How Much Is 48000 After Tax Per Week FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

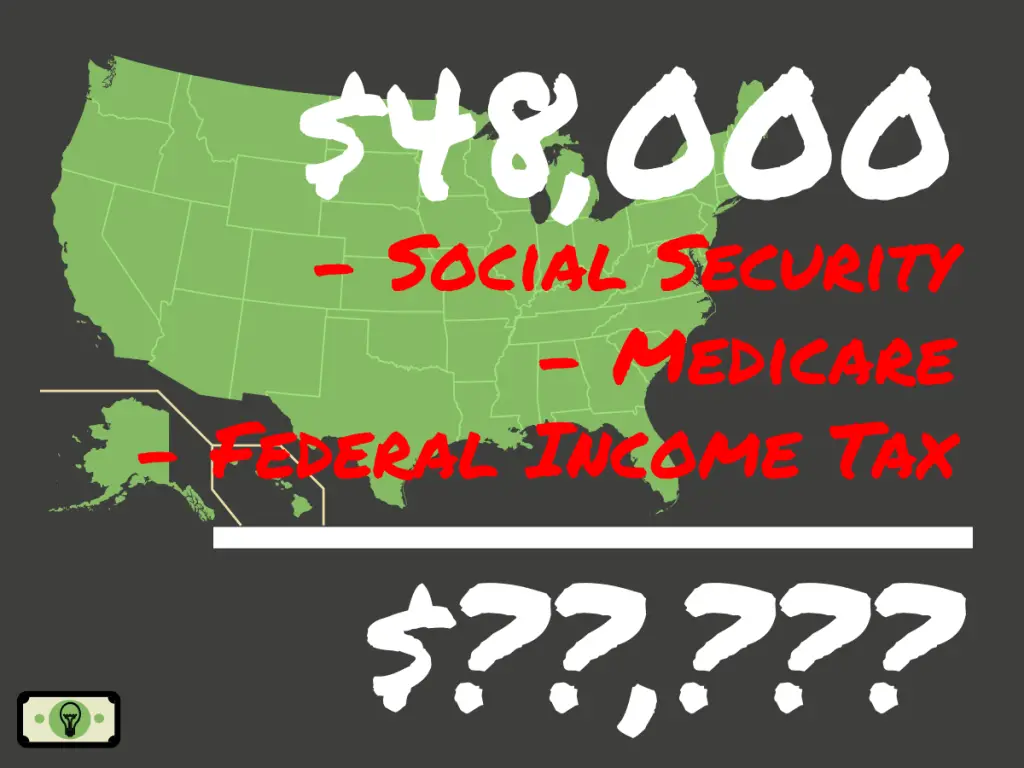

In the year 2024 in the United States 48 000 a year gross salary after tax is 40 328 annual 3 055 monthly 702 52 weekly 140 5 daily and 17 56 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 48 000 a year after tax in the United States Yearly An individual who receives 38 440 00 net salary after taxes is paid 48 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Answer is 24 78 assuming you work roughly 40 hours per week or you may want to know how much 48k a year is per month after taxes

How Much Is 48000 After Tax Per Week

How Much Is 48000 After Tax Per Week

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

How Much Is 48 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-48000-dollars-sm-2-1024x768.png

Solved If Your Annual Household Income Is 48 000 75 000 What

https://www.coursehero.com/qa/attachment/26059821/

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income salaryafter tax Salary After Tax Home 26 Working weeks per year 52 Working days per week 5 Working hours per week 40 0 Show Taxes Monthly Gross Income 5 781 69 368 2 668 1 334 266 80 33 35 Tax Due 1 244

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted

More picture related to How Much Is 48000 After Tax Per Week

48 000 A Year Is How Much A Month After Taxes 48k After Tax

https://trybeem.com/blog/wp-content/uploads/2023/04/tax-on-salary-48000-per-year.webp

The Monthly Salary Of An Employee Was Rs 48000 Income Tax Was Free

https://hi-static.z-dn.net/files/dc0/3f5c0a7a0ed730ea105cbaacf513f859.jpg

48000 After Tax Calculator How Much Is Salary After Tax 48k In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/03/after-tax-for-48k-in-UK.png

An individual who receives 38 878 44 net salary after taxes is paid 48 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Answer is 24 78 assuming you work roughly 40 hours per week or you may want to know how much 48k a year is per month after taxes In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

An individual who receives 38 489 38 net salary after taxes is paid 48 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Answer is 24 78 assuming you work roughly 40 hours per week or you may want to know how much 48k a year is per month after taxes The rate on the first 11 000 of taxable income would be 10 then 12 on the next 33 725 then 22 on the final 5 275 falling in the third bracket This is because marginal tax rates only apply to income that falls within that specific bracket

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Is 48000 After Tax Per Week - Hourly wage Hourly wage Hours worked per day Days worked per week Weeks worked per year Your weekly paycheck Step 2 Federal income tax liability There are four substeps to take to work out your total federal taxes Step 2 1 Gross income adjusted The formula is Gross income Pre tax deductions Gross income adjusted