How To Compute For Net Taxable Income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

What are Tax Brackets How Many Tax Brackets Are There The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates 2022 tax brackets and federal income tax rates 2021 tax brackets and federal income tax rates View all filing statuses Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

How To Compute For Net Taxable Income

How To Compute For Net Taxable Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6a6997f20ccd16eedc709a3c6dff9884/thumb_1200_1553.png

How To Compute Tax On Monthly Salary Monthly Withholding Tax On

https://i.ytimg.com/vi/5dkPPFL84bw/maxresdefault.jpg

How To Compute Income Tax In The Philippines

https://www.thinkpesos.com/wp-content/uploads/2016/07/How-to-compute-income-tax-in-the-philippines-1.png

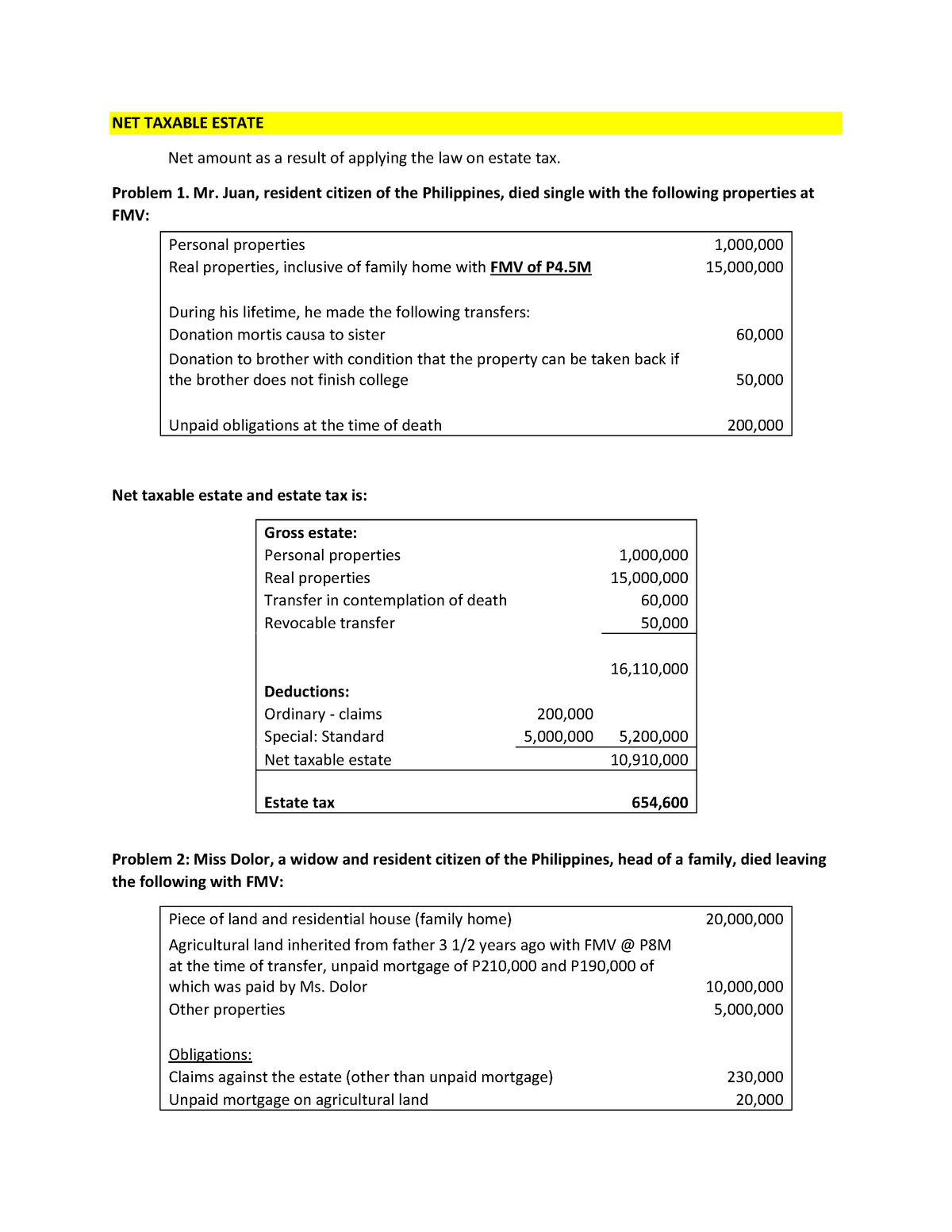

Simply stated it s three steps You ll need to know your filing status add up all of your sources of income and then subtract any deductions to find your taxable income amount So how do you determine your taxable income exactly This post will break down the details of how to calculate taxable income using these steps To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI Once you have calculated adjusted gross income you can subtract any deductions for which you qualify either itemized or standard to arrive at taxable income

For example assume a hypothetical taxpayer who is married with 150 000 of joint income in 2024 and claiming the standard deduction of 29 200 They would owe the following taxes 10 of the first 23 200 2 320 12 of the next 71 100 8 532 22 of the remaining 26 500 5 830 Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable

More picture related to How To Compute For Net Taxable Income

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator.jpg

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

Problem 3 26 LO 1 Compute The Taxable Income For 2020 For Aiden On

https://media.cheggcdn.com/media/3fa/3fa397be-0f84-42e4-90a3-5c72742d1c02/phpzHVIZ2.png

The gross price would be 40 25 40 40 10 50 Net price is 40 gross price is 50 and the tax is 25 You perform a job and your gross pay is 50 The income tax is 20 so your net income is 50 20 50 10 40 In both examples we had the same gross and net amounts but the tax percentage turned out to be different She pays 272 51 in federal taxes 46 61 in Medicare taxes 193 31 in Social Security taxes 102 48 in state taxes and 125 for insurance This leaves her with a net income of This leaves her

To calculate income tax you add all forms of taxable income earned in a tax year Next find your adjusted gross income Then subtract any eligible deductions from your adjusted gross income 1 Employee compensation and benefits These are the most common types of taxable income and include wages and salaries as well as fringe benefits 2 Investment and business income For people who are self employed they are also subject to tax liability specifically through their business income For example net rental income and

When Are Individual Tax Returns Due TaxesTalk

https://www.taxestalk.net/wp-content/uploads/philippine-tax-talk-this-day-and-beyond-how-to-compute-taxable-income.jpeg

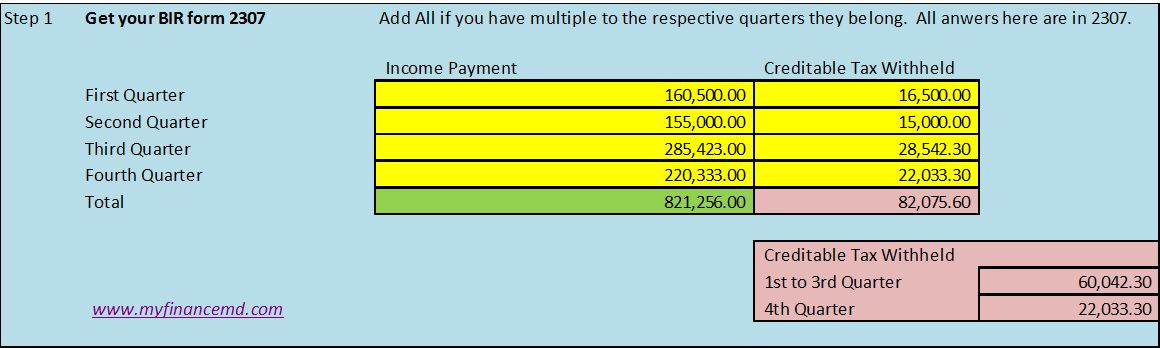

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

https://myfinancemd.com/wp-content/uploads/2016/01/1.jpg

How To Compute For Net Taxable Income - Each portion of your income that falls within a specific bracket will be taxed at its corresponding rate As of 2024 the tax brackets in Oregon are as follows 4 75 for income up to 3 650 6 75 for income between 3 651 and 9 200 8 75 for income between 9 201 and 125 000 9 9 for income above 125 000