How To Calculate Net Income For Tax Return Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable Because tax rules change from year to year your tax refund might change even if your salary and deductions don t change

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison Income Has Business or Self Employment Income yes no You can use our Income Tax Calculator to estimate how much you ll owe or whether you ll qualify for a refund Simply enter your taxable income filing status and the state you reside in to

How To Calculate Net Income For Tax Return

How To Calculate Net Income For Tax Return

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

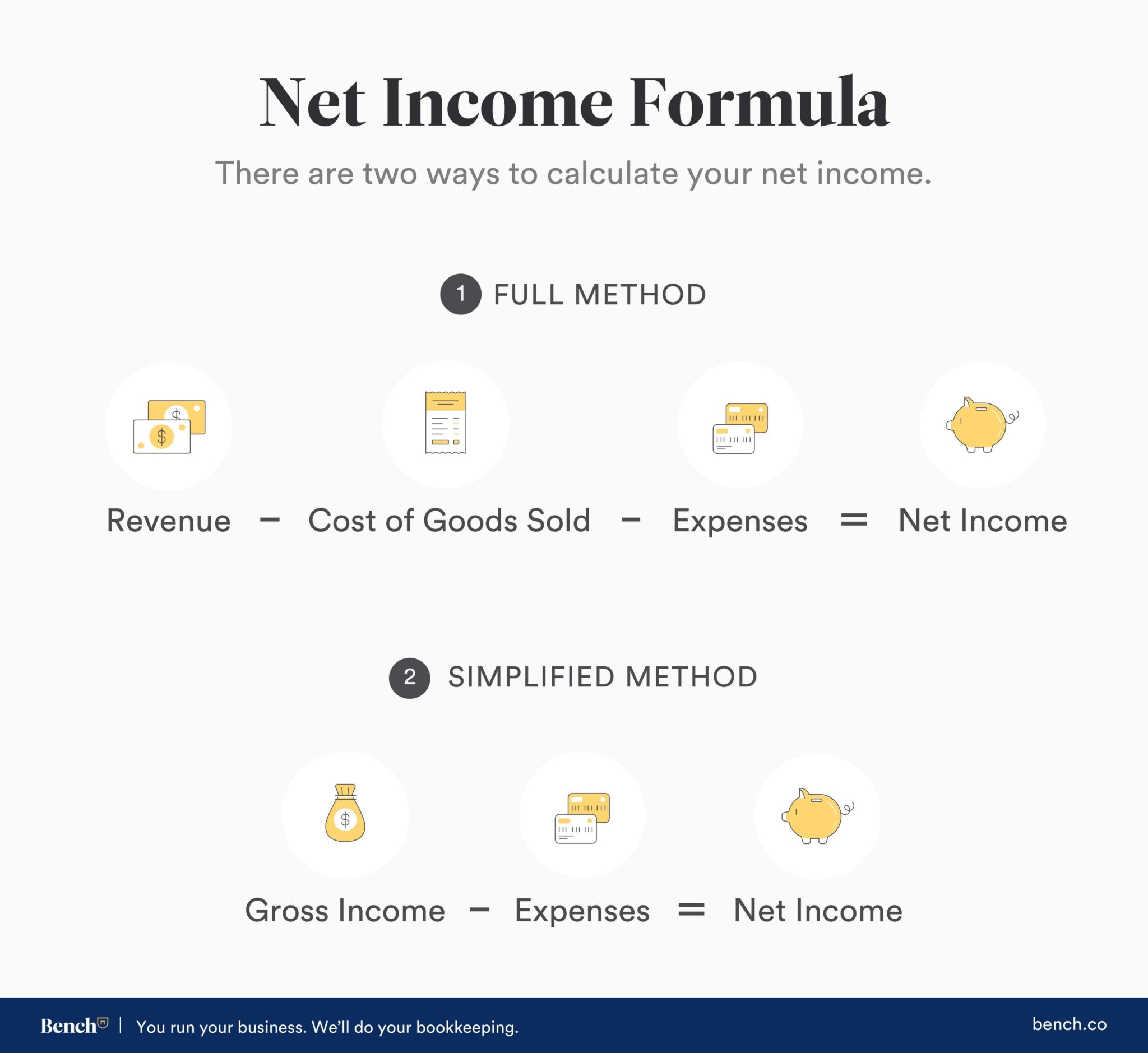

How To Calculate Net Income In Two Minutes Net Income Income Net

https://i.pinimg.com/originals/b5/3f/a7/b53fa7e1d7d46cc468c3e046b7281fe4.png

How To Calculate Net Income Formula And Examples Bench Accounting OPENZEM

https://openzem.com/wp-content/uploads/2022/11/How-To-Calculate-Net-Income-Formula-And-Examples-Bench-Accounting_411-2048x1879.jpg

For example assume a hypothetical taxpayer who is married with 150 000 of joint income in 2024 and claiming the standard deduction of 29 200 They would owe the following taxes 10 of the first 23 200 2 320 12 of the next 71 100 8 532 22 of the remaining 26 500 5 830 Enter your tax year filing status and taxable income to calculate your estimated tax rate What Is My Tax Rate 2021 Filing status Annual taxable income Your 2023 marginal tax rate 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 What are Tax Brackets How Many Tax Brackets Are There

To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI Once you have calculated adjusted gross income you can subtract any deductions for which you qualify either itemized or standard to arrive at taxable income Introduction If your deductions for the year are more than your income for the year you may have a net operating loss NOL An NOL year is the year in which an NOL occurs You can use an NOL by deducting it from your income in another year or years What this publication covers

More picture related to How To Calculate Net Income For Tax Return

Net Income Formula How To Calculate Net Income Insurance Insider News

https://blog.mint.com/wp-content/uploads/2022/08/in-post03-how-to-calculate-net-income-for-your-business.png?resize=768

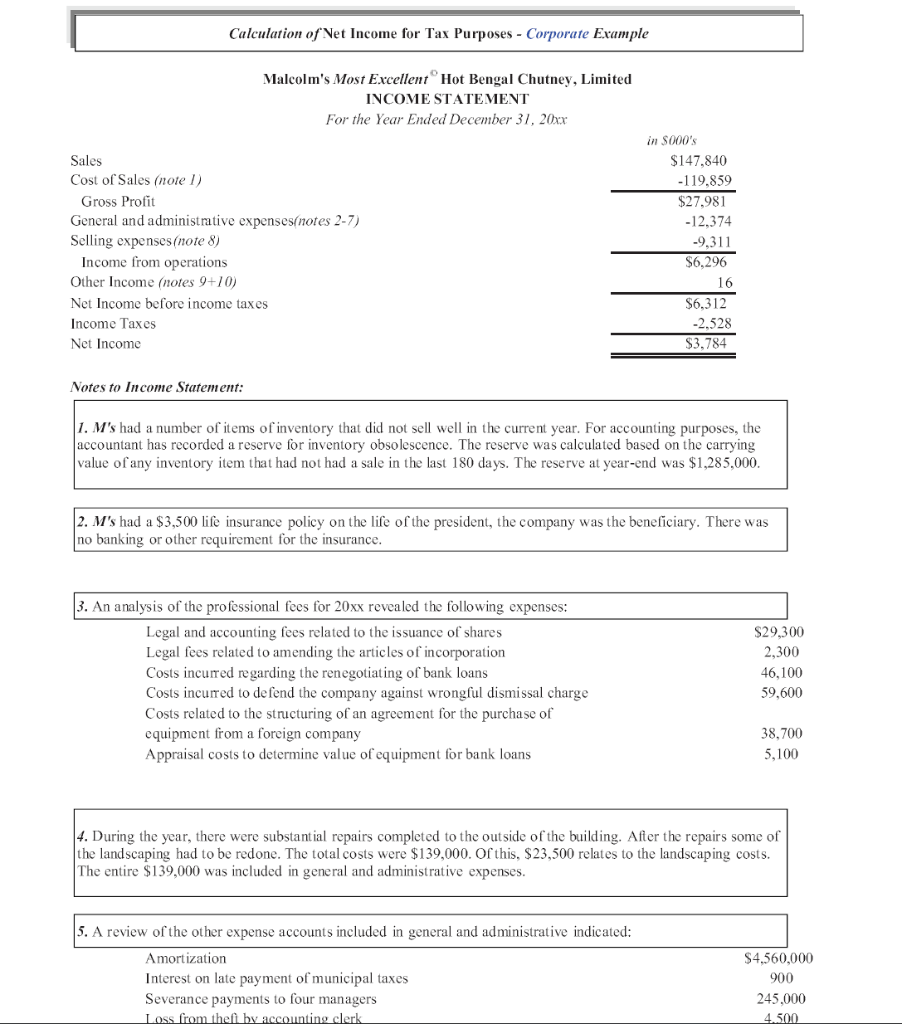

Calculation Of Net Income For Tax Purposes Chegg

https://media.cheggcdn.com/media/065/0656bde3-3167-4b7f-b6ee-b42ed97ffda8/phpZYYdYF

How To Calculate Net Income 12 Steps with Pictures WikiHow

https://www.wikihow.com/images/7/74/Calculate-Net-Income-Step-12-Version-2.jpg

Calculator Use Updated to include income tax calculations for 2022 form 1040 and 2023 Estimated form 1040 ES for status Single Married Filing Jointly Married Filing Separately or Head of Household Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas To calculate net income take the gross income the total amount of money earned then subtract expenses such as taxes and interest payments For the individual net income is the money you

The rules vary from year to year and from person to person depending on your filing status age income and other factors This story is part of Taxes 2024 CNET s coverage of the best tax Effective Jan 1 2013 individual taxpayers are liable for a 3 8 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status The statutory threshold amounts are Married filing jointly 250 000

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/217/2020/12/Screen-Shot-2020-01-04-at-2.38.37-PM.png

How To Find Net Income Calculations For Business

https://www.patriotsoftware.com/wp-content/uploads/2019/12/net-income-visual.jpg

How To Calculate Net Income For Tax Return - Self employed individuals generally must pay self employment SE tax as well as income tax SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners In general the wording self employment tax only refers