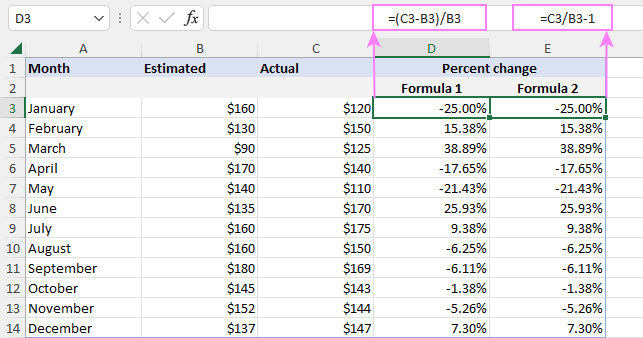

How To Calculate 15 Percent Tax In Excel Method 1 Getting the Sales Tax using a Subtraction The receipt shows price tax rate and total price Steps Subtract the price value from the total price to get the tax amount Go to C7 and enter the following formula

Column C now shows each price in column B with the sales tax added to it For example A 10 item with a 20 sales tax rate becomes 12 A 15 item with a 20 sales tax rate becomes 18 A 20 item with a 20 sales tax rate becomes 24 And so on Example 2 Remove Sales Tax from Prices in Excel Suppose we have the following list of products Scenario 3 Calculate a 15 tax on a 1 200 purchase Troubleshooting Common Issues When working with Excel to calculate tax percentage users may encounter common errors and mistakes that can hinder their calculations It is important to address these issues and offer solutions to ensure accurate results

How To Calculate 15 Percent Tax In Excel

How To Calculate 15 Percent Tax In Excel

https://www.smarttechdata.com/wp-content/uploads/2022/03/New-Project-2022-03-10T223109.886.jpg

How To Calculate 15 VAT In Excel 2 Useful Methods

https://www.exceldemy.com/wp-content/uploads/2022/06/How-to-Calculate-VAT-15-in-Excel-Dataset-1-767x894.png

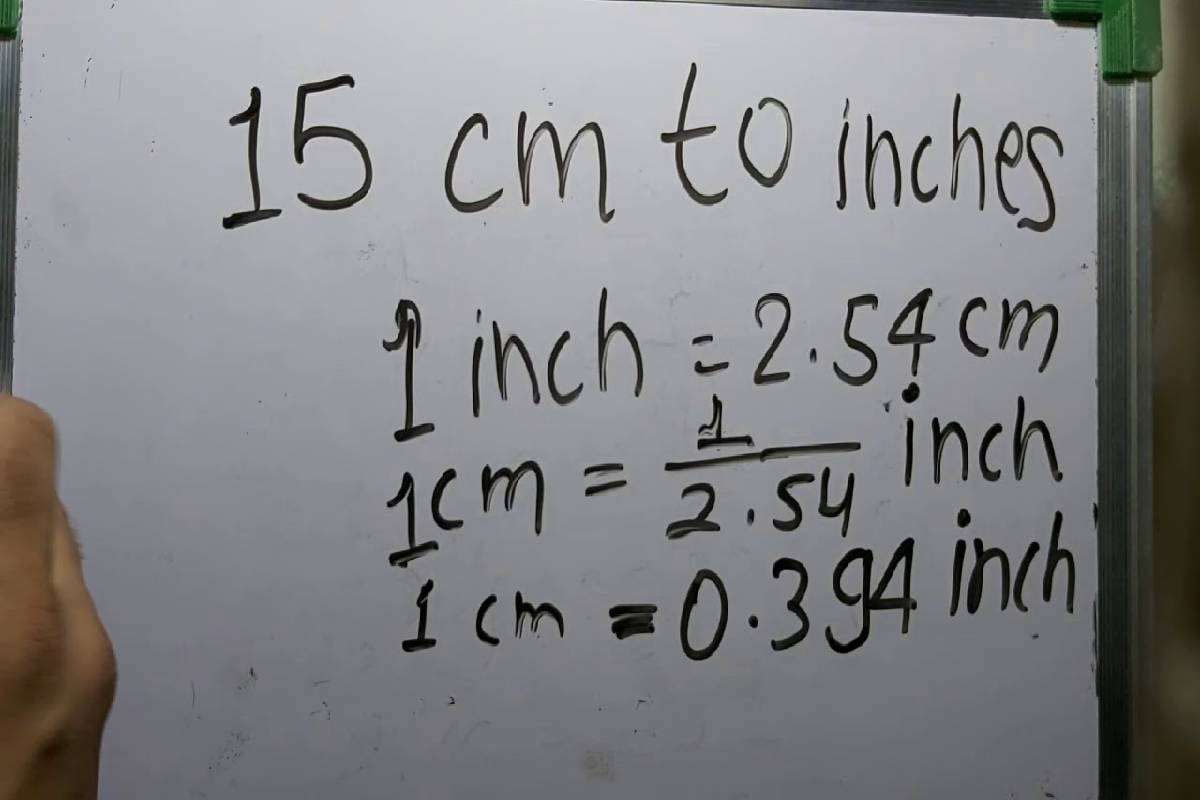

Convert 15 Km To Miles How To Calculate 15 Kilometers In Miles

https://niceconvert.com/wp-content/uploads/2022/05/15-km-to-mi.jpg

Step 2 Calculate Taxable Income For the first bracket due to the zero lower limit the maximum Taxable Income will be 9 315 To calculate the taxable income for the second Bracket we need to subtract the lower limit Cell D6 from the upper limit Cell E6 and then add the result with 1 Determine the taxable income for the third bracket in the same way There are two common ways of adding sales tax in Excel One way is to insert the total tax on a purchase as a separate line item and then add it to the net price Another way is to apply the tax

Adding Tax in Excel In this guide we ll show you how to calculate the total price including tax in Excel By the end of this tutorial you ll be able to input a price and a tax rate and Excel will automatically compute the final amount Step 1 Open Excel and Create a New Spreadsheet Start by launching Excel and opening a new spreadsheet tax percentage invoice amount invoice amount With the above formula you don t need a separate column for the VAT amount The total amount includes the tax and the invoice amount There s one more way to write this formula In this formula you can use the percentages to get the total amount with the VAT

More picture related to How To Calculate 15 Percent Tax In Excel

Te a Dnes Ve er Odtie Formula To Calculate Vat From Gross Citr n

https://qph.cf2.quoracdn.net/main-qimg-6edacdaabe918283d22f2ec38a4c09f4-pjlq

How To Calculate Percene Increase Over 3 Years In Excel Tutorial Pics

https://cdn.ablebits.com/_img-blog/percent-change/percent-change-formula.png

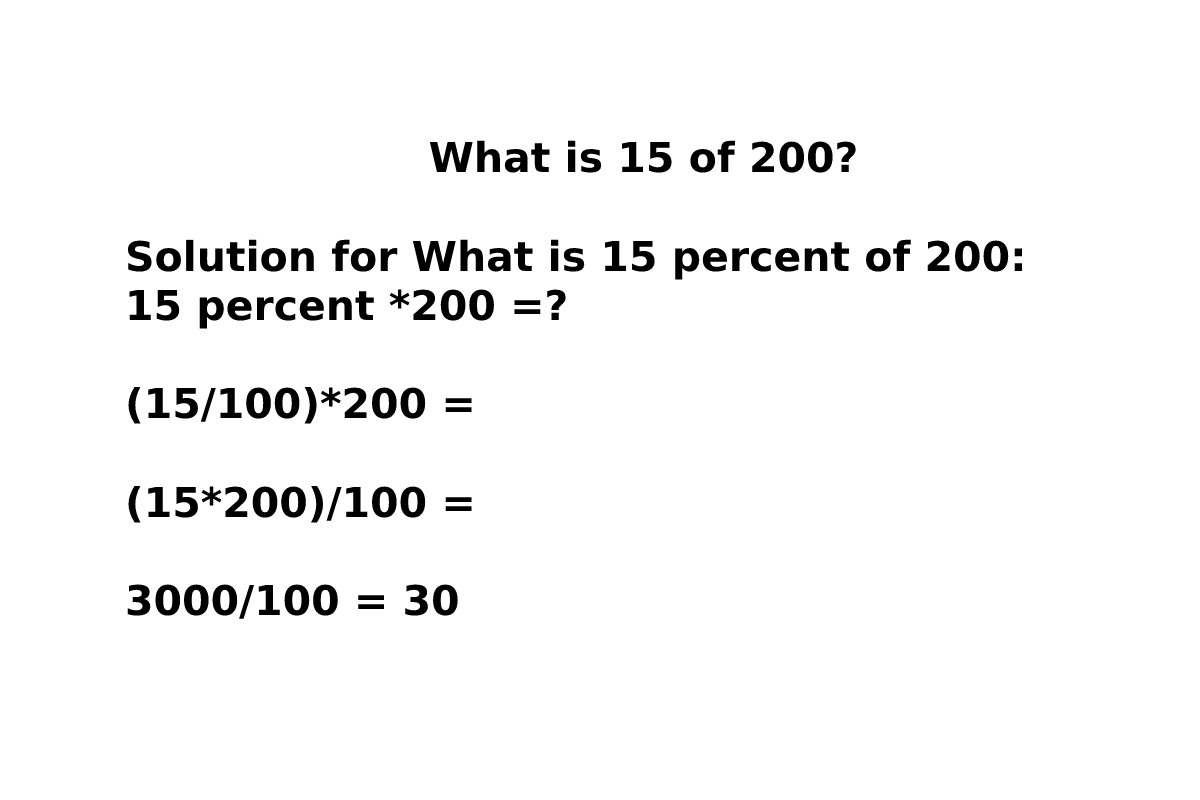

What Is 15 Of 200 What Is 15 Percent Of The 200 And Calculated Percent

https://www.techiesrepublic.com/wp-content/uploads/2022/11/What-is-15-of-200.jpg

How to calculate 15 VAT in Excel fully automatic VAT in MS Excel how to calculate VAT in KSAWelcome to Excel formulas YouTube channel In this tutoria The formulas used in the table are To calculate the sales tax for each product we use the formula B2 C2 and copy it down to the other cells in column D To calculate the price after sales tax for each product we use the formula B2 1 C2 and copy it down to the other cells in column E To calculate the total sales tax for all the products we use the formula SUM D2 D5 in cell D6

[desc-10] [desc-11]

Springfield s Brad Bradshaw Sues Over Competing Marijuana Proposals

https://www.gannett-cdn.com/presto/2018/08/15/PDTF/c4b149e2-a0f2-4b4b-80e7-7ed536867e4d-Weed_031910_plant_wa.jpg?crop=2399,1349,x1,y165&width=2399&height=1349&format=pjpg&auto=webp

How To Calculate 15 VAT In Excel 2 Useful Methods

https://www.exceldemy.com/wp-content/uploads/2022/06/How-to-Calculate-VAT-15-in-Excel-1-2-768x522.png

How To Calculate 15 Percent Tax In Excel - tax percentage invoice amount invoice amount With the above formula you don t need a separate column for the VAT amount The total amount includes the tax and the invoice amount There s one more way to write this formula In this formula you can use the percentages to get the total amount with the VAT