How Do U Calculate Earnings Before Interest And Taxes Earnings Before Interest and Taxes EBIT is a key metric for measuring a company s profitability as it reflects operational efficiency without the impact of taxes or interest expenses In this article you ll learn how to calculate EBIT why it matters and how you can use it to analyze business performance effectively By the end of this guide you ll have a complete understanding of

What Is Earnings Before Interest and Taxes EBIT Earnings Before Interest and Taxes EBIT is one of the various profitability metrics for businesses It can be calculated by deducting the cost of goods sold COGS operating expenses and non operating expenses from sales revenue and then adding any non operating revenue In order to calculate our EBIT ratio we must add the interest and tax expense back in Thus Ron s EBIT for the year equals 150 000 This means that Ron has 150 000 of profits left over after all of the cost of goods sold and operating expenses have been paid for the year This 150 000 left over is available to pay interest taxes

How Do U Calculate Earnings Before Interest And Taxes

:max_bytes(150000):strip_icc()/EPS-final-838bf0756ca04435ae9e15237ca914a7.png)

How Do U Calculate Earnings Before Interest And Taxes

https://www.investopedia.com/thmb/4K-xwR3lfRpvb9a4gajfkIj2m6Y=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/EPS-final-838bf0756ca04435ae9e15237ca914a7.png

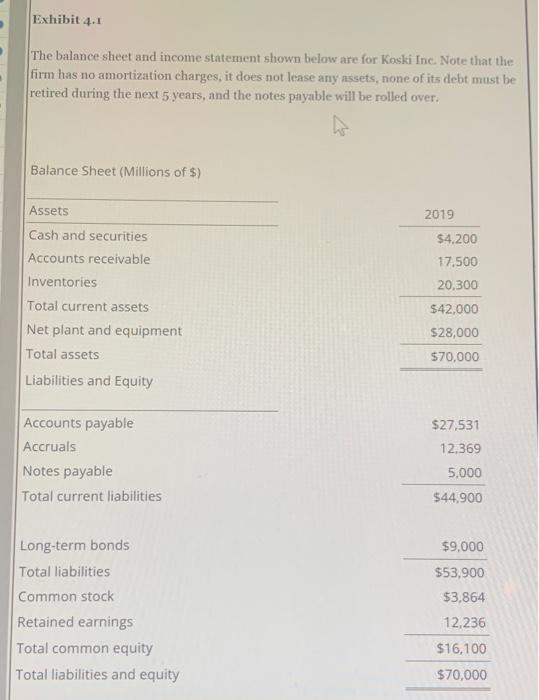

Solved Can Someone Please Explain The Balance Shee

https://media.cheggcdn.com/study/495/49565683-5152-4e24-9ac7-d3a8fb46b066/image

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted EBIT Earnings Before Interest and Taxes has become an essential metric for measuring company performance and profitability While many financial metrics require complex calculations or deep accounting knowledge EBIT provides a clear snapshot of operational efficiency that both analysts and stakeholders can easily understand and act on

Let s calculate EBIT Earnings Before Interest and Taxes Example 3 Let us assume that there is a Project is of 5 Years Sales 5 million and 7 increment Per Annum Contribution Margin is 70 75 77 80 and 65 of Sales each year respectively The fixed cost is 125 000 Calculate EBIT Solution Example 4 We have the following How to Calculate EBIT EBIT stands for Earnings Before Interest and Taxes and measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated by a company across a given period

More picture related to How Do U Calculate Earnings Before Interest And Taxes

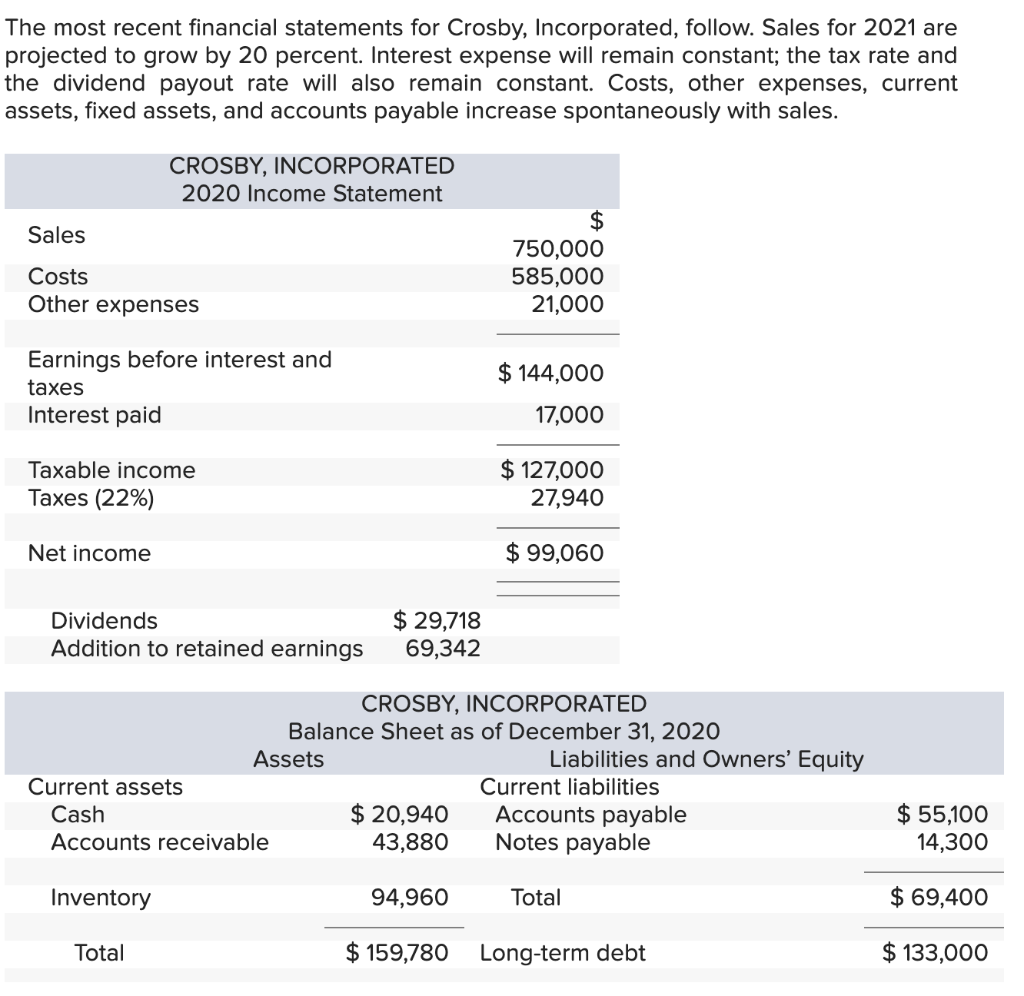

Solved The Most Recent Financial Statements For Crosby Chegg

https://media.cheggcdn.com/media/564/5647cd28-5cd6-401b-9028-e5ef9148d0d1/phpEAsFsL

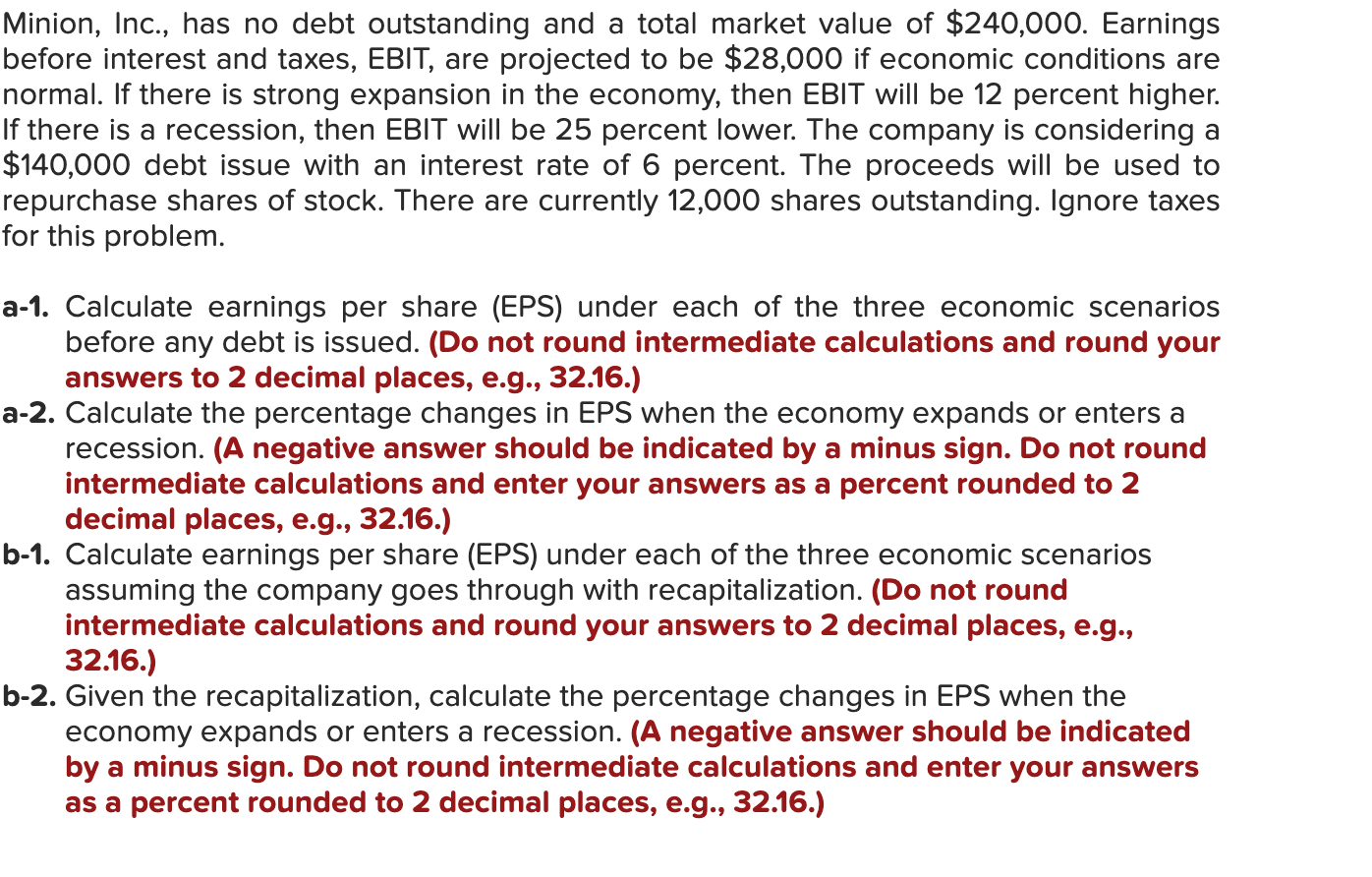

Solved Minion Inc Has No Debt Outstanding And A Total Chegg

https://media.cheggcdn.com/media/414/4149b38c-b546-45ae-bf5f-fd3b2e9fcf04/php3GFu0U.png

What Is Earnings Per Share EPS Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/23060650/Earnings-Per-Share-Example-AAPL.jpg

In this example EBIT is 200 000 while net income is 100 000 Why Does Earnings Before Interest and Taxes EBIT Matter EBIT provides investment analysts with useful information for evaluating a company s operating performance without regard to interest expenses or tax rates EBIT helps minimize these two variables that may be unique from company to company and enables one to analyze Learn the importance of each part of the EBIT calculation 1 Earnings A company s earnings is the amount of income generated after subtracting operating expenses from total revenue 2 Interest It s common for a company with many fixed assets on their balance sheets to finance those assets by debt which requires that the company make interest payments

[desc-10] [desc-11]

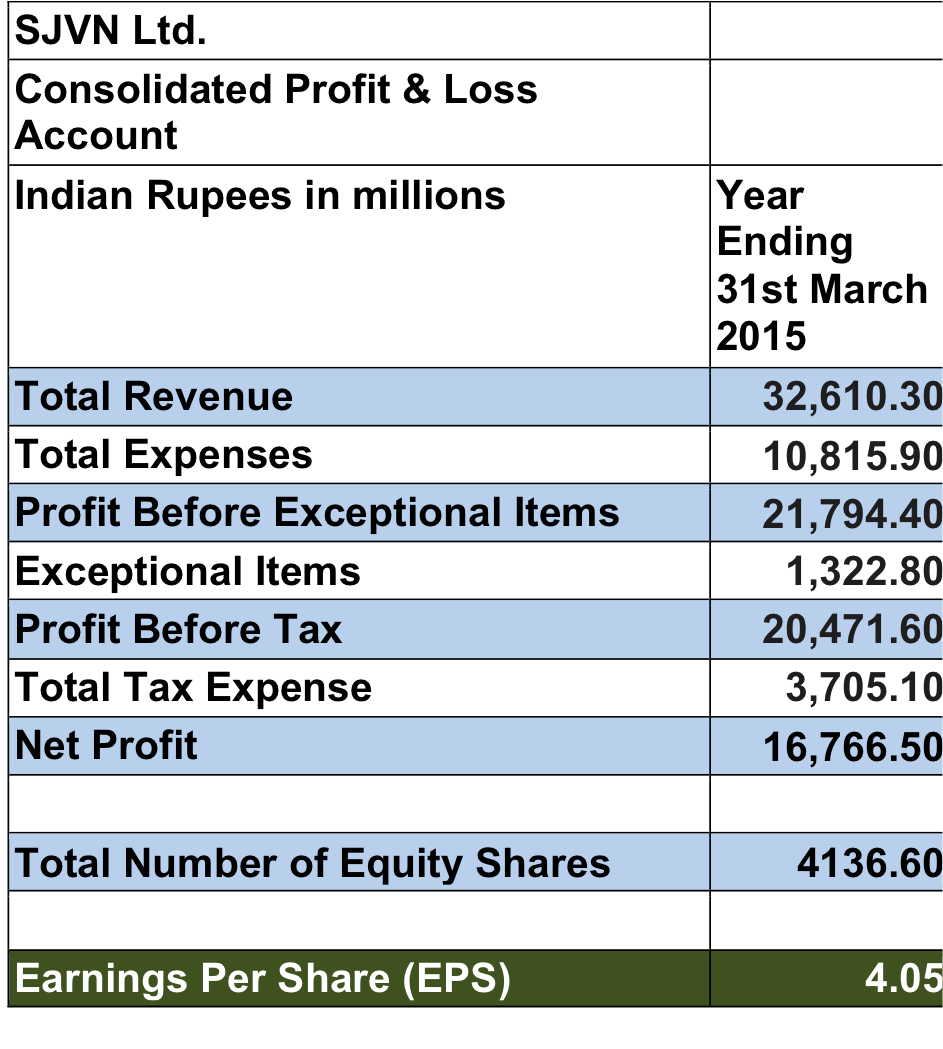

How To Calculate Estimated Eps Haiper

https://4.bp.blogspot.com/-Rq74uJ1UCnw/V-TpkOTpu1I/AAAAAAAABKQ/YhfyPwRh7_ECW60ZdJJiDqOJVWBoMfK9gCLcB/s1600/EPS%2BSJVN%2BExample.png

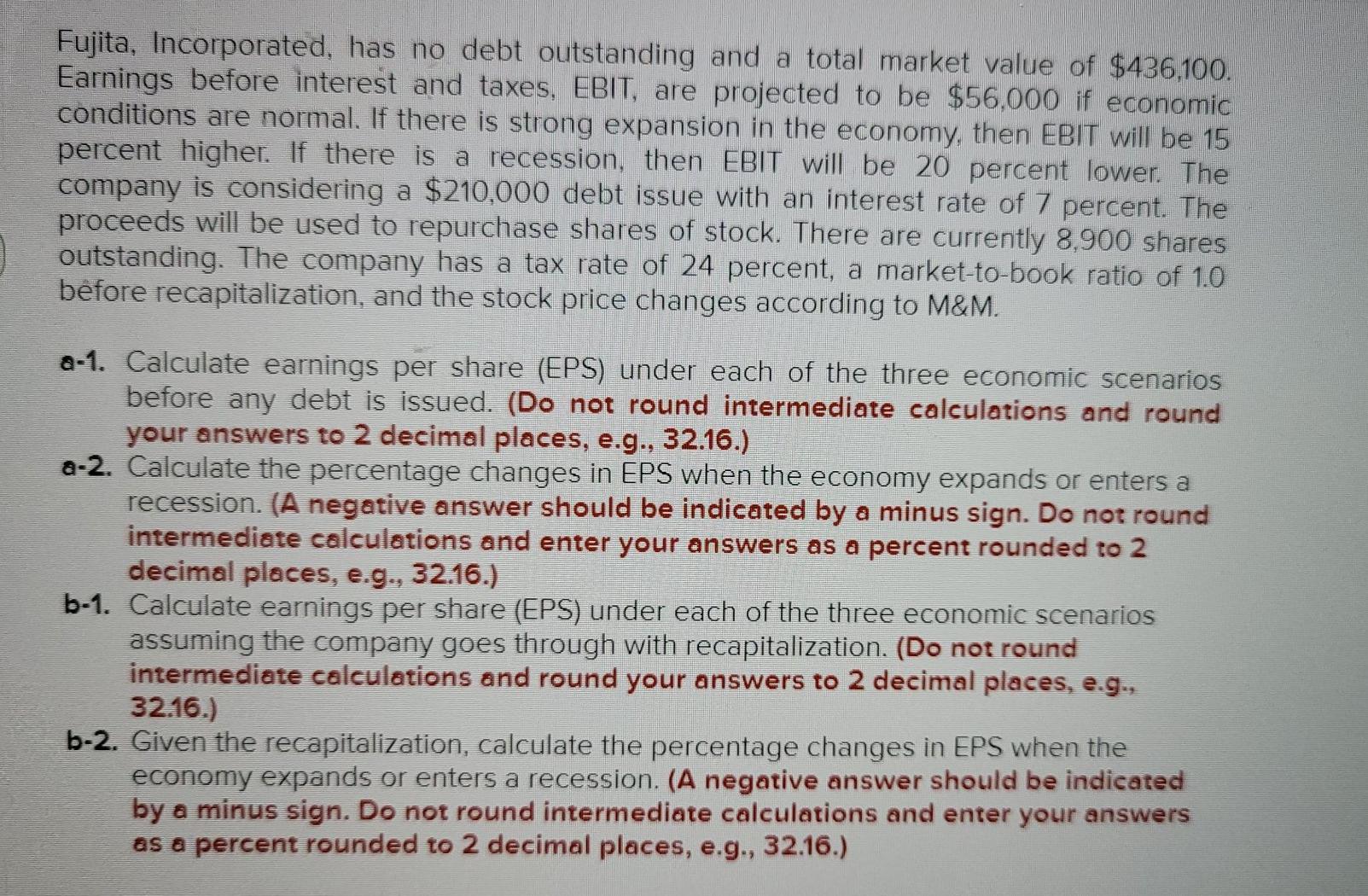

Solved Fujita Incorporated Has No Debt Outstanding And A Chegg

https://media.cheggcdn.com/study/11f/11fcd942-d0ca-483b-a076-459aaa422a0d/image

How Do U Calculate Earnings Before Interest And Taxes - Let s calculate EBIT Earnings Before Interest and Taxes Example 3 Let us assume that there is a Project is of 5 Years Sales 5 million and 7 increment Per Annum Contribution Margin is 70 75 77 80 and 65 of Sales each year respectively The fixed cost is 125 000 Calculate EBIT Solution Example 4 We have the following