What Is My Net Pay After Taxes Uk Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

What Is My Net Pay After Taxes Uk

What Is My Net Pay After Taxes Uk

https://www.income-tax.co.uk/images/60000-after-tax-salary-uk-2020.png

When Is It Worth It To Pay Taxes With A Credit Card

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=2128&height=1202&fit=crop&format=pjpg&auto=webp

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home Calculators Net Income 4 537 54 442 2 094 1 047 209 39 26 17 22 tax Salary Calculator UK Tax Year 2024 2025 If you live in the UK and earn a gross annual salary of 35 204 or 2 934 per month your monthly take home pay will be 2 406 This results in an effective tax rate of 18 as estimated by our UK salary calculator

Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Check out PaycheckCity for federal salary paycheck calculators withholding calculators tax calculators payroll information and more Free for personal use Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

More picture related to What Is My Net Pay After Taxes Uk

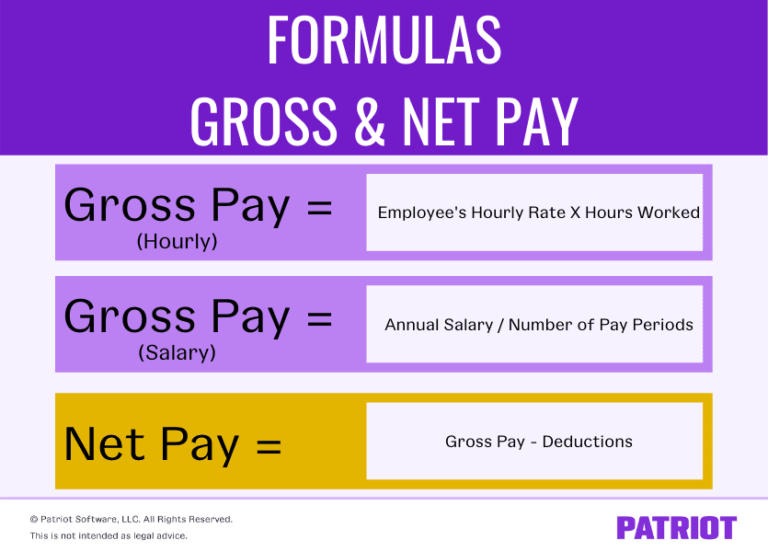

How To Calculate Net Income From Hourly Wage Haiper

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

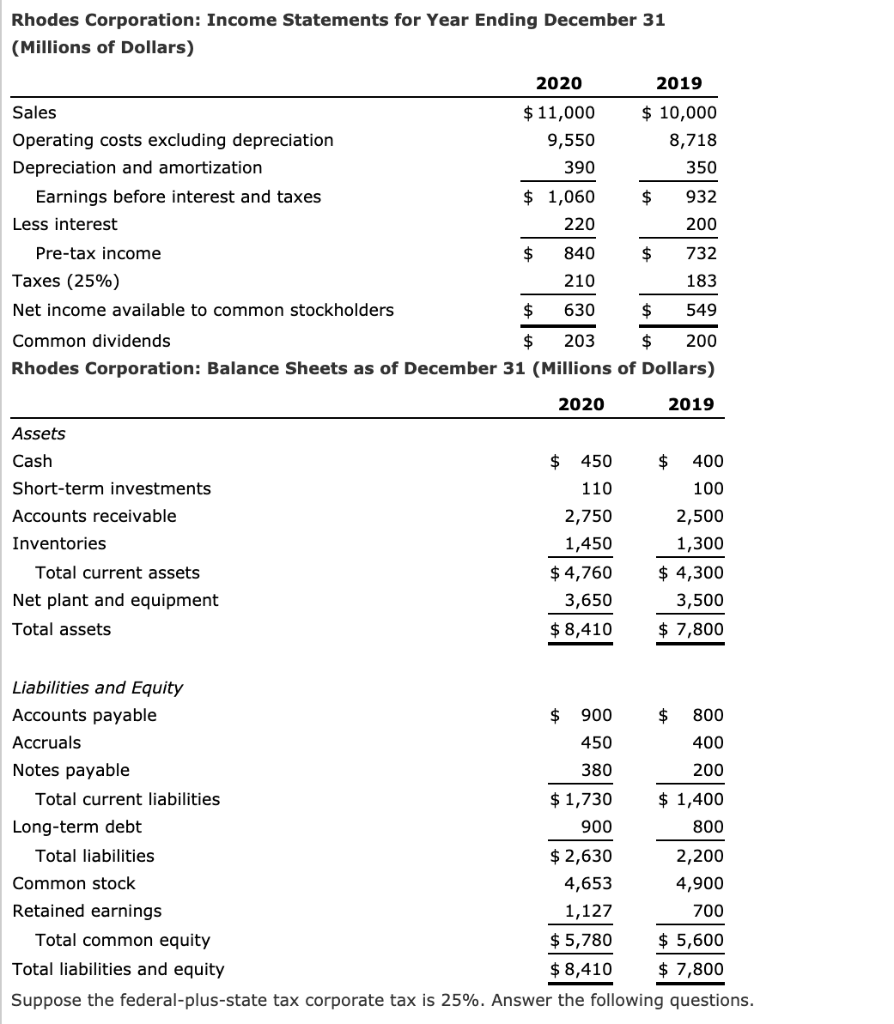

Solved What Is The Net Operating Profit After Taxes NOPAT Chegg

https://media.cheggcdn.com/media/1c4/1c467629-764b-4167-be96-b4f3176c01fb/phpiJxVeu.png

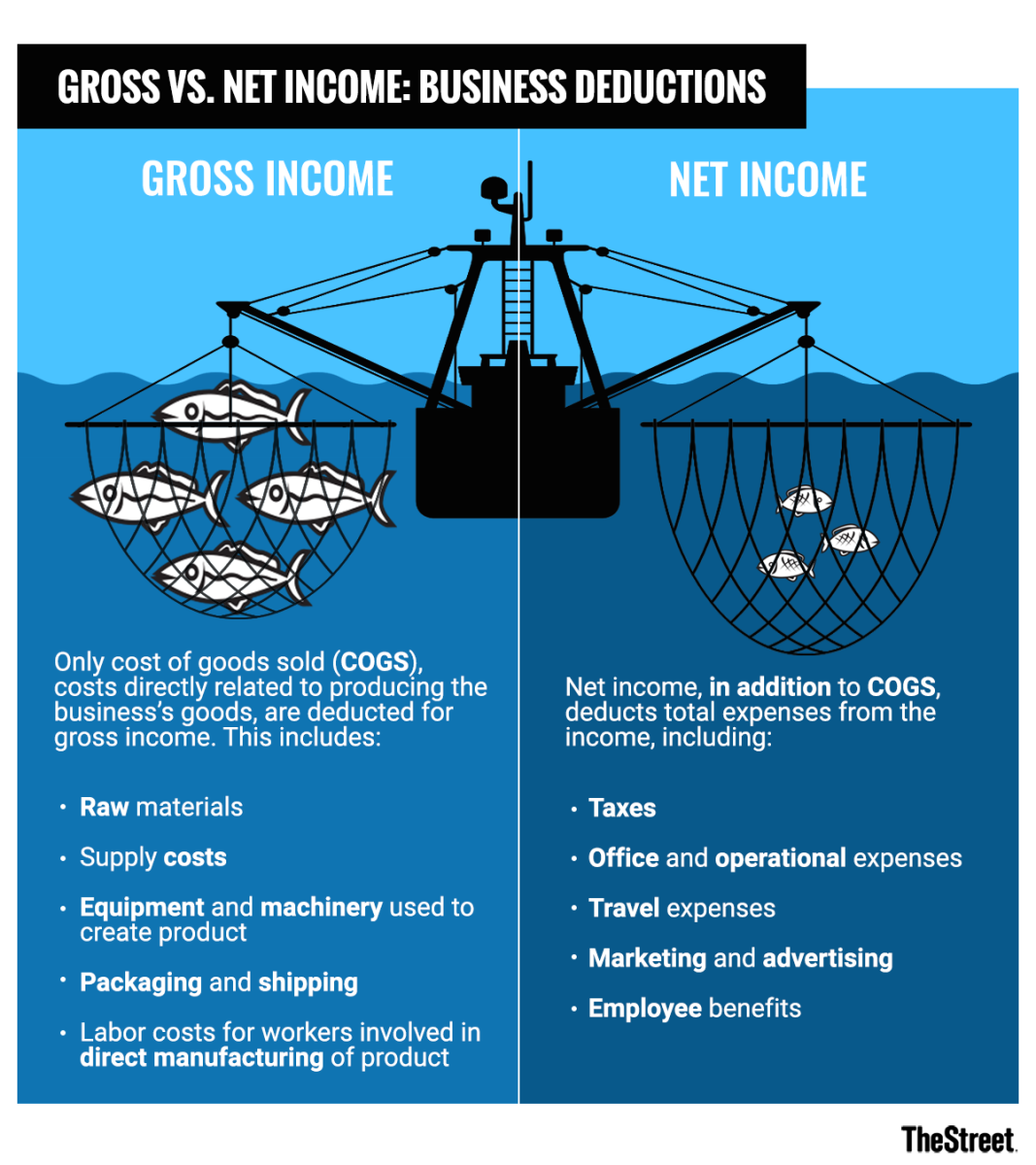

What s The Difference Between Gross Vs Net Income TheStreet

https://www.thestreet.com/.image/t_share/MTY3NTQxMjkzMTYwNDc0NTEw/image-placeholder-title.png

1 Check your tax code you may be owed 1 000s free tax code calculator 2 Transfer unused allowance to your spouse marriage tax allowance 3 Reduce tax if you wear wore a uniform uniform tax rebate 4 Up to 2 000 yr free per child to help with childcare costs tax free childcare 5 To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and

Personal Allowance is an amount of money you re allowed to earn each year without having to pay income tax on it You can used this allowance for your salary savings interests dividends and other income For the 2024 25 tax year the Personal Allowance is set at 12 570 If you earn less than this amount you typically won t owe any Income Tax In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

W 2 Vs Last Pay Stub What s The Difference 2023

https://apspayroll.com/wp-content/uploads/2022/11/w2-last-pay-stub-difference.png

Six Overlooked Tax Breaks For Individuals Montgomery Community Media

http://s19499.pcdn.co/wp-content/uploads/2016/03/Cut-Taxes.jpg

What Is My Net Pay After Taxes Uk - Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax