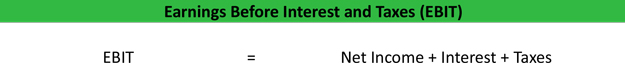

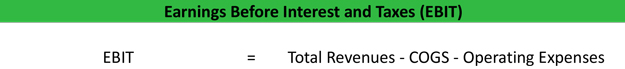

How Do You Calculate Earnings Before Interest And Taxes Earnings before interest and taxes EBIT indicate a company s profitability and are calculated as revenue minus expenses excluding taxes and interest expenses

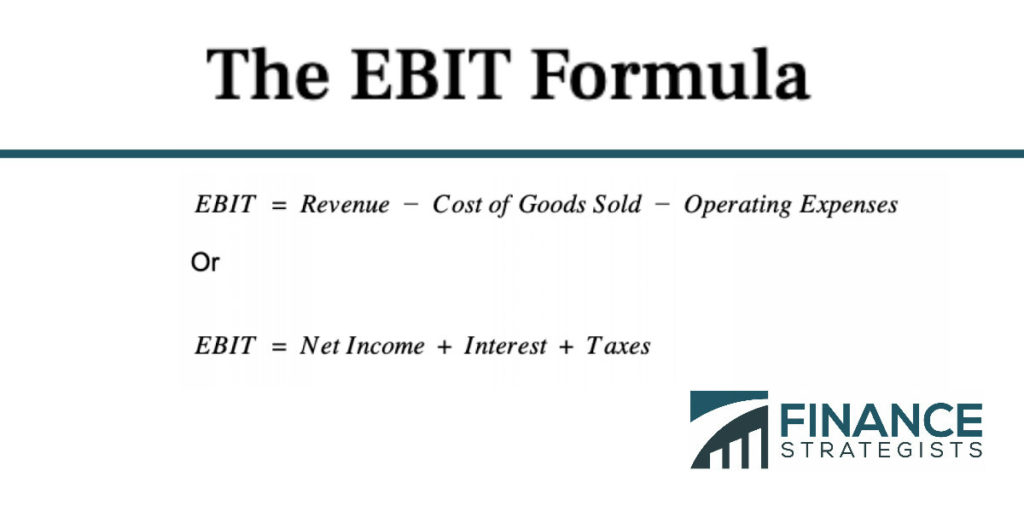

What Is Earnings Before Interest and Taxes EBIT Earnings Before Interest and Taxes EBIT is one of the various profitability metrics for businesses It can be calculated by deducting the cost of goods sold COGS operating expenses and non operating expenses from sales revenue and then adding any non operating revenue How to Calculate EBIT EBIT stands for Earnings Before Interest and Taxes and measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated by a company across a given period

How Do You Calculate Earnings Before Interest And Taxes

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)

How Do You Calculate Earnings Before Interest And Taxes

https://www.investopedia.com/thmb/TKO9xGWig7qtuMSBOW0v3l90mmI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png

Earnings Before Interest Taxes EBIT Formula Example Calculation

https://www.myaccountingcourse.com/financial-ratios/images/earnings-before-interest-and-taxes-equation-calculation.jpg

Earnings Before Interest Taxes EBIT Formula Example Calculation

https://www.myaccountingcourse.com/financial-ratios/images/ebit-formula.jpg

This interest income should be included Typically most income statements do not include this calculation because it s not mandated by GAAP Financial statements that do include it typically subtotal and calculate the earnings before interest and taxes right before non operating expenses are listed This way investors can see the earning Let s calculate EBIT Earnings Before Interest and Taxes Example 3 Let us assume that there is a Project is of 5 Years Sales 5 million and 7 increment Per Annum Contribution Margin is 70 75 77 80 and 65 of Sales each year respectively The fixed cost is 125 000 Calculate EBIT Solution Example 4 We have the following

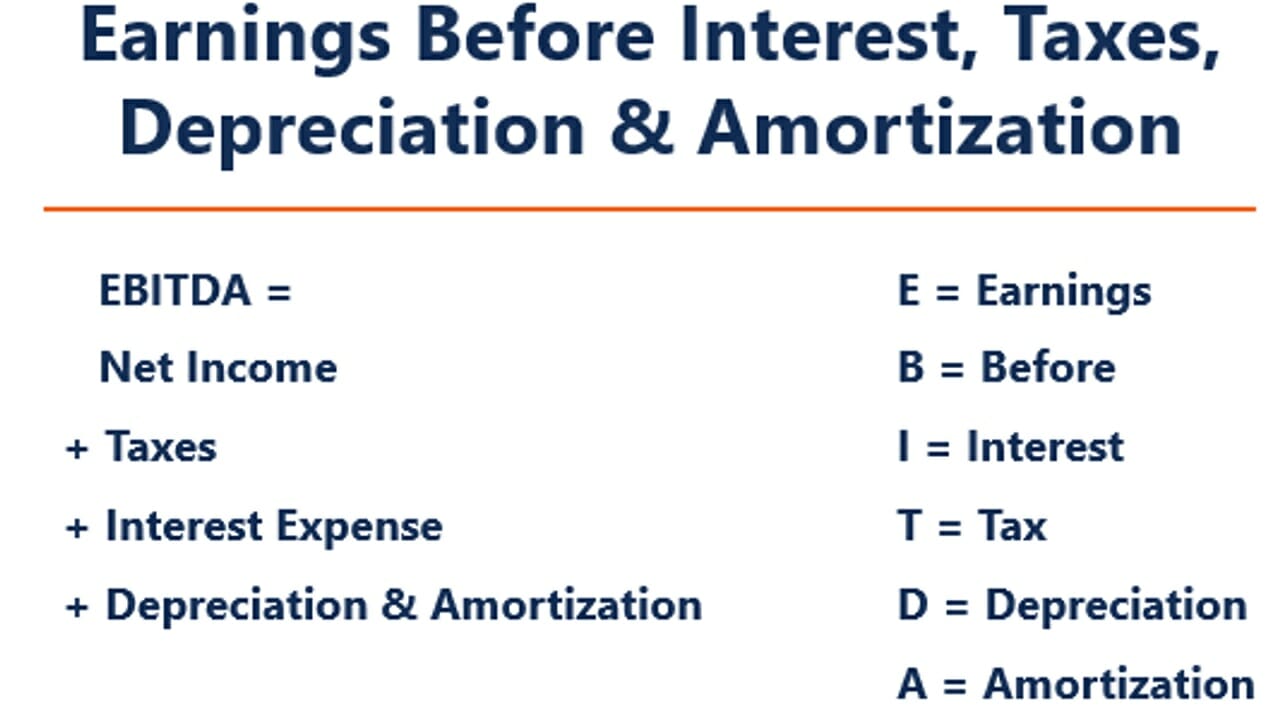

Learn the importance of each part of the EBIT calculation 1 Earnings A company s earnings is the amount of income generated after subtracting operating expenses from total revenue 2 Interest It s common for a company with many fixed assets on their balance sheets to finance those assets by debt which requires that the company make interest payments EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted

More picture related to How Do You Calculate Earnings Before Interest And Taxes

How To Calculate EBITDA

https://www.learntocalculate.com/wp-content/uploads/2020/07/EBITDA.jpg

How To Calculate Earnings Before Interest And Taxes EBIT

https://investoralist.com/wp-content/uploads/2020/12/Businessman-puts-wooden-blocks-with-word-EBIT-1024x517.jpg

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Determine net income You can find net income on the bottom line of your income statement Calculate interest and taxes Interest and taxes each will be listed separately on the income statement in the expenses category Find EBIT Add together the net income interest and taxes to calculate the EBIT Example It is the start of a new fiscal Investors use Earnings Before Interest and Taxes for two reasons 1 it s easy to calculate and 2 it makes companies easily comparable 1 It s very easy to calculate using the income statement as net income interest and taxes are always broken out

[desc-10] [desc-11]

Pin On Values

https://i.pinimg.com/originals/3d/cc/bd/3dccbdcca9d7c0bf49249ae3607ff862.jpg

Earnings Before Interest And Taxes EBIT Definition

https://www.financestrategists.com/wp-content/uploads/2020/10/ebitformulaRIBBET-1024x512.jpg

How Do You Calculate Earnings Before Interest And Taxes - Learn the importance of each part of the EBIT calculation 1 Earnings A company s earnings is the amount of income generated after subtracting operating expenses from total revenue 2 Interest It s common for a company with many fixed assets on their balance sheets to finance those assets by debt which requires that the company make interest payments