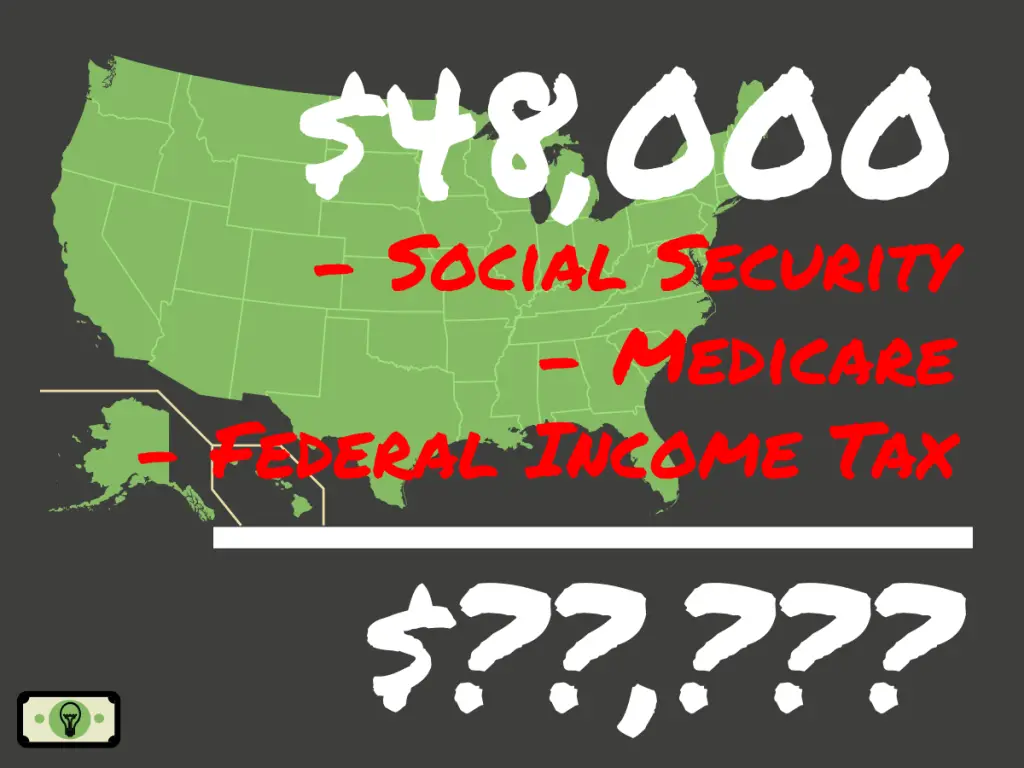

How Much Is 48000 After Taxes In Ny Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Summary If you make 48 000 a year living in the region of New York USA you will be taxed 10 111 That means that your net pay will be 37 889 per year or 3 157 per month Your average tax rate is 21 1 and your marginal tax rate is 26 0 This marginal tax rate means that your immediate additional income will be taxed at this rate FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

How Much Is 48000 After Taxes In Ny

How Much Is 48000 After Taxes In Ny

http://1.bp.blogspot.com/-HaCPocuqiXg/U_KNdyDL0pI/AAAAAAAAEnY/5Y2wOFGzOwc/s1600/TaxBurden.jpg

How Much Is 48 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-48000-dollars-sm-2-1024x768.png

Solved If Your Annual Household Income Is 48 000 75 000 What

https://www.coursehero.com/qa/attachment/26059821/

48k Salary After Tax in New York 2024 This New York salary after tax example is based on a 48 000 00 annual salary for the 2024 tax year in New York using the State and Federal income tax rates published in the New York tax tables The 48k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 What is a 48k after tax 48000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax refund calculations 38 440 00 net salary is 48 000 00 gross salary

More picture related to How Much Is 48000 After Taxes In Ny

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

Para Los Que Dicen Que Espa a Es De Facto Un Estado Federal Como EEUU O

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

See What A 100K Salary Looks Like After Taxes In Your State

https://cdn.gobankingrates.com/wp-content/uploads/2019/07/Bentonville-Arkansas-shutterstock_1366857071.jpg?quality=80

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

Use SmartAsset s Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount This calculator is updated with rates brackets and other information for your 2023 taxes which you ll file in 2024 Details Federal Withholding Your Tax Return Breakdown Total Income Adjustments Here s a breakdown of the state and local income tax brackets along with key aspects that set NYC apart State Income Tax Graduated scale ranging from 4 to 10 9 as of February 2024 Applies to your taxable income meaning higher earners pay a larger share Local Income Tax New York City imposes additional local income taxes

See What A 100K Salary Looks Like After Taxes In Your State

https://cdn.gobankingrates.com/wp-content/uploads/2018/03/50-Wyoming-shutterstock_723587425.jpg?quality=80

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Is 48000 After Taxes In Ny - Estimate your net pay from a 48k salary in New York State Calculate your monthly paycheck or annual take home pay Also includes bi weekly figures