How To Find Net Taxable Income Taxable income is the portion of your gross income that the IRS deems subject to taxes It consists of both earned and unearned income Taxable income comes from compensation businesses

At a glance Learning how to calculate your taxable income involves knowing what items to include and what to exclude Simply stated it s three steps You ll need to know your filing status add up all of your sources of income and then subtract any deductions to find your taxable income amount So how do you determine your taxable income exactly Home File Taxable income Taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away

How To Find Net Taxable Income

How To Find Net Taxable Income

https://www.paretolabs.com/wp-content/uploads/2021/06/Illustration-of-net-income-formula.png

How To Calculate Net Income With Tax Rate Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

How To Find Net Income Calculations For Business

https://www.patriotsoftware.com/wp-content/uploads/2019/12/net-income-visual.jpg

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Income Tax Calculator Income Tax Calculator Tax Year Filing Status Taxable Income Answer Estimated Income Tax 9 934 Tax Bracket 22 0 Tax as a percentage of your taxable income 11 69 Net Income after Tax is paid 75 066 How could this calculator be better Share this Answer Link help Paste this link in email text or social media

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison Income Has Business or Self Employment Income yes no All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate

More picture related to How To Find Net Taxable Income

How To Compute Your Total Taxable Income A Closer Look On Gross

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Taxable Income Formula Calculator Examples With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

Taxable Income Formula Financepal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-1024x737.png

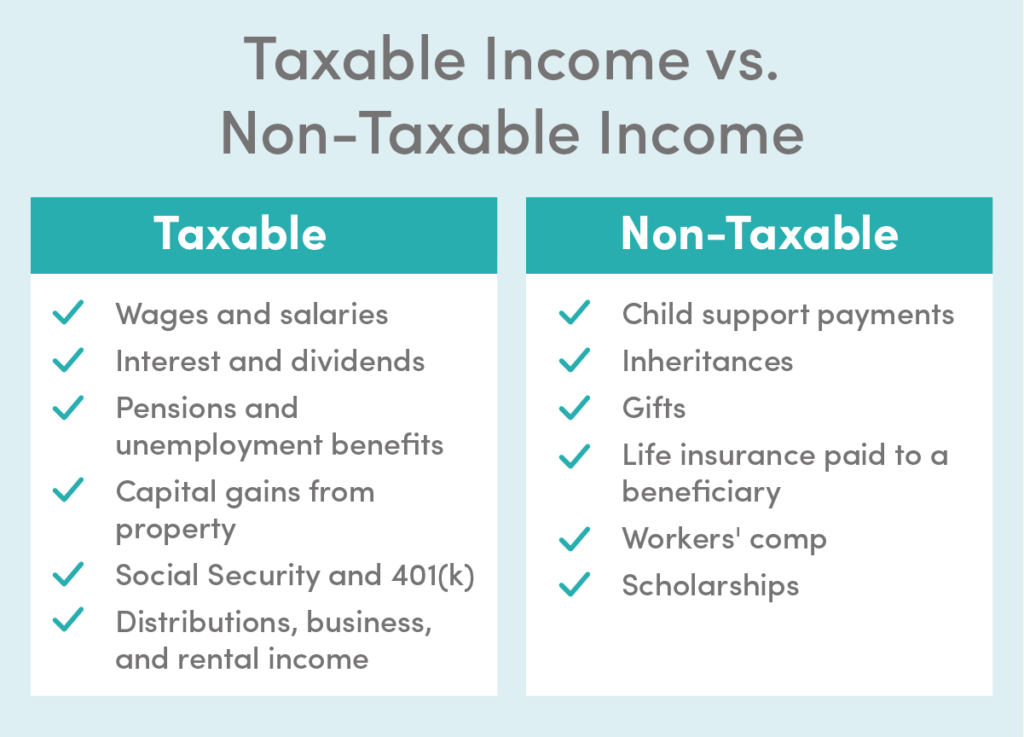

To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI Once you have calculated adjusted gross income you can subtract any deductions for which you qualify either itemized or standard to arrive at taxable income Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but is not taxable A list is available in Publication 525 Taxable and Nontaxable Income Constructively received income You are generally taxed on income that is available to you regardless of

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status Use our income tax calculator to estimate how much you ll owe in taxes Enter your income and other filing details to find out your tax burden for the year Net Pay Effective State Tax Rate

Net Income Formula Calculator With Excel Template

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Net-Income-Formula-1.jpg

Net Income Formulas What Is Net Income Formula Examples

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/net-income-formula-1623236027.png

How To Find Net Taxable Income - Calculate Gross Total Income The sum arrived at after step 4 is known as the gross total income Deduct Tax Deductions From the gross total income deduct the eligible tax deductions such as investments under Section 80C 80D etc Calculate Net Taxable Income The result after step 6 is your net taxable income