What Is Net Income For Tax Purposes Effective Jan 1 2013 individual taxpayers are liable for a 3 8 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status Qualifying widow er with a child 250 000

If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3 000 1 500 if married filing separately or your total net loss shown on line 16 of Schedule D Form 1040 Capital Gains and Losses Claim the loss on line 7 of your Form 1040 or Form 1040 SR The following items are considered taxable income and included as such on one s federal income tax return Those states that have state and local income taxes generally follow federal income tax rules Wage income Form W 2 Box 1 Taxable Wages represents for employees the amount of wage income reported on IRS Form 1040 line 7

What Is Net Income For Tax Purposes

What Is Net Income For Tax Purposes

https://media.cheggcdn.com/media/065/0656bde3-3167-4b7f-b6ee-b42ed97ffda8/phpZYYdYF

What Is Net Income For Tax Purposes YouTube

https://i.ytimg.com/vi/ysFkJq7A-Fk/maxresdefault.jpg

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but is not taxable A list is available in Publication 525 Taxable and Nontaxable Income Constructively received income You are generally taxed on income that is available to you regardless of Net income is a measure of how much money a person or a business makes after accounting for all costs Sales tax deduction What it is and how to take advantage of it 4 min read Sep 22

Step 1 Calculate Your Gross Income Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc To illustrate say your income for 2022 The above deduction results in net income for tax purposes line 23600 on the tax return Line 23600 is used in the calculation of adjusted family net income Adjusted Family Net Income Adjusted family net income is your family net income line 23600 for individual spouse common law partner if applicable minus Universal child care

More picture related to What Is Net Income For Tax Purposes

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/34/2019/05/Screen-Shot-2020-01-04-at-2.38.37-PM.png

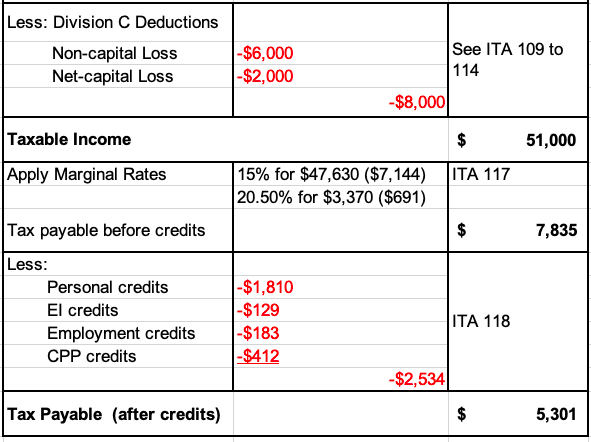

Exam 4 December 2020 Questions And Answers ABC Company Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/597c9d4542e117ccbe1c7170c4bcf881/thumb_1200_1553.png

Cheque Jud as Verdes Corta Vida Calculate Your Net Salary Saludar

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

Earned income is income derived from active participation in a trade or business including wages salary tips commissions and bonuses This is the opposite of unearned income Taxable income is the amount of income used to calculate how much tax an individual or a company owes to the government in a given tax year It is generally described as gross income or adjusted

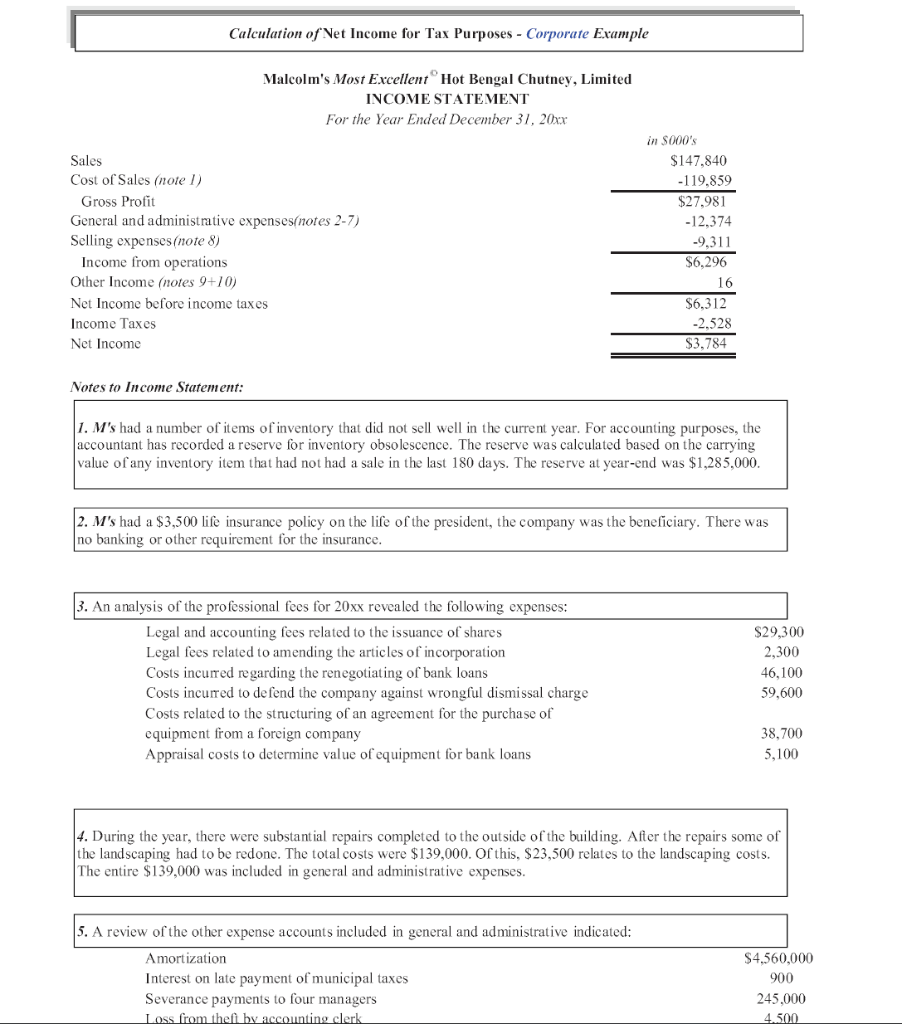

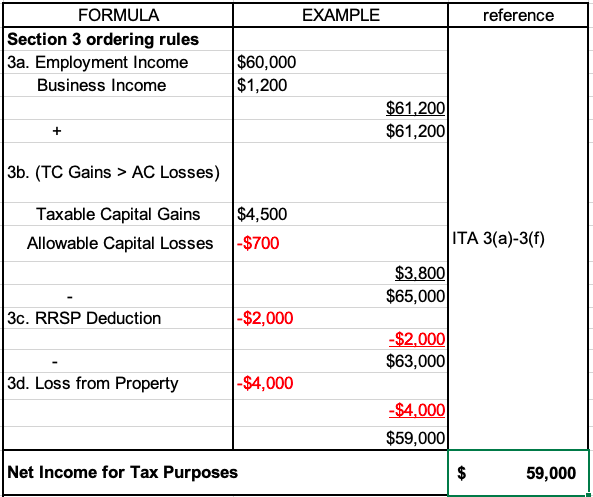

The definition of taxable income is found in the Internal Revenue Code Section 63 Gross income is defined in Section 61 of the Internal Revenue Code Gross income is an individual s total personal income before taking taxes or deductions into account Taxable income of course includes salary and wages but it can also encompass After determining Net Income for Tax Purposes NIFTP using the Section 3 ordering rules Division C deductions are subtracted to get to the Taxable income note don t confuse Division C deductions with section 3 c deductions Then Marginal rates are applied to the Taxable Income to calculate the Tax Payable before credits Lastly credits are deducted to get to the Tax Payable

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

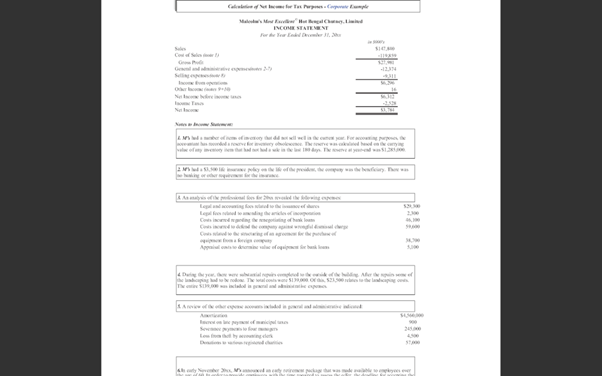

Get Answer Calculation Of Net Income For Tax Purposes Corporate

https://files.transtutors.com/book/qimg/c7eab636-55aa-41dc-8c01-48423103fe7f.png

What Is Net Income For Tax Purposes - Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but is not taxable A list is available in Publication 525 Taxable and Nontaxable Income Constructively received income You are generally taxed on income that is available to you regardless of