How To Calculate Sales Tax Rate In Excel In this situation we have two ways to determine the sales tax See below for details Case 1 Put the following formula on Cell C6 C4 C4 1 C5 Hit the Enter button In the second part of the formula we calculate the price without tax and then subtract that to get the tax

Click cell C9 and multiply the net price in cell C8 by your sales tax rate by entering a formula such as C8 0 05 for a 5 tax If your tax rate is 8 enter C8 0 08 Press Enter and the amount In some regions the tax is included in the price In the condition you can figure out the sales tax as follows Select the cell you will place the sales tax at enter the formula E4 E4 1 E2 E4 is the tax inclusive price and E2 is the tax rate into it and press the Enter key And now you can get the sales tax easily

How To Calculate Sales Tax Rate In Excel

How To Calculate Sales Tax Rate In Excel

https://propakistani.pk/how-to/wp-content/uploads/2020/03/sales-tax.jpg

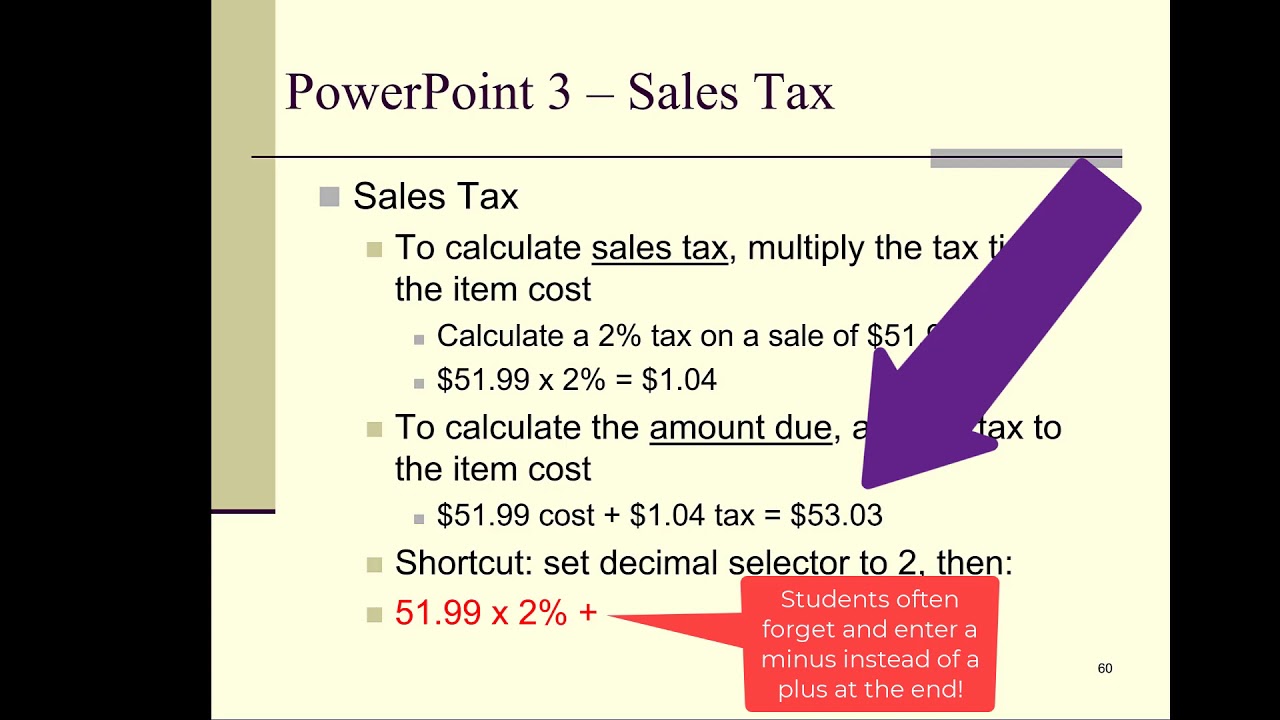

How To Calculate Sales Tax On A Desktop Calculator YouTube

https://i.ytimg.com/vi/vYEMNudSUK4/maxresdefault.jpg

6 Ways On How To Calculate Sales Tax Marketing91

https://www.marketing91.com/wp-content/uploads/2020/07/How-to-calculate-sales-tax.jpg

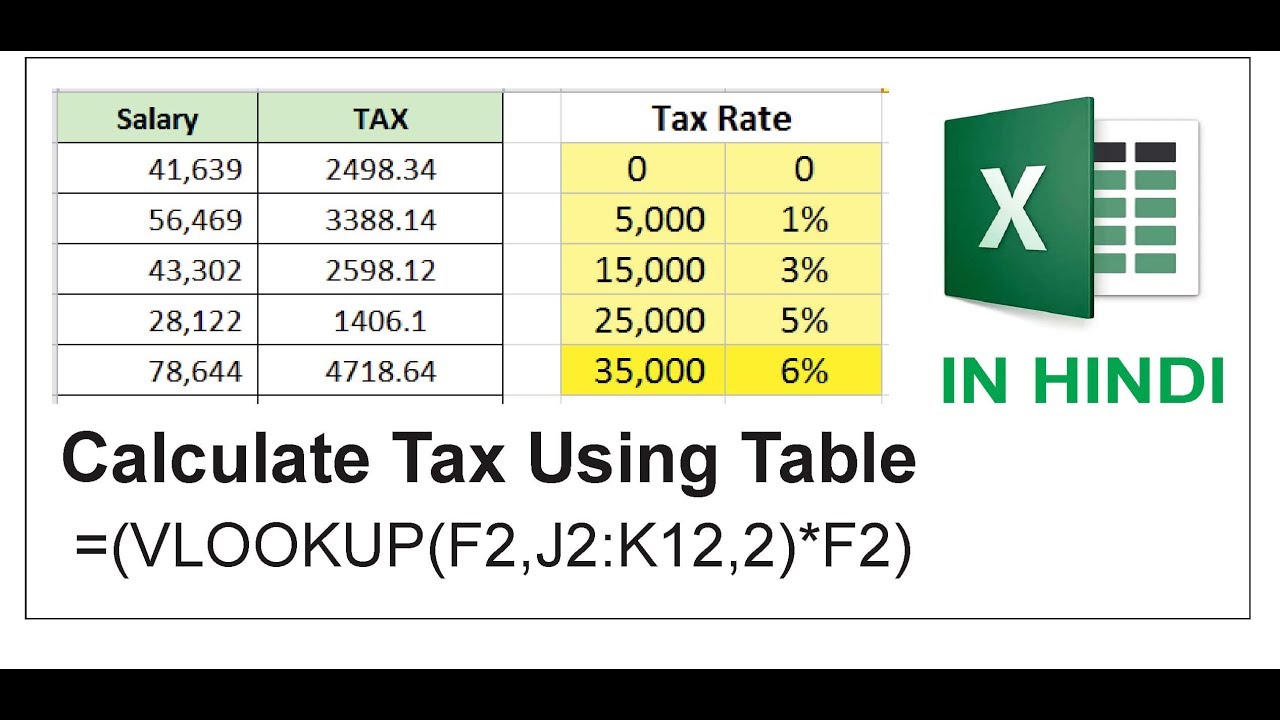

To illustrate the application of the sales tax formula let s consider an example where the pre tax price of an item is 100 and the sales tax rate is 8 Step 1 Multiply the pre tax price by the sales tax rate to get the tax amount In this case it would be 100 x 0 08 8 Step 2 Add the tax amount to the pre tax price to get the total To calculate a sales tax with two rates brackets you can use the IF function In the example shown the formula in C5 copied down is IF B5 limit B5 rate1 limit rate1 B5 limit rate2 where limit F6 rate1 F4 and rate2 F5 are named ranges As the formula is copied down it calculates a tax of 6 on amounts up to

In this video I will show you how to calculate sales Tax in Microsoft Excel Do Subscribe to My Channel for More Subscribe for More http bit ly 2PLMnH The formula should include the original amount and the sales tax rate For example if the original amount is in cell A2 and the sales tax rate is 8 the formula would be A2 8 Press Enter After entering the formula press Enter to calculate the total amount including sales tax The result will appear in the selected cell

More picture related to How To Calculate Sales Tax Rate In Excel

Calculate Sales Tax In Excel Using Vlookup Formula YouTube

https://i.ytimg.com/vi/m6HtEY-UDac/maxresdefault.jpg

5 Ways To Calculate Sales Tax WikiHow

https://www.wikihow.com/images/4/41/File-Back-Taxes-Step-9-Version-2.jpg

How To Calculate Sales Tax In Excel Tutorial YouTube

https://i.ytimg.com/vi/Gze_TLfPwHg/maxresdefault.jpg

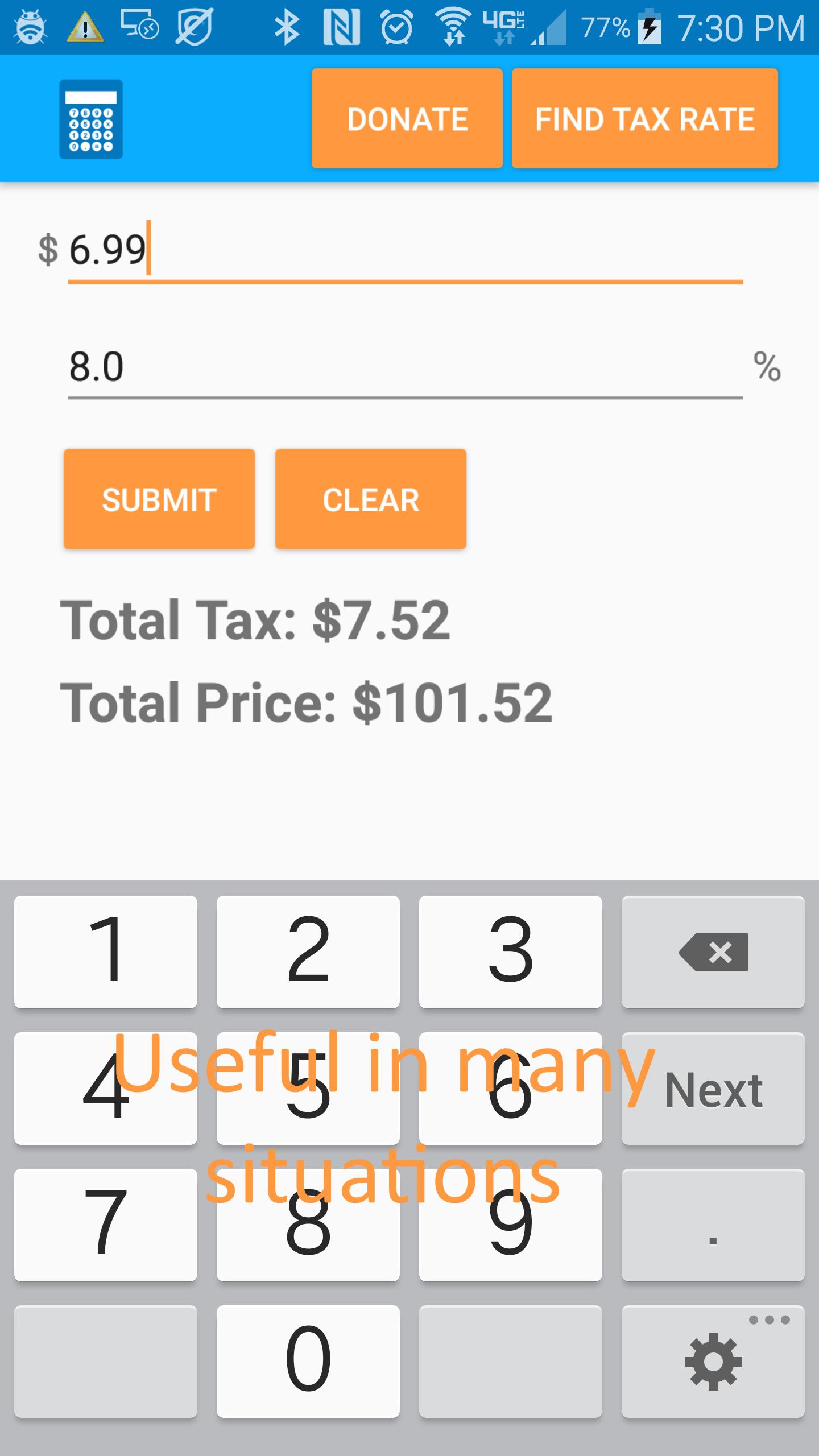

Free calculator to find the sales tax amount rate before tax price and after tax price Also check the sales tax rates in different states of the U S home The following is an overview of the sales tax rates for different states State General State Sales Tax Max Tax Rate with Local City Sale Tax Alabama 4 13 50 Alaska 0 7 The tax is typically paid by consumers at the point of sale and is calculated by multiplying the sales tax rate by the price of the good or service being purchased Sales tax is not a uniquely

The Excel sales tax decalculator works by using a formula that takes the following steps Step 1 take the total price and divide it by one plus the tax rate Step 2 multiply the result from step one by the tax rate to get the dollars of tax Step 3 subtract the dollars of tax from step 2 from the total price In order to calculate sales tax with Excel type in the amount of a purchase and multiply it by the state s sales tax which has to be converted into decimal

How To Calculate Sales Tax Rate

https://image.winudf.com/v2/image/Y29tLkNhbGN1bGF0b3IuU2FsZXNUYXhDYWxjdWxhdG9yX3NjcmVlbl8yXzE1MzcwMjY4MzNfMDkw/screen-2.jpg?fakeurl=1&type=.jpg

State Taxes Can Add Up Wealth Management

https://www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2015/12/taxratechart.png

How To Calculate Sales Tax Rate In Excel - To illustrate the application of the sales tax formula let s consider an example where the pre tax price of an item is 100 and the sales tax rate is 8 Step 1 Multiply the pre tax price by the sales tax rate to get the tax amount In this case it would be 100 x 0 08 8 Step 2 Add the tax amount to the pre tax price to get the total