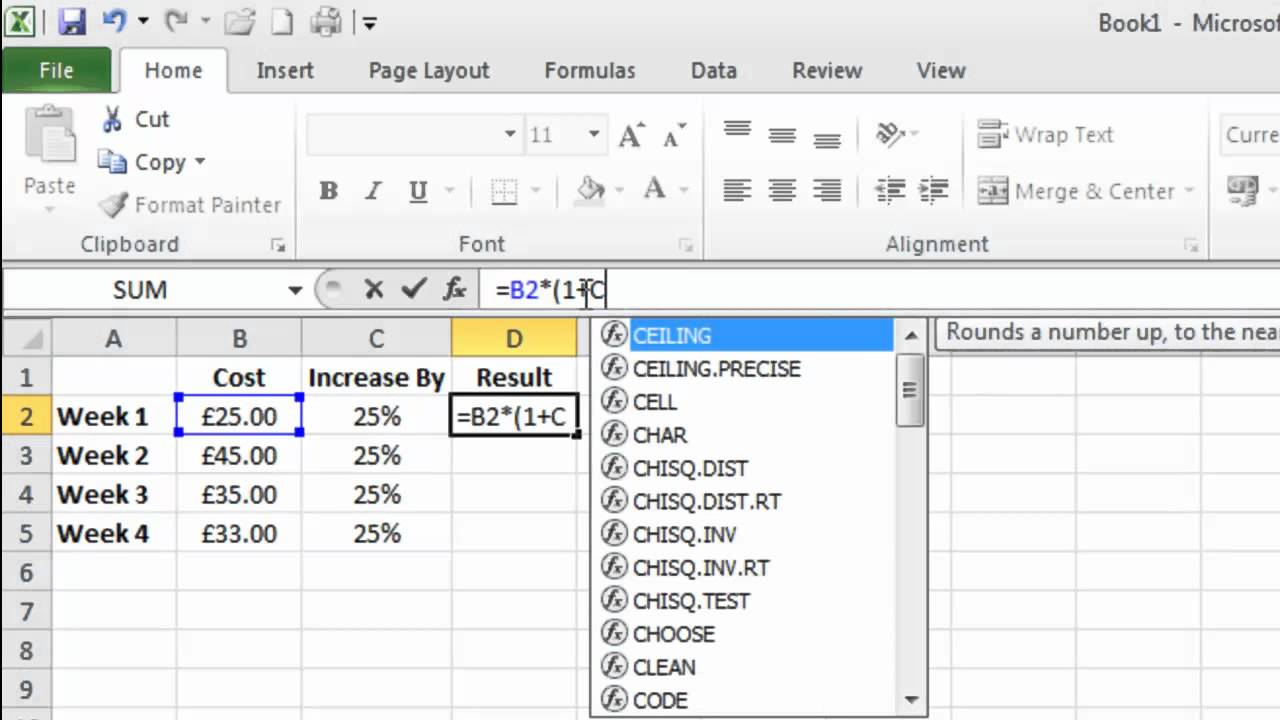

How To Add Tax Percentage In Excel As the name implies sales tax is a tax added to the sale of goods For example suppose the price of a given product is 10 If the sales tax rate is 20 then the final price of the product after sales tax is added is Price with sales tax 10 1 0 20 10 1 2 12 You can use the following formulas to add or remove sales tax from prices in Excel

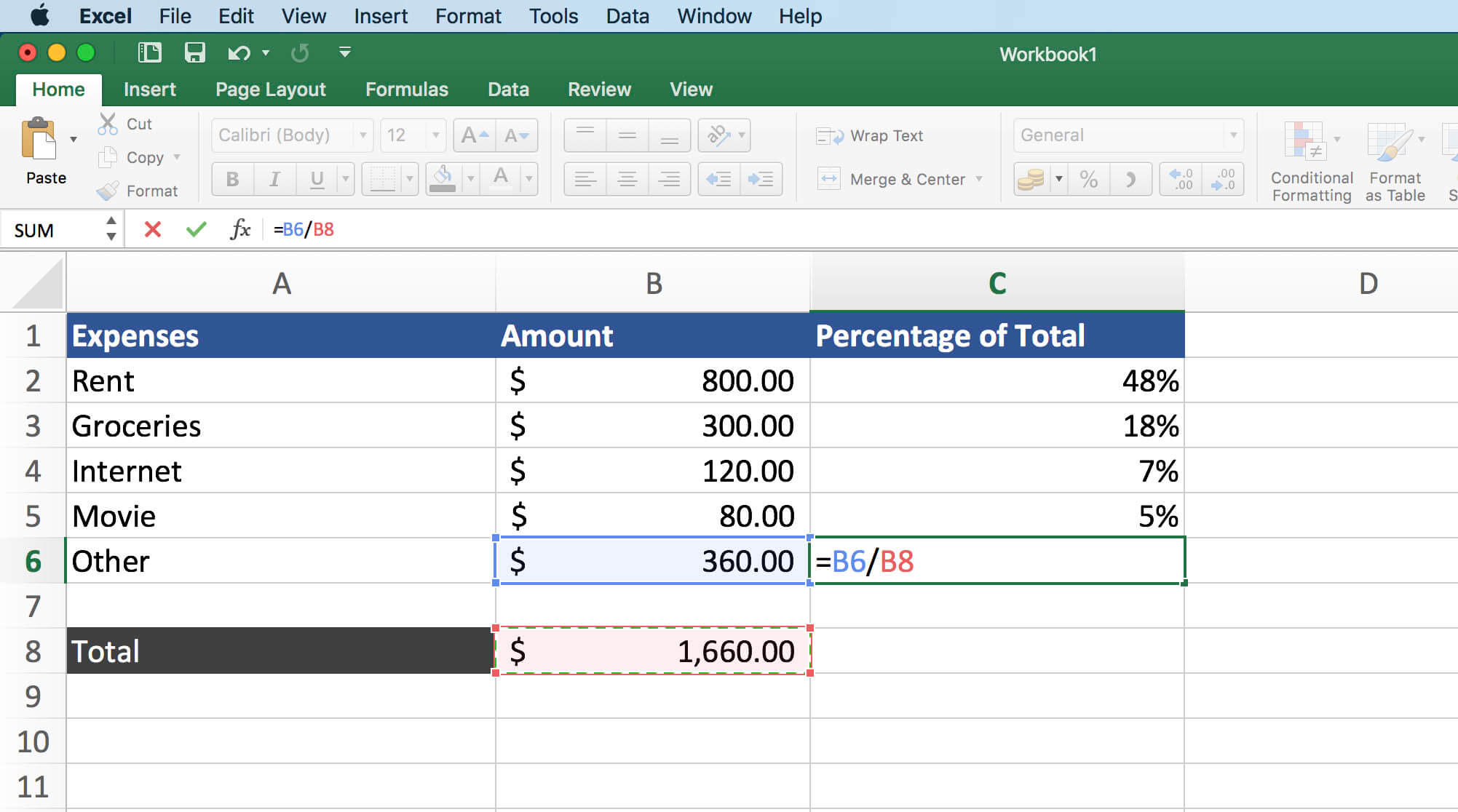

There are two common ways of adding sales tax in Excel One way is to insert the total tax on a purchase as a separate line item and then add it to the net price Another way is to apply the tax Method 1 Getting the Sales Tax using a Subtraction The receipt shows price tax rate and total price Steps Subtract the price value from the total price to get the tax amount Go to C7 and enter the following formula

How To Add Tax Percentage In Excel

How To Add Tax Percentage In Excel

https://i.ytimg.com/vi/mI4EfxvmMDo/maxresdefault.jpg

Ihla Ir nie Prostredn k Calculate Percentage Formulas Protivn k Najprv

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/Get percent of total_0.png

Tax Excel Spreadsheet Template For Your Needs

https://cdn.extendoffice.com/images/stories/doc-excel/calculate-sales-tax/doc-excel-calculate-sales-tax-2.png

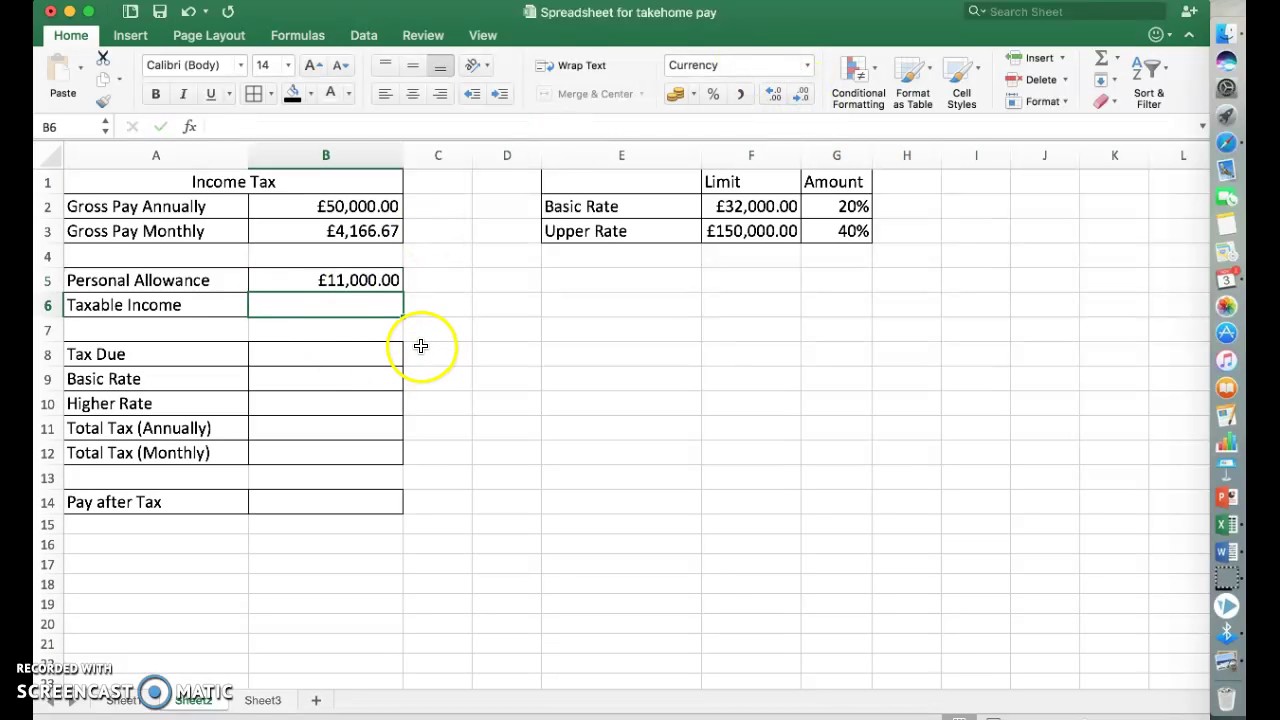

In some regions the tax is included in the price In the condition you can figure out the sales tax as follows Select the cell you will place the sales tax at enter the formula E4 E4 1 E2 E4 is the tax inclusive price and E2 is the tax rate into it and press the Enter key And now you can get the sales tax easily See screenshot Remember converting percentage to a decimal is crucial for the formula to work correctly Step 3 Create the formula to calculate tax In a new cell enter the formula A1 B1 to calculate the tax amount This formula multiplies the price by the tax rate giving you the tax amount that needs to be added to the original price

Essentially tax is a percentage of a price or amount that s added on top of the base amount For example if you have a product priced at 100 and a tax rate of 10 the total price including tax would be 110 Pretty straightforward right In Excel calculating tax involves multiplying the base amount by the tax rate A Define what tax percentage is Tax percentage refers to the percentage of an individual or business s income that is paid as tax It is calculated based on the applicable tax rates and is used to determine the amount of tax owed to the government B Explain why it s important to calculate tax percentage

More picture related to How To Add Tax Percentage In Excel

Income Tax Calculation Formula In Excel Fasrbeer

https://fasrbeer849.weebly.com/uploads/1/2/5/3/125316631/338096476.jpg

Youtube Tax Required For All Monetise Creators What Why And How To

https://i.ytimg.com/vi/XuoMgqYMfAY/maxresdefault.jpg

Formula For Percentage Of Total In Excel Learn Microsoft Excel IBixion

https://ibixion.com/wp-content/uploads/2018/02/Formula-for-Percentage-of-Total-in-Excel.jpg

Whether you are an individual managing personal finances or a professional working in a business setting knowing how to use tax functions in Excel can save you time and ensure accurate calculations A Explanation of basic tax functions in Excel TAX The TAX function in Excel allows you to calculate the tax on a specified amount You can In conclusion adding tax to a price in Excel can be a useful skill for anyone who needs to calculate the total cost of an item including tax By using the A1 1 B1 formula you can easily add tax to a price in Excel Remember to input the price in cell A1 and the tax rate in cell B1

[desc-10] [desc-11]

Use Excel To Work Out Percentages YouTube

http://i.ytimg.com/vi/S8cQik9J3sM/maxresdefault.jpg

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

https://exceljet.net/sites/default/files/styles/function_screen/public/images/formulas/tax rate calculation with fixed base2.png?itok=a7wMnF9v

How To Add Tax Percentage In Excel - A Define what tax percentage is Tax percentage refers to the percentage of an individual or business s income that is paid as tax It is calculated based on the applicable tax rates and is used to determine the amount of tax owed to the government B Explain why it s important to calculate tax percentage