How Much Is 48000 After Tax Australia 48k Salary After Tax in Australia This Australia salary after tax example is based on a 48 000 00 annual salary for the 2024 tax year in Australia using the income tax rates published in the Australia tax tables The 48k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day

Up next in Work and tax GST calculator How to calculate Australian goods and services tax 1 min read Income tax Find out how much tax you need to pay 4 min read Lodging a tax return Simple steps to lodge your 2024 tax return online 6 min read Salary packaging Sacrificing part of your salary can reduce your tax 1 min read Returning What you can do with this calculator This calculator will only work out your tax for income years 2013 14 to 2023 24 This amount is the tax on taxable income before you take into account tax offsets The calculator results are based on the information you provide Use these results as an estimate and for guidance purposes only

How Much Is 48000 After Tax Australia

How Much Is 48000 After Tax Australia

https://i.pinimg.com/originals/3a/7c/5c/3a7c5c7285806de9839c6c942a098cb2.jpg

How Much Is 48 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-48000-dollars-sm-2-1024x768.png

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Simple calculator for Australian income tax Australian income is levied at progressive tax rates Tax bracket start at 0 known as the tax free rate and increases progressively up to 45 for incomes over 180 000 A Yearly salary of 48 000 is approximately 41 933 after tax in Australia for a resident Gross pay 48 000 Income Tax 6 067 Take home pay 41 933 Approximately 6 067 13 of your salary will be income tax Numbers based on the Australian Taxation Office The exact amount of take home pay for an individual earning 48 000 Yearly in

Welcome to TaxCalc the Australian income tax calculator Financial Year 2024 2025 2023 2024 2022 2023 2021 2022 2020 2021 Calculate your tax and after tax salary Enter your taxable income in dollars For example if you earn 50 000 enter in 50000 Income includes super For income years before 2019 20 the calculator will estimate your tax refund or debt The calculator uses your tax payable and calculate your Medicare levy surcharge HELP SSL or TSL repayment SFSS repayment any tax offsets that may apply Your estimate is based on the information you provide at the time of the calculation

More picture related to How Much Is 48000 After Tax Australia

48 000 A Year Is How Much A Month After Taxes 48k After Tax

https://trybeem.com/blog/wp-content/uploads/2023/04/tax-on-salary-48000-per-year.webp

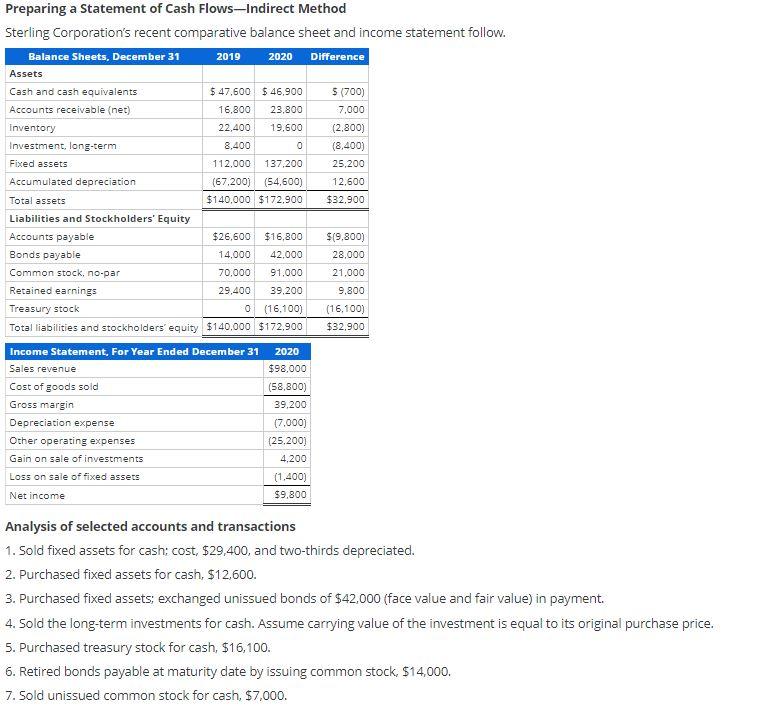

Solved Preparing A Statement Of Cash Flows Indirect Method Chegg

https://media.cheggcdn.com/media/451/451a809f-ab6a-4ca3-869a-cb52f49075d9/phpF4qLZg

Solved If Your Annual Household Income Is 48 000 75 000 What

https://www.coursehero.com/qa/attachment/26059821/

Please enter your salary into the Annual Salary field and click Calculate Updated with 2024 2025 ATO Tax rates DON T FORGET For salary and wage payments made on or after 1 July 2024 the new superannuation guarantee contribution rate of 11 5 will apply So check your payslip employer is paying you the correct amount of super Finally Your Take Home Pay after deducting Income Tax and Medicare You can check any option if it applies to you Stage 3 Tax Cuts This Calculator is now updated with new tax rates announced by Goverment On 25 January 2024 These rates will be affective from 1 July 2024 In Australia Income tax is one of the vital source of revenue for

In Australia all employees are entitled to earn at least the national minimum wage of 24 10 per hour With a standard working week lasting 38 hours the minimum wage is equal to a weekly salary of 915 90 That works out to monthly gross earnings of around 3 969 or a yearly salary of 47 627 Once taxes and the Medicare Levy have been Tax Calculator Take Home Pay Calculator 2022 23 Canstar s Income Tax Calculator calculates the tax payable on gross wages paid in equal weekly amounts The rates are obtained from the Australian Taxation Office ATO No allowance is made for tax deductions Medicare or other levies and or payments

How Much Is Redacted Whois Data Worth Internet Governance Project

https://www.internetgovernance.org/wp-content/uploads/iStock-515643332.jpg

The Monthly Salary Of An Employee Was Rs 48000 Income Tax Was Free

https://hi-static.z-dn.net/files/dc0/3f5c0a7a0ed730ea105cbaacf513f859.jpg

How Much Is 48000 After Tax Australia - Simple calculator for Australian income tax Australian income is levied at progressive tax rates Tax bracket start at 0 known as the tax free rate and increases progressively up to 45 for incomes over 180 000