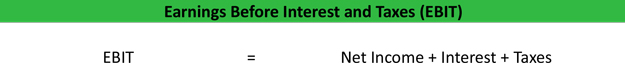

How Do You Calculate Profit Before Interest And Tax What Is Earnings Before Interest and Taxes EBIT Earnings before interest and taxes EBIT indicate a company s profitability EBIT is calculated as revenue minus expenses excluding tax and

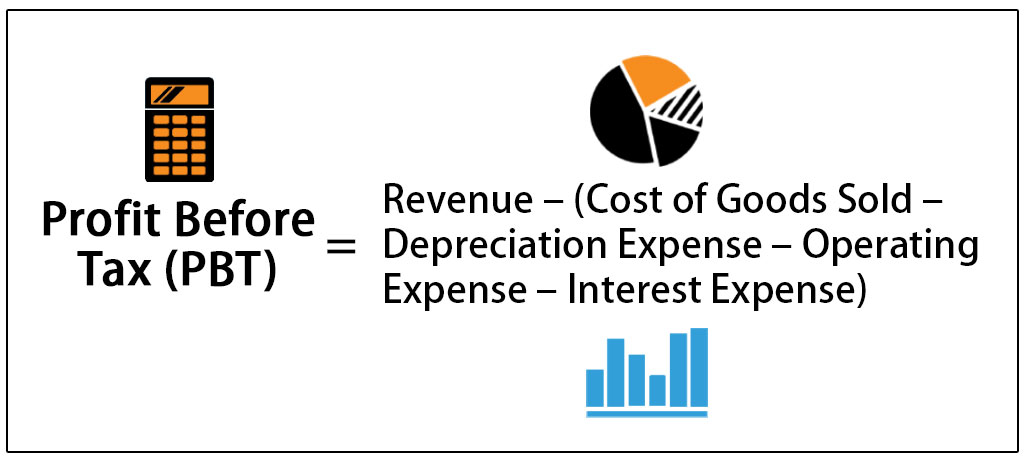

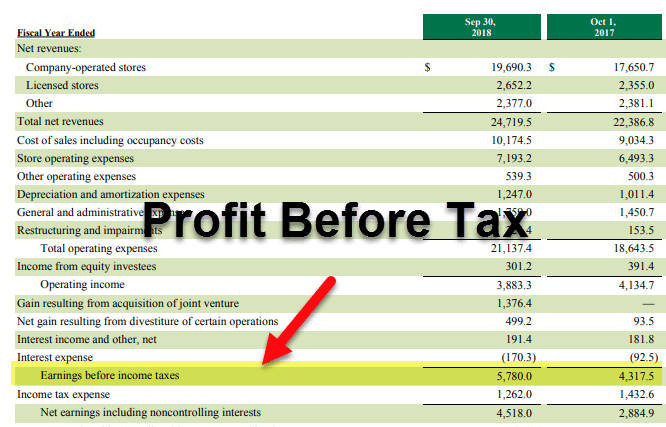

Take the operating profit from the income statement and subtract any interest payments then add any interest earned PBT is generally the first step in calculating net profit but it Profit before tax PBT is a line item in a company s income statement that measures profits earned after accounting for operating expenses like COGS SG A Depreciation Amortization etc non operating expenses Non operating ExpensesNon operating expenses are those payments which have no relation with the principal business activities

How Do You Calculate Profit Before Interest And Tax

How Do You Calculate Profit Before Interest And Tax

https://www.myaccountingcourse.com/financial-ratios/images/earnings-before-interest-and-taxes-equation-calculation.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

How To Calculate EBITDA

https://www.learntocalculate.com/wp-content/uploads/2020/07/EBITDA.jpg

Calculating earnings before interest and taxes or EBIT is one important way of measuring a business value EBIT is a useful tool for comparing the profitability of multiple companies In this article we define EBIT and demonstrate how to calculate it with examples Related How Analyzing Data Can Improve Decision Making What is EBIT Profit Before Tax PBT It is a crucial financial metric that assesses a company s profitability before accounting for tax obligations Currently pursuing a dual degree in B Tech Metallurgical and Materials Engineering and M Tech Financial Engineering at IIT Kharagpur my focus lies at the intersection of finance data analytics and machine

Now we have all the required calculations to come to the profit before tax value So using the formula PBT Revenue Cost of goods sold or cost of sales Operating expenses Interest expenses we can see that PBT 29 000 9 000 9 500 250 10 250 The last step is to put everything together and calculate the EBT using the earnings before taxes formula EBT gross profit operating expense interest expense other income Thus the Company Alpha s EBT is 700 000 300 000 200 000 100 000 300 000

More picture related to How Do You Calculate Profit Before Interest And Tax

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)

Earnings Before Interest And Taxes EBIT Formula And Example

https://www.investopedia.com/thmb/TKO9xGWig7qtuMSBOW0v3l90mmI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

How To Find Net Profit Before Interest And Tax

https://media.cheggcdn.com/media/2cd/2cd4a4e5-a895-46ae-bc6f-f0fd1e0450b6/php7iqCMp.png

Earnings Before Interest After Taxes EBIAT is one of a number of financial measures that is used to evaluate a company s profitability over a certain period such as a quarter or a year It is Written out the formula for calculating a company s operating income EBIT is as follows EBIT Gross Profit Operating Expenses Where Gross Profit Revenue Cost of Goods Sold COGS Operating Expenses Indirect Operating Costs

What is Profit before Interest and Tax In finance and Accounting Profit before Interest and Tax PBIT is a tool used to measure the financial performance or profitability of an organization We calculate this by measuring the profitability of a company without the addition of interest and income tax expenses How to calculate EBIT To calculate EBIT you should deduct direct and indirect expenses from the net revenue excluding interest and tax From the first formula EBIT Net Income Interest Taxes Net income this is also the net profit or the company s bottom line Interest the company s profit deducted before calculating net income

Net Profit Before Interest And Tax 400000 Q 144 Ch 4 Accounting Ratios

https://touch4career.com/wp-content/uploads/2021/10/q144-1024x656.jpg

Qu Es El EBITDA F rmula Ejemplo Contabilizar Renting Ejemplos

https://www.contabilizarrenting.com/wp-content/uploads/2021/12/¿Que-es-el-EBITDA-Formula-Ejemplo.jpg

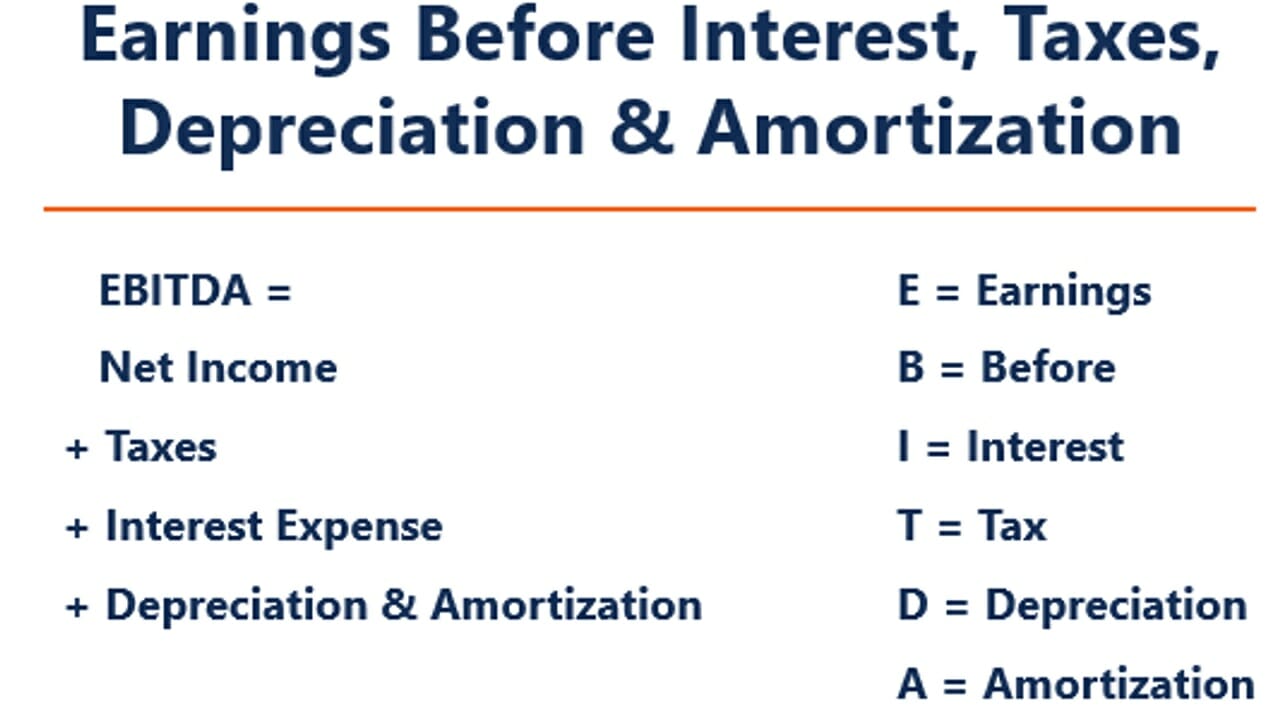

How Do You Calculate Profit Before Interest And Tax - Updated May 27 2021 What Is EBITDA Earnings before interest taxes depreciation and amortization EBITDA is a measure of corporate profitability Analysts and investors use EBITDA to evaluate a company s underlying profits without factoring in financing accounting decisions or tax environments