How Do You Calculate Net Income For Tax Purposes In Canada You take your gross income subtract all your deductions and get your net income The applicable tax rates are then applied to your net income which gets you the amount of tax you have to pay for the year You then look at the tax you have already paid and the tax you owed for the year and the difference becomes either a tax refund or a tax bill

The total of the above is total income for tax purposes line 15000 on the tax return Net Income Before Adjustments Line 23400 Note Before tax year 2019 line 23400 was line 234 To calculate Net Income Before Adjustments line 23400 on the tax return deduct the following items from Total Income for Tax Purposes Total income Net income An individual s income from all sources is their total income and is reported on line 15000 A set of net income deductions is then subtracted from the total income resulting in the individual s net income Used to calculate some credits and line 23600 Tip The net income is used to determine amounts an individual

How Do You Calculate Net Income For Tax Purposes In Canada

How Do You Calculate Net Income For Tax Purposes In Canada

https://images.contentful.com/ifu905unnj2g/66K2AdsLlvARouig6tdw8D/9fb05a7c0c4b54eca5f4d7bb8c04ce1c/Net_income_formula.jpg

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

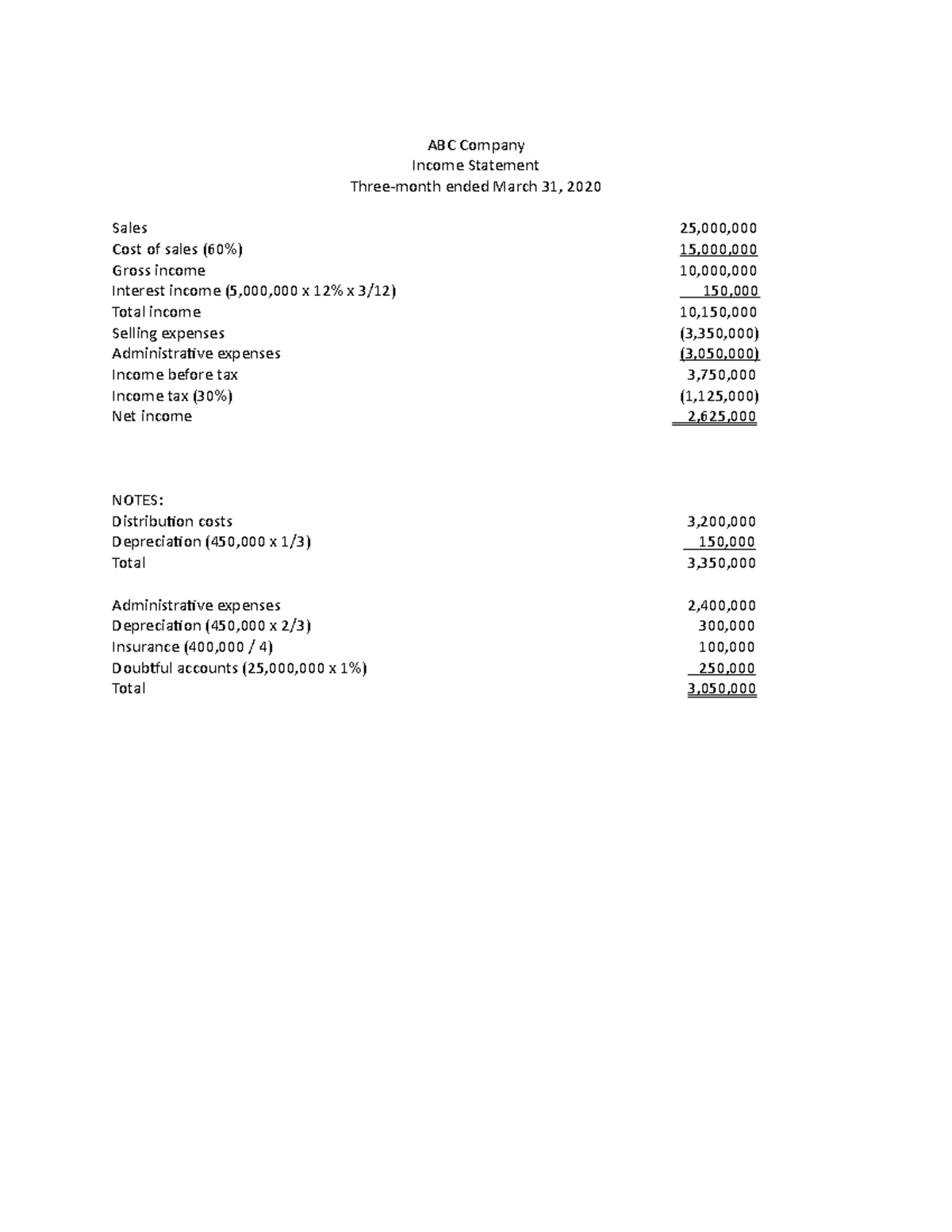

Exam 4 December 2020 Questions And Answers ABC Company Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/597c9d4542e117ccbe1c7170c4bcf881/thumb_1200_1553.png

After reporting your income you will list your deductions A deduction reduces your total income For example if you have a total income of 100 000 and you have total deductions of 10 000 Tax Year 2024 2025 If you live in Ontario and earn a gross annual salary of 75 753 or 6 313 per month your monthly take home pay will be 4 743 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator

For this reason you would need to reconcile your business net income with the net income required for tax purposes using the schedule 1 form How to Calculate Net Income For Individuals Your net income is shown on line 23600 of your income tax and benefit return To get your net income first you need to calculate your total income on line A basic calculation for Net Income from a T4 is to subtract from Box 14 any amounts included in Boxes 20 and Box 44 This is not exact for tax purposes of Line 236 as it will not include other income T5 T3 or deductions RRSP etc but it will give you a basis to start from

More picture related to How Do You Calculate Net Income For Tax Purposes In Canada

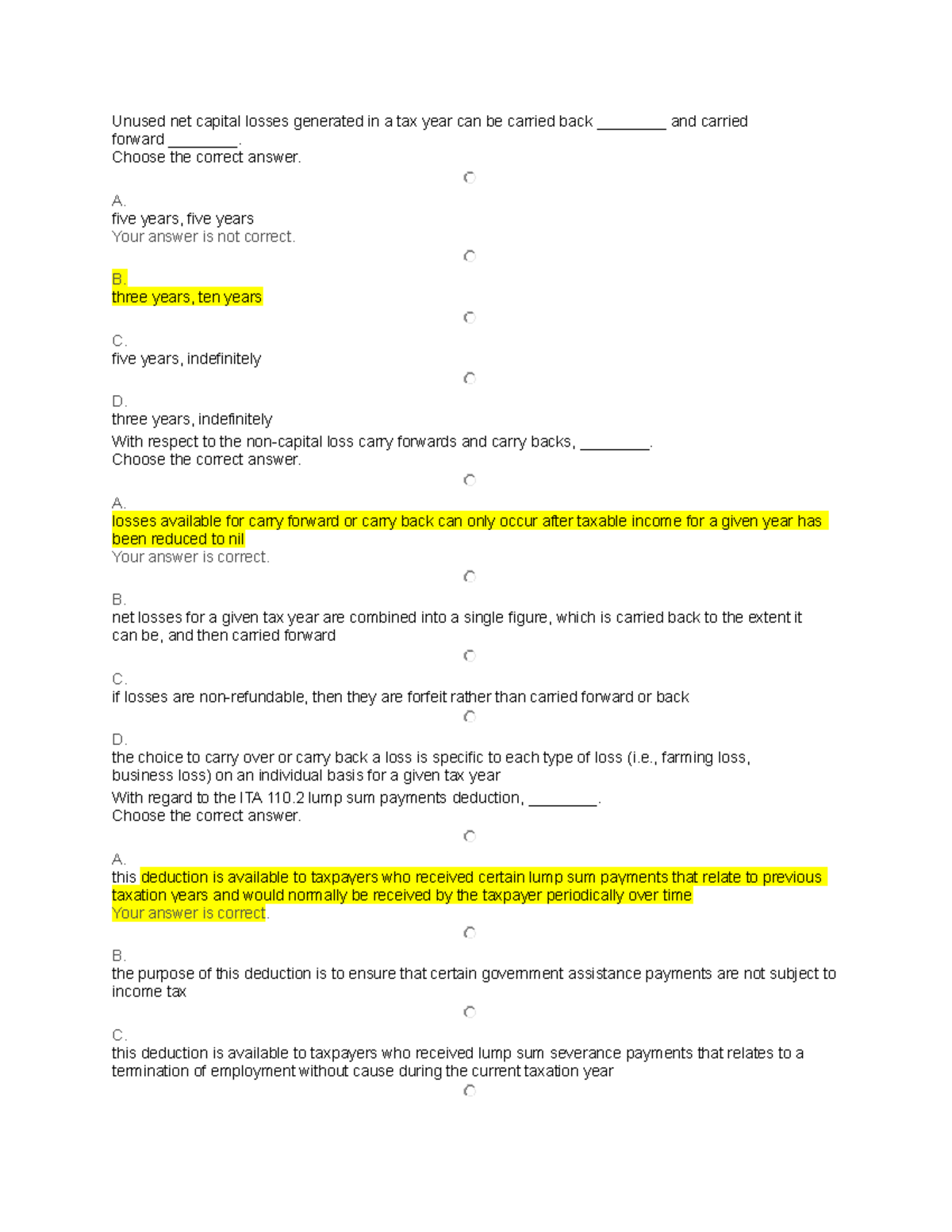

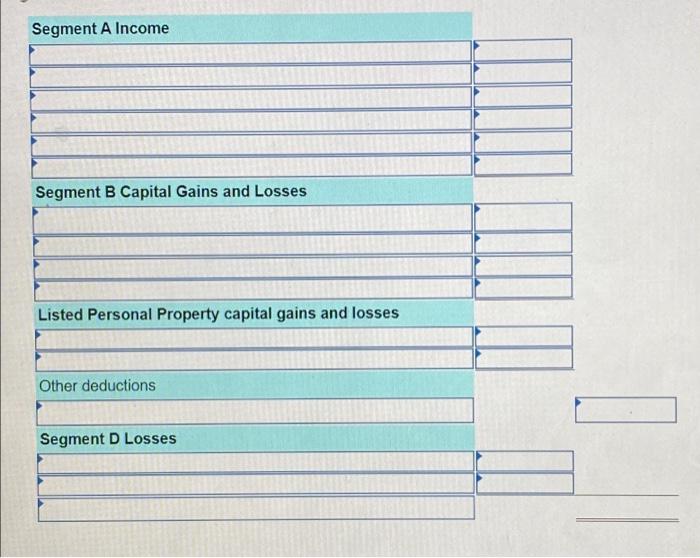

Sample Question For Tax 2 Unused Net Capital Losses Generated In A

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/74ba378144ce6f5321b7ff0772ffaa3a/thumb_1200_1553.png

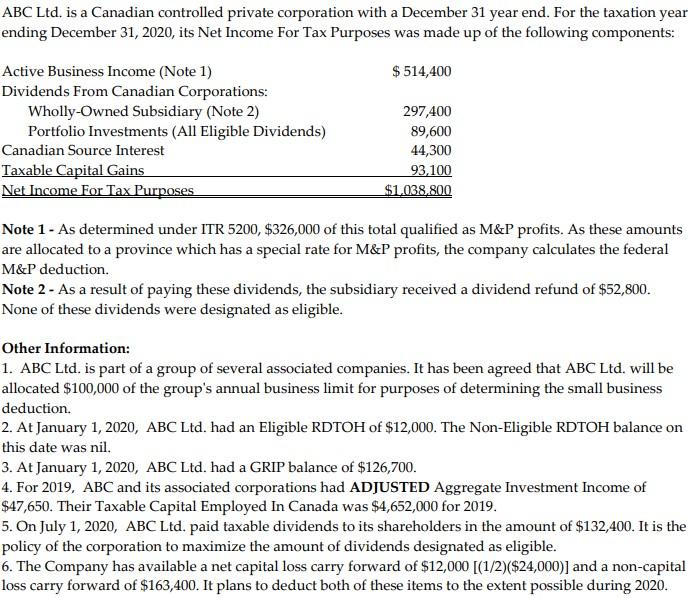

ABC Ltd Is A Canadian Controlled Private Corporation Chegg

https://media.cheggcdn.com/media/8e5/8e5569dd-5ef1-4c25-95fd-55a52e54d13c/phpWuHcE5

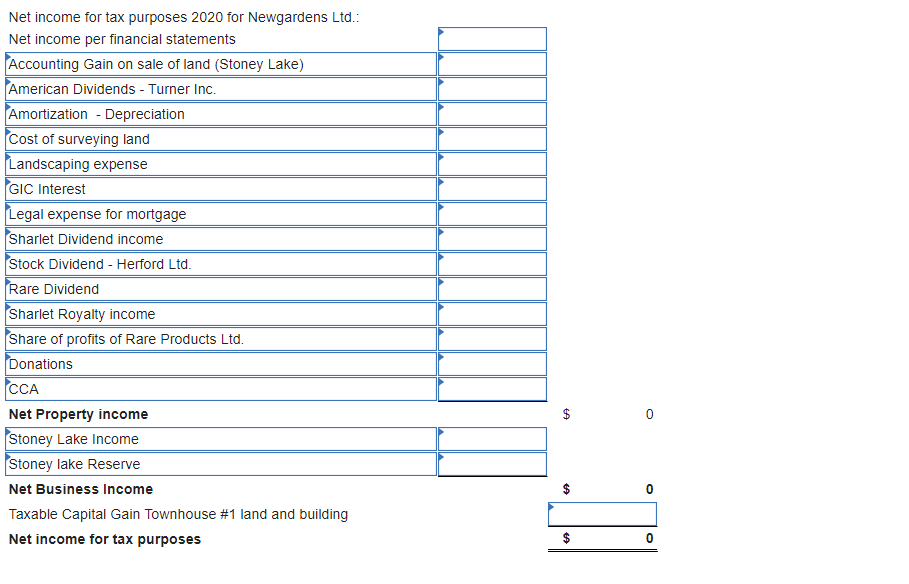

Solved Lia Wright Is The Sole Shareholder Of Newgardens Ltd Chegg

https://media.cheggcdn.com/media/729/729ae77a-9b2a-4cda-8771-755f9462f11d/phpyWbf1D

Net income Taxable income 128 162 Income tax see the Taxes on personal income section Federal tax before credits 24 104 Less Personal credits Basic 2 356 Spouse 2 356 4 712 Less Other credits Employment tax credit 215 Government pension plan and employment insurance plan contributions tax credit 640 855 Basic Your federal net income is reported on line 23600 Your Qu bec net income is reported on line 275 Note If you need this information to complete the Newcomers page in H R Block s tax software you ll also need to determine how much of the income reported on line 23600 was earned while your spouse was living in and outside of Canada if

[desc-10] [desc-11]

House Rent Allowance Income Tax InvestForEasyLife

https://investforeasylife.com/wp-content/uploads/2021/12/White-Grey-Minimalist-Design-Furniture-Instagram-post-1024x1024.jpg

Solved 4 000 133 The Following Financial Information Is Chegg

https://media.cheggcdn.com/study/a35/a353d2f5-a714-45a9-8b66-438522092577/image

How Do You Calculate Net Income For Tax Purposes In Canada - A basic calculation for Net Income from a T4 is to subtract from Box 14 any amounts included in Boxes 20 and Box 44 This is not exact for tax purposes of Line 236 as it will not include other income T5 T3 or deductions RRSP etc but it will give you a basis to start from