How Are Corporate Income Taxes Calculated The United States imposes a tax on the profits of US resident corporations at a rate of 21 percent reduced from 35 percent by the 2017 Tax Cuts and Jobs Act The corporate income tax raised 424 7 billion in fiscal year 2022 accounting for 8 7 percent of total federal receipts and 1 7 percent of

Now calculate the corporation tax liability Solution Corporate Tax Taxable Income Corporate Tax Rate Taxable Income Adjusted Gross Income All Applicable Deductions Taxable Income 50000 5000 45000 Corporate Tax 45000 21 9450 Thus XYZ Corporation is liable to pay 9450 as corporation tax Most corporations must pay state income tax 44 states have a corporate income tax but South Dakota and Wyoming are the only states that do not have a corporate income tax or a gross receipts tax For the 2022 tax year state tax rates for corporations range from 2 5 in North Carolina to 11 5 in New Jersey

How Are Corporate Income Taxes Calculated

How Are Corporate Income Taxes Calculated

https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&w=2560&ssl=1

Corporate Income Tax Rates Around The World 2014 Conservative Free

http://taxfoundation.org/sites/taxfoundation.org/files/docs/Corporate Income Tax Rates.png

Tax Rates At The Federal Level For Years 2022 And 2023 Stonnamangreenhome

https://lawyer.stonnamangreenhome.com/wp-content/uploads/2022/08/Top_Marginal_State_Income_Tax_Rate.svg_.png

The District of Columbia collected 5 1 percent of its general revenue from the tax In most states the corporate income tax accounted for less than 2 percent of general revenue In New York local corporate income taxes raised more revenue 7 2 billion than its state corporate income tax 5 0 billion Using the above formula the company will pay a total of 14 700 000 in corporate income tax The math is calculated as follows by first determining taxable income Taxable income 75 000 000 5 000 000 70 000 000 And then calculating corporate income tax Corporate income tax 70 000 000 x 21 14 700 000 Considerations

The current tax expense is the amount of income taxes payable or refundable for the current year calculated based on taxable income and applicable tax rates This component is shaped by the company s operations and jurisdictional tax laws such as the Internal Revenue Code IRC in the United States Corporate income taxes are the third largest source of revenues for the federal government However as a share of total federal tax collections the corporate income tax accounts for a relatively small amount In 2023 the federal government is projected to collect 475 billion from the corporate income tax just 10 percent of the total 4 8

More picture related to How Are Corporate Income Taxes Calculated

Corporate Tax Definition And Meaning Market Business News

https://i0.wp.com/marketbusinessnews.com/wp-content/uploads/2016/09/Corporate-tax-rates-in-the-United-States.jpg?w=610&ssl=1

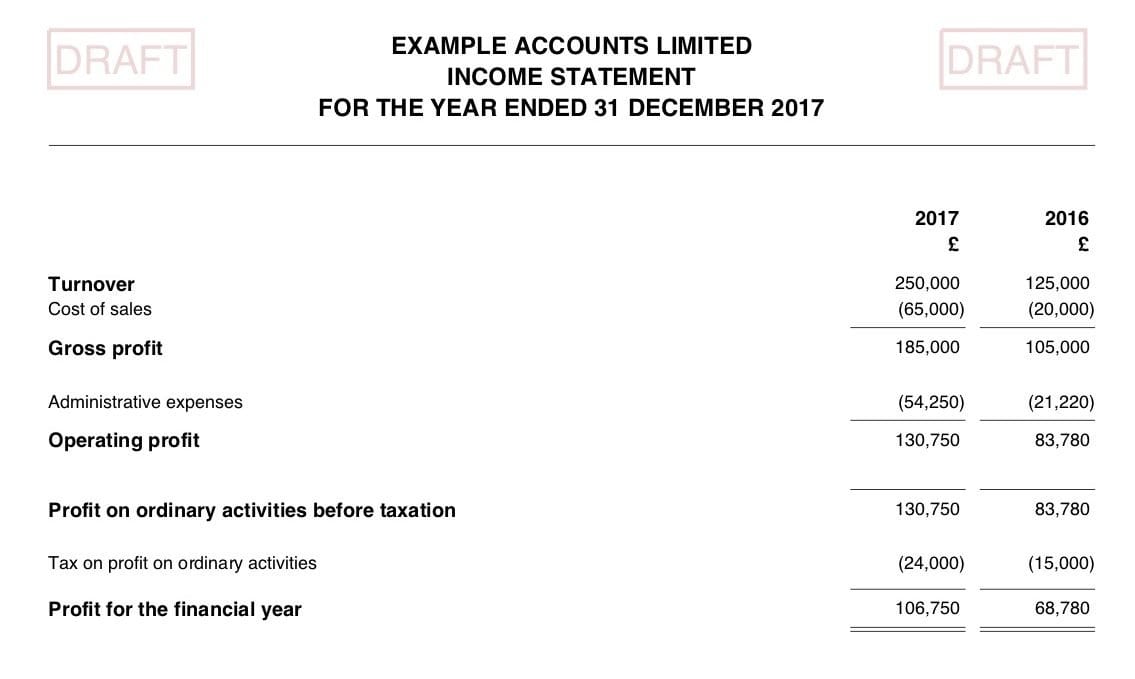

How To Calculate Corporation Tax Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2017/12/operating-profit-1-e1514478638261.jpg

How Are My Property Taxes Calculated HelpMeJohn Make The Right Move

https://d33x6c2gojonez.cloudfront.net/wp-content/uploads/sites/7451/2019/03/07133229/How-Property-Taxes-Are-Calculated.png

Corporate Tax Rate Since the Tax Cuts and Jobs Act of 2017 the statutory corporate income tax rate state and federal combined is 25 8 percent The TCJA reduced the federal corporate tax rate from 35 percent to 21 percent dropping the combined rate from 38 9 percent to 25 8 percent and bringing the U S nearer to the worldwide average For tax years beginning after 31 December 2025 the percentage of modified taxable income that is compared against the regular tax liability increases to 12 5 13 5 for certain banks and securities dealers and unfavourably requires all credits to be applied in determining the US corporation s regular tax liability

[desc-10] [desc-11]

.png)

How High Are Personal Dividends Income Tax Rates In Your State Tax

http://taxfoundation.org/sites/taxfoundation.org/files/docs/Dividends-Income-Tax-(large).png

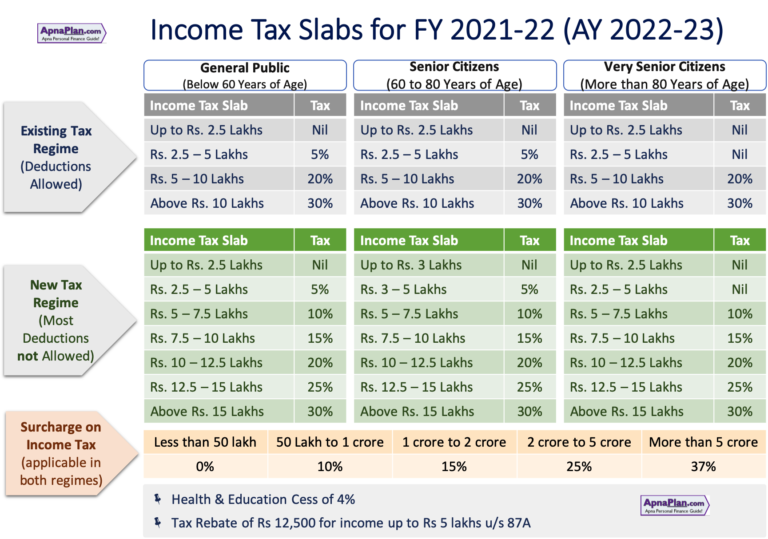

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-768x539.png

How Are Corporate Income Taxes Calculated - [desc-14]