How To Compute Total Taxable Income To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI Once you have calculated adjusted gross income you can subtract any deductions for which you qualify either itemized or standard to arrive at taxable income

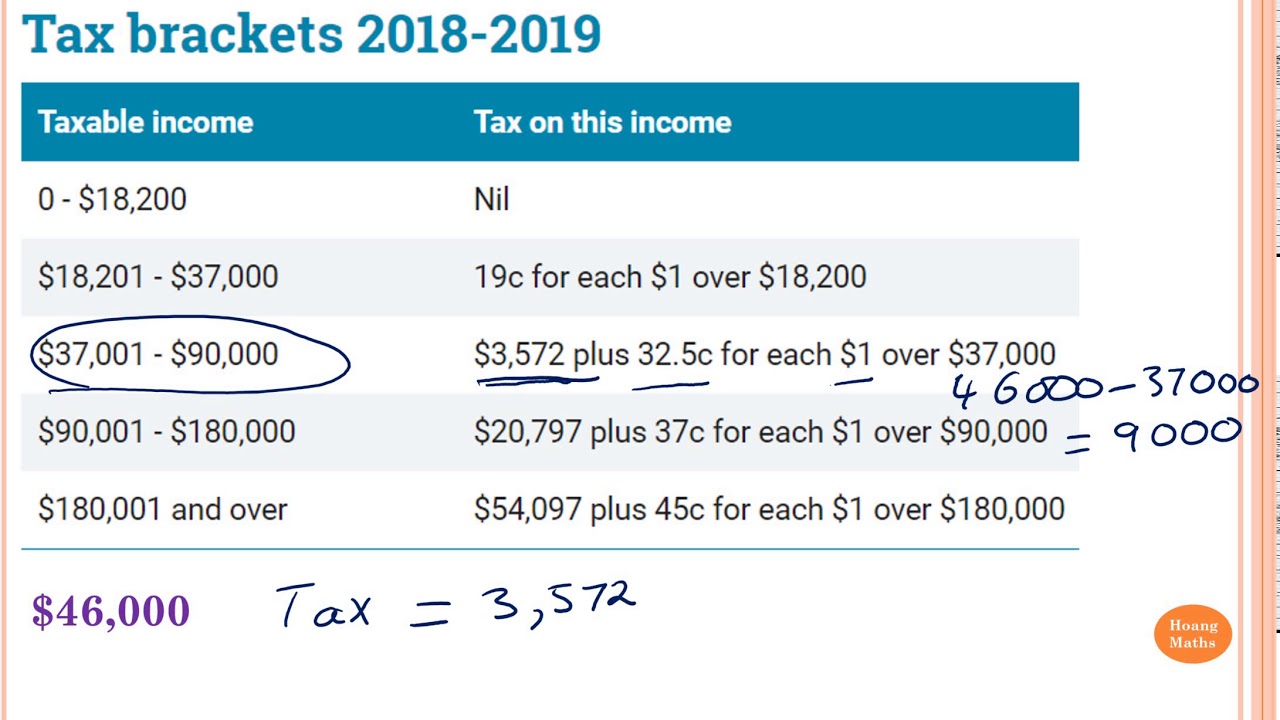

At a glance Learning how to calculate your taxable income involves knowing what items to include and what to exclude Simply stated it s three steps You ll need to know your filing status add up all of your sources of income and then subtract any deductions to find your taxable income amount So how do you determine your taxable income exactly What are Tax Brackets How Many Tax Brackets Are There The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates 2022 tax brackets and federal income tax rates 2021 tax brackets and federal income tax rates View all filing statuses

How To Compute Total Taxable Income

How To Compute Total Taxable Income

https://i.ytimg.com/vi/1lA9I61SPeU/maxresdefault.jpg

How To Calculate Income Tax FY 2016 17 FinCalC TV YouTube

https://i.ytimg.com/vi/n88iQ1EfB-Y/maxresdefault.jpg

How Do You Calculate The Net Income Haiper

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable Calculate your potential tax liability or refund with our free income tax calculator Plug in your expected income deductions and credits and the calculator will quickly estimate

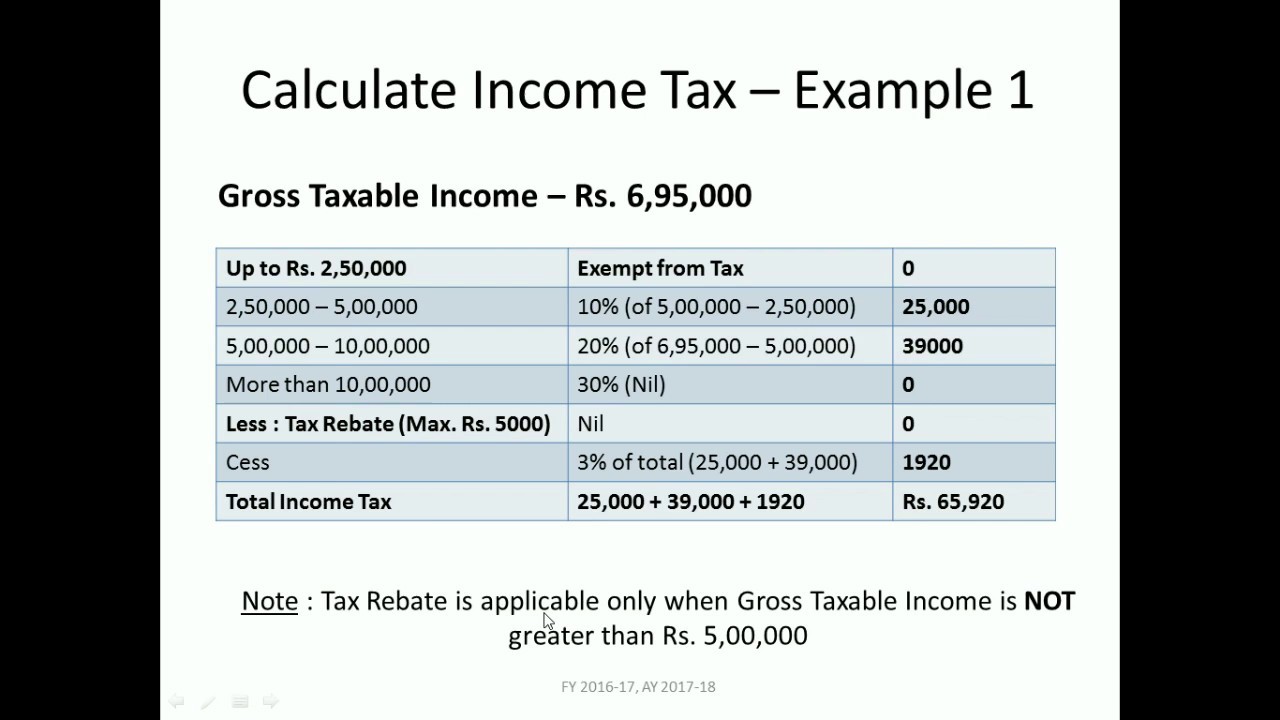

Arriving at Taxable Income Both individuals and corporations begin with gross income the total amount earned in a given year For individual filers calculating federal taxable income starts by taking all income minus above the line deductions and exemptions like certain retirement plan contributions higher education expenses and student loan interest and alimony payments among others Step by step Enter the filing status income deductions and credits to estimate your total taxes for 2008 Filing status Total exemption Total income Related links Tips Determining your

More picture related to How To Compute Total Taxable Income

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Taxable Income Calculator India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/IncomeTaxCalci-Final2.jpg

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Income Tax Calculator Income Tax Calculator Tax Year Filing Status Taxable Income Answer Estimated Income Tax 9 934 Tax Bracket 22 0 Tax as a percentage of your taxable income 11 69 Net Income after Tax is paid 75 066 How could this calculator be better Share this Answer Link help Paste this link in email text or social media The total income amount or gross income is used as the basis to calculate how much the individual or organization owes the government for the specific tax period One important thing to remember about taxable income is that it includes not just one s salary but also compensation in other forms such as tips bonuses allowances commissions

What is taxable income Taxable income is the part of your gross income the total income you receive that is subject to federal tax Taxable income and gross income differ The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison File Status

How To Calculate Taxable Income H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

How To Calculate Current Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

How To Compute Total Taxable Income - 2 Total up your income The next step is to determine the total amount of taxable income you have to report to the IRS The IRS indicates that income can include money property or services Both earned and unearned income count including the following sources of income Earned income Unearned income