How To Calculate Income Tax Percentage In Excel To calculate the total income tax owed in a progressive tax system with multiple tax brackets you can use a simple elegant approach that leverages Excel s new dynamic array engine In the worksheet shown the main challenge is to split the income in cell I6 into the correct tax brackets This is done with a single formula like this in cell E7 LET income I6 upper C7 C13 lower DROP VSTACK

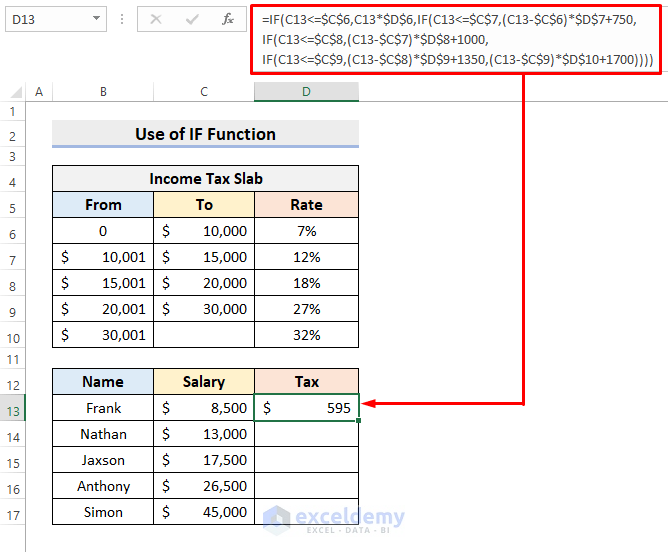

Step 1 Set up Income Tax Slab To illustrate how to calculate taxes we ll use the following tax rate sample A flat 7 for incomes 0 to 10 000 750 12 for income from 10 001 to 15 000 1000 18 for income from 15 001 to 20 000 1 350 27 for income from 20 001 to 30 000 1 700 32 for income from 30 001 and higher In this post we ll examine a couple of ideas for computing income tax in Excel using tax tables Specifically we ll use VLOOKUP with a helper column we ll remove the helper column with SUMPRODUCT and then we ll use data validation and the INDIRECT function to make it easy to pick the desired tax table such as single or married filing joint

How To Calculate Income Tax Percentage In Excel

How To Calculate Income Tax Percentage In Excel

https://static.toiimg.com/thumb/msid-62634413,width-1070,height-580,imgsize-130310,resizemode-6,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

How To Calculate Income Tax Calculator Ay 2019 2020 Carfare me 2019 2020

https://www.bankbazaar.com/images/india/infographic/how-calculate-income-tax-on-salary-with-example.png

How to Use Our Income Tax Calculator for Excel Below we explain step by step how to use our income tax calculator Excel template Step 1 Enter Your Gross Income Enter your gross income in the cell under Amount in for Gross Income In our example we have 50 000 Step 2 Enter Your Deductions That tells me the correct tax bracket but I still need to calculate the taxes that are due at each level which I will cover in the next section Determine how much you owe at each tax bracket For the first tax bracket I will need to determine if the income level reaches the second tax bracket

Excel can be used to calculate various types of taxes including income tax sales tax property tax and more Each type of tax has its own specific calculation methods and Excel provides the tools to accurately calculate these taxes based on the relevant tax rates and income or transaction amounts Being able to calculate tax percentage In this video I use a simple Excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket In the proce

More picture related to How To Calculate Income Tax Percentage In Excel

Calculate Income Tax In Excel AY 2023 24 Template Examples

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1.png

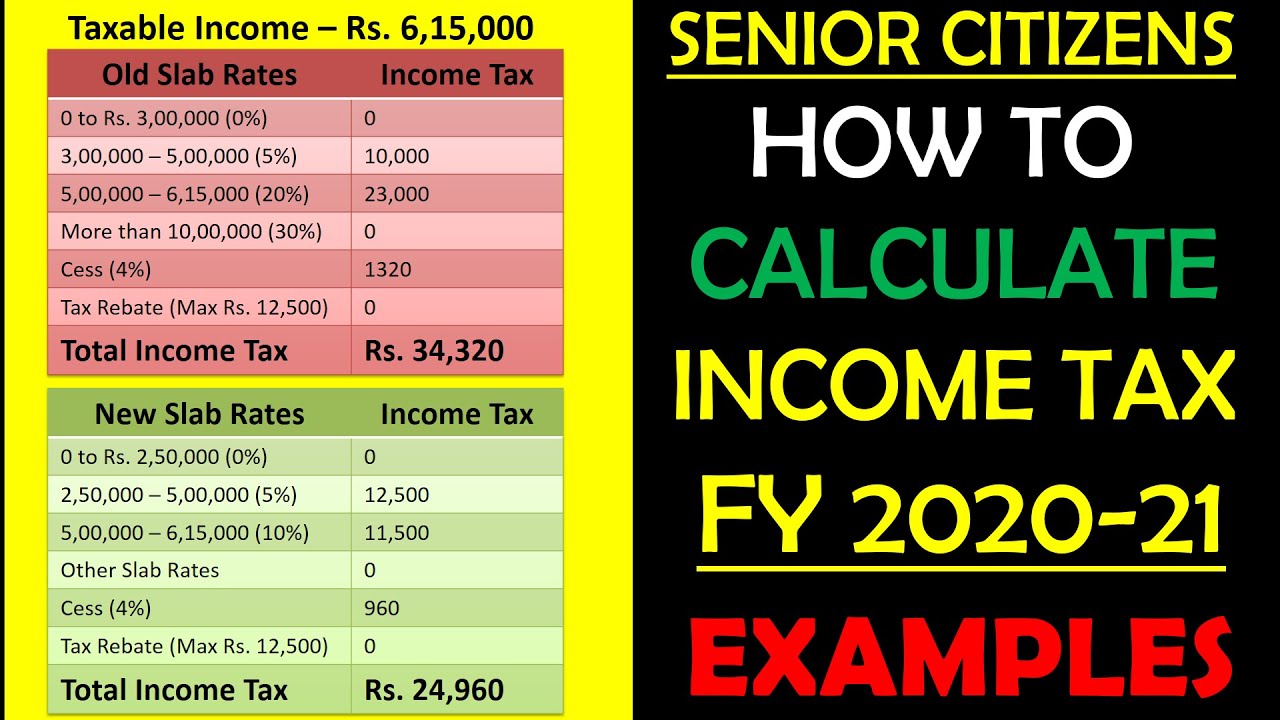

Income Tax Calculation SENIOR CITIZENS 2020 21 How To Calculate

https://i.ytimg.com/vi/o6DXtXn_lIc/maxresdefault.jpg

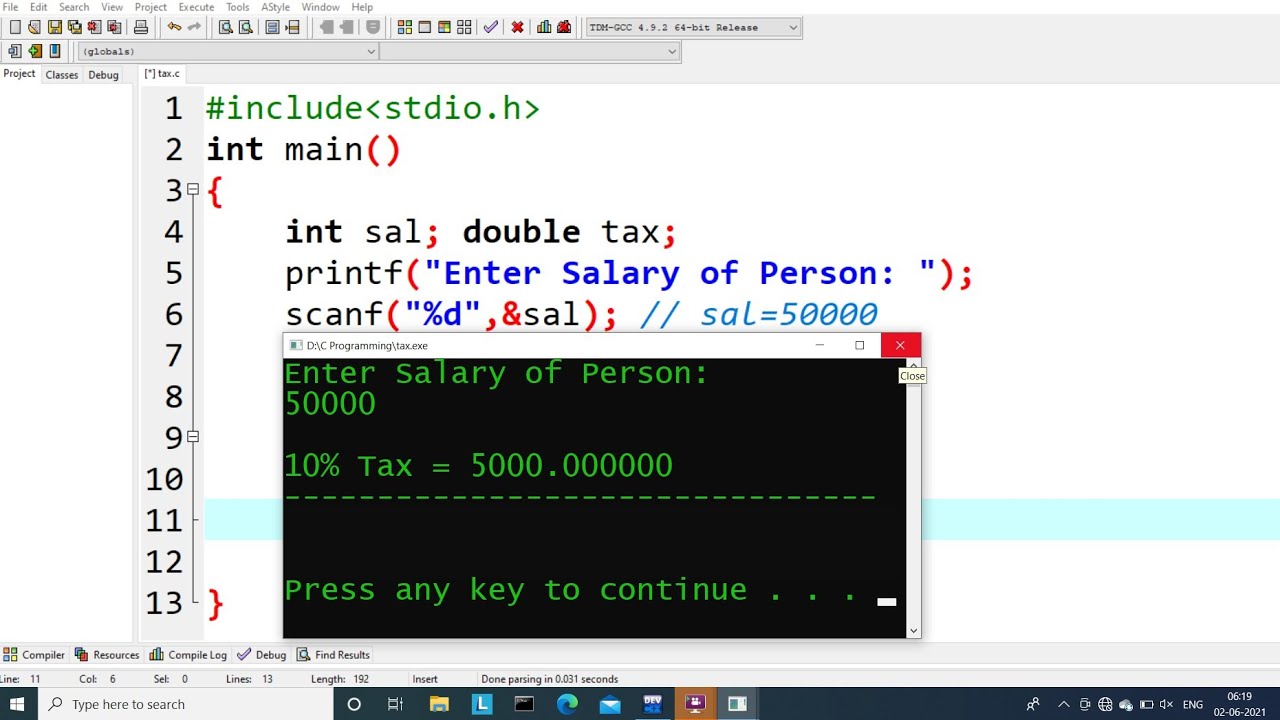

C Program To Calculate Income Tax

https://i.ytimg.com/vi/8-RnzZGfAK4/maxresdefault.jpg

IF B10 To see the explanation how this formula is created click here Explanation of income tax formula using nested IF Step 2 Now hit the Enter button and see the returned value for the calculated tax on Martina s salary amount See that Tax is NiL Now we will calculate the tax on Harry s salary whose salary amount is 17 00 000 Learn how to calculate your effective tax rate using Microsoft Excel what income tax rates to apply to your earned income and what tax percentage applies to each span

[desc-10] [desc-11]

How To Calculate Income Tax Expense Insurance Noon

https://insurancenoon.com/wp-content/uploads/2020/12/how-to-calculate-income-tax-expense.jpg

Kuskus Manu lny Pansk S dlo Tax Calculator De trukt vne Smie Rozsah

https://www.exceldemy.com/wp-content/uploads/2022/06/calculate-income-tax-in-excel-using-if-function-3.png

How To Calculate Income Tax Percentage In Excel - That tells me the correct tax bracket but I still need to calculate the taxes that are due at each level which I will cover in the next section Determine how much you owe at each tax bracket For the first tax bracket I will need to determine if the income level reaches the second tax bracket