How To Calculate Tax Percentage In Excel For the first 25 000 10 will be applied then 20 30 40 and 50 for 50 000 to 75 000 respectively The first cell should be 25 000 times 10 the last 5 000 times 40 etc A cell for every income tax rate should be created and multiplied by the amount of income you have in the different brackets

A Define what tax percentage is Tax percentage refers to the percentage of an individual or business s income that is paid as tax It is calculated based on the applicable tax rates and is used to determine the amount of tax owed to the government B Explain why it s important to calculate tax percentage Select the cell you will place the sales tax at enter the formula E4 E4 1 E2 E4 is the tax inclusive price and E2 is the tax rate into it and press the Enter key And now you can get the sales tax easily See screenshot Related articles How to calculate income tax in Excel Best Office Productivity Tools

How To Calculate Tax Percentage In Excel

How To Calculate Tax Percentage In Excel

http://static.makeuseof.com/wp-content/uploads/2015/04/excel-vlookup-taxes-640x399.jpg

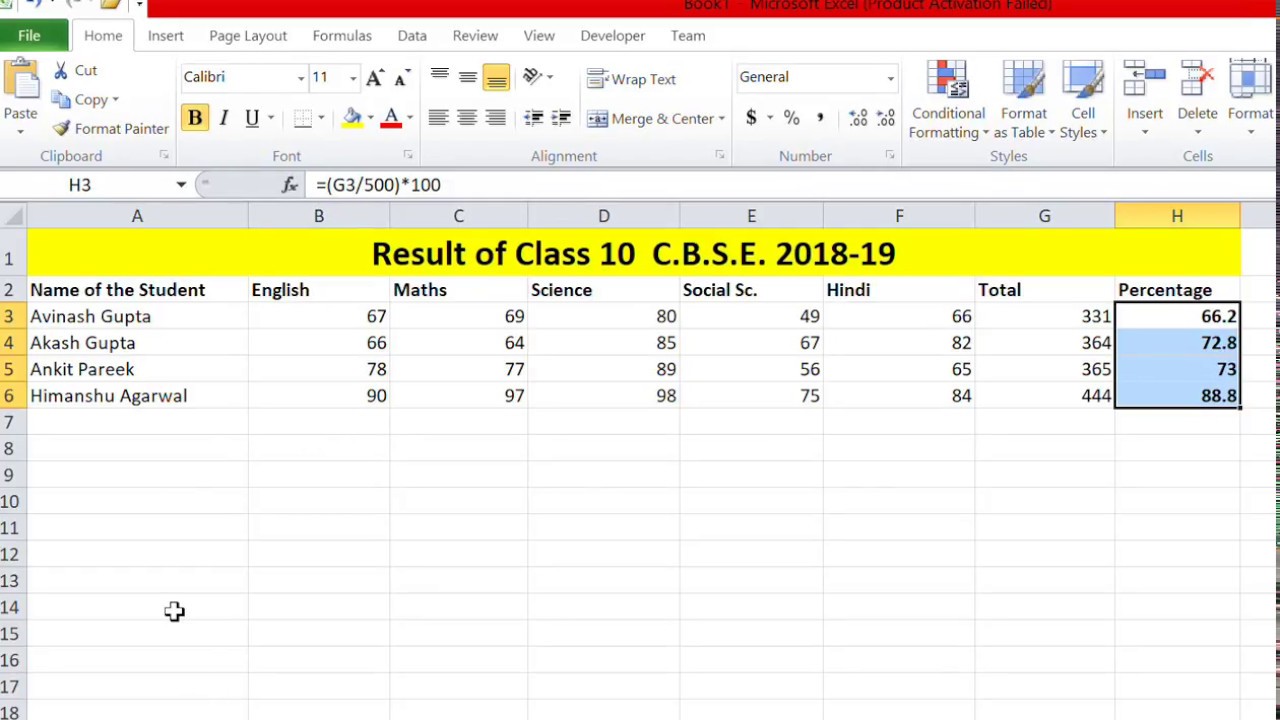

Calculate Taxes In Excel

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel.png

Percentage Formula In Excel Oclena

https://i.ytimg.com/vi/oD0QZIGYkkI/maxresdefault.jpg

Basic Excel percentage formula The basic formula to calculate percentage in Excel is this Part Total Percentage If you compare it to the basic math formula for percentage you will notice that Excel s percentage formula lacks the 100 part Applying a sales tax formula directly to a price without a separate line item showing the tax is a simple matter of multiplication If the sales tax is 5 for example then the final price

1 On the second sheet create the named range Rates 2 When you set the fourth argument of the VLOOKUP function to TRUE the VLOOKUP function returns an exact match or if not found it returns the largest value smaller than lookup value A2 That s exactly what we want Explanation Excel cannot find 39000 in the first column of Rates You can calculate the difference by subtracting your new earnings from your original earnings and then dividing the result by your original earnings Calculate a percentage of increase Click any blank cell Type 2500 2342 2342 and then press RETURN The result is 0 06746 Select the cell that contains the result from step 2

More picture related to How To Calculate Tax Percentage In Excel

How To Calculate Sales Tax In Excel

https://cdn.extendoffice.com/images/stories/doc-excel/calculate-sales-tax/doc-excel-calculate-sales-tax-2.png

EXCEL C lculo De Tasa Impositiva Con Monto Fijo TRUJILLOSOFT

https://exceljet.net/sites/default/files/styles/function_screen/public/images/formulas/tax rate calculation with fixed base2.png?itok=a7wMnF9v

How To Calculate Percentage In Excel Gambaran

https://i.ytimg.com/vi/ce1UQ_SqB30/maxresdefault.jpg

Tax rate calculation with fixed base Related functions IF Summary This example shows how to set up simple formula using the IF function to calculate a tax amount with both fixed and variable components In the example shown the formula in C5 is IF B5 limit base base B5 limit rate In column C enter A1 B1 Find the of a total Put the total in column A and number completed in B In column C enter B1 A1 Decrease by Use the formula A1 1 B1 Original number is in A and the percentage to reduce by is in B This article explains how to calculate a percentage in Excel using various methods such as formulas

Create a different cell for each income tax rate and multiply it by the amount of income you have in each bracket 25 000 times 10 for the first 5 000 times 40 for the last and so on Formula 1 Add Sales Tax to Price B2 1 F 1 Formula 2 Remove Sales Tax from Price B2 1 F 1 Both formulas assume the price of a good is located in cell B2 and the sales tax rate is located in cell F1 The following examples show how to use each formula in practice Example 1 Add Sales Tax to Prices in Excel

How To Calculate Tax Depreciation TaxesTalk

https://www.taxestalk.net/wp-content/uploads/using-percentage-tables-to-calculate-depreciation-center-for.png

How To Calculate Tax Percentage YouTube

https://i.ytimg.com/vi/SD1Wx7eUl2Y/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLBbyV5P77WerkcVF0Rzl1N6t-AsrA

How To Calculate Tax Percentage In Excel - 1 On the second sheet create the named range Rates 2 When you set the fourth argument of the VLOOKUP function to TRUE the VLOOKUP function returns an exact match or if not found it returns the largest value smaller than lookup value A2 That s exactly what we want Explanation Excel cannot find 39000 in the first column of Rates