How Do You Calculate Net Income For Tax Purposes As far as qualified dividend and long term capital gains taxes go they are taxed at different more favorable rates of 0 15 or 20 depending on the taxpayer s marginal tax brackets High

Let s say your gross income is 3 350 a month But you pay 272 51 in federal taxes 102 48 in state taxes 46 61 in Medicare taxes 193 31 in Social Security taxes and 125 for insurance To calculate the net income of an individual you need to know their tax rate based on filing status federal tax rate and state tax rate and any deductions taken out of their paycheck such as

How Do You Calculate Net Income For Tax Purposes

How Do You Calculate Net Income For Tax Purposes

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/34/2019/05/Screen-Shot-2020-01-04-at-2.38.37-PM.png

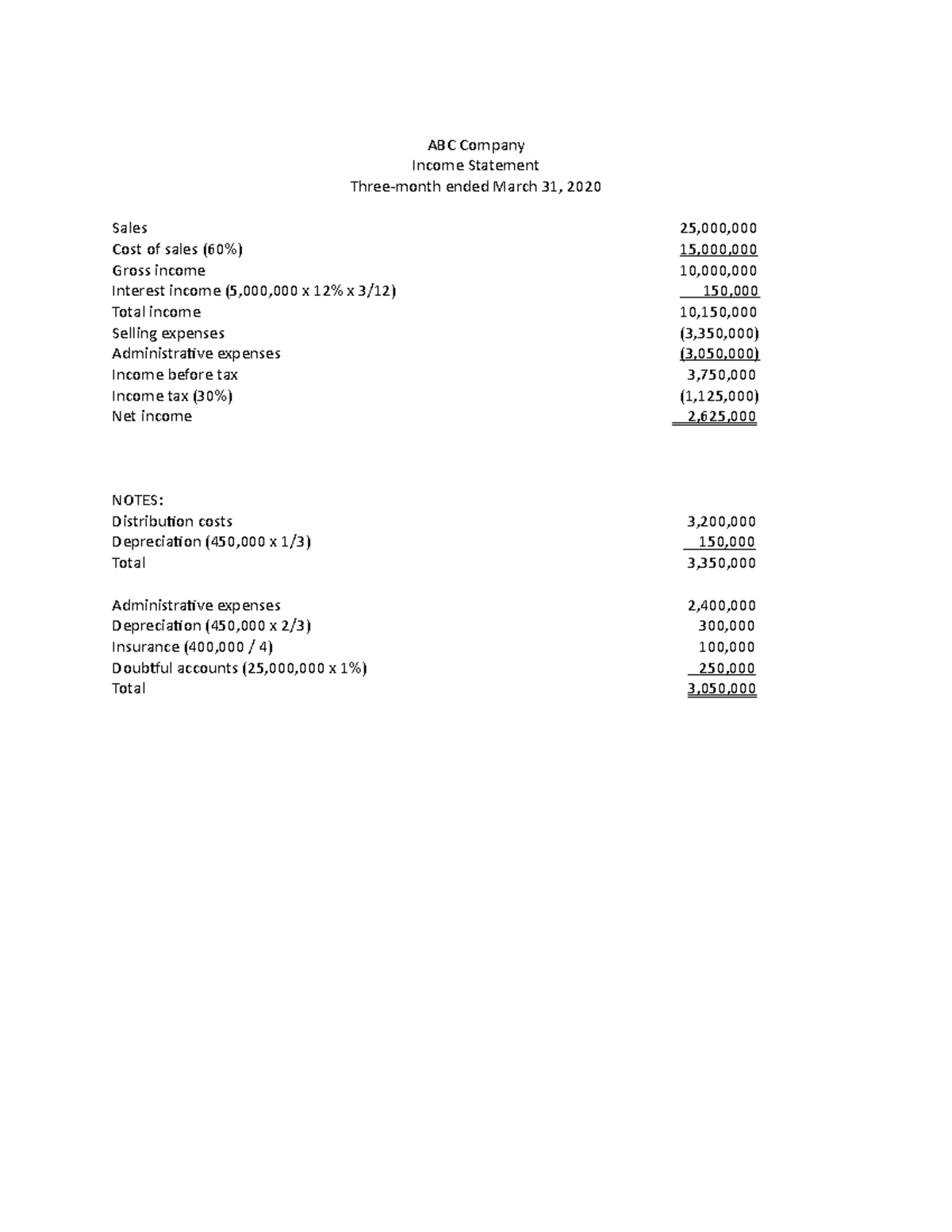

Exam 4 December 2020 Questions And Answers ABC Company Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/597c9d4542e117ccbe1c7170c4bcf881/thumb_1200_1553.png

After you figure out what you owe in taxes subtract that number from your taxable income Once you do this then you ve arrived at your business net income Let s say that you figure out you owe 10 000 in taxes but you have that 1 000 tax credit so you owe 9 000 Subtract that from your taxable income of 83 000 and you get a final net Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes The IRS uses many factors to calculate the actual tax you may owe in any given year Note that if you are

The formula to calculate net income subtracts the income tax expense from pre tax income EBT The net income the bottom line can be conceptualized as the remaining accounting profit once operating costs such as COGS and SG A and non operating costs like interest and taxes are deducted from revenue The difference between your taxable income and your income tax will be your net income For example let s say you earn 50 000 in gross income each year and you qualify for around 5 000 in allowable deductions Your taxable income would be equal to 45 000 With a tax rate of 13 88 you have an income tax payment of 6 246

More picture related to How Do You Calculate Net Income For Tax Purposes

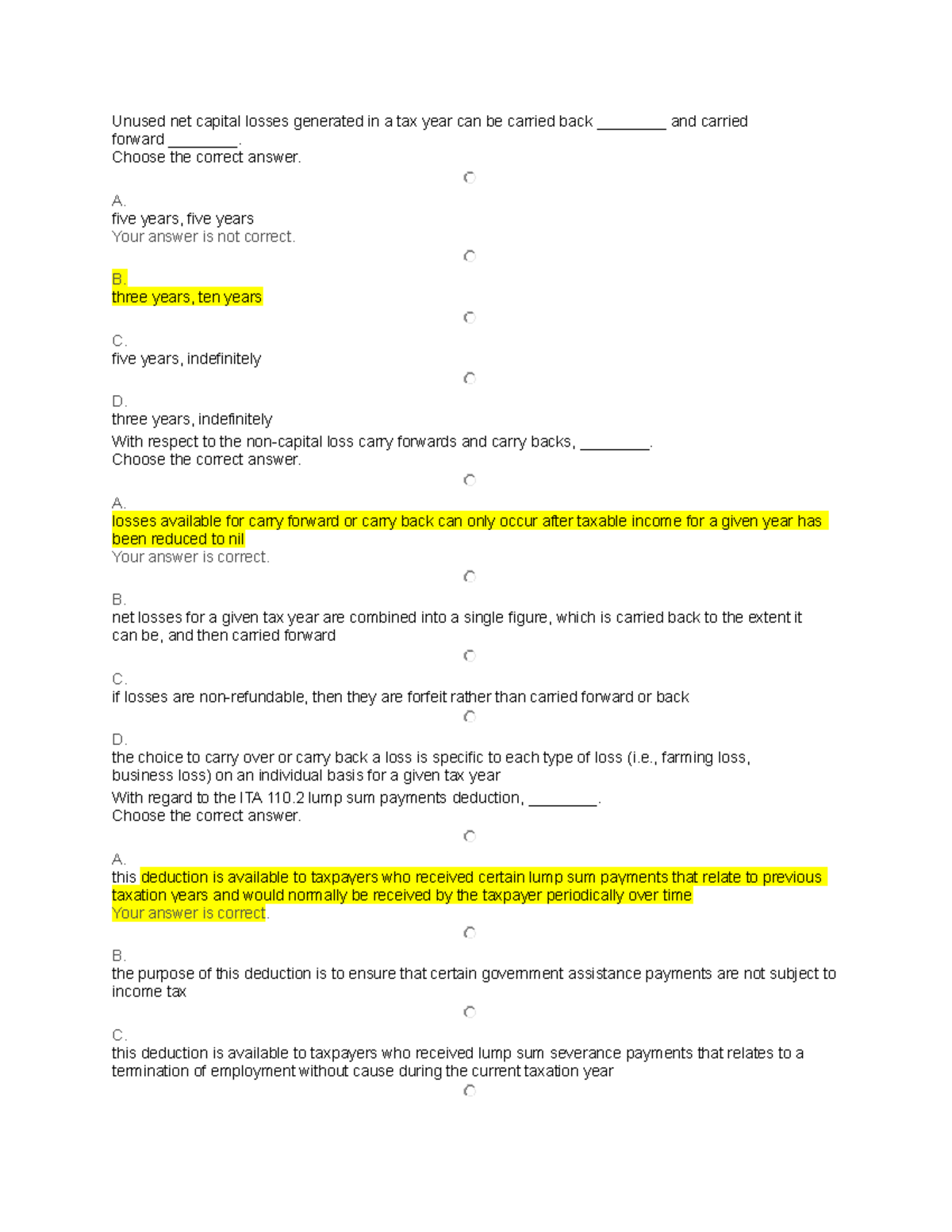

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/84/2019/05/Screenshot-2022-12-30-at-11.24.42-PM.png

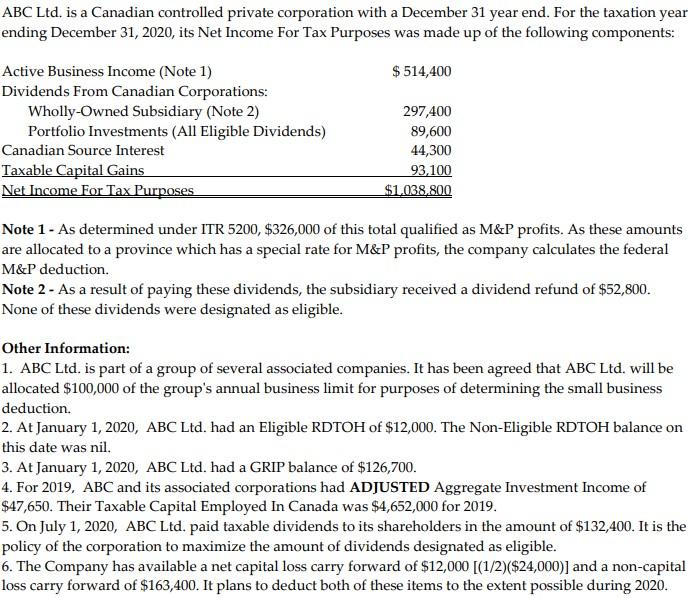

ABC Ltd Is A Canadian Controlled Private Corporation Chegg

https://media.cheggcdn.com/media/8e5/8e5569dd-5ef1-4c25-95fd-55a52e54d13c/phpWuHcE5

What you re left with is your net income Here s the formula Net Income Revenue Cost of Goods Sold Expenses You can make it even simpler your revenue minus the cost of goods sold is called your gross income So you could also say Net Income Gross Income Expenses Or to really keep it basic What is Net Income Net income also known as net earnings is a measure of a company s profitability It represents the amount of money that a company earns after deducting all of its expenses from its total revenue In simpler terms net income is the amount of money that remains after paying all the bills We can calculate net income by

[desc-10] [desc-11]

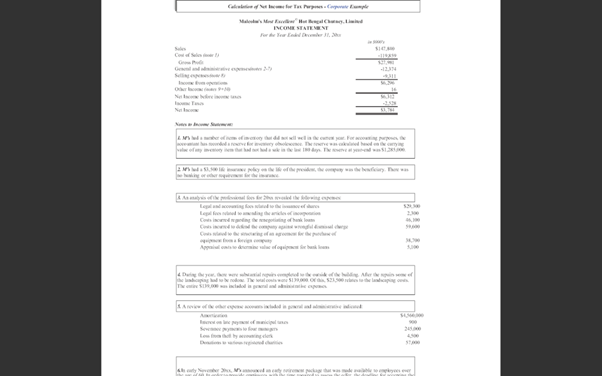

Get Answer Calculation Of Net Income For Tax Purposes Corporate

https://files.transtutors.com/book/qimg/c7eab636-55aa-41dc-8c01-48423103fe7f.png

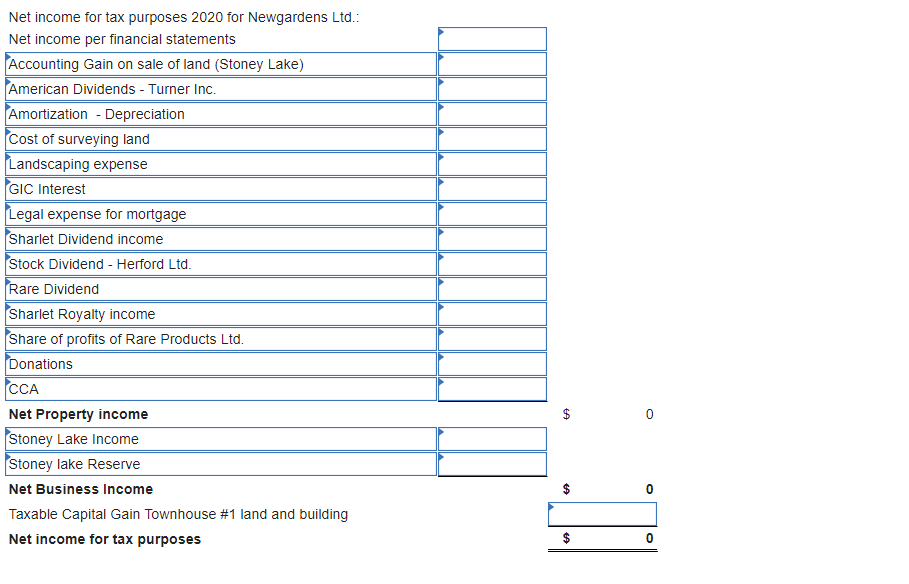

Solved Lia Wright Is The Sole Shareholder Of Newgardens Ltd Chegg

https://media.cheggcdn.com/media/729/729ae77a-9b2a-4cda-8771-755f9462f11d/phpyWbf1D

How Do You Calculate Net Income For Tax Purposes - Calculate net income after taxes Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes The IRS uses many factors to calculate the actual tax you may owe in any given year Note that if you are