How To Calculate Net Income For Tax Purposes Calculating net income and operating net income is easy if you have good bookkeeping In that case you likely already have a profit and loss statement or income statement that shows your net income Income Tax Expense 10 000 00 Net Profit This post is to be used for informational purposes only and does not constitute legal

Calculating net income for tax and OAS purposes I like your definition of net income Kevin It sounds logical But it is not the definition the Canada Revenue Agency CRA uses The general After determining Net Income for Tax Purposes using the Section 3 ordering rules Division C deductions are subtracted to get to the Taxable income note don t confuse Division C deductions with section 3 c deductions Then Marginal rates are applied to the Taxable Income to calculate the Tax Payable before credits Lastly credits are deducted to get to the Tax Payable

How To Calculate Net Income For Tax Purposes

How To Calculate Net Income For Tax Purposes

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/34/2019/05/Screen-Shot-2020-01-04-at-2.38.37-PM.png

Cheque Jud as Verdes Corta Vida Calculate Your Net Salary Saludar

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

Your net income is used to calculate your federal and provincial or territorial non refundable tax credits The CRA also uses your net income and your spouse s or common law partner s net income to calculate amounts such as the Canada child benefit GST HST credit social benefits repayment and certain other credits Enter your spouse s or common law partner s net income on page 1 of your For Tax Reporting The net earnings amount is the basis for calculating your business income tax For all business legal types the amount of tax the business pays begins with the calculation of net earnings If you are self employed your net earnings from self employment are used to calculate your Self employment Taxes Self employment tax

Follow these steps to locate your 2024 net income amount in H R Block s tax software Note Before you access this information make sure you ve entered all of your slips receipts and completed all of the relevant sections of your return example any self employment page s claimed allowable deductions etc On the left navigation menu under Wrap Up click SUMMARY For this reason you would need to reconcile your business net income with the net income required for tax purposes using the schedule 1 form How to Calculate Net Income For Individuals Your net income is shown on line 23600 of your income tax and benefit return To get your net income first you need to calculate your total income on line

More picture related to How To Calculate Net Income For Tax Purposes

How To Calculate Net Income Loss News At How To Www joeposnanski

https://i.pinimg.com/736x/c9/79/5d/c9795db2abeff9fa85883f753c070feb.jpg

Preliminary Net Income Formula JunaidTasnim

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

House Rent Allowance Income Tax InvestForEasyLife

https://investforeasylife.com/wp-content/uploads/2021/12/White-Grey-Minimalist-Design-Furniture-Instagram-post-1024x1024.jpg

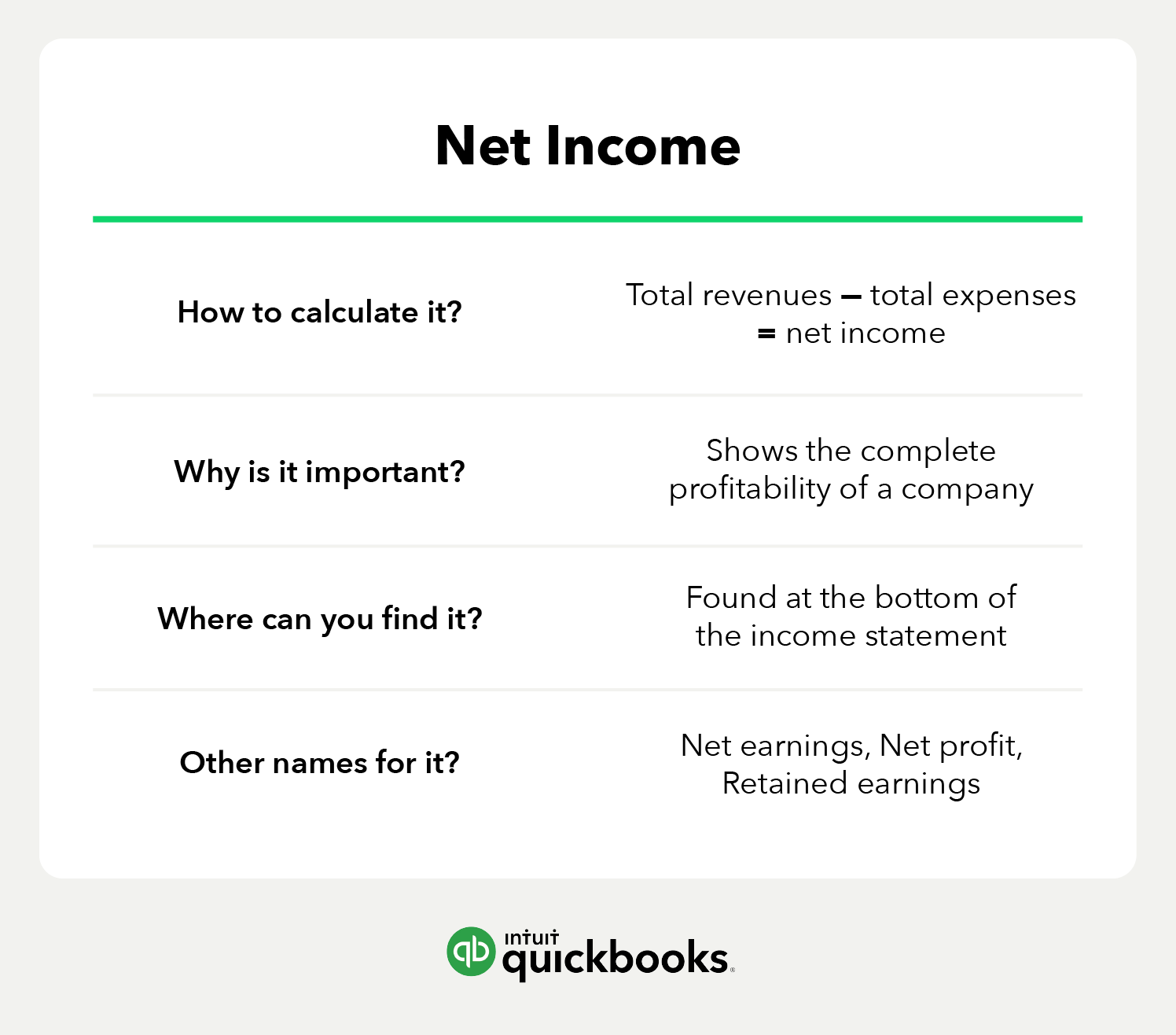

How to calculate net income The net income can be calculated generally using the net income formula The formula is as follows Revenue the price of all goods sold total expenses The total prices of all goods sold and the expenses incurred from running the organization are added The value gotten is then deducted from the revenue Net income is not the same as revenue however To calculate the net income you need to start with the firm s revenues and deduct the relevant expenses located on the income statement

[desc-10] [desc-11]

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/84/2019/05/Screenshot-2022-12-30-at-11.24.42-PM.png

Cheque Jud as Verdes Corta Vida Calculate Your Net Salary Saludar

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/net-income-summary-image-2x-us-en.png

How To Calculate Net Income For Tax Purposes - Follow these steps to locate your 2024 net income amount in H R Block s tax software Note Before you access this information make sure you ve entered all of your slips receipts and completed all of the relevant sections of your return example any self employment page s claimed allowable deductions etc On the left navigation menu under Wrap Up click SUMMARY