How To Calculate Net Taxable Income From Ctc The CTC is partially refundable meaning that low income families can get up to 1 600 per child from the IRS even if they don t owe any federal income taxes Though the CTC operates

All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

How To Calculate Net Taxable Income From Ctc

How To Calculate Net Taxable Income From Ctc

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

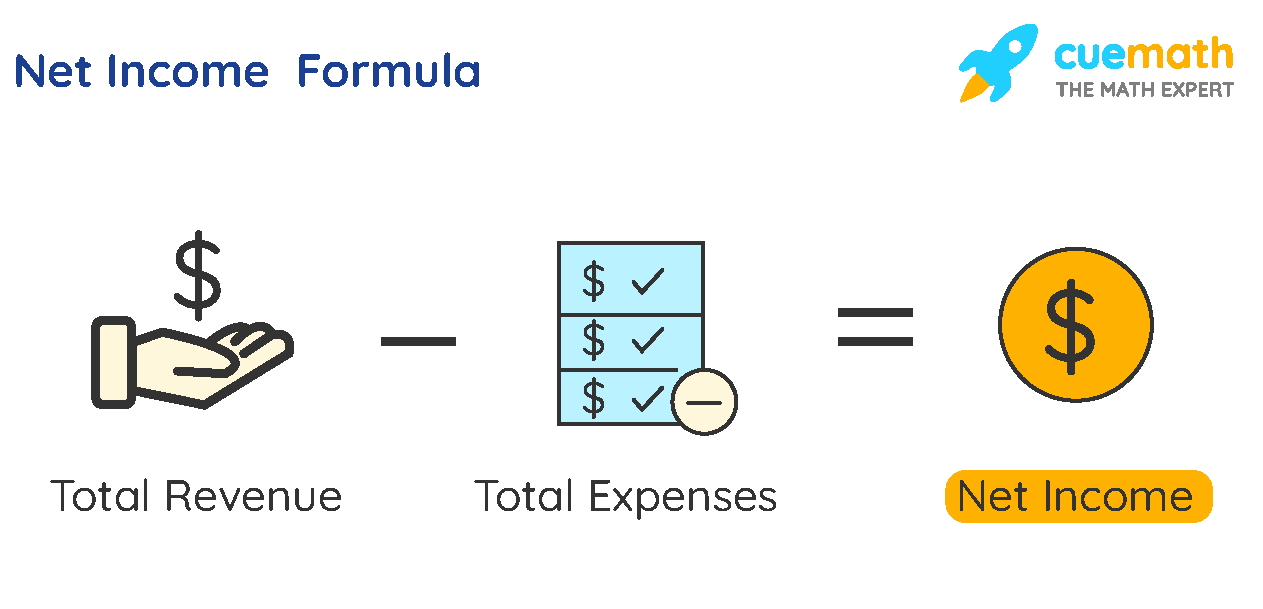

How To Calculate Net Income Gross Profit Haiper

https://learn.financestrategists.com/wp-content/uploads/2020/09/Net-Income-Formula-SIMPLE-1024x512.jpg

Net Income Formulas What Is Net Income Formula Examples

https://d138zd1ktt9iqe.cloudfront.net/media/seo_landing_files/net-income-formula-1623236027.png

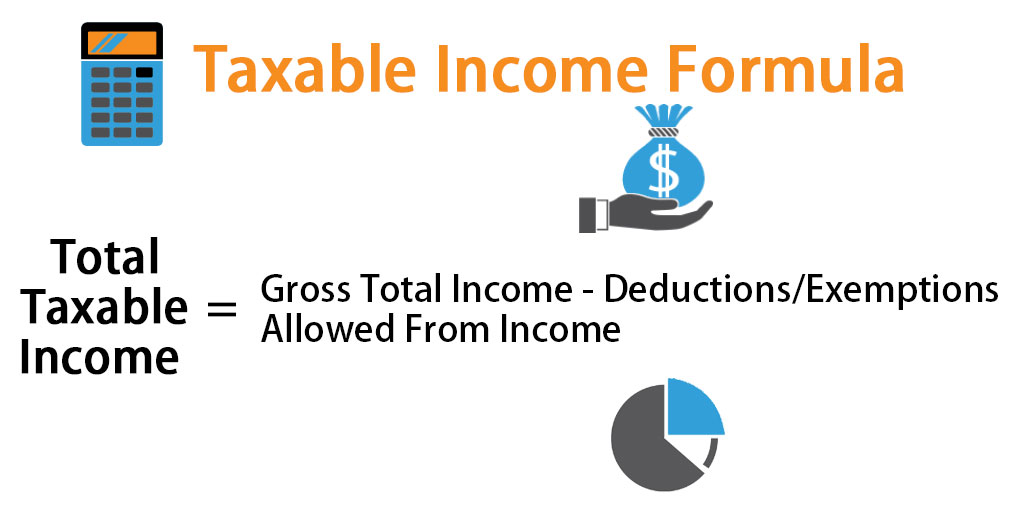

The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child For tax year 2021 the expanded child Taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away It s considered your income

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison For example a 1 000 deduction can only reduce net taxable Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Also calculated is your net income the amount you

More picture related to How To Calculate Net Taxable Income From Ctc

Taxable Income Calculator India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/IncomeTaxCalci-Final2.jpg

Sauer Bildhauer nderungen Von Net Worth Formula Balance Sheet Emulsion

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

How To Calculate Current Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-Formula.jpg

As your income goes up the tax rate on the next layer of income is higher When your income jumps to a higher tax bracket you don t pay the higher rate on your entire income You pay the higher rate only on the part that s in the new tax bracket 2023 tax rates for a single taxpayer For a single taxpayer the rates are The proposal also includes a lookback provision for earned income in 2024 and 2025 allowing filers to use either current year or previous year earned income when calculating the refundable credit The proposal would have no effect on the child tax credit after 2025 meaning that the currently scheduled reduction in 2026 would still occur

About 16 million kids from low income families would benefit according to the Center on Budget and Policy Priorities a liberal leaning think tank that has pushed to expand the CTC A quarter of Step 1 Calculate Your Gross Income Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc To illustrate say your income for 2022

How To Calculate Taxable Income H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

How To Calculate Accounts Payable Formula Modeladvisor

https://imgmidel.modeladvisor.com/how_to_calculate_accounts_payable_from_income_statement.png

How To Calculate Net Taxable Income From Ctc - Taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you receive it even if you don t cash it or use it right away It s considered your income