How Do We Calculate Earnings Before Interest And Taxes Earnings Before Interest and Taxes EBIT is a key metric for measuring a company s profitability as it reflects operational efficiency without the impact of taxes or interest expenses In this article you ll learn how to calculate EBIT why it matters and how you can use it to analyze business performance effectively By the end of this guide you ll have a complete understanding of

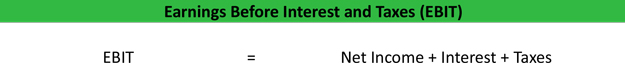

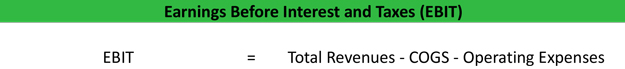

In order to calculate our EBIT ratio we must add the interest and tax expense back in Thus Ron s EBIT for the year equals 150 000 This means that Ron has 150 000 of profits left over after all of the cost of goods sold and operating expenses have been paid for the year This 150 000 left over is available to pay interest taxes What Is Earnings Before Interest and Taxes EBIT To calculate EBIT using the direct method we subtract the cost of sales or COGS total selling and administrative expense and other expenses from revenues EBIT 44 538 24 576 13 025 14 6 923

How Do We Calculate Earnings Before Interest And Taxes

:max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png)

How Do We Calculate Earnings Before Interest And Taxes

https://www.investopedia.com/thmb/TKO9xGWig7qtuMSBOW0v3l90mmI=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Earnings-Before-Interest-and-Taxes-97b90834ddfe45e985e5e931a4b860e1.png

Earnings Before Interest Taxes EBIT Formula Example Calculation

https://www.myaccountingcourse.com/financial-ratios/images/earnings-before-interest-and-taxes-equation-calculation.jpg

Pin On Values

https://i.pinimg.com/originals/3d/cc/bd/3dccbdcca9d7c0bf49249ae3607ff862.jpg

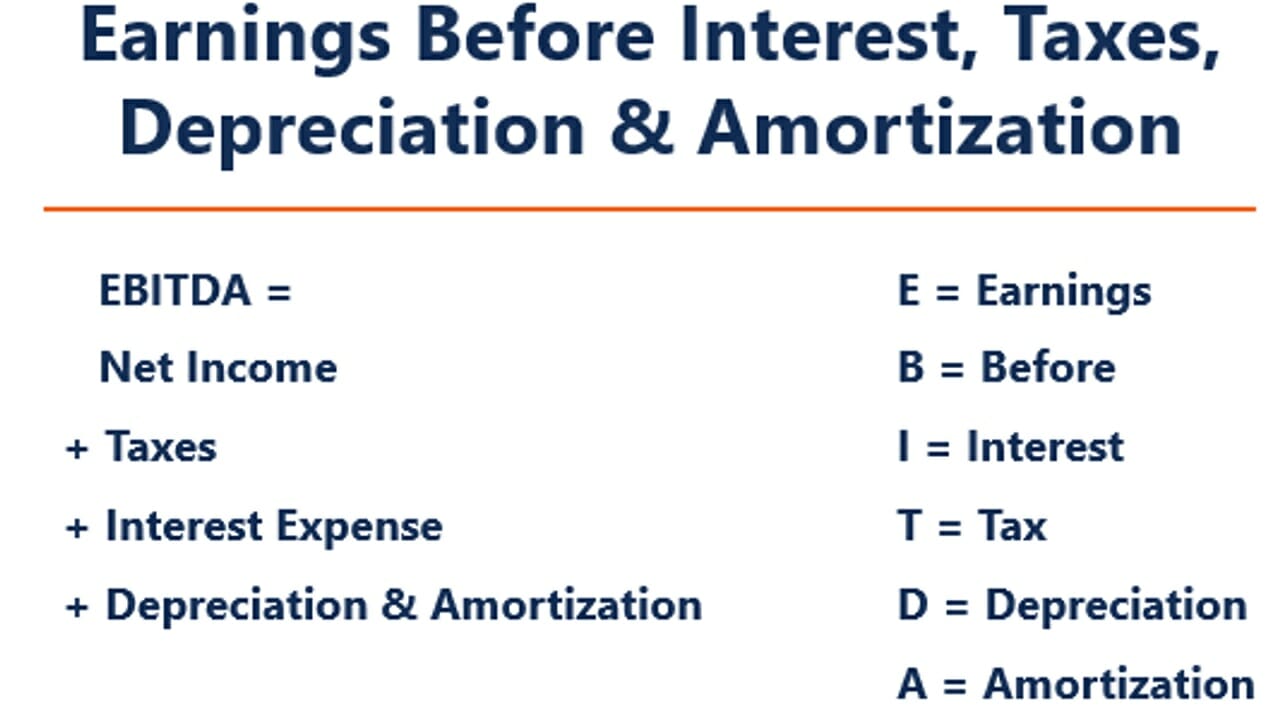

How to Calculate EBIT EBIT stands for Earnings Before Interest and Taxes and measures the operating profitability of a company in a specific period with all core operating costs deducted from revenue On the income statement operating income takes into account the following line items Revenue The net sales generated by a company across a given period Calculate the earnings before tax EBT The last step is to put everything together and calculate the EBT using the earnings before taxes formula EBT gross profit operating expense interest expense other income Thus the Company Alpha s EBT is 700 000 300 000 200 000 100 000 300 000

Let s calculate EBIT Earnings Before Interest and Taxes Example 3 Let us assume that there is a Project is of 5 Years Sales 5 million and 7 increment Per Annum Contribution Margin is 70 75 77 80 and 65 of Sales each year respectively The fixed cost is 125 000 Calculate EBIT Solution Example 4 We have the following EBIT stands for Earnings Before Interest and Taxes As the name indicates EBIT is a company s income before interest and taxes are deducted so what is left of the revenue after deducting all the costs that have gone into creating the goods such as raw materials wages or rent This means that EBIT has most but not all expenses deducted

More picture related to How Do We Calculate Earnings Before Interest And Taxes

How To Calculate EBITDA

https://www.learntocalculate.com/wp-content/uploads/2020/07/EBITDA.jpg

Earnings Before Interest Taxes EBIT Formula Example Calculation

https://www.myaccountingcourse.com/financial-ratios/images/ebit-formula.jpg

How To Calculate Earnings Before Interest And Taxes EBIT

https://investoralist.com/wp-content/uploads/2020/12/Businessman-puts-wooden-blocks-with-word-EBIT-1024x517.jpg

You can find net income on the bottom line of your income statement Calculate interest and taxes Interest and taxes each will be listed separately on the income statement in the expenses category Find EBIT Add together the net income interest and taxes to calculate the EBIT Example It is the start of a new fiscal year Danny s DanceWear In this example EBIT is 200 000 while net income is 100 000 Why Does Earnings Before Interest and Taxes EBIT Matter EBIT provides investment analysts with useful information for evaluating a company s operating performance without regard to interest expenses or tax rates EBIT helps minimize these two variables that may be unique from company to company and enables one to analyze

[desc-10] [desc-11]

Guardian Inc Is Trying To Develop An Asset financing Plan The Firm

https://img.homeworklib.com/questions/2c7abf10-6f4d-11ea-bfb4-d923e4af9a47.png?x-oss-process=image/resize,w_560

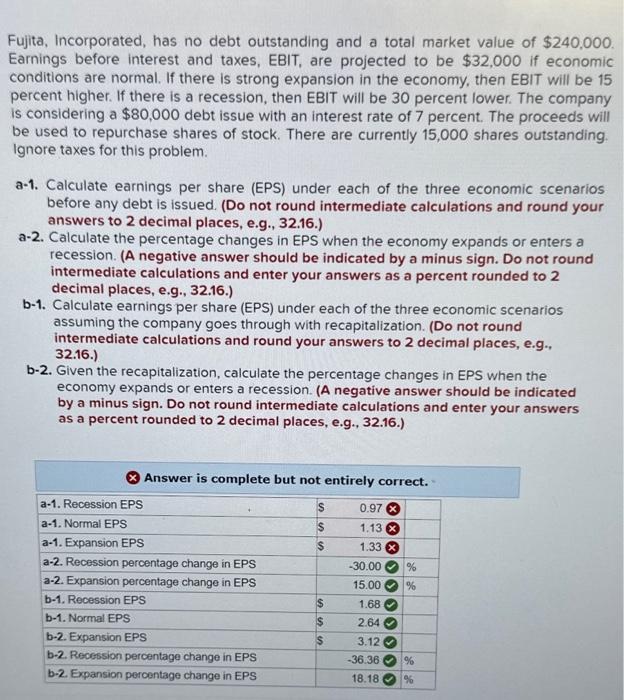

Solved Fujita Incorporated Has No Debt Outstanding And

https://media.cheggcdn.com/study/a78/a78d5a78-eb4c-4695-bfd9-4e5f82eb46d3/image

How Do We Calculate Earnings Before Interest And Taxes - Let s calculate EBIT Earnings Before Interest and Taxes Example 3 Let us assume that there is a Project is of 5 Years Sales 5 million and 7 increment Per Annum Contribution Margin is 70 75 77 80 and 65 of Sales each year respectively The fixed cost is 125 000 Calculate EBIT Solution Example 4 We have the following