaxesTalk

https://www.taxestalk.net/wp-content/uploads/4-ways-to-calculate-sales-tax-wikihow.jpeg

How To Get Tax Return Information TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-use-your-tax-return-to-invest-in-your-home-infographic.jpeg

How To Calculate Sales Tax Percentage In Excel - 1 Understand the sales tax rate Before creating the formula it s essential to know the sales tax rate applicable to your business or location This rate will be used in the formula to accurately calculate the sales tax 2 Select a cell for the calculation Choose a cell where you want the sales tax amount to be displayed