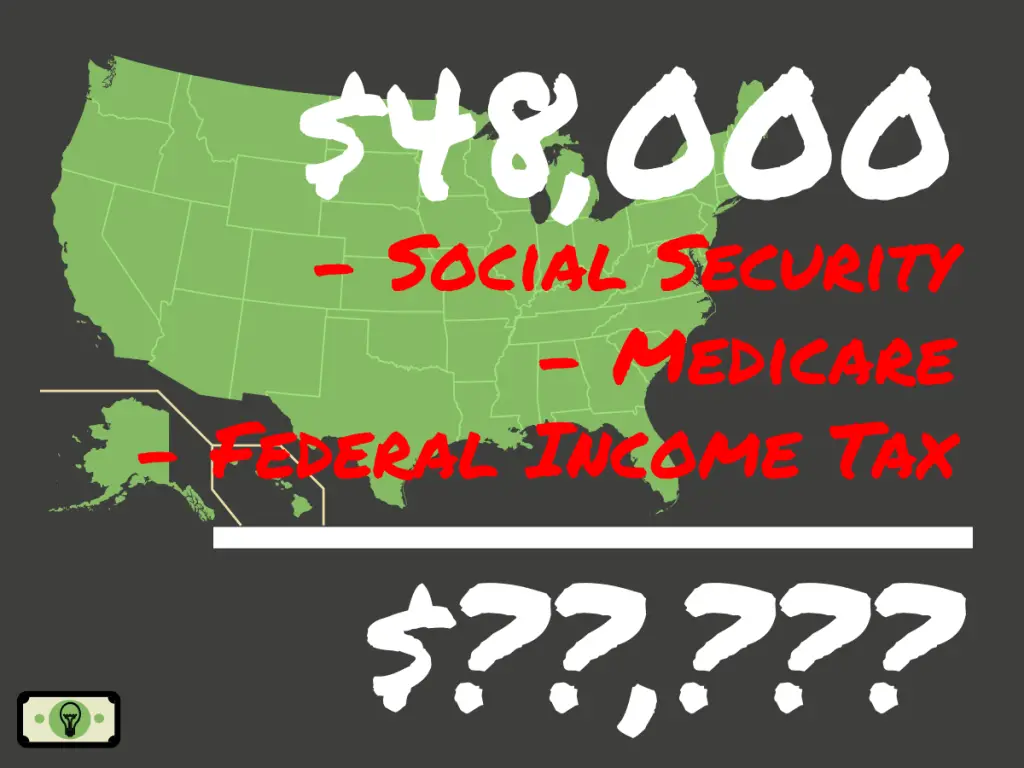

How Much Is 48000 Annually After Taxes SmartAsset s hourly and salary paycheck calculator shows your income after federal state and local taxes Enter your info to see your take home pay

Tax Year 2024 2025 If you live in California and earn a gross annual salary of 69 368 or 5 781 per month your monthly take home pay will be 4 537 This results in an effective tax rate of 22 as estimated by our US salary calculator What is a 48k after tax 48000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax refund calculations 38 440 00 net salary is 48 000 00 gross salary

How Much Is 48000 Annually After Taxes

How Much Is 48000 Annually After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/48000-a-Year-is-How-Much-an-Hour.jpg

48 000 A Year Is How Much A Month After Taxes 48k After Tax

https://trybeem.com/blog/wp-content/uploads/2023/04/tax-on-salary-48000-per-year.webp

65000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/65000-a-year-1.jpg

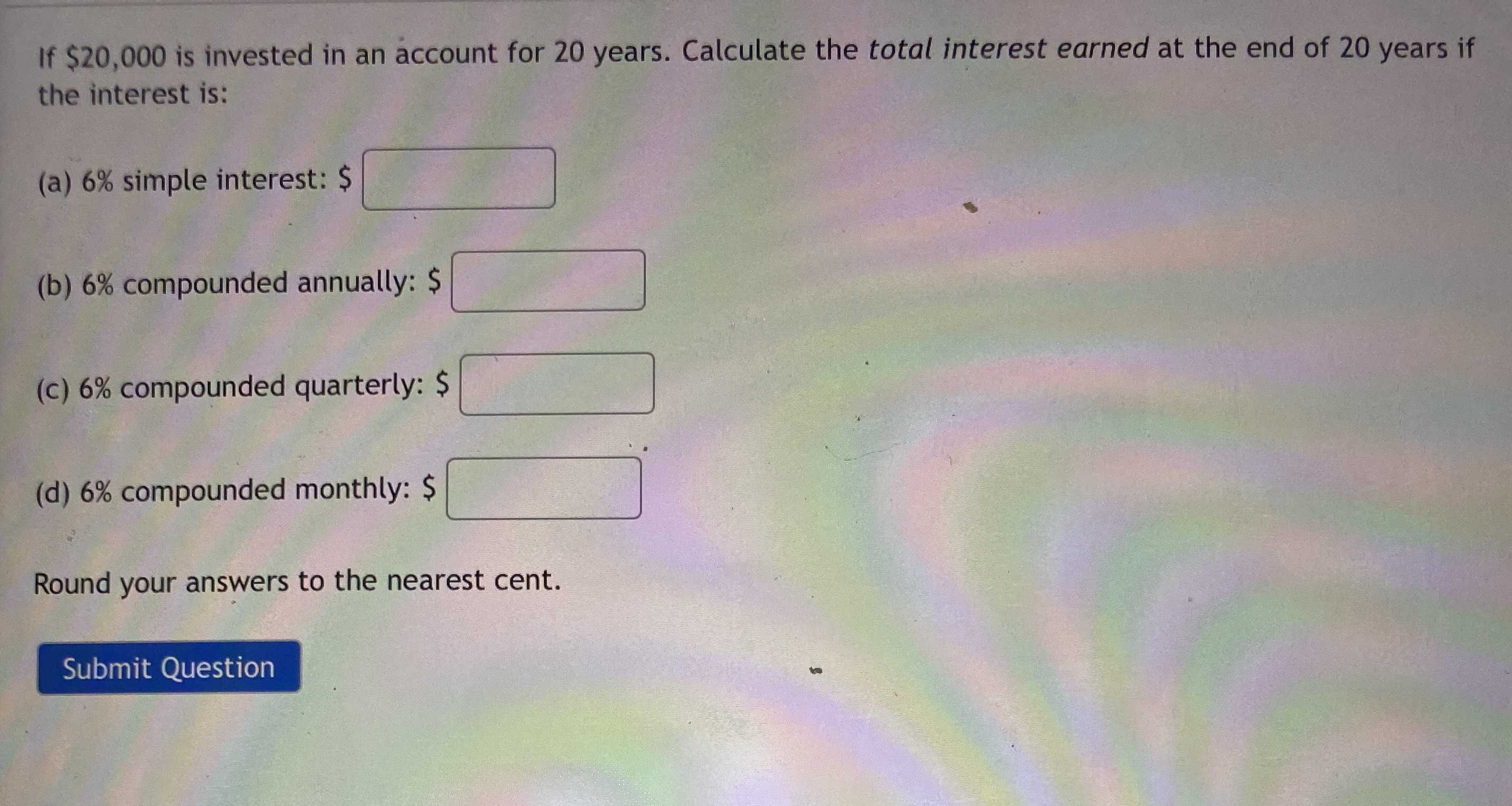

Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions Paycheck Calculator For Salary And Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes Use our take home pay calculator to determine your after tax income by entering your gross pay and additional details

More picture related to How Much Is 48000 Annually After Taxes

Solved If Your Annual Household Income Is 48 000 75 000 What

https://www.coursehero.com/qa/attachment/26059821/

How Much Is 48 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-48000-dollars-sm-2-1024x768.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in USA for the 2024 tax year Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

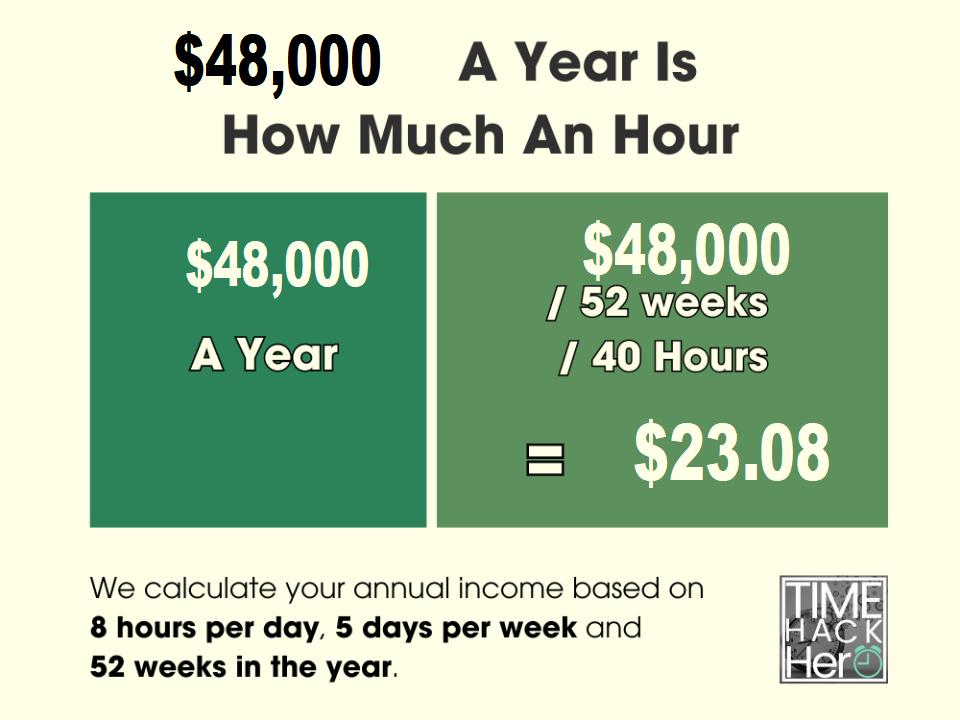

How much is 48 000 a Year After Tax in the United States In the year 2024 in the United States 48 000 a year gross salary after tax is 40 328 annual 3 055 monthly 702 52 weekly 140 5 daily and 17 56 hourly gross based on the information provided in the calculator above How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

What Annual Rate Of Interest Compounded Annually S CameraMath

https://static.cameramath.com/jkyx9y2yhe/aab76722b1276fef2a6272c1022e65c3

48000 A Year Is How Much An Hour Real Updatez

https://realupdatez.com/wp-content/uploads/2023/02/48000-a-year-is-how-much-per-hour-1.png

How Much Is 48000 Annually After Taxes - Use our take home pay calculator to determine your after tax income by entering your gross pay and additional details