How Much Is 48000 After Taxes 2023 Income Tax Brackets due April 2024 Married Filing Jointly Married Filing Separately 11 000 44 725 44 725 95 375 95 375 182 100

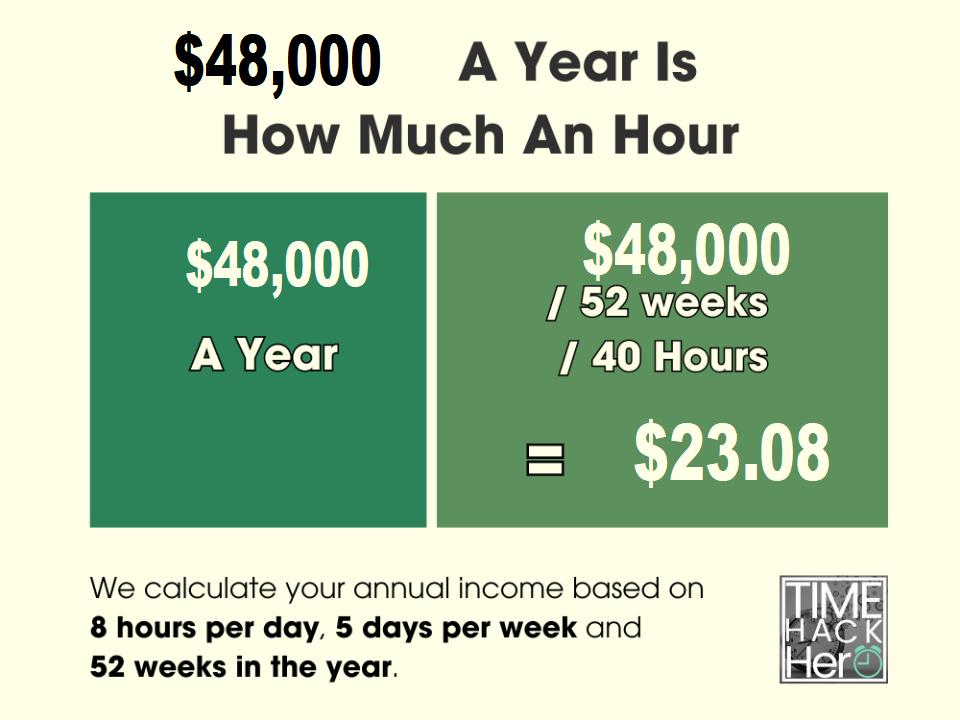

To answer 48 000 a year is how much an hour divide the annual amount by 2 080 52 weeks 40 hours resulting in an hourly income of 17 56 Is 48 000 a Year a Good Salary To answer if 48 000 a year is a good salary We need to compare it to the national median This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Income Tax Calculator Budget Calculator Before Tax vs After Tax Income

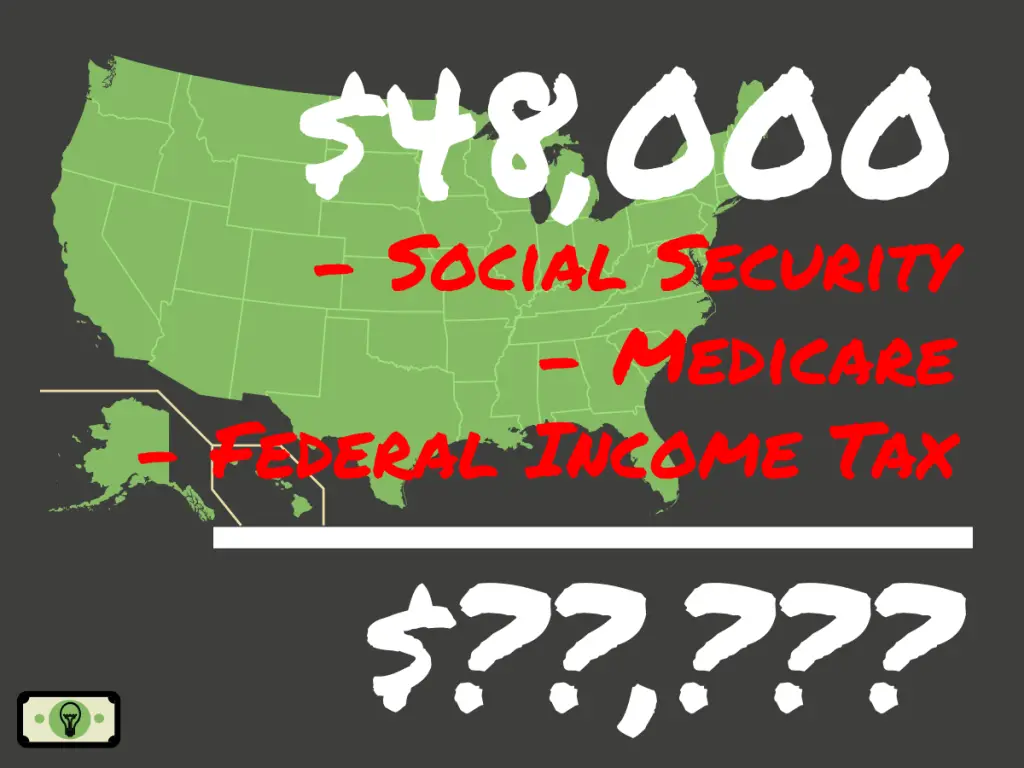

How Much Is 48000 After Taxes

How Much Is 48000 After Taxes

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-48000-dollars-sm-2-1024x768.png

48000 After Tax Calculator How Much Is Salary After Tax 48k In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/03/after-tax-for-48k-in-UK.png

48000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/48000-a-Year-is-How-Much-an-Hour.jpg

This income tax calculation for an individual earning a 48 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration Calculate your potential tax liability or refund with our free tax calculator The calculator will estimate your 2023 2024 federal income taxes based on your income deductions and credits

Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate

More picture related to How Much Is 48000 After Taxes

How Much 48000 After Tax In Ontario Filing Taxes

https://filingtaxes.ca/wp-content/uploads/2024/01/48000.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Solved If Your Annual Household Income Is 48 000 75 000 What

https://www.coursehero.com/qa/attachment/26059821/

In this article we ll calculate estimates for a salary of 48 000 dollars a year for a taxpayer filing single We also have an article for 48 thousand dollars of combined earned income after taxes when declaring the filing status as married filing jointly 2 976 in social security tax 696 in medicare tax 3 878 in federal tax Based on the rates in the table above a single filer with an income of 50 000 would have a top marginal tax rate of 22 However that taxpayer would not pay that rate on all 50 000 The rate on the first 11 000 of taxable income would be 10 then 12 on the next 33 725 then 22 on the final 5 275 falling in the third bracket

Simply enter your taxable income filing status and the state you reside in to find out how much you can expect to pay Generally if your taxable income is below the 2023 2024 standard deduction Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable Because tax rules change from year to year your tax refund might change even if your salary and deductions don t change In other words you might get different results for the 2023 tax year than you did for other

How Much Money Do You Need To Live Comfortably UK Retirement News Daily

https://www.retirementnewsdailypress.com/wp-content/uploads/2021/12/How-much-money-do-you-need-to-live-comfortably-UK.jpeg

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

How Much Is 48000 After Taxes - All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate