What Is My Net Pay After Taxes In Bc In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

Net pay is calculated by subtracting all of the deductions from your gross pay These deductions can include federal income taxes state income taxes Social Security and Medicare taxes health How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

What Is My Net Pay After Taxes In Bc

What Is My Net Pay After Taxes In Bc

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

Gross Pay Vs Net Pay Definitions And Examples Indeed

https://images.ctfassets.net/pdf29us7flmy/1mWYaSiqsKhd8iV2E5UhXD/bb8f71b867741ce5d170c0c00f09781e/what-is-gross-pay-FINAL-JULY-02.png

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 You can check the status of your tax refund in as little as 24 hours after you have filed electronically for the year 2023 and around three to four days after e filing for 2022 and 2021

Summary If you make 52 000 a year living in the region of British Columbia Canada you will be taxed 13 446 That means that your net pay will be 38 554 per year or 3 213 per month Your average tax rate is 25 9 and your marginal tax rate is 33 8 This marginal tax rate means that your immediate additional income will be taxed at this Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

More picture related to What Is My Net Pay After Taxes In Bc

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Ca Tax Brackets Chart Jokeragri

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min-1309x1536.jpg

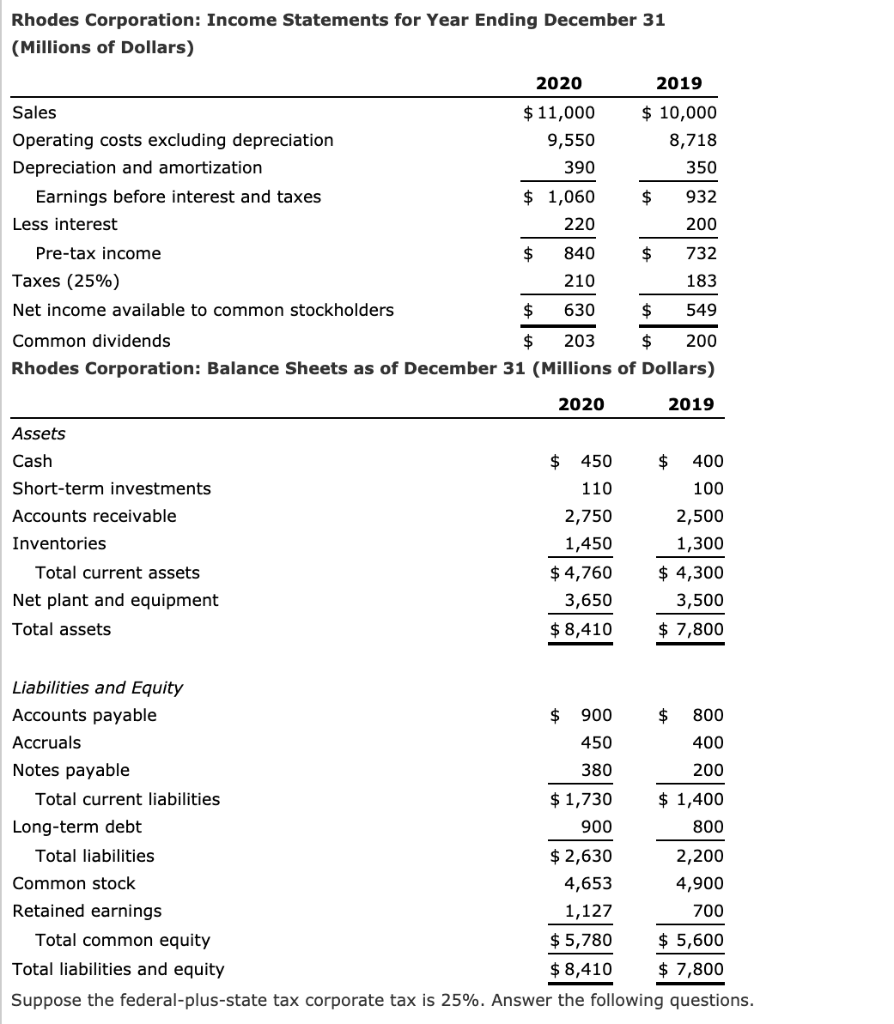

Solved What Is The Net Operating Profit After Taxes NOPAT Chegg

https://media.cheggcdn.com/media/1c4/1c467629-764b-4167-be96-b4f3176c01fb/phpiJxVeu.png

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major This online paycheck calculator with overtime and claimed tips will estimate your net take home pay after deductions and federal state and local income tax withholding You can choose between weekly bi weekly semi monthly monthly quarterly semi annual and annual pay periods and between single married or head of household

Salary Calculator Results If you are living in Canada in Ontario and earning a gross annual salary of 73 793 or 6 149 monthly before taxes your net income or salary after tax will be 55 428 per year 4 619 per month or 1 066 per week Taxes and contributions may vary significantly based on your location Income tax calculator Check your estimated tax burden Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Revenu Net Apr s Imp ts NIAT

https://www.investopedia.com/thmb/Q5ir-NHCLUsmqJvAAh9FImZ64CU=/1247x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

Net Operating Profit After Tax Calculator EFinanceManagement

https://efinancemanagement.com/wp-content/uploads/2021/05/Net-Operating-Profit-After-Tax-Calculator.png

What Is My Net Pay After Taxes In Bc - Summary If you make 52 000 a year living in the region of British Columbia Canada you will be taxed 13 446 That means that your net pay will be 38 554 per year or 3 213 per month Your average tax rate is 25 9 and your marginal tax rate is 33 8 This marginal tax rate means that your immediate additional income will be taxed at this