How To Compute Net Taxable Income Philippines How To Compute Your Income Tax Based on Graduated Rates Sample income tax computation for the taxable year 2020 Scenario 1 Employee with a gross monthly salary of Php 30 000 and receiving 13th month pay of the same amount Scenario 2 Employee with a gross monthly salary of Php 100 000 and receiving 13th month pay of the same amount

Net Salary Gross Salary Monthly Contributions Income Tax 25 000 1 600 513 4 25 000 2 113 4 22 886 6 Your net take home pay or net salary would be 22 886 6 That s the step by step guide on how you can compute your income tax and get your monthly net salary Philippine social tax contributions if any made by the resident alien and or his wife to the Philippine social security agencies shall be allowed as deductions from gross income in calculating their tax liabilities for the year

How To Compute Net Taxable Income Philippines

How To Compute Net Taxable Income Philippines

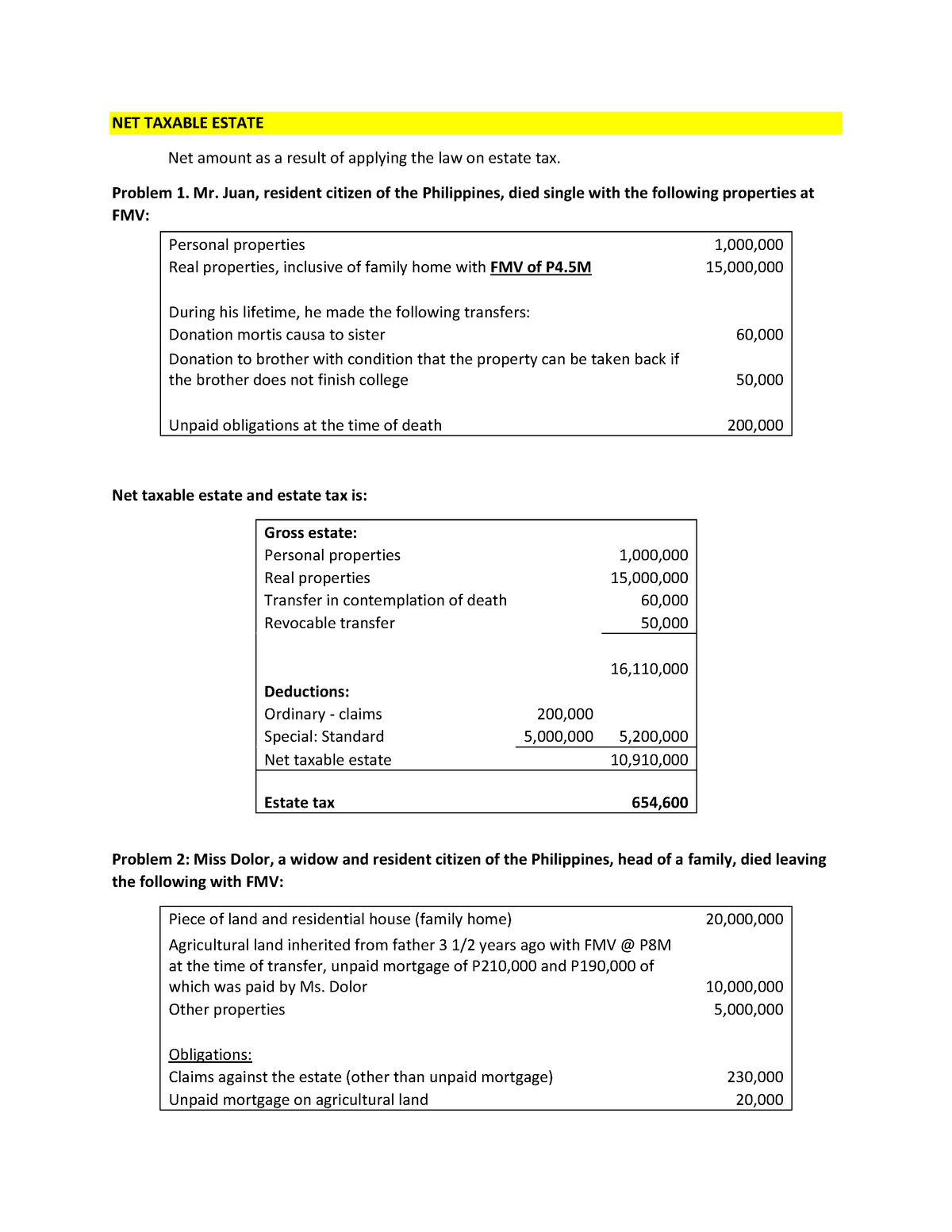

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6a6997f20ccd16eedc709a3c6dff9884/thumb_1200_1553.png

Annualized Tax Table 2017 Philippines Review Home Decor

https://www.wallstreetmojo.com/wp-content/uploads/2021/05/Taxable-Income-Formula.jpg

When Are Individual Tax Returns Due TaxesTalk

https://www.taxestalk.net/wp-content/uploads/philippine-tax-talk-this-day-and-beyond-how-to-compute-taxable-income.jpeg

Step 1 Base on your salary per month get your taxable income figure Step 2 Look into the income tax above and determine your salary column Step 3 Compute your personal income tax base on your salary taxable income and income tax rate For Pinoys Who Want to Get their Net Take Home Pay Illustration 1 The following is the information of Employee A who is a non minimum wage earner and a pure compensation employee for taxable year 2023 Annual salary P300 000 Overtime P10 000

Income Tax 22002 45 12 250000 0 20 12 264029 4 250000 0 20 12 2805 88 12 Income Tax 233 82 All that s left is to subtract your income tax from your taxable income Net Pay Taxable Income Income Tax 22002 45 233 82 Net Pay 21768 63 Worry About Your Taxes Less with Taxumo Employers annualize income tax by following these steps Prepare an annual summary of employees earnings and deductions for the entire fiscal year Calculate the total non taxable and taxable income for the year including items like De Minimis benefits and 13th month pay subject to certain limits Determine the total amount of employee

More picture related to How To Compute Net Taxable Income Philippines

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096872/

How To Compute Tax Refund in the Philippines Formula General Formula for computing annual income tax refunds Tax Due Prepaid Tax Payments Tax Payable or Refund Sample Cases A Compensation Income for employees The employee has a basic salary of Php 30 000 monthly or Php 360 000 annually 1 How to Get Taxpayer Identification Number TIN a How to Get a TIN Using BIR Tax Forms Walk in Registration b How to Get a TIN Using the BIR eReg Website Online Registration 2 How to Verify TIN If It Has Been Lost or Forgotten 3 How to Get TIN ID Card in the Philippines What Are the Different Types of Taxes in the Philippines 1

This online calculator computes your monthly income tax due and net take home pay under the TRAIN law vs the old tax system based on your monthly gross income It also shows how much you ll save on taxes per month and per year 2016 2015 2014 2013 2017 Philippine Capital Income and Financial Intermediation Statistics Philippine Public Finance and Related Statistics 2020 Tax Information Tax Laws Issuances Amendments to NIRC

Cherish Childhood Memories Quotes

https://www.coursehero.com/qa/attachment/19096866/

How To Compute Income Tax In The Philippines

https://www.thinkpesos.com/wp-content/uploads/2016/07/HOW-TO-COMPUTE-INCOME-TAX-IN-THE-PHILIPPINES.jpg

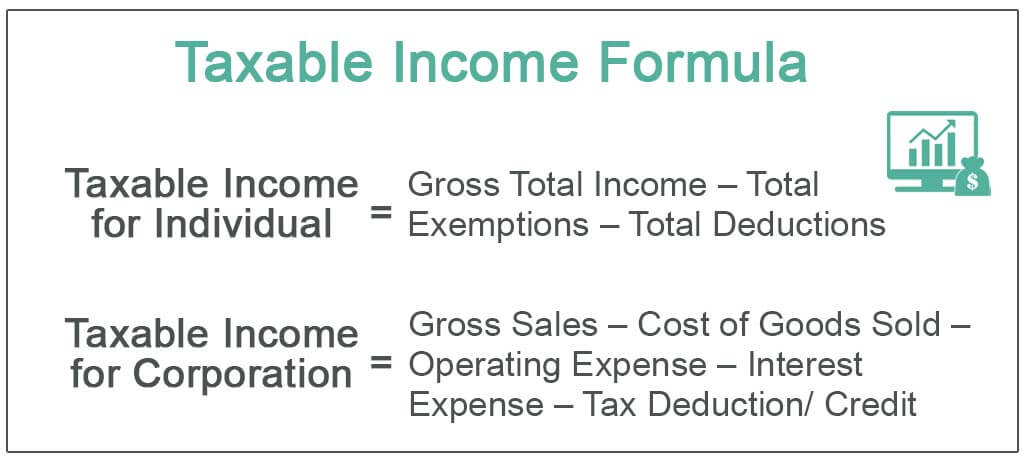

How To Compute Net Taxable Income Philippines - The formula to compute the income tax payable is Gross Income Less Allowable Deductions Itemized or Optional Net Income Less Personal Additional Exemptions Net Taxable Income Applicable Tax Rate see Tax Rate Table below Income Tax Due Less Tax Withheld Income Tax Payable What are the Income Tax Rates in the Philippines