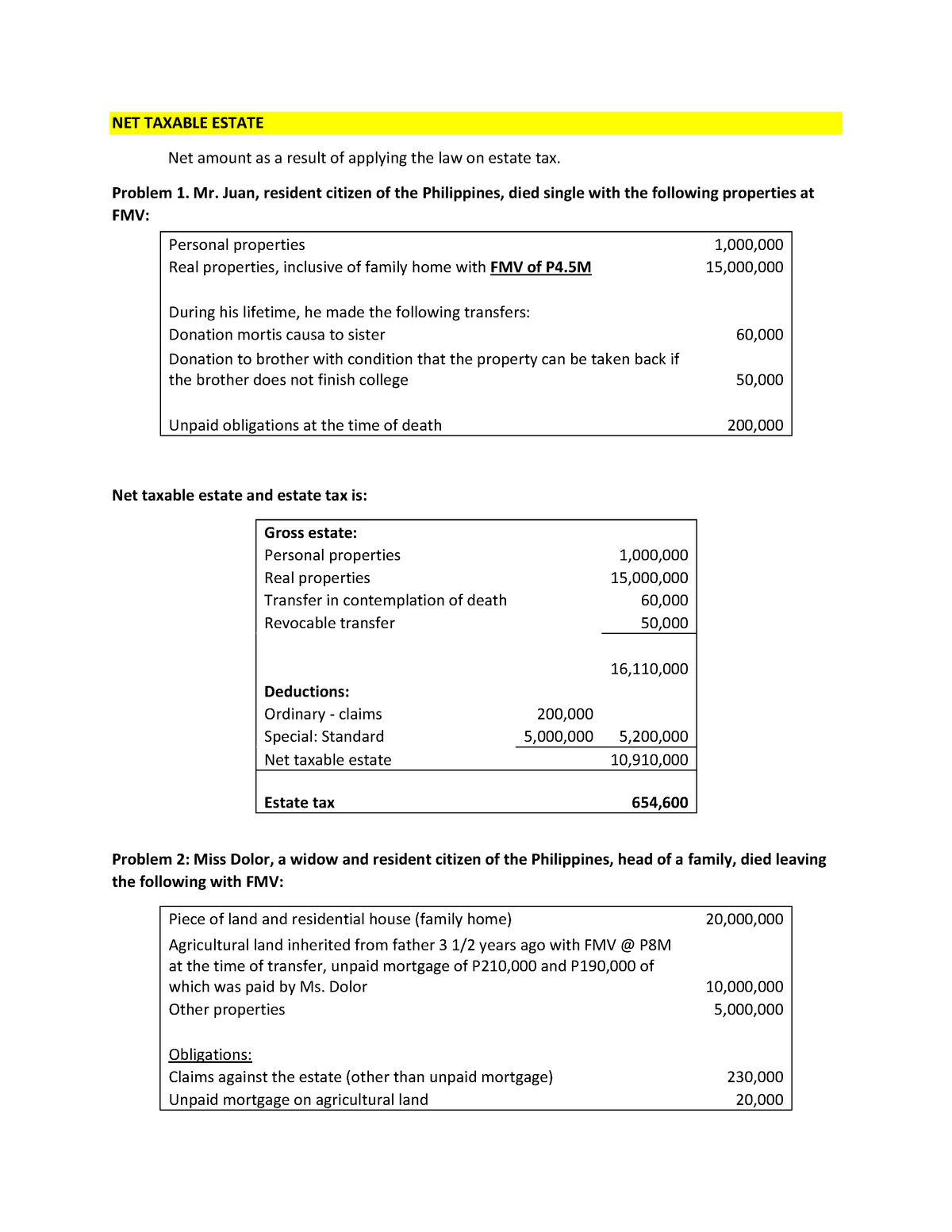

How To Compute Net Taxable Compensation Income Total Deductions This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax Caculator Philipines 2024 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag IBIG Monthy Contribution Tables for the computation

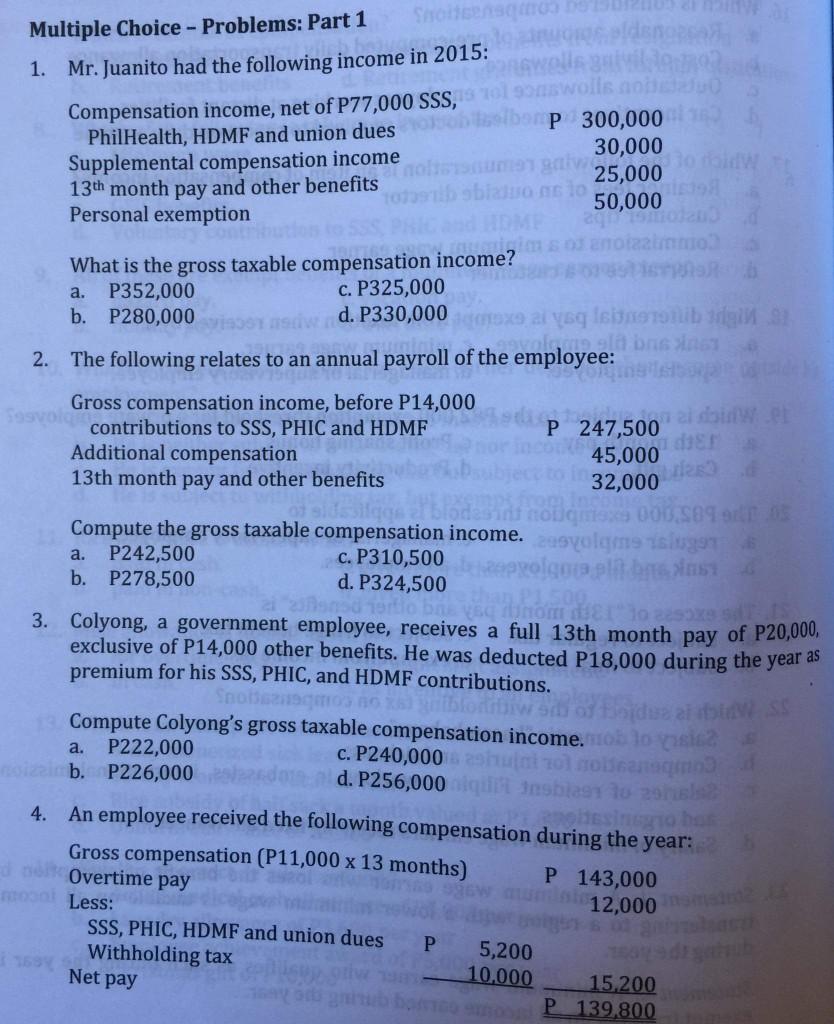

Taxable Compensation Income REGULAR Basic Salary Representation Allowance Transportation Allowance Cost of Living Allowance Fixed Housing Allowance Other Taxable Regular Compensation SUPPLEMENTARY Commission Profit Sharing Fees including Director s Fee Taxable 13th Month Pay Other Benefits Hazard Pay Overtime Pay To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

How To Compute Net Taxable Compensation Income

How To Compute Net Taxable Compensation Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6a6997f20ccd16eedc709a3c6dff9884/thumb_1200_1553.png

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

What is Taxable Income Taxable income refers to any individual s or business compensation that is used to determine tax liability The total income amount or gross income is used as the basis to calculate how much the individual or organization owes the government for the specific tax period The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable 1 How to Compute Your Income Tax Using the New BIR Tax Rate Table 2 How To Compute Your Income Tax Based on an 8 Preferential Tax Rate Sample income tax computation for the taxable year 2020 3 How To Compute Tax on Passive Income 4 How to Compute Your Income Tax Using an Online Tax Calculator Frequently Asked Questions 1

More picture related to How To Compute Net Taxable Compensation Income

How To Calculate Current Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096872/

Joe must pay 14 130 in SE taxes To compute his plan compensation Joe must subtract from his net profit of 100 000 the IRC Section 164 f deduction which in this case is of his SE tax 14 130 x and the amount of contribution for himself to the plan At a glance Learning how to calculate your taxable income involves knowing what items to include and what to exclude Simply stated it s three steps You ll need to know your filing status add up all of your sources of income and then subtract any deductions to find your taxable income amount So how do you determine your taxable income exactly

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 For individuals receiving salary and other allowances from one employer only the tax due is usually equal to tax withheld since the employer is required to compute and withhold the total tax due on the employee s compensation earned during the year using the annual graduated income tax table before paying the last payroll for the year

How To Compute Tax On Monthly Salary Monthly Withholding Tax On

https://i.ytimg.com/vi/5dkPPFL84bw/maxresdefault.jpg

Solved A Multiple Choice Problems Part 1 1 Mr Juanito Chegg

https://media.cheggcdn.com/study/96d/96d768ad-22a5-4271-b85b-31df5c80eeba/image

How To Compute Net Taxable Compensation Income - 1 How to Compute Your Income Tax Using the New BIR Tax Rate Table 2 How To Compute Your Income Tax Based on an 8 Preferential Tax Rate Sample income tax computation for the taxable year 2020 3 How To Compute Tax on Passive Income 4 How to Compute Your Income Tax Using an Online Tax Calculator Frequently Asked Questions 1