How To Calculate Profit Before Interest And Taxes Ratio Earnings before interest and taxes EBIT help measure a company s profitability and is calculated as revenue minus expenses excluding tax and interest EBIT is also called operating profit

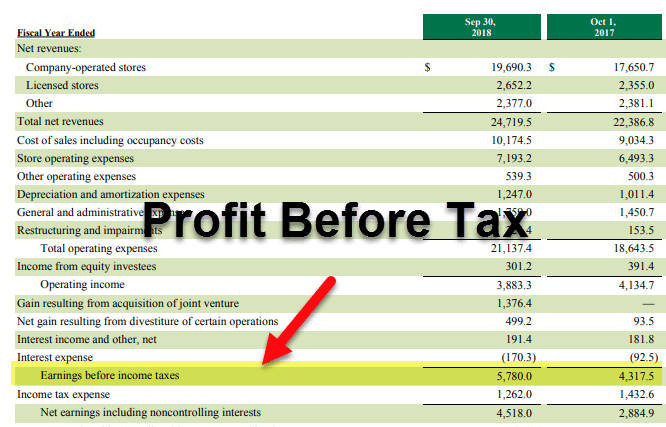

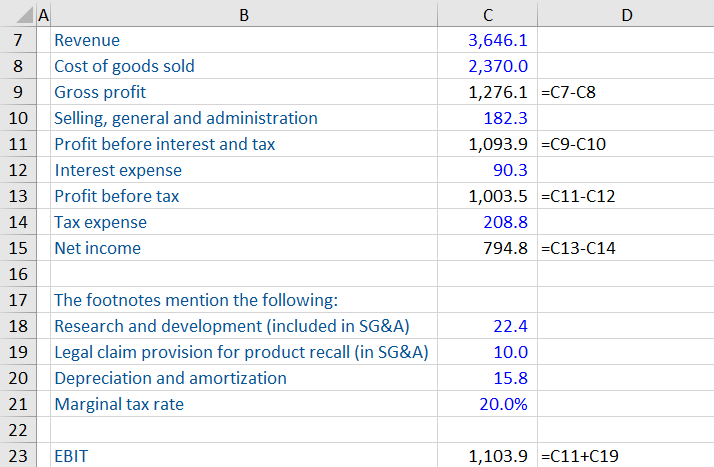

Profit before tax PBT is a measure of a company s profitability that looks at the profits made before any tax is paid How to Calculate Profit Before Tax To calculate the PBT of a company one must follow several steps They are 1 200 000 in cost of goods sold and 300 000 in operating expenses The earnings before interest and Profit before tax PBT is a line item in a company s income statement that measures profits earned after accounting for operating expenses like COGS SG A Depreciation Amortization etc non operating expenses like interest expense but before paying off the income taxes This is a significant measure because it gives the company s overall profitability and performance before making

How To Calculate Profit Before Interest And Taxes Ratio

How To Calculate Profit Before Interest And Taxes Ratio

https://www.investsmall.co/wp-content/uploads/2020/06/investments-in-1024x683.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/07/Profit-Before-Tax-PBT-1.jpg

Profit Before Tax Formula Examples How To Calculate PBT

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Profit-Before-Tax-Format.png

Interest Expense 50 000 Income Taxes 10 000 Net Income 90 000 In this example Ron s company earned a profit of 90 000 for the year In order to calculate our EBIT ratio we must add the interest and tax expense back in Thus Ron s EBIT for the year equals 150 000 How to Calculate EBIT EBIT stands for Earnings Before Interest and Taxes and measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated by a company across a given period

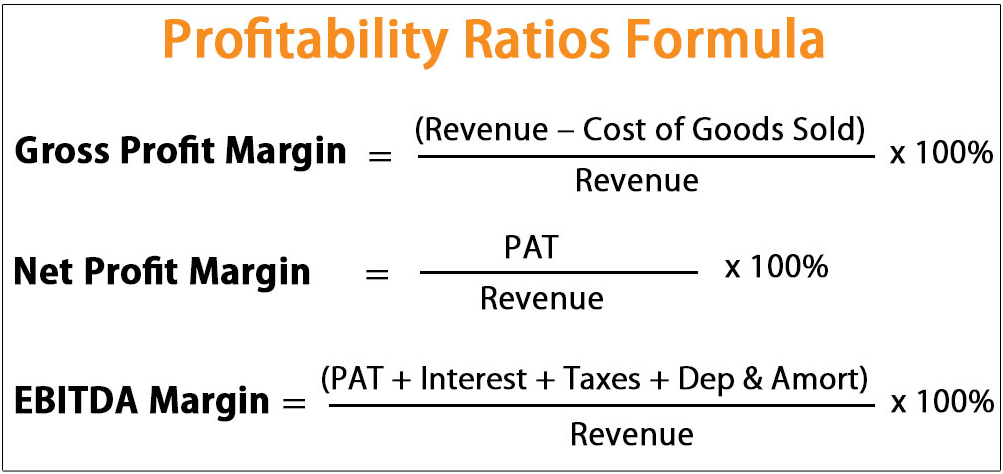

How to Calculate Pre Tax Profit Margin The pre tax profit margin ratio compares a company s earnings before taxes to its revenue in the corresponding period EBT also known as pre tax income represents the residual earnings after operating expenses and non operating expenses are accounted for except taxes The EBIT ratio commonly known as the operating margin measures operational efficiency by dividing EBIT by total revenue This ratio shows what percentage of revenue remains after covering operational costs but before paying interest and taxes A higher ratio indicates stronger operational efficiency and better cost management

More picture related to How To Calculate Profit Before Interest And Taxes Ratio

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)

Earnings Before Interest And Taxes EBIT Formula And Example

https://www.investopedia.com/thmb/TKO9xGWig7qtuMSBOW0v3l90mmI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png

Earnings Before Interest And Taxes EBIT Financial Edge

https://financial-edge-staging-media.s3-eu-west-2.amazonaws.com/2020/11/EBIT-1.png

Net Profit Before Interest And Tax 400000 Q 144 Ch 4 Accounting Ratios

https://touch4career.com/wp-content/uploads/2021/10/q144-1024x656.jpg

Going further earnings before interest and tax EBIT which is also known as operating profit operating earnings and profit before interest and taxes factors into both Calculating PBIT involves subtracting the total operating expenses excluding interest and tax from the gross profit The formula can be represented as PBIT Gross Profit Total Operating Expenses excluding Interest and Tax Profit Before Interest and Taxes PBIT is a financial metric used to assess a company s operational profitability

[desc-10] [desc-11]

What Is The Profit Formula It Business Mind

https://itbusinessmind.com/wp-content/uploads/2019/09/Screenshot_16.png

Qu Es El EBITDA F rmula Ejemplo Contabilizar Renting Ejemplos

https://www.contabilizarrenting.com/wp-content/uploads/2021/12/¿Que-es-el-EBITDA-Formula-Ejemplo.jpg

How To Calculate Profit Before Interest And Taxes Ratio - How to Calculate Pre Tax Profit Margin The pre tax profit margin ratio compares a company s earnings before taxes to its revenue in the corresponding period EBT also known as pre tax income represents the residual earnings after operating expenses and non operating expenses are accounted for except taxes