How Much Is 48000 Minus Taxes The aim of this 48 000 00 salary example is to provide you detailed information on how income tax is calculated for Federal Tax and State Tax We achieve this in the following steps The salary example begins with an overview of your 48 000 00 salary and deductions for income tax Medicare Social Security Retirement plans and so forth

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed

How Much Is 48000 Minus Taxes

How Much Is 48000 Minus Taxes

https://solaroidenergy.com/wp-content/uploads/2023/03/how-much-is-itel-p35-pro-in-nigeria.jpg

How Much Is 40 Inches Update Achievetampabay

https://i.ytimg.com/vi/OK9rmvDGPY8/maxresdefault.jpg

How Much Is Redacted Whois Data Worth Internet Governance Project

https://www.internetgovernance.org/wp-content/uploads/iStock-515643332.jpg

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

More picture related to How Much Is 48000 Minus Taxes

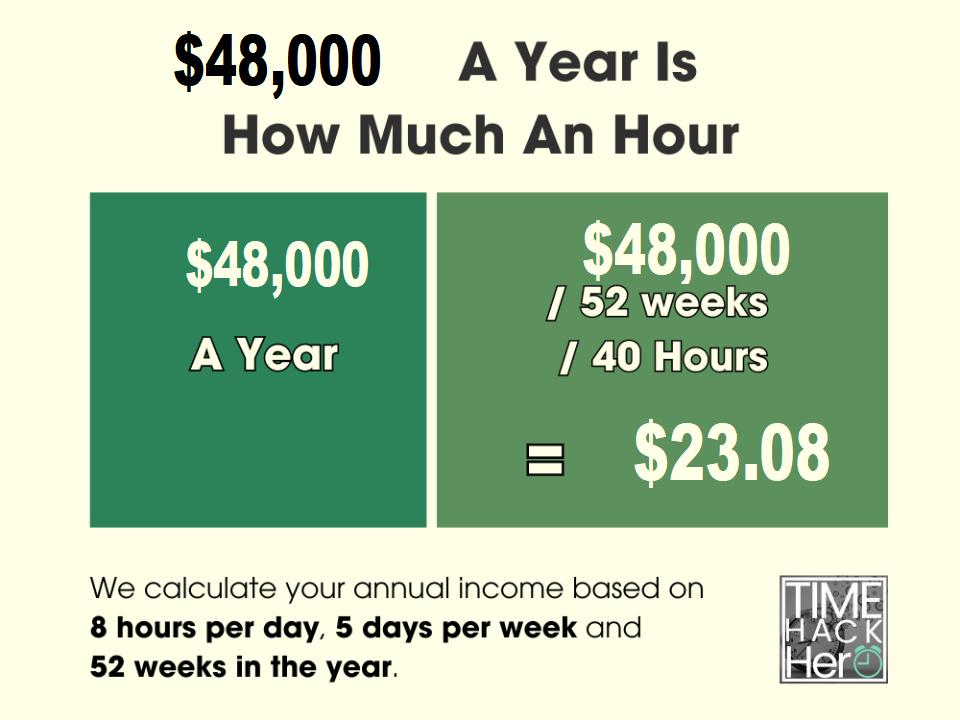

48000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/48000-a-Year-is-How-Much-an-Hour.jpg

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Solved If Your Annual Household Income Is 48 000 75 000 What

https://www.coursehero.com/qa/attachment/26059821/

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2023 and 2024 The 2024 tax values can be used for 1040 ES estimation planning ahead or comparison File Status The Tax Withholding Estimator doesn t ask for personal information such as your name social security number address or bank account numbers We don t save or record the information you enter in the estimator For details on how to protect yourself from scams see Tax Scams Consumer Alerts Check your W 4 tax withholding with the IRS Tax

If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate Use Bankrate s free calculator to estimate your average tax rate for 2022 2023 your 2022 2023 tax bracket and your marginal tax rate for the 2022 2023 tax year

How Much Is 48 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-48000-dollars-sm-2-1024x768.png

48 000 A Year Is How Much A Month After Taxes 48k After Tax

https://trybeem.com/blog/wp-content/uploads/2023/04/tax-on-salary-48000-per-year.webp

How Much Is 48000 Minus Taxes - The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336