How To Calculate Federal Tax Rate In Excel To calculate the total income tax owed in a progressive tax system with multiple tax brackets you can use a simple elegant approach that leverages Excel s new dynamic array engine In the worksheet shown the main challenge is to split the income in cell I6 into the correct tax brackets This is done with a single formula like this in cell E7 LET income I6 upper C7 C13 lower DROP VSTACK

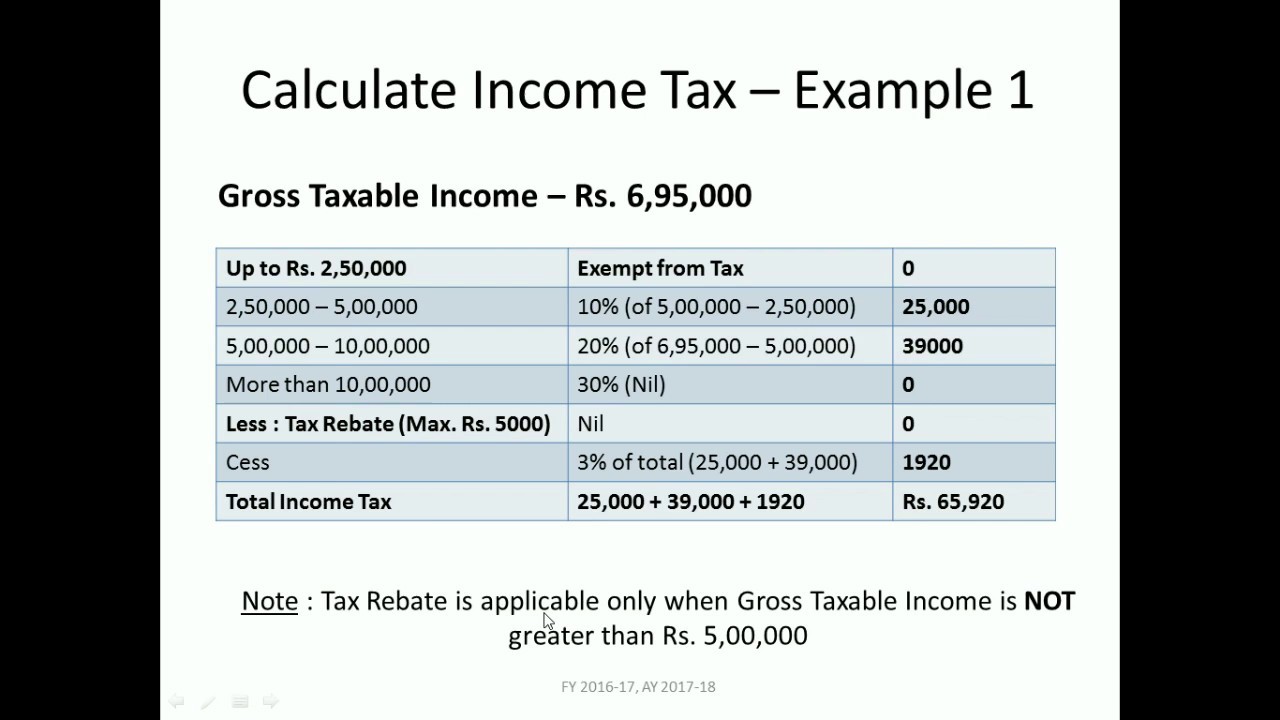

Please kindly help me calculate the Tax Amount this problem with all or one techniques in Excel Chargeable income is 2473 Tax Table Chargeable income Tax rate 1st 240 Free Next 240 5 Next 1200 10 Exceeding 1200 17 5 Best regards Method 1 Apply Excel VLOOKUP Function to Calculate Income Tax In this method we ll apply the VLOOKUP function This function looks for a value in a range and returns a value from the specified column The tax rate here is not like the earlier sample So follow the steps below to perform the task Steps Select cell D13 Type the formula

How To Calculate Federal Tax Rate In Excel

How To Calculate Federal Tax Rate In Excel

https://michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg

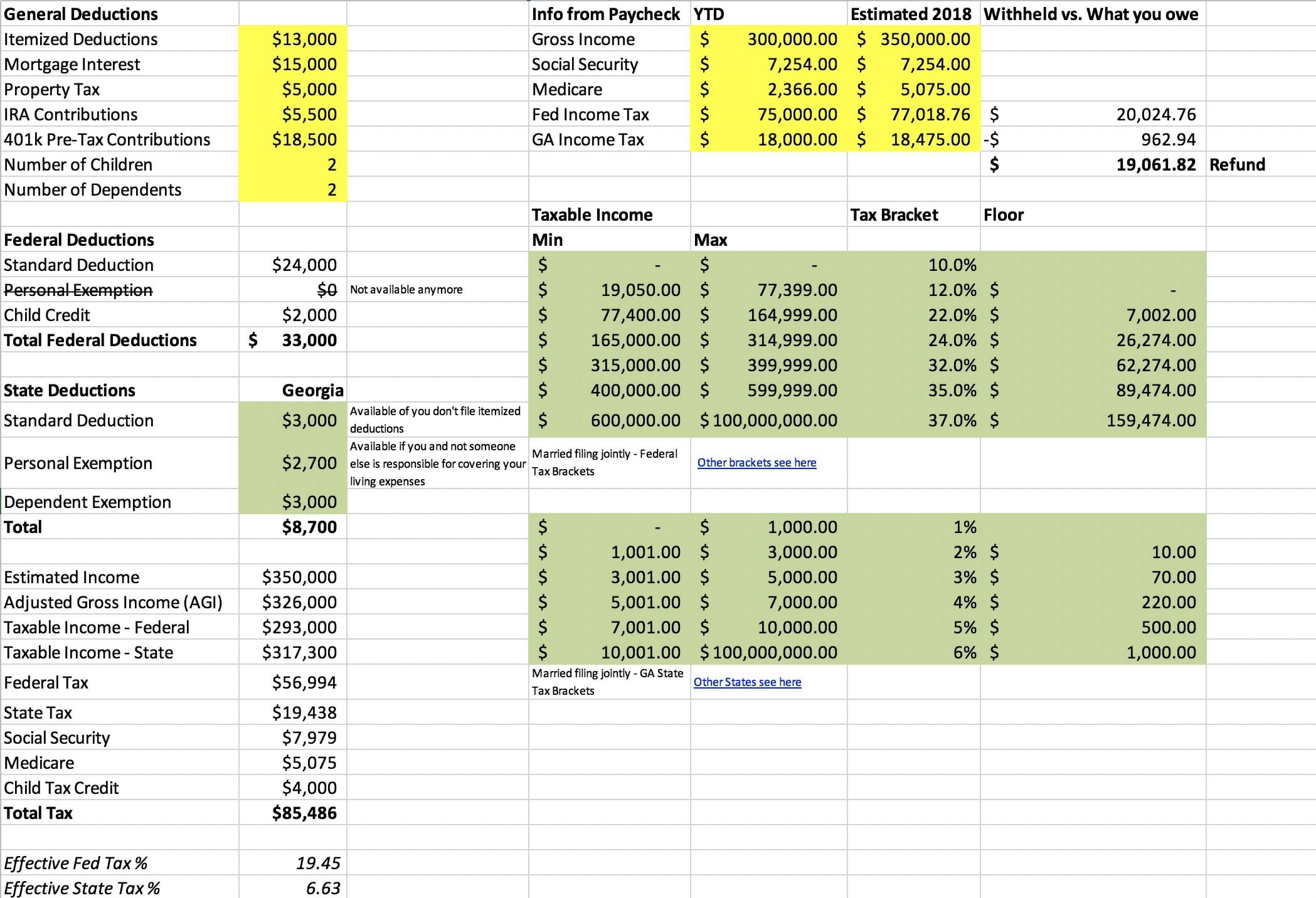

How To Calculate Federal Income Taxes Social Security Medicare

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/income-tax-calculator-format-for-financial-year-2020-21-13.jpg

The Tax Amount for each bracket will be displayed in the corresponding cells under Tax Amount in Step 6 Calculate Total Federal Tax The Total Federal Tax will be the sum of the taxes calculated for each bracket and will be displayed in the Total Federal Tax row We hope that you now have a better understanding of how to use Applying VLOOKUP to Calculate Federal Tax To calculate federal tax with VLOOKUP in Excel you need to know how to enter income and set up the formula By following a few steps you can make the process easier Entering the Taxable Income First enter the taxable income in a cell in your spreadsheet This number will be the lookup value for

This example uses the VLOOKUP function to calculate a simple tax rate In the example shown the formula in C5 is VLOOKUP B5 tax data 2 1 where tax data is the named range F5 G9 As the formula is copied down column C the VLOOKUP function looks up the income in column B in the range F5 F9 and returns the correct tax rate from the range G5 G9 A formula in column D multiples the income by In this video I use a simple Excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket In the proce

More picture related to How To Calculate Federal Tax Rate In Excel

Effective Tax Rate Formula Calculator Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Effective-Tax-Rate-Formula.jpg

Federal Income Tax FIT Payroll Tax Calculation YouTube

https://i.ytimg.com/vi/Bpta4olQddw/maxresdefault.jpg

How To Calculate Federal Income Tax

https://lh5.googleusercontent.com/pwemnxhAIzBDpSkyCmQIsK09emlODW_wEfg0dWYMF_lAXs4i6WrKtTukGmoTRWhR6Hac73GWTi-zQAHYcxxC1zFV-hD61BH8V6F40WfFq7X92F6pqmlDlJZcZAvwFiblUOwj0lY3

Before you can calculate federal tax in Excel you will need to gather certain important pieces of information A Outline the information needed to calculate federal tax in Excel Income This includes all sources of income such as wages interest dividends and capital gains Tax table range This is the range of cells containing your tax table including both income thresholds and tax rates tax rate column number Here you tell VLOOKUP which column holds the tax rates usually the second column TRUE This tells VLOOKUP to use an approximate match Since tax brackets are ranges VLOOKUP will find the closest

[desc-10] [desc-11]

How To Calculate Income Tax FY 2016 17 FinCalC TV YouTube

https://i.ytimg.com/vi/n88iQ1EfB-Y/maxresdefault.jpg

Income Tax Calculator Excel Sheet For Salaried Individuals YouTube

https://i.ytimg.com/vi/NYNB9AxsUK4/maxresdefault.jpg

How To Calculate Federal Tax Rate In Excel - [desc-13]