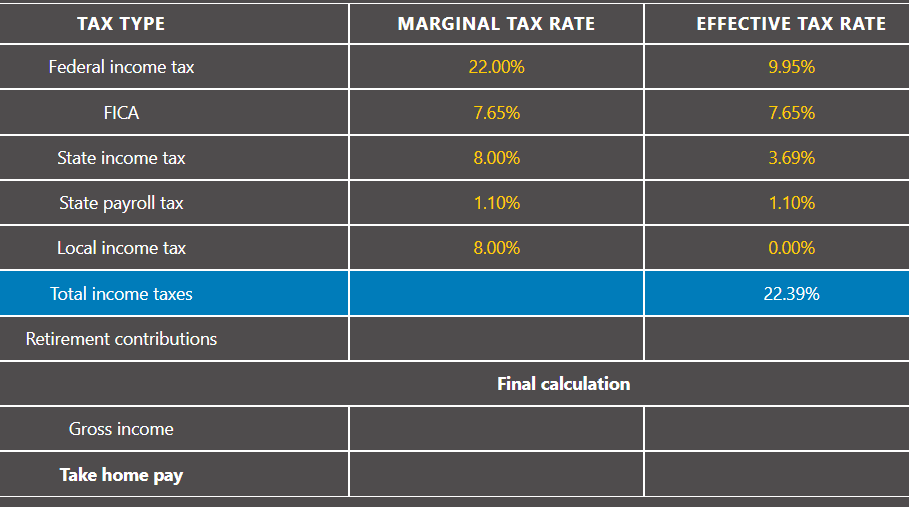

What Is My Net Pay After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

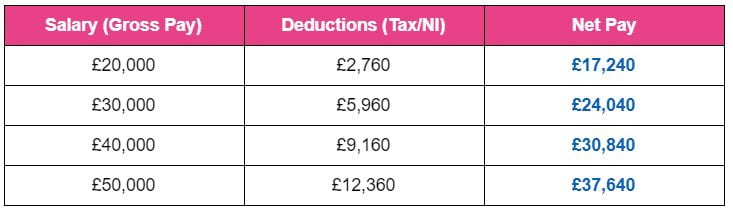

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 Note that if you have any after tax paycheck withholding health or dental insurance premiums etc you will need to add them to the Total Withholding before calculating your net pay Step 8 Calculate Net Pay To calculate net pay subtract the total withholding for the pay period from the gross wages

What Is My Net Pay After Taxes

What Is My Net Pay After Taxes

https://media-exp1.licdn.com/dms/image/C5622AQGW6mE3ruy1eA/feedshare-shrink_800/0/1606235354448?e=2147483647&v=beta&t=TVC20mHwhkw9uXa3HxP8YtfKggfl0vfXTDXtPg0-W9s

Pay Salary Calculators Take Home Pay After Taxes

https://www.mypaycalculator.net/wp-content/uploads/2022/10/income-calc-screenshot.png

Take Home Pay After Tax TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/how-much-money-you-take-home-from-a-100000-salary-after-taxes-1024x864.png

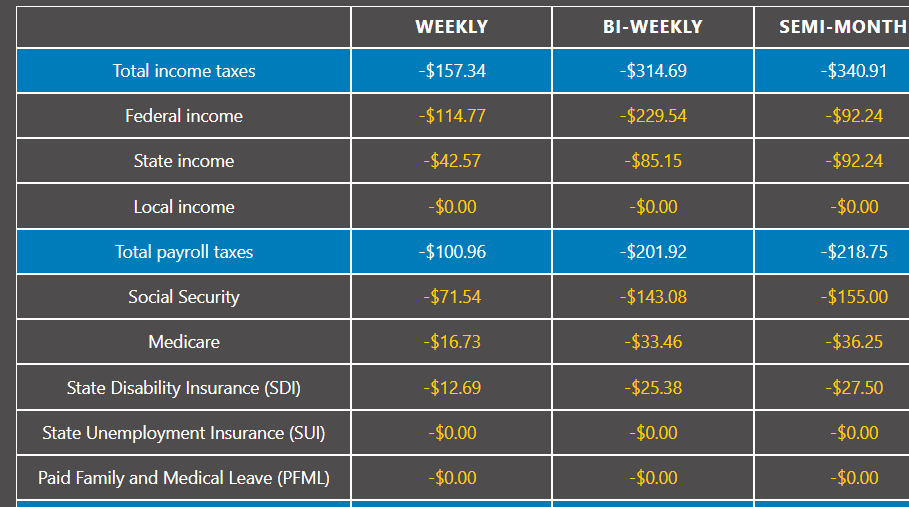

Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Check out PaycheckCity for federal salary paycheck calculators withholding calculators tax calculators payroll information and more Free for personal use The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

More picture related to What Is My Net Pay After Taxes

Calculate Take Home Pay After Taxes Oregon TAXP

https://lh6.googleusercontent.com/proxy/dsepurP2Rm71Xq4TUhKoWg_RcxZHV7gIeNRJ8Ialp23kOEIH4HoeK0t20lIfyk_zBRT1rZIpa_gkCIpPRcKro_5VeHdoWMLUlZjsaQbtxAle9mPeILY1IUE6_A=w1200-h630-p-k-no-nu

Pay Salary Calculators Take Home Pay After Taxes

https://www.mypaycalculator.net/wp-content/uploads/2022/10/paycheck-calc-screenshot.png

24 Deposit Slip Free To Edit Download Print CocoDoc

https://cdn.cocodoc.com/cocodoc-form/png/31030535-fillable-dbs-bank-deposit-slip-form-x-01.png

To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year

Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

Calculate Semi Monthly Pay After Taxes KatyaLainey

https://i.pinimg.com/originals/60/57/58/6057581f83daade2ff55b17beb0d2942.png

What Is Net Pay Reed co uk Serfu

https://www.reed.co.uk/career-advice/wp-content/uploads/sites/6/2020/08/Net-pay-examples.jpg

What Is My Net Pay After Taxes - If you re an hourly wage earner your weekly gross income is the number of hours you work in a week multiplied by your hourly rate If you re working at the federal minimum wage of 7 25 and