How To Calculate Corporate Net Income For Tax Purposes Net Income After Taxes NIAT Net income after taxes NIAT is an accounting term most often found in a company s annual report that is meant to show the company s definitive bottom line for

The formula for calculating net income is Revenue Cost of Goods Sold Expenses Net Income The first part of the formula revenue minus cost of goods sold is also the formula for gross income Check out our simple guide for how to calculate cost of goods sold So put another way the net income formula is Some of that income is taxable and some isn t which makes calculating your taxable income and estimating how much tax you ll owe challenging However estimating your taxable income

How To Calculate Corporate Net Income For Tax Purposes

How To Calculate Corporate Net Income For Tax Purposes

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/34/2019/05/Screen-Shot-2020-01-04-at-2.38.37-PM.png

How To Calculate Corporate Investment Income Tax In Canada EDM Chicago

https://www.edmchicago.com/wp-content/uploads/2022/12/Investment-in-canada.jpg

Net earnings also called net income or profit is your gross business income minus business expenses No matter what kind of business you have you begin with gross income and deduct allowable expenses to get net income Gross income is the income received directly by an individual before any withholding deductions or taxes To calculate net income for a business start with a company s total revenue From this figure subtract the business s expenses and operating costs to calculate the business s earnings

In July 2019 the IRS released a Chief Counsel Memorandum explaining how a corporate taxpayer should calculate their charitable contribution deduction and use charitable contribution carryovers when the corporation has current year taxable income before using prior year net operating loss NOL carryforwards The IRS also clarifies the ordering rules with respect to using prior year Jan 3 2024 at 2 34 p m Impact of Net Investment Income Tax The intention of the net investment income tax NIIT is to raise funds for the Affordable Care Act However unlike other U S tax

More picture related to How To Calculate Corporate Net Income For Tax Purposes

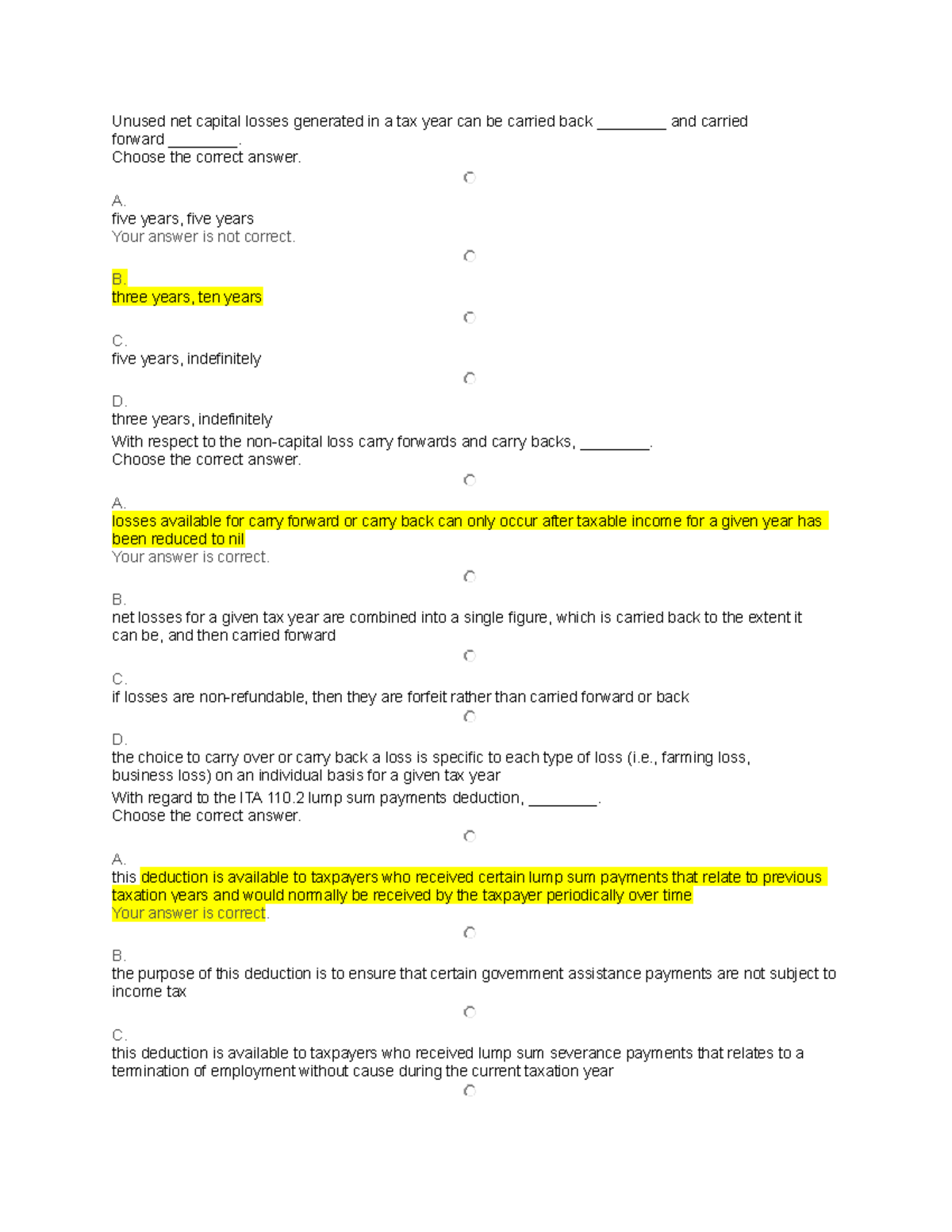

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

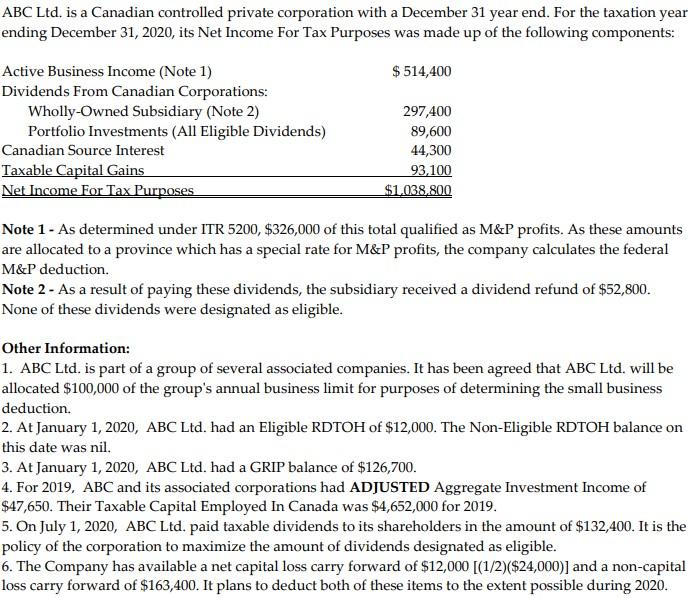

ABC Ltd Is A Canadian Controlled Private Corporation Chegg

https://media.cheggcdn.com/media/8e5/8e5569dd-5ef1-4c25-95fd-55a52e54d13c/phpWuHcE5

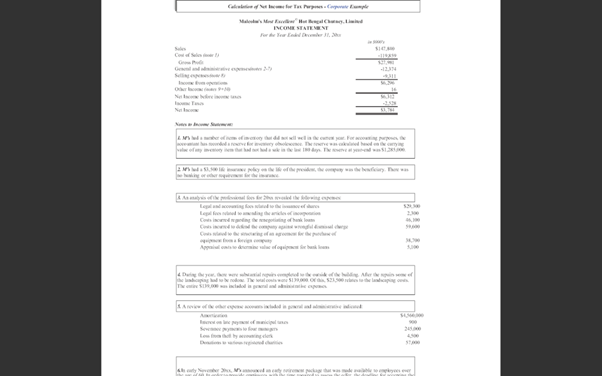

Get Answer Calculation Of Net Income For Tax Purposes Corporate

https://files.transtutors.com/book/qimg/c7eab636-55aa-41dc-8c01-48423103fe7f.png

1 Write down the total sales revenue for the firm This figure can be found on the income statement 2 Subtract the cost of goods sold as they appear on the income statement to get the gross How to calculate net income To calculate net income take the gross income the total amount of money earned then subtract expenses such as taxes and interest payments For the individual

Accrual vs cash How to calculate net income on an accrual basis The good news is it s just as easy to calculate net income whether your business uses the accrual or cash method of accounting The formula is exactly the same What s different is how you record your revenue and expenses To get a better understanding of what net income means and how to calculate it read our guide The net income formula is simple Net Income Total Revenue Total Expenses This calculation will give you the company s net profit which is equal to its pre tax income or earnings before tax minus its tax expenses However the value of net

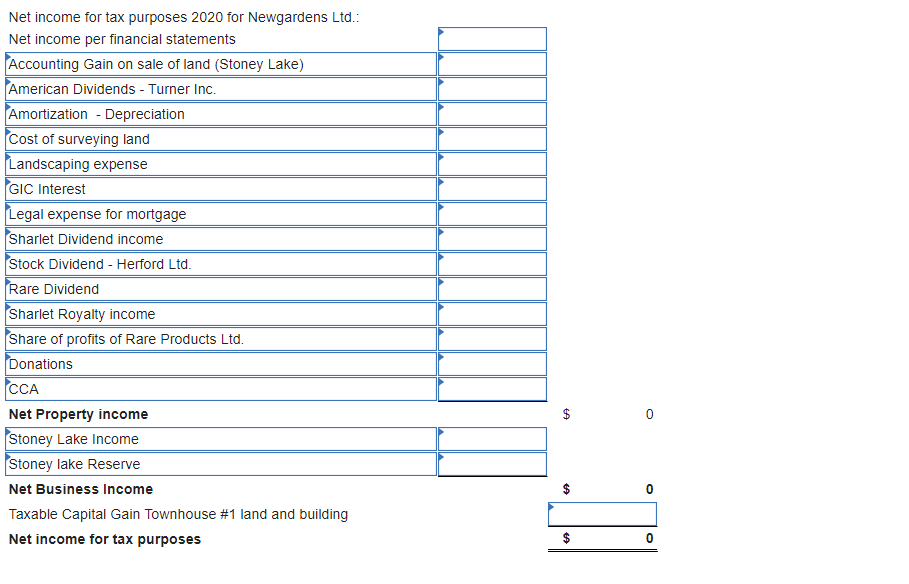

Solved Lia Wright Is The Sole Shareholder Of Newgardens Ltd Chegg

https://media.cheggcdn.com/media/729/729ae77a-9b2a-4cda-8771-755f9462f11d/phpyWbf1D

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/84/2019/05/Screenshot-2022-12-30-at-11.24.42-PM.png

How To Calculate Corporate Net Income For Tax Purposes - Jan 3 2024 at 2 34 p m Impact of Net Investment Income Tax The intention of the net investment income tax NIIT is to raise funds for the Affordable Care Act However unlike other U S tax