How To Work Out Net Income For Tax Return Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate A tax credit is a dollar for dollar discount on your tax bill So if you owe 1 000 but qualify for a 500 tax credit your tax bill goes down to 500

Finding the Annual Net Income on Tax Returns Locating the annual net income on tax returns depends on the specific form being used to file taxes The most common tax forms used by individuals in the United States are Form 1040 Form 1040A and Form 1040EZ The annual net income is typically reported in the income section of these forms Form The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison

How To Work Out Net Income For Tax Return

How To Work Out Net Income For Tax Return

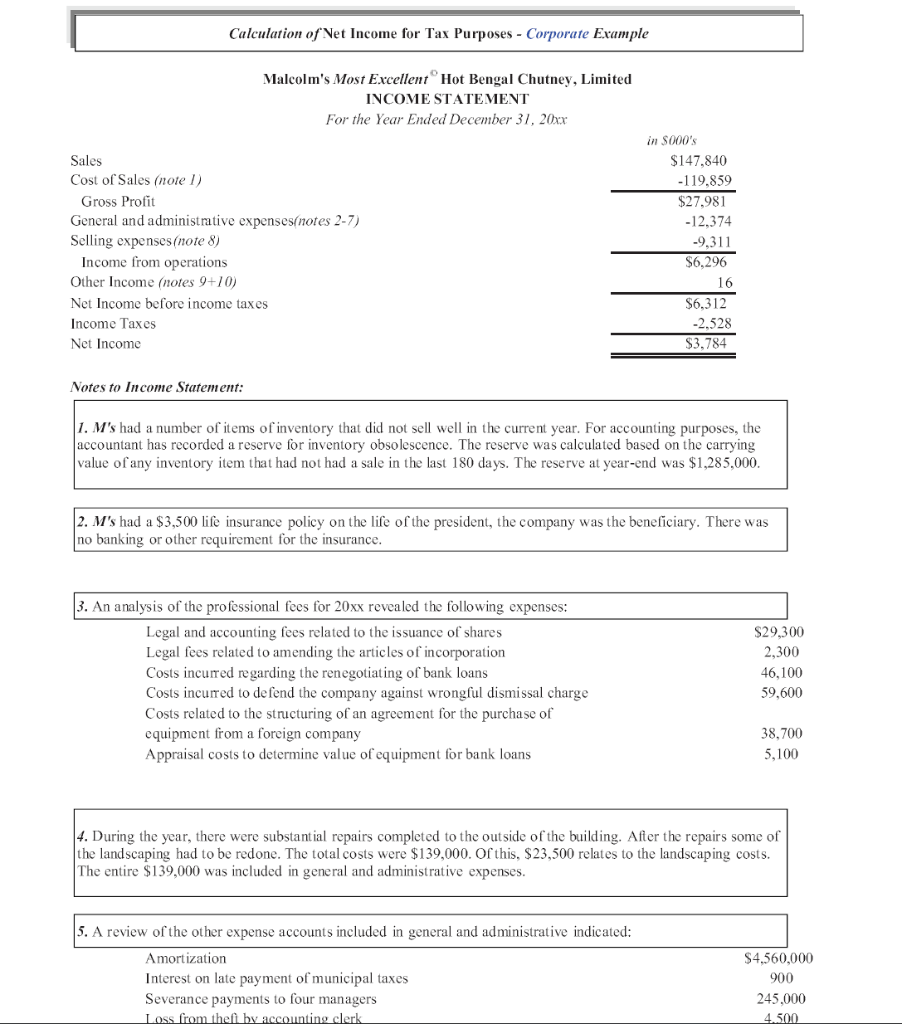

https://media.cheggcdn.com/media/065/0656bde3-3167-4b7f-b6ee-b42ed97ffda8/phpZYYdYF

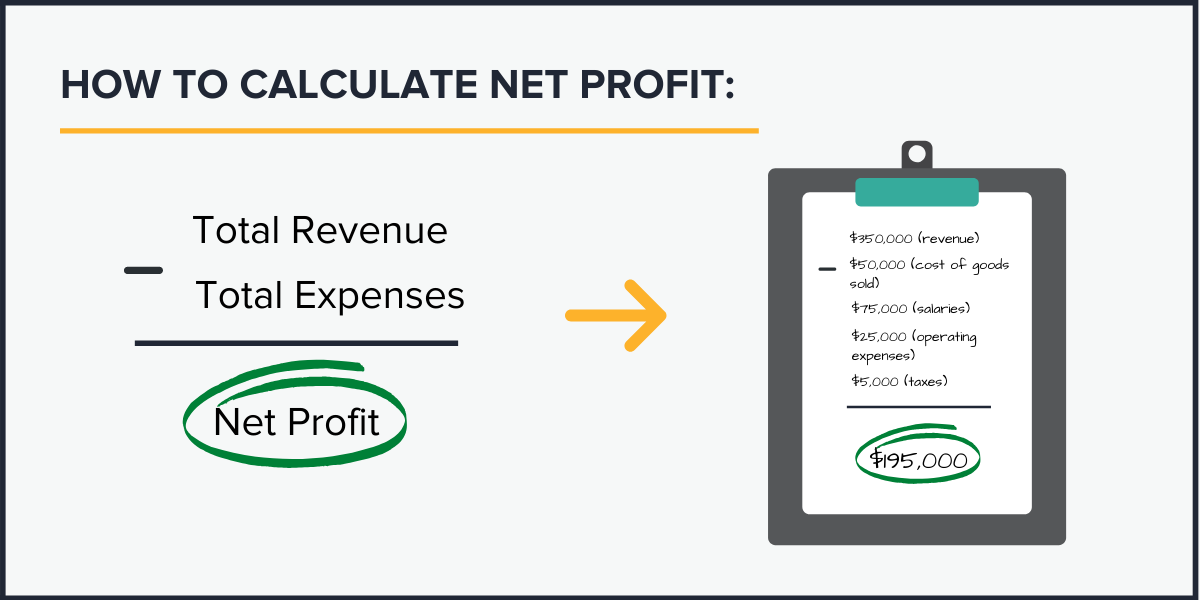

What Is Net Profit Net Profit Formula updated 2022

https://fastloans.ph/wp-content/uploads/2020/11/Created-by-2-copy.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012 and his CPA from the Alabama State Board of Public Accountancy in 1984 Your first step to calculating your net income is finding out your gross income It serves as your starting point for calculating net income If you are on a salary or work Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160 Given that the second tax bracket is 12 once we have taken the previously taxed 11 600 away from 25 400 we are left with a total taxable amount of 13 800 After taking 12 tax from that 13 800 we are left with 1 656 of tax

Similarly if you have your net salary and know your tax rate you can work backward to find out your gross annual income For instance if your hourly wage is 34 you work 40 hours per week and 52 weeks per year your annual income would be 70 720 If you are taxed at 12 your net annual income would come to 62 233 60 Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

More picture related to How To Work Out Net Income For Tax Return

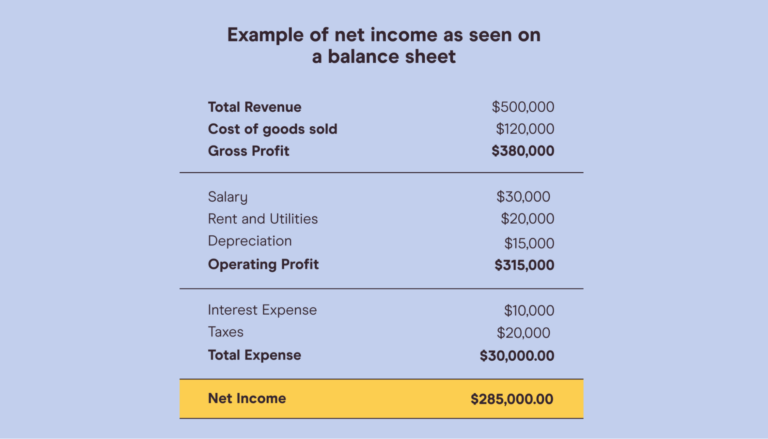

How To Find Net Income For Beginners Pareto Labs

https://www.paretolabs.com/wp-content/uploads/2021/06/Example-of-net-income-as-seen-on-a-balance-sheet-768x439.png

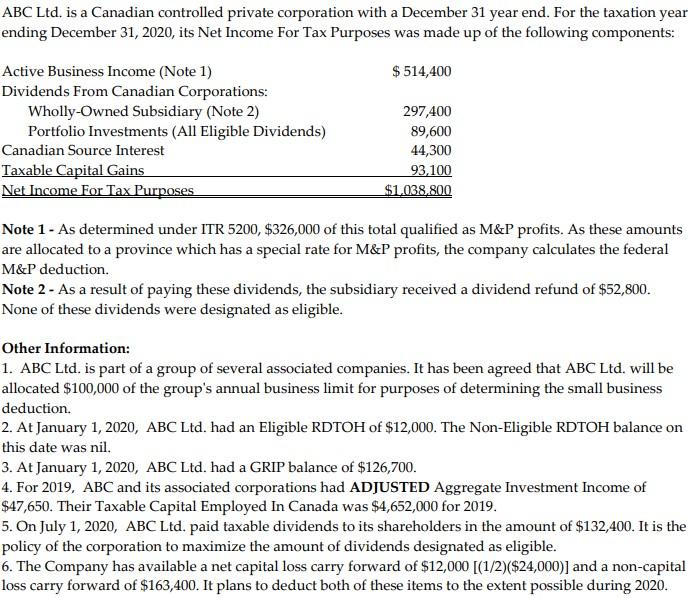

ABC Ltd Is A Canadian Controlled Private Corporation Chegg

https://media.cheggcdn.com/media/8e5/8e5569dd-5ef1-4c25-95fd-55a52e54d13c/phpWuHcE5

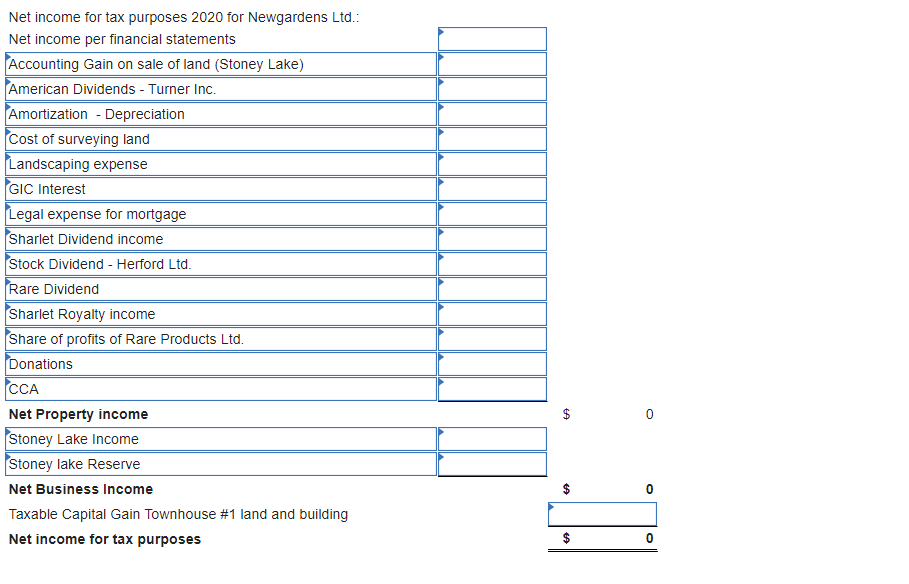

Solved Lia Wright Is The Sole Shareholder Of Newgardens Ltd Chegg

https://media.cheggcdn.com/media/729/729ae77a-9b2a-4cda-8771-755f9462f11d/phpyWbf1D

To calculate the net income of an individual you need to know their tax rate based on filing status federal tax rate and state tax rate and any deductions taken out of their paycheck such as Whether you re preparing your income tax returns or applying for a loan it s important to know how to calculate your income before taxes While net income is the amount of money you earn after you subtract taxes and other deductions gross income refers to the amount of money you earn before factoring in these deductions Renting out

[desc-10] [desc-11]

Understanding Your Tax Forms The W 2

https://imageio.forbes.com/blogs-images/kellyphillipserb/files/2014/02/W2.png?format=png&width=1200

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Revenu Net Apr s Imp ts NIAT

https://www.investopedia.com/thmb/Q5ir-NHCLUsmqJvAAh9FImZ64CU=/1247x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

How To Work Out Net Income For Tax Return - Similarly if you have your net salary and know your tax rate you can work backward to find out your gross annual income For instance if your hourly wage is 34 you work 40 hours per week and 52 weeks per year your annual income would be 70 720 If you are taxed at 12 your net annual income would come to 62 233 60