What Is My Net Income After Taxes In Texas Income you earn that s in excess of 200 000 single filers 250 000 joint filers or 125 000 married people filing separately is also subject to a 0 9 Medicare surtax Your employer will not match this surtax though Any premiums that you pay for employer sponsored health insurance or other benefits will also come out of your paycheck

Income tax calculator Texas Find out how much your salary is after tax Enter your gross income Per Where do you work Calculate Salary rate Annual Month Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 Social Security 3 410 Medicare 798 Total tax 9 076 Net pay 45 925 Marginal tax rate 29 6 Average tax rate 16 5 Texas paycheck calculator Use ADP s Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is

What Is My Net Income After Taxes In Texas

What Is My Net Income After Taxes In Texas

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

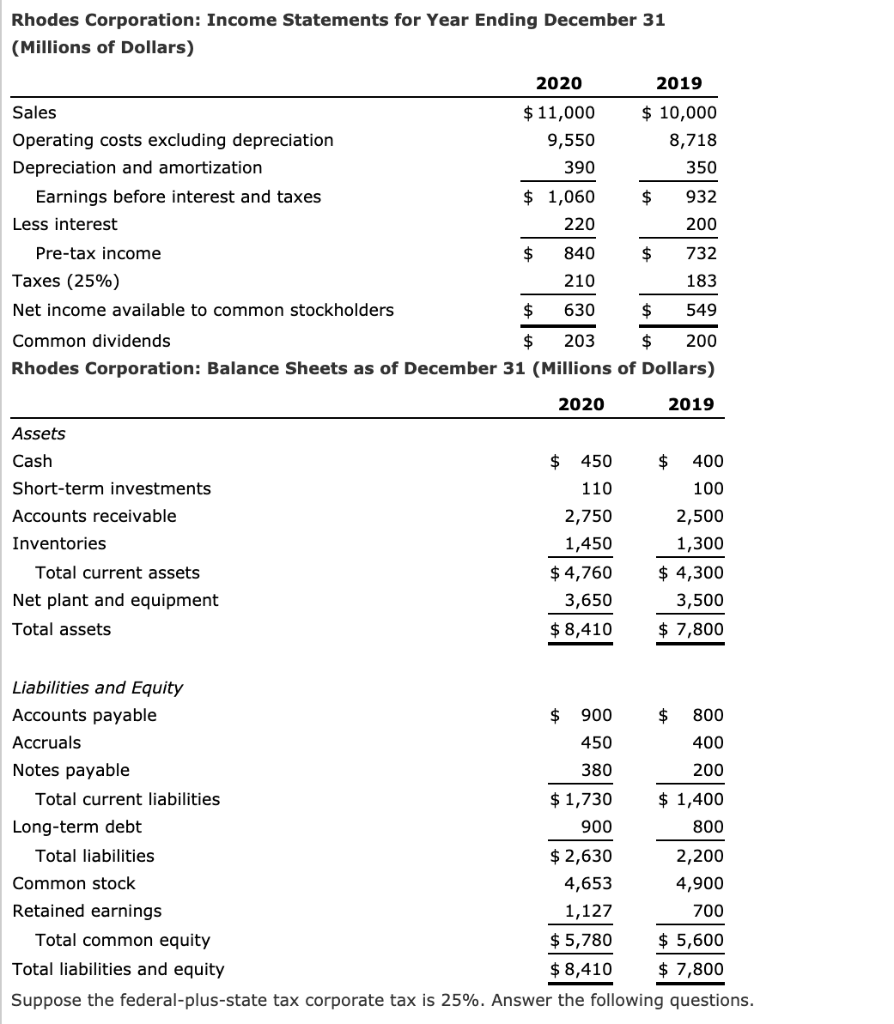

Solved What Is The Net Operating Profit After Taxes NOPAT Chegg

https://media.cheggcdn.com/media/1c4/1c467629-764b-4167-be96-b4f3176c01fb/phpiJxVeu.png

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2023 tax year on Dec 05 2023 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings Pre tax deduction s Post tax deduction s Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents

Tax Breakdown For a gross annual income of 72 020 our US tax calculator projects a tax liability of 1 370 per month approximately 23 of your paycheck The table below breaks down the taxes and contributions levied on these employment earnings in California What Is a Good Salary in the US Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 How Your Paycheck Works Income Tax Withholding

More picture related to What Is My Net Income After Taxes In Texas

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Revenu Net Apr s Imp ts NIAT

https://www.investopedia.com/thmb/Q5ir-NHCLUsmqJvAAh9FImZ64CU=/1247x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator.jpg

Taxes Scolaires Granby

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

In simple terms net pay is the money you take home directly from your paycheck For example if someone gets paid 1 200 per week but 160 is taken away by deductions the person s net pay will Find out how much your salary is after tax Enter your gross income Per Where do you work Calculate Salary rate Annual Month Weekly Day Hour Withholding Salary 65 000 Federal Income Tax 7 068 Social Security 4 030 Medicare 943 Total tax 12 041 Net pay 52 960 Marginal tax rate 29 6 Average tax rate 18 5 81 5 Net pay 18 5

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

PBT Voxt

https://wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

What Is My Net Income After Taxes In Texas - Calculate your Texas net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator Switch to hourly calculator Texas paycheck FAQs Texas payroll State Date State Texas Change state Check Date Earnings Gross Pay Gross Pay Method