What Is My Net Pay After Taxes In Alberta If you live in Ontario and earn a gross annual salary of 76 004 or 6 334 per month your monthly take home pay will be 4 758 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator Please note that all figures on this page are expressed in Canadian dollars CAD

These calculations are approximate and include the following non refundable tax credits the basic personal tax amount CPP QPP QPIP and EI premiums and the Canada employment amount After tax income is your total income net of federal tax provincial tax and payroll tax Rates are current as of July 30 2024 Instead they are first multiplied against the rate on the lowest tax bracket before subtracting the result from your income tax This may seem confusing but it essentially means that these act sort of like deductions in the traditional sense but with a slight twist For 2024 the non refundable basic personal amount in Alberta is 21 885

What Is My Net Pay After Taxes In Alberta

What Is My Net Pay After Taxes In Alberta

https://www.patriotsoftware.com/wp-content/uploads/2018/05/calc-net-pay-gross-pay-1.jpg

Living On 100 000 After Taxes In Alberta Canada alberta canada

https://i.ytimg.com/vi/Gvh2ULcWWFw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AZQDgALQBYoCDAgAEAEYciBdKBswDw==&rs=AOn4CLAXsH1ygEy3n0hP4k74ylvrOdNLPQ

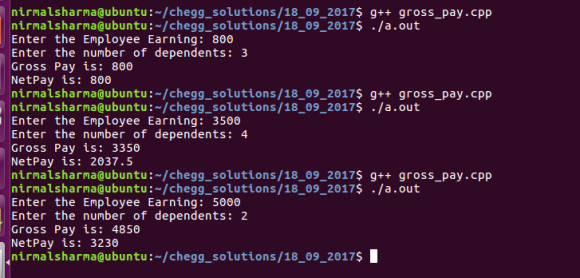

Develop A C Program That Will Determine The Gross Pay And Netpay

https://img.wizedu.com/questions/47a53120-f39b-11ec-8812-cf174147f39a.png?x-oss-process=image/resize,w_580

Remember that how much tax you will pay on your salary in Alberta is a function of federal and provincial taxes rates and tax deductions You may be able to reduce your taxable income but the tool can give you a good starting point Alberta gross to net salary example To give two examples of take home pay in Alberta we look at a nurse If you make 60 000 Annually in Alberta Canada you will be taxed 14 039 Your average tax rate is 14 12 and your marginal tax rate is 20 5 This marginal tax rate means that your immediate

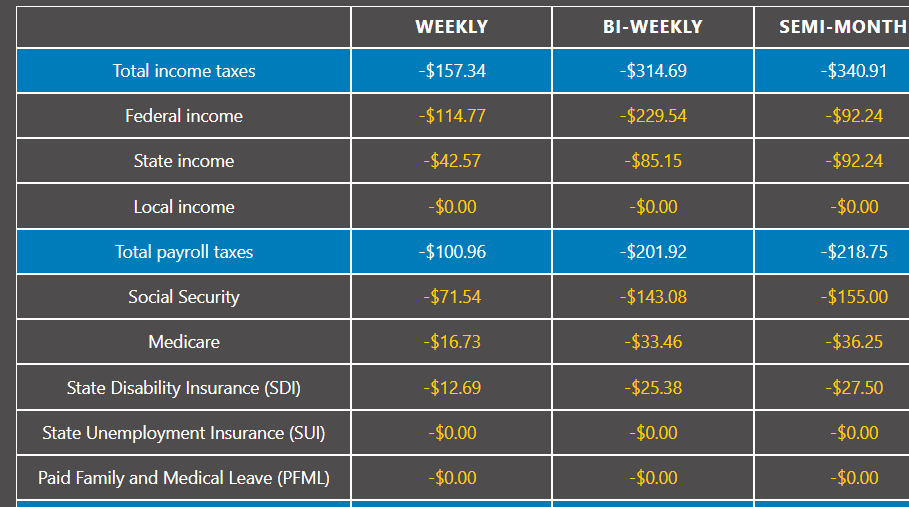

Alberta Weekly Salary After Tax Calculator 2024 The Weekly Salary Calculator is updated with the latest income tax rates in Alberta for 2024 and is a great calculator for working out your income tax and salary after tax based on a Weekly income The calculator is designed to be used online with mobile desktop and tablet devices Advanced Features of the Alberta Income Tax Calculator Tax Assessment Year The tax assessment year is defaulted to 2024 you can change the tax year as required to calculate your salary after tax for a specific year Your Age You age is used to calculate specific age related tax credits and allowances in Alberta

More picture related to What Is My Net Pay After Taxes In Alberta

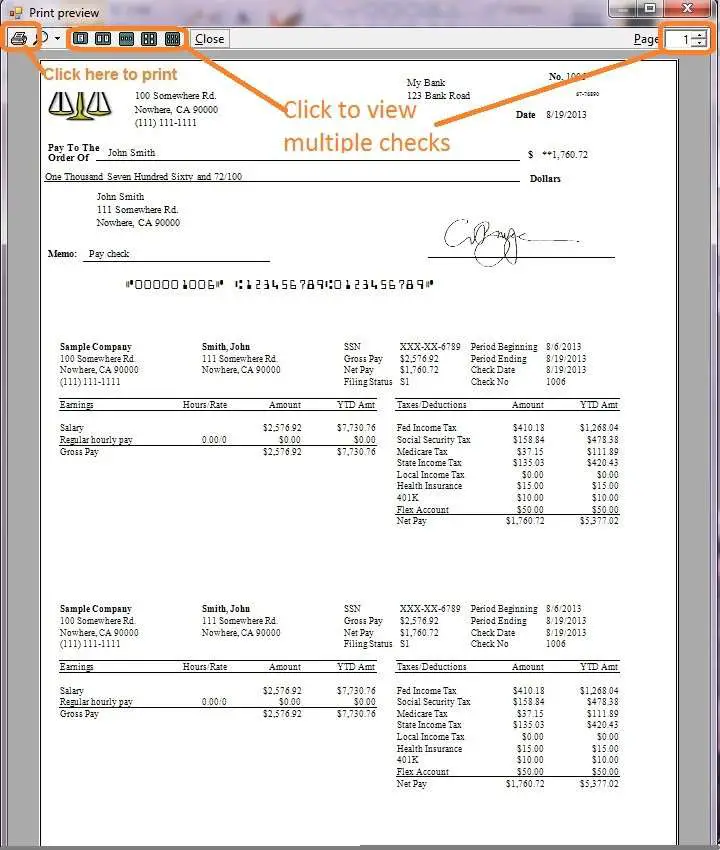

How To Calculate Paycheck After Taxes TaxesTalk

https://www.taxestalk.net/wp-content/uploads/how-to-calculate-paycheck-after-taxes-in-mn.jpeg

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

AppHarvest On LinkedIn AppHarvest Chief People Officer Marcella Butler

https://media-exp1.licdn.com/dms/image/C5622AQGW6mE3ruy1eA/feedshare-shrink_800/0/1606235354448?e=2147483647&v=beta&t=TVC20mHwhkw9uXa3HxP8YtfKggfl0vfXTDXtPg0-W9s

Summary If you make 80 000 a year living in the region of Alberta Canada you will be taxed 24 785 That means that your net pay will be 55 215 per year or 4 601 per month Your average tax rate is 31 0 and your marginal tax rate is 30 5 This marginal tax rate means that your immediate additional income will be taxed at this rate Calculate your after tax salary for the 2024 tax season on CareerBeacon Use our free tool to explore federal and provincial tax brackets and rates Net Pay Average Tax Rate Comprehensive Deduction Rate Alberta 0 00 0 00 0 00 0 0 British Columbia 0 00 0 00 0 00 0 0 Alberta British Columbia Manitoba New

Summary If you make 70 000 a year living in the region of Alberta Canada you will be taxed 21 735 That means that your net pay will be 48 265 per year or 4 022 per month Your average tax rate is 31 1 and your marginal tax rate is 30 5 This marginal tax rate means that your immediate additional income will be taxed at this rate What is 150 000 a year after taxes in Alberta Calculate your take home pay with CareerBeacon s income tax calculator for the 2022 tax year Search Jobs Search Employers Salary Tools Net Pay 108 483 60 Average Tax Rate 24 71 Comprehensive Deduction Rate 27 68 Yukon Total Income 150 000 00 Total Deductions 44 067 18

GST On Carbon Taxes In Alberta B C Worth Millions In Federal Revenue

https://thumbnails.cbc.ca/maven_legacy/thumbnails/809/423/PRICEONCARBON_MOBILE_2500kbps_852x480_781471811646.jpg?crop=1.777xh:h;*,*&downsize=510px:*510w

Pay Salary Calculators Take Home Pay After Taxes

https://www.mypaycalculator.net/wp-content/uploads/2022/10/paycheck-calc-screenshot.png

What Is My Net Pay After Taxes In Alberta - Advanced Features of the Alberta Income Tax Calculator Tax Assessment Year The tax assessment year is defaulted to 2024 you can change the tax year as required to calculate your salary after tax for a specific year Your Age You age is used to calculate specific age related tax credits and allowances in Alberta