What Is My Take Home Pay After Taxes Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Use our paycheck tax calculator If you re an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from

What Is My Take Home Pay After Taxes

:max_bytes(150000):strip_icc()/GettyImages-987375510-9321d56fc41b498a923cab34d20476de.jpg)

What Is My Take Home Pay After Taxes

https://i0.wp.com/www.thebalancemoney.com/thmb/yzxtBrkyMSLEXpH7tINec3g7WQo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-987375510-9321d56fc41b498a923cab34d20476de.jpg

Paycheck Calculator What Is My Take home Pay After Taxes In 2019 Business Insider

https://static4.businessinsider.com/image/5c5485aa85aef51af24320f5-1667/take home pay by city 75k bimonthly paycheck v2.png

What Will My Take home Pay Be After Tax And NI In 22 23

http://static1.squarespace.com/static/5d8c6cef28ac7b58bd17ab1e/5d8c6cef28ac7b58bd17ab6e/6278d296671629771cda751e/1652598045612/unsplash-image-utWyPB8_FU8.jpg?format=1500w

The net pay is the amount you will take home after taxes The best free online tool paycheck tax calculator calculates the take home net pay after deducting taxes from your gross hourly wages and salary in all states You know your salary But how much are you really making Once you ve accounted for taxes the amount of money left in your paycheck might be a lot less than you think Your take home

Net income also called take home income is the money that actually goes into your bank account Most people receive their income from either an hourly wage or a salary We ll assume for How do I complete a paycheck calculation To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year This number is the gross pay per pay period Subtract any deductions and payroll taxes from the gross pay to get net pay Don t want to calculate this by hand

More picture related to What Is My Take Home Pay After Taxes

Is My Take home Box From Olive Garden Microwavable Safe JacAnswers

https://jacanswers.com/wp-content/uploads/2021/12/canva-young-woman-opening-the-microwave-MACed1FPncs.jpg

FedEx Driver Salary 2022 Everything You Need To Know

https://ripenecommerce.com/wp-content/uploads/2022/07/Downloader.la-62d9fe23ad1a0-768x512.jpg

Take Home Pay After Tax TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/how-much-money-you-take-home-from-a-100000-salary-after-taxes-1024x864.png

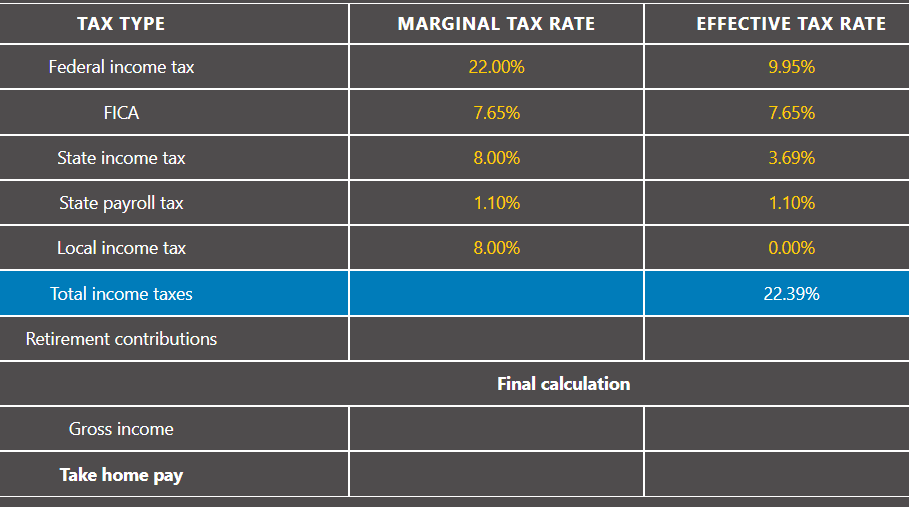

When you start a new job you fill out a W 4 form to tell your employer how much to withhold from your check Your tax filing status There are standard federal and state tax deductions that vary depending on whether you are single married filing jointly married filing separately head of household or a surviving spouse Self employed individuals earning up to 200 000 are subject to a combined Social Security and Medicare tax rate of 15 3 In comparison those earning over 200 000 are subject to a combined rate of 16 2 Updated on Dec 05 2023 Free tool to calculate your hourly and salary income after taxes deductions and exemptions

10 Take Home Salary Take home salary is the amount of money an employee receives after all deductions including taxes and other withholdings have been subtracted from their gross salary It s the actual income that an employee can use for their personal expenses Take Home Salary Gross Salary Deductions Income Tax Employees PF US Salary Calculator Calculate Your Take Home Pay Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442

How Much Would My Take Home Pay Be

https://d2vlcm61l7u1fs.cloudfront.net/media/e85/e8561b56-477d-494d-8cb2-a4128cdd34bf/phpqx2S1U.png

Pay Salary Calculators Take Home Pay After Taxes

https://www.mypaycalculator.net/wp-content/uploads/2022/10/income-calc-screenshot.png

What Is My Take Home Pay After Taxes - Summary If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate