How To Calculate Tax Brackets In Excel Step 2 Calculate Taxable Income For the first bracket due to the zero lower limit the maximum Taxable Income will be 9 315 To calculate the taxable income for the second Bracket we need to subtract the lower limit Cell D6 from the upper limit Cell E6 and then add the result with 1 Determine the taxable income for the third bracket in the same way

Step 5 Display Tax Amounts The Tax Amount for each bracket will be displayed in the corresponding cells under Tax Amount in Step 6 Calculate Total Federal Tax The Total Federal Tax will be the sum of the taxes calculated for each bracket and will be displayed in the Total Federal Tax row We hope that you now have a better I want to calculate Gross amount of Rent when i know net amount and tax slabs applicable I want to devise a formula so that when i enter net rent payable it gives me gross amount and tax amount in two cells without using Goal Seek Example Rent 100 000 per month Tax As per Slab Annual Gross Rent Tax Slab Rates are

How To Calculate Tax Brackets In Excel

How To Calculate Tax Brackets In Excel

https://exceljet.net/sites/default/files/styles/function_screen/public/images/formulas/income tax bracket calculation_0.png

Tax Calculator 2022 CharisseRhyanna

https://i2.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-768x539.png

Tax Brackets Rates Definition And How To Calculate TheStreet

http://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/e6301875-c023-11e8-be29-d9c5a5287655.png

Some Other Suitable Ways to Calculate Income Tax in Excel Moreover we have other methods to calculate income tax in Excel besides the IF function Here we ll show you 2 other functions that you can use for determining the income tax Here we are going to use the same dataset above Tax Calculation in Excel Using SUMPRODUCT Function The tax system in the United States like that of many other countries operates on a structured framework It involves income brackets and individuals are required to pay taxes based on their earnings from the previous year

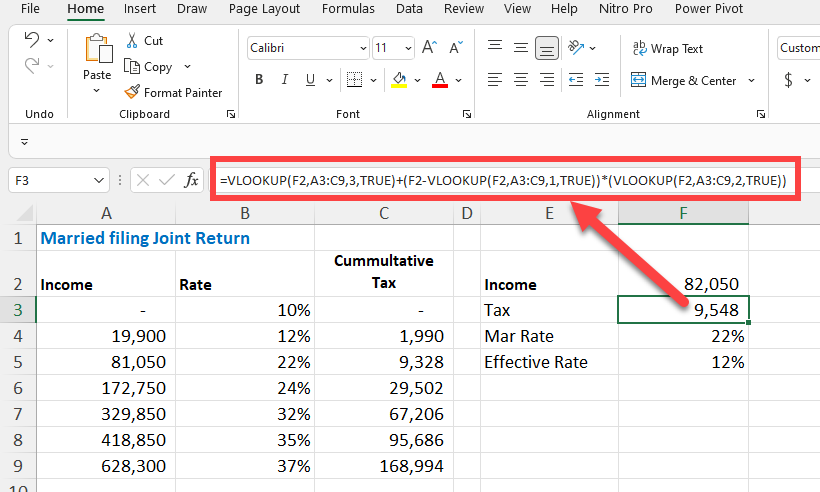

If I want to look up the incremental tax bracket for a given level of income I can accomplish this using a VLOOKUP formula This is the formula I would use to accomplish that VLOOKUP Income TaxBrackets 2 What it is doing is taking the income number and looking up the tax bracket table and pulling in the second column the tax rate To automatically calculate the tax on an income execute the following steps 1 On the second sheet create the named range Rates 2 When you set the fourth argument of the VLOOKUP function to TRUE the VLOOKUP function returns an exact match or if not found it returns the largest value smaller than lookup value A2

More picture related to How To Calculate Tax Brackets In Excel

Excel VLOOKUP For Tax Brackets Year 2021 With Examples Chris Menard

https://chrismenardtraining.com/_CMT/images/photos/Original/1317.jpg

2021 Tax Brackets Calculator SapphoBucci

https://www.forbes.com/advisor/wp-content/uploads/2021/05/taxes-federal-income-tax-bracket--900x510.jpeg

How To Calculate Payroll Taxes 2021 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/calculate-payroll-taxes-income-tax-brackets-chart-inforgraphic-us.png

In this video I use a simple Excel example to show how you can calculate federal income taxes depending on your taxable income and tax bracket In the proce When it comes to calculating federal tax in Excel it is important to understand the concept of tax brackets and how they affect the calculations Tax brackets are the ranges of income that are subject to different tax rates As income increases the tax rate also increases resulting in a progressive tax system

[desc-10] [desc-11]

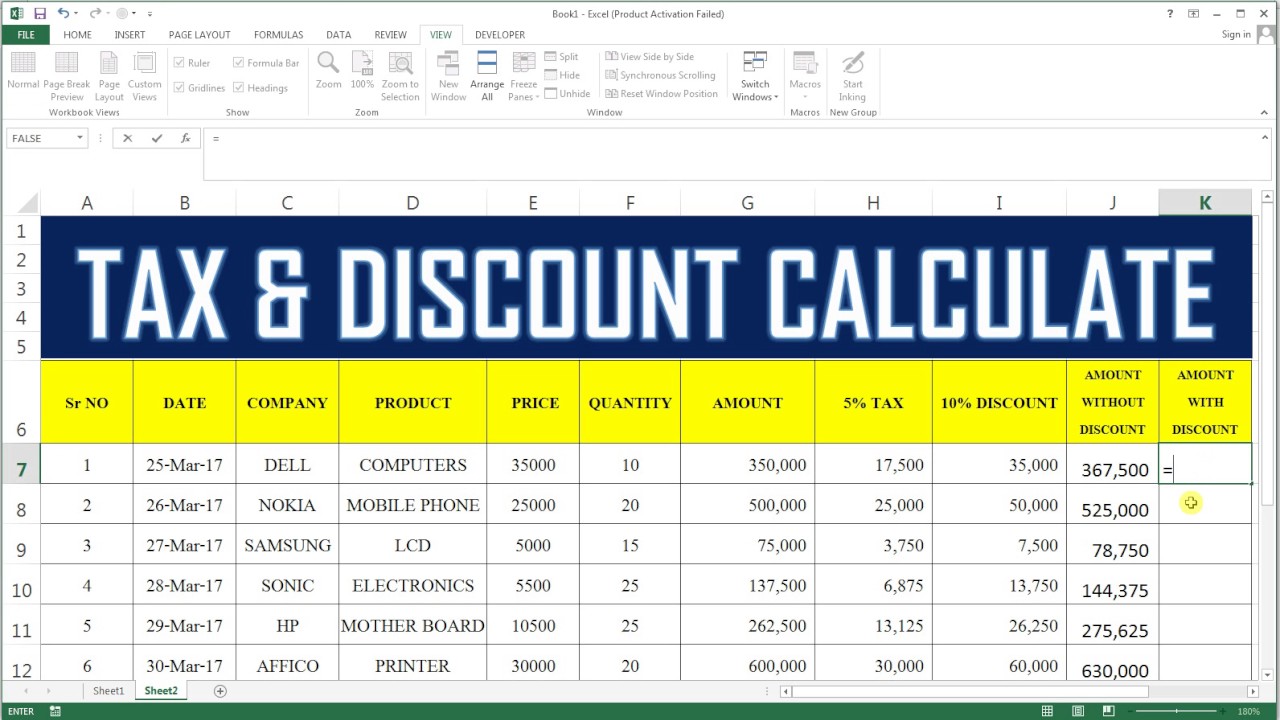

How To Calculate Tax Discount In Excel 36 YouTube

https://i.ytimg.com/vi/XctRo4rpa0I/maxresdefault.jpg

Salary Income Tax Calculator Excel Sheet Free Download Sgase

https://i.ytimg.com/vi/_bM1Y6-JXl4/maxresdefault.jpg

How To Calculate Tax Brackets In Excel - [desc-14]